Mastering Your Portfolio: An Investor’s Guide to Diversification and Beyond

September 23, 2024

|

For an individual investor, the virtue of patience is the single most important trait that he/she must cultivate when managing their own stock/securities portfolio. The volatility and uncertainty of the ever-changing markets can play spoilsport with an investor’s mindset and investment plans. Hence it becomes essential to chalk out a “plan of action” or “I will do “x” if “y” happens” kind of rule. While many investors are great at picking an investment strategy - few go down deeper and truly learn how to manage their portfolio with discipline and prudence.

In this article, we enumerate some ways in which you can better manage your portfolio. Consider it as a DIY- guide to portfolio management for an individual investor 😊

1) Diversification – How well do you use it?

Diversification is one of the key tools investors use to minimize their downside risks in the market. Diversification is achieved by allocating different kinds of stocks across your portfolio—and you can mitigate potential losses from any single investment. Additionally, consider geographic and sector variations to further spread your exposure. This approach helps to stabilize returns and enhances the overall resilience of your portfolio against market fluctuations.

To effectively diversify one's portfolio, it’s important to understand the concept of correlation.

Correlation measures how closely different securities (like stocks) move in relation to each other. If two stocks have a high positive correlation, it means they tend to rise and fall together. In contrast, if two stocks have a low or negative correlation, they move independently. A well-diversified portfolio aims for low or negative correlation among its stocks. This means that if some stocks are performing poorly, others might still be doing well, helping to protect your overall investment.

In simple terms, diversification aims to create a mix of investments that do not all react the same way to market changes. This strategy helps minimize risk while maximizing potential returns.

The Pitfalls of Over-Diversification

While diversification is important, it’s also possible to over-diversify, which can lead to significant challenges, including:

- Inability to track more than a handful of stocks consistently over time. There is only so much one person can track.

- The loss of returns that could have been earned, if not over-diversified.

- Taking on additional risks that you may not fully understand, simply by adding more securities to your portfolio.

- Diversification should be used as a tool in the larger investment strategy, rather than making it the entire strategy on which your portfolio is built.

2) What is the Optimal Number of Stocks to Hold in Your Portfolio?

Research states that the number comes in at 20.

In Edwin J. Elton and Martin J. Gruber’s book “Modern Portfolio Theory and Investment Analysis,” they concluded that with a portfolio of 20 stocks, the risk (as measured by standard deviation) was reduced to about 20 percent from ~50% when a portfolio larger than 20 stocks was made.

Therefore, the additional stocks from 20 to 1,000 only reduced the portfolio’s risk by about 0.8 percent, while the first 20 stocks reduced the portfolio’s risk by 29.2 percent.

Thus, the “marginal increase in the diversification benefit” does not increase significantly as the number of stocks in the portfolio increases upwards of 20 stocks.

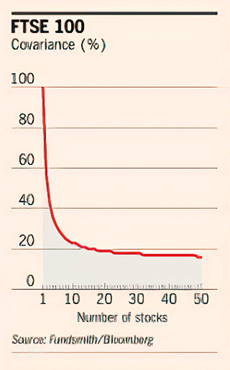

Further analysis of diversification also considers a concept known as "covariance," which measures how much a set of stocks tends to move together.

As you decrease the number of stocks in your portfolio from 100 to 80 and lower, the covariance drops sharply.

However, this reduction in covariance levels off around the 20-stock mark, reinforcing the idea that 20 is often the most effective number for achieving optimal diversification benefits.

That said, it’s important to note that “20” is not a strict rule or a one-size-fits-all solution. In some situations, having more stocks can enhance the stability of your portfolio’s returns. As you add more stocks, the influence of any single stock on the overall portfolio diminishes.

Moreover, the greater the number of winners in your portfolio, the higher your potential returns will be. Certain stocks tend to massively outperform others over time, and these standout performers can come to represent a significant portion of your overall portfolio as time progresses.

Considering Your Investment Amount

The total amount you plan to invest also affects how many stocks you should include in your portfolio. For example:

- If you are investing ₹1 lakh, it might be wise to spread that amount across 7-8 different stocks.

- If you are investing ₹10 lakh, you could consider including as many as 15-20 stocks to diversify effectively.

3) Allocation Styles in Equity Investing

Choosing the right allocation style is crucial and should reflect your individual risk appetite and investment goals. The two fundamental styles of allocation are:

- Strategic Allocation is similar to the buy-and-hold strategy. You decide on a specific percentage of your total investment to allocate to each stock and hold those positions for the long term. This method emphasizes careful planning and aims for steady growth over time.

-

Tactical allocation on the other hand is more flexible as compared to strategic allocation.

A tactical investor stays on the lookout for opportunities created by the market from time to time.

Tactical allocation involves market timing, as well as increasing/reducing exposure to portfolio constituents as per the market conditions.

Tactical allocation itself is a broad discipline, ranging from managing constituent weights to being opportunistic about certain sectoral/sub-sectoral developments that are seen by fund managers as significant pockets of value.

Example of Tactical Allocation

One good example of tactical allocation is stockaxis’ MILARS® strategy. This strategy includes:

- A clear plan for selecting stocks that are likely to grow in value.

- The ability to take advantage of market opportunities as they arise.

- The flexibility to change your strategy based on new market information.

- A well-defined exit strategy for when it’s time to sell.

Another tactical investment approach is “Stocks on the Move,” which focuses on momentum-based factors to provide high-quality stock recommendations.

4) Position Sizing

Position sizing is about deciding how much money to invest in each stock within your portfolio.

There are different schools of thought as to how to approach position sizing:

Equal-Weighted Portfolios: Some investors, like Mohnish Pabrai, prefer to allocate equal amounts of money to each stock. This is often best for those with a long-term investment perspective.

Statistical Approaches: Others may use statistical metrics—like volatility, or risk ratios like the Sharpe, Treynor, or Sortino Ratios—to decide how much to invest in each stock.

Back-of-the-envelope calculations: Some investors also make use of back-of-the-envelope calculations to determine the position sizes. As long as one is aware of the level of risk being taken, we are good to go.

Position sizing is primarily about protecting your capital rather than just trying to maximize returns. It focuses on how much risk you’re willing to take with each investment.

Factors to Consider while Position Sizing:

- Expected Return: If you have a stock that you believe will yield a higher return (for example, a 20% growth per year) compared to another stock with a lower expected return (like 16% growth), you might want to allocate more money to the higher-return stock.

- Stock Volatility: Use a metric called beta to assess how much a stock’s price moves compared to the overall market. Stocks with higher volatility might warrant smaller allocations to manage risk.

- Portfolio Risk: Decide in advance how much of your total capital you are willing to risk on any single stock. For instance, if you are comfortable risking 25% of your overall capital, you can use this guideline to determine position sizes.

- Review Frequency: Regularly check your portfolio, as the market is always changing. If you have limited time, aim to review your portfolio at least once a month to ensure that it aligns with your goals.

Key Portfolio Metrics to Track Regularly:

- Sector Exposure: Use visual tools, like pie charts, to see how your investments are distributed across different sectors.

- Individual Stock Contribution: Keep an eye on how much of your total portfolio each stock represents. If a few stocks make up a large portion of your portfolio, they can significantly affect your overall performance.

- Beta: Regularly evaluate the beta of both your portfolio and individual stocks. This helps you understand how sensitive your investments are to market movements.

“Over-diversification is a hedge for ignorance”

“Observation, experience, memory, and mathematics - these are what the successful investor must depend on.”

Continue with Google

Continue with Google