Automotive ER&D – Huge Transformations and Revolutionary Changes

October 29, 2024

|

Automotive ER&D – Huge Transformations and Revolutionary Changes

October 29, 2024

|Introduction

The automotive sector is undergoing a transformation globally.

In the initial years, the shift was towards softwarization and ownership of the software. This means that previously, the software and hardware parts of the vehicle were treated as two separate parts that would go into an automobile & would be acquired separately by the OEMs from distinct vendors.

The profound transformation in the Indian automotive industry is prompting the entire ecosystem to adapt to these changes.

In this article, we discuss:

- What is ER&D?

- What are the so-called “transformational changes? What are the key trends emerging? What caused them?

- How will they change the customer experience?

- Who will bring about these changes?

- What is being left behind? What are some applications of cutting-edge technologies?

- What are the opportunities for India?

Engineering and Research & Design (ER&D) in India

As the name suggests, ER&D is focused on making products better and cheaper. It is the initial, conceptualization (or drawing board) phase before a product, system, or service is put into production/commercialization.

The topmost sectors in which ER&D is practised worldwide are as follows:

- ICT (Information & Communication Technology) companies: This includes computer hardware, electronic and electrical equipment, semiconductors, and telecommunication equipment) This accounts for ~50% of the total ER&D market.

- Healthcare: This industry accounts for 21% of the total market.

- Automotive: This accounts for 13.8% of total R&D spending.

- Energy & chemicals

- Aerospace and defence

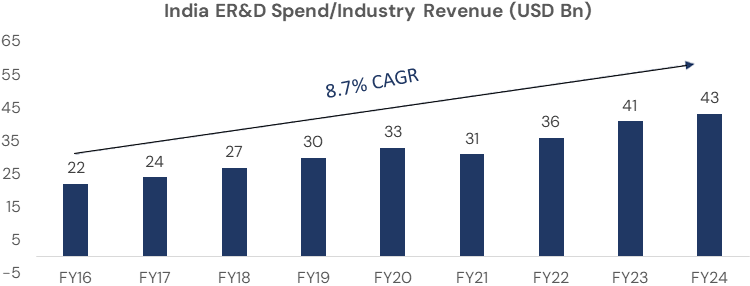

The Indian ER&D industry generated revenues of $43bn in 2024, accounting for ~1.1% of India’s GDP in 2024.

The above chart illustrates the revenue of the Indian ER&D industry from FY16-24, which grew at a CAGR of 8.7% during this period.

ER&D is a global opportunity for Indian tech companies and is not limited to India. In 2023, global R&D spending in the automotive and mobility sector reached USD 150 billion (~ INR 12,60,000 crore). This market is expected to grow at an annual CAGR of 8-9% till 2030.

India is expected to get an increasingly larger share of the global ER&D outsourcing pie, reaching a 22% share by 2030 (up from 17% in FY23).

The key companies in the Indian Automotive ER&D sourcing market are:

| Company | Market Cap (₹Cr) | Revenue (₹Cr) | ROCE% | PEG | PE |

|---|---|---|---|---|---|

| TCS | 14,80,774 | 2,40,893 | 64% | 3.7 | 30.5 |

| HCL Tech | 5,09,400 | 1,09,913 | 30% | 3.2 | 29.9 |

| LTI Mindtree | 1,74,691 | 9,143 | 31% | 1.5 | 37.6 |

| Tech Mahindra | 1,66,716 | 51,996 | 12% | -4.6 | 51.3 |

| L&T Technology Services | 54,453 | 9,647 | 34% | 3.9 | 43.6 |

| Tata Elxsi | 43,967 | 3,552 | 43% | 2.4 | 53.3 |

| Tata Technologies | 40,527 | 5,117 | 28% | 4.6 | 63.1 |

| KPIT Technologies | 37,983 | 4,872 | 38% | 1.1 | 51.9 |

| Cyient | 19,537 | 7,147 | 22% | 3.3 | 28.8 |

| Axiscades Technologies | 2,085 | 955 | 14% | 1.4 | 46.8 |

| Happiest Minds Technologies | 11,700 | 1625 | 22% | 1.05 | 50.6 |

| Sasken Technologies | 2579 | 406 | 12% | -12.1 | 39.9 |

| Onward Technologies | 787 | 472 | 22% | 1.2 | 32.6 |

| Average | 2.5 | 43.1 | |||

| Median | 1.5 | 43.6 |

The highlighted companies are pure-play ER&D companies. Please note that this is not an exhaustive list. For market cap, PE and PEG ratios, the data is as of 28th October, 2024.

The four mega-transformations in product engineering

“Electrification, Autonomous, and AI & Digital (for personalization and customization)” - We talk about each of these over the course of this article.

Product Engineering

- The entire industry is working to make the driving environment and space a more pleasurable, comfortable, and efficient one for the owner, while also ensuring safety. (“Safe Mobility”)

-

Different OEMs across the globe have taken different approaches to product engineering. In this aspect, the industry is entering into an evolving phase:

- While some players have gone pure electric, others have ventured into hybrid & plug-in hybrid vehicles.

- Fuel cell technology: Newer technologies such as fuel cell-based cars are also coming to the fore, as they have proven advantages over battery-electric technologies.

-

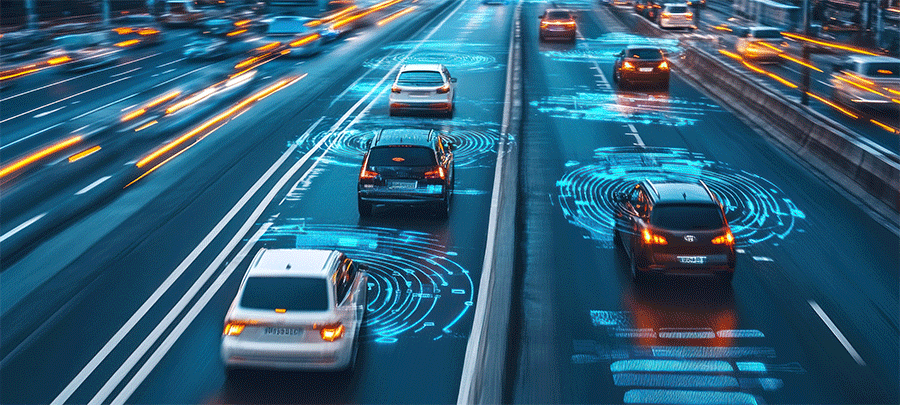

Autonomous vehicles: Autonomous vehicles include self-driving cars, buses, etc. Autonomous vehicles are those that use various detection systems to make real-time decisions regarding vehicle operations like adjusting the steering wheel continuously, switching between driving modes, cruising speed, acceleration, braking, collision prevention, etc. These vehicles make use of sensors such as radar, GPS, cameras, and lidar to continuously monitor the environment around them, by creating a 3D map of their surroundings.

For autonomous vehicles, the progress in product development and commercialization has been slow. And it seems that at least a decade will pass before India sees such cars on its roads. (Autonomous vehicles are estimated to be only 10% of the global vehicle market by 2030.)

There are obvious questions about the reliability of the systems controlling such vehicles. And hence, the first step would be to make the vehicles more reliable and economically viable.

These are things that OEMs will have to figure out in the future:

Economic feasibility, availability of skilled labor, sourcing of relevant components, choice of technologies – a balance between product attractiveness, functional efficiency, environmental sustainability and cost.

“Electrification” and “Softwarization” of the Vehicle

When we talk about transformation, we mean that the “entire architecture” of the vehicle is changing.

Electrification of a vehicle simply means transitioning from traditional ICE engine-based autos to vehicles that run on electricity, via batteries, inverters, controllers, motors, transmission equipment, AC/DC converters, printed circuit boards, etc.

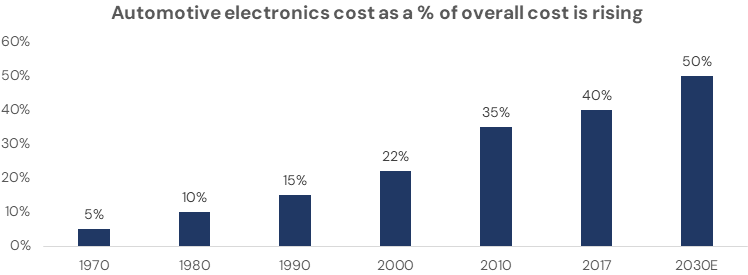

For Hybrids + Fuel Efficient EVs, as much as 40% of the cost of a car is now attributed to semiconductor-based systems, and this is expected to go up to 50% by 2030.

Vehicles built on hardware-centric technologies have now aged in technological terms and will slowly and gradually be considered outdated.

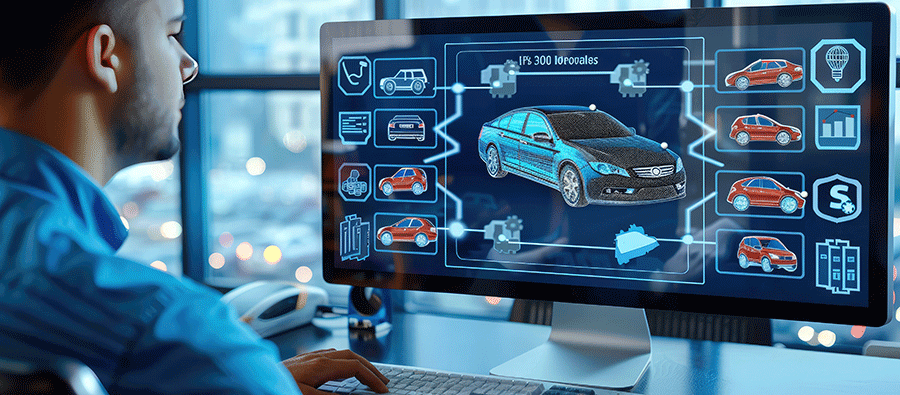

Softwarisation takes a huge leap forward. It acts as the brain of the car, just as the human brain controls all the movement and sensory functions of the body. Auto OEMs and ER&D companies are working relentlessly on this so that the vehicle would feel more and more like a “smartphone on wheels.” (“Software-defined vehicles”, “Personalization of the Car”, “Safe, exciting automotive mobility experience”).

OEMs and ER&D companies have conceptualized, and in some markets started to commercialize the hardware, software, and service modules as a package for software-defined vehicles on the road. This would include using cloud services for information management, real-time data collection, software upgrades, etc.

Software-defined vehicles require higher computational power for real-time processing using sensors. The need for advanced computing architectures is driving the demand for specialized chips, which are critical for the development of autonomous features.

In the coming years, up to 30% of OEMs' revenues may come from services.

Smart mobility applications & other automotive innovations

- Digital interfaces in the vehicle: The era of inflexible and standardized interfaces is over. With the help of GenAI, vehicles can customize the aesthetics, displays, and controls to align with customer experiences. (by continuously learning the driver's behavior!)

Digital Solutions such as in-car settings for temperature adaptation to climate, seating position, steering wheel position, infotainment choices - Android-based digital cockpit: An Android-based infotainment system with high resolution integrated display, connectivity, voice recognition and media features.

This framework is flexible enough to fit into different variants, and models, with a single code base. The Android OS for the infotainment system also makes the software easier to update.

- A high-end – rider assistance system for two-wheelers, with features such as adaptive cruise control, emergency braking, forward collision warning, lane departure warning, blind spot detection, etc, is being developed by several companies. This is critical for the Indian market specifically.

- Radar Vision Parking: Radar-based parking solutions.

- GenAI-based voice assistant: Conversational navigation

- Jaguar Land Rover: Offers Dual Memory Architecture for “over-the-air software updates.”

- Offering greater in-car convenience: E.g. KPIT Technologies has invested in a gaming company N-dream – for gaming in-the-car solutions.

For instance, while one is charging the car away from home, the occupant can sit in the car, order a pizza, and play the game while the vehicle is charging.

In the US, about 70% of EV car owners charge at out-of-home charging points rather than at home. (“Understanding not only the driver but the occupant”). -

Modern applications for design and manufacturing processes:

- GenAI is a key enabler to reduce the simulation time for carmakers. It is also used to improve productivity, costs, and “time to market” for the OEMs and manufacturers.

- Developmental costs are minimized by using GenAI, by adopting digital rendering of automobiles created with a set of specified inputs.

- For autonomous vehicles, use GenAI to test the “models” (i.e. AI/ML models) across weather conditions and traffic situations.

- Defect detection system for cars, while coming out of the paint shop: Eg. Using a combination of 16 cameras, lights, and edge computing, the deformations, once detected are sent to the cloud via 5G for storage and integrated with the MES system.

- KPIT Technologies has pioneered the development of fuel cell bus architectures and ready-to-use technical accelerators. This includes the fuel cell stack, electric powertrain, battery management system, etc. KPIT is working with several original equipment manufacturers to introduce this technology into vehicles worldwide. Compared to battery electric vehicles, fuel cell vehicles have been proven to offer: (i) longer ranges of over 500 miles, (ii) greater payload capacity, and (iii) lighter weight.

- Maruti Suzuki’s 'NEXAverse' is a 3D online version of Maruti Suzuki's NEXA dealerships where users can search for vehicles in an immersive way.

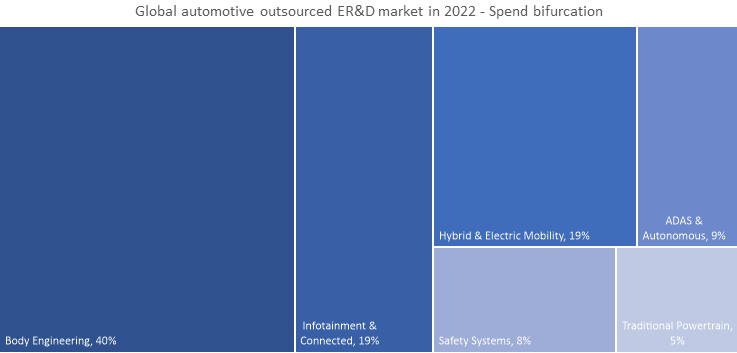

Outsourced Auto ER&D Spend breakdown:

Source: Tata Tech RHP

India’s Potential in Automotive ER&D

India can eventually serve as a major capability center for R&D and innovation in the global market. The ecosystem of Global Capability Centers (GCCs), domestic ER&D companies, and auto OEMs presents a tremendous opportunity for India going forward.

The main objectives behind this ER&D are:

- Reduce the “end time” cost of automobile manufacturing by almost 1/3rd by optimizing the value chain,

- Increase the revenue contribution of services as a sustainable source of income,

- to provide more comfort, pleasure and efficiency while ensuring safety and sustainability.

Automotive ER&D companies like KPIT Technologies are pioneering futuristic applications for automobiles, which are revolutionizing the way cars are designed, tested, built, sold, and used.

Tasks at hand for the Indian automotive industry:

- Revamping the product engineering as per the prevalent and emerging trends in car-making.

- Closing the significant gap in adopting newer technologies/applications across the industry. Some pockets are grasping them quickly, while the industry remains to adopt these at a full-fledged scale.

- Integration of charging structure with the national grid, renewable microgrids, and energy storage systems.

- Charging infrastructure – software management, establishing a well-connected charging station network.

- Energy storage, supply, and transmission for automotive use cases.

- Fleet management software, data collection from connected vehicles using technologies like telematics.

Disclaimer: Please note that the stocks mentioned in the above article are for illustrative purposes only, and should not be considered as investment advice.

Continue with Google

Continue with Google