So much power in a tiny chip: The India Semiconductor Opportunity

September 28, 2024

|In this article, we discuss why there’s “so much power in a tiny chip” and what it means for India in particular and the world at large.

What is a semiconductor chip?

“Manufacturers process silicon and other materials into semiconductors for all kinds of electronic devices that rely on harnessing electricity for processing power. These semiconductors, or chips, are in greater demand than ever before: the Fourth Industrial Revolution (4IR), which is currently transforming manufacturing, production, and global business more generally, is characterized by smart computers and connected devices. Smart means connected, and connected means chips.”

What are its applications?

Semiconductors are essential for powering a wide range of modern technologies, from smartphones and computers to household appliances and electric vehicles.

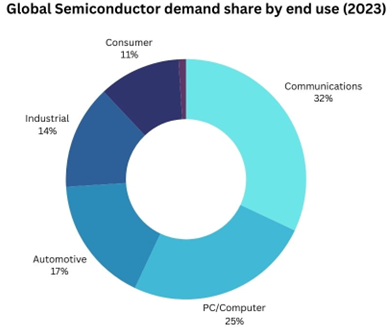

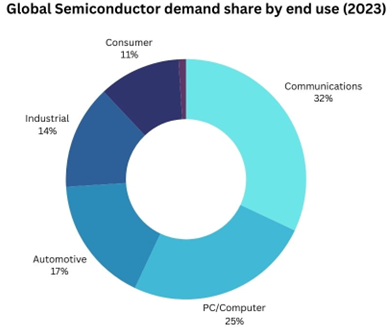

The fact that semiconductors are used across a plethora of industries, underscores the significance of the product globally, in the decades to come.

The Global Semiconductor Industry

The forefront of technological innovation

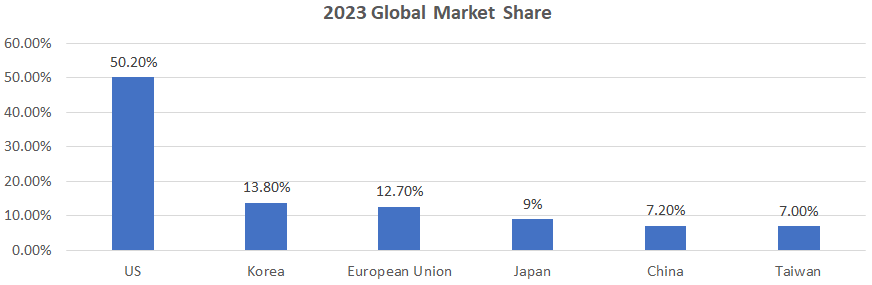

As per the Semiconductor Industry Association (SIA), global semiconductor sales stood at $526.9bn in 2023.

Out of the $526.9bn, the US commanded a 50% revenue market share.

The US Semiconductor ecosystem contains a large set of design and manufacturing companies, which are leading the world in terms of chip innovation:

Global Manufacturing Ecosystem

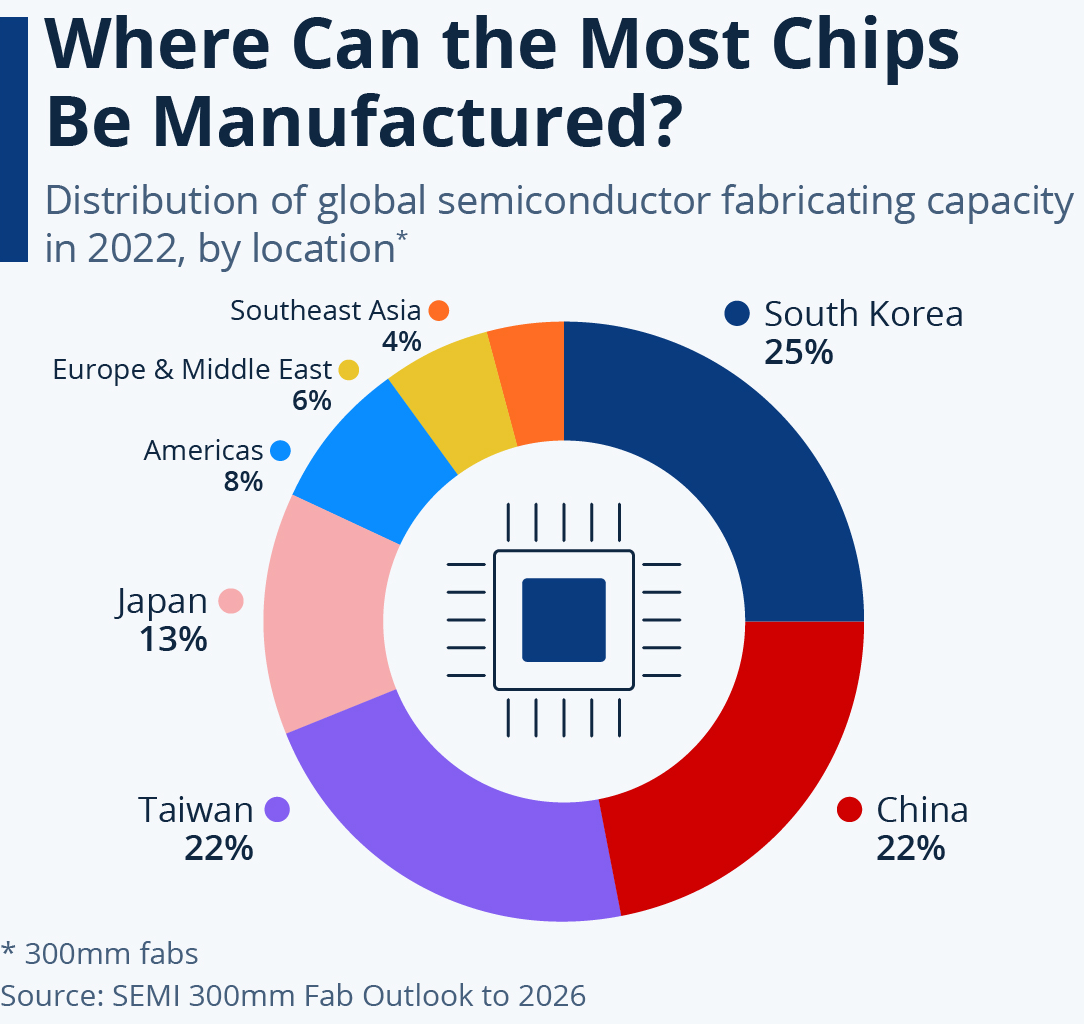

While the US commands 50% of revenue share globally, more than 75% of the global semiconductor fab capacity is actually in Asia (the front end)! – spread between Taiwan, Japan, South Korea, and China. The region’s market share is even higher (90%) in chip assembly and testing (the back end).

Except for large IDMs (Integrated Design and Manufacturing Companies) like Intel, Samsung, Texas Instruments, Micron Technologies, Broadcom, Qualcomm, and NXP Semiconductors, most chip players have been outsourcing manufacturing to third-party vendors (OSATs).

The majority of the big OSATs are based in China and Taiwan, commanding roughly 80% of the OSAT market share in 2022. (OSAT stands for “Outsourced Semiconductor Assembly and Test Unit” – as the name suggests, an OSAT does the assembly and testing part of the manufacturing process.

Companies in the US have ensured that the critical stage of chip production is done in the US, to maintain their IP advantages.

One must also note that there are various grades of chips, based on size (in mm), precision, utility, and processing speeds.

India: Emerging Asian economy with stars aligned

Multiple conducive factors are playing out for India, in the semiconductor space. We list down a few below:

- Tensions between the US and China in high-end chips: The US is actively moving to stall Chinese companies from gaining access to high-end chips, by imposing restrictions and bans on Chinese semiconductor companies operating in the US and globally.

India, then is naturally being considered as one of the convenient alternatives by global semiconductor majors over China and Japan to set up shop in India, since it offers a much stabler political, economic, and macro environment, with robust demand, in addition to the low cost of labor. - Government support: Indian semiconductor mission and capex support >$10bn.

- Private sector capex coming in at the right time: several Indian companies have committed substantial capex over the next decade towards setting up semiconductor design and manufacturing facilities in India.

- Leader in incremental market share gains in Asia: With Asia continuing to be the dominant manufacturing hub for semiconductors globally, India stands to benefit immensely. As the fastest-growing major economy in the world, India is well-positioned to gain an increasing share of the semiconductor manufacturing pie in Asia.

India ‘s semiconductor market was worth $38bn in 2023, and is expected to grow at a 15.57% CAGR to reach $109bn by 2030:

Key developments in India

A noticeable pattern across all the Indian corporates who have ventured into this space is the collaboration with global semiconductor design and manufacturing companies:

For international stakeholders, partnering with India presents significant advantages, including access to a stable political and economic environment and the opportunity to tap into the rapidly growing demand for electronic products within the Indian market.

The table below illustrates the top 3 sectors globally that spend most on R&D (as a % of their sales). India is favourably positioned to become the “manufacturing hub” for the most innovative sectors across the globe, this time focusing on the semiconductors industry.

| R&D Expenditures as a % of sales | |

|---|---|

| Pharma & Biotech | 23.1% |

| Semiconductors | 19.3% |

| Software & Computer Services | 19% |

The fact that large corporate houses in India, (i.e. the Tatas, L&T group, Adanis, Vedanta) are venturing into it reiterates that this industry is very closely aligned to India’s economic growth, and the goal to become a $5 trillion economy by 2027 and $7 trillion by 2030.

The players that have ventured into/committed capex in this space till now are as follows:

| Company | Partner | Type of Facility | Committed Capex (₹Cr) | Location | Comments |

|---|---|---|---|---|---|

| Tata Electronics | Powerchip Semiconductor Manufacturing Corporation (PSMC), Taiwan, & Analog Devices | Semiconductor fab | 118000 | Gujarat, Assam |

"(i) AI-enabled fab, high-end chips used in power management IC, display drivers, microcontroller units, high-performance computing logic. (ii) Applications across sectors like automotive, computing and data storage, wireless communication and artificial intelligence. (iii) Capacity: 50000 wafers per month" |

| L&T Semiconductor Technologies | IBM | Chip design & semiconductor fab | 84000 | Tamil Nadu | "(i) 6 deals worth $150mn won, (ii) Focus on auto, energy, and industrials. Products like smart meters, smart sensing, and System-on-chips (SoCs)" |

| Adani Group | Tower Semiconductor, Israel | Semiconductor fab | 83947 | Maharashtra | "Phase 1: 40,000 wafers/month; Phase 2: Cumulative 80000 wafers/month " |

| Vedanta (via Avanstrate) | - | Chip design, semiconductor fab, LCD glass substrate | 61824 | Dholera, Taiwan, Korea | |

| RPP Electronics | HMT Zurich | OSAT | 24000 | Maharshtra | |

| Micron Technology | OSAT | 23100 | Gujarat | ||

| CG Power | Renesas Japan, Star Microelectronics | OSAT | 7500 | Gujarat | |

| Kaynes Semicon | Globetronics, Malaysia, and Aptos Technologies, Taiwan | OSAT | 5000 | Gujarat | |

| Jabil | OSAT | 2000 | Tamil Nadu |

409k

Sum of Committed Capex (Rs. Cr)

In the arena of Chip Design (Fabless chip design), both Indian and Foreign companies have made progress:

- Indian companies like HCL Technologies, Moschip Technologies, Tata Elxsi, & ASM Technologies.

- Global fabless chip companies like Qualcomm and AMD have already set up R&D operations in India.

Government Initiatives

The government has been extremely supportive in facilitating the setting up of semiconductor projects in India.

- India Semiconductor mission (ISM):

Set up in 2021 to build a vibrant semiconductor & display design and manufacturing ecosystem in India. It is a collaboration platform for the government, industry, associations, and experts related to the semiconductor and display fab space.

The government had committed a $10bn budgetary allocation in 2021, which has already been exhausted. A fresh incentive package is expected soon, being northwards of $15bn.

Comparatively larger economies like Japan, South Korea, and Taiwan have given incentives ranging from $25bn-50bn. This puts India in the league of the developed economies when it comes to capex. - Subsidies:

Up to 50% of the project cost (i.e. the capex) will be funded by the government, subject to approvals. On top of that, several states are also offering additional capex funding. E.g., the UP government has offered to give 25% capex support over and above the 50% support committed by the central government. So, someone setting up a plant in UP will have to incur only 25% of the project cost, while the balance 75% would be funded by the central and state governments.

Semiconductor to Electronic goods – the “critical” link in the value chain

It is estimated that over 90% of electronic goods require a semiconductor chip.

India’s domestic electronics market is worth $150 billion (~ ₹12.6 lakh crore) and is expected to reach $500bn by 2030, (implying a CAGR of 20%) as quoted by our honorable PM Narendra Modiji, at Semicon India, a three-day conference conducted to showcase India's semiconductor strategy and policy.

It is noteworthy to mention that the semiconductor industry as a % of GDP is merely ~1% for the US, China, as well as India. However, given that this industry serves as a foundation for other industries, such as electronics, automotive, consumer, railways, and renewables, its true potential is obscured by the contribution to GDP number. The real essence of the industry lies in the fact that it enables significant value addition for the secondary sectors, by providing the critical component required for manufacturing goods and services that are eventually sold to the end consumer.

Continue with Google

Continue with Google