Hyundai Motors India: Global Leadership with an Indian Touch

October 09, 2024

|

Hyundai Motors India (HMIL) has recently received approval from SEBI for its upcoming $3.3 billion (~₹27,870 crore) IPO, set to launch this month. This marks India's largest IPO to date, surpassing those of LIC and Adani Enterprises. In this article, we explore what distinguishes HMIL from its competitors and its implications for the Indian private vehicle (PV) market.

About Hyundai Motor Company

Hyundai Motor Company (HMC) stands as the third-largest carmaker globally, following Toyota and Volkswagen. With a total revenue of approximately $126 billion as of December 31, 2023, and operations in 193 international markets, HMC has established itself as a formidable player in the global automotive industry.

The name "Hyundai" translates to "modernity" in Korean, reflecting the brand's current slogan: “New Thinking. New Possibilities.”

History and Founder

Founded by Chung Ju-Yung in 1967, Hyundai Motor Company emerged during a period of rapid economic growth in South Korea, just 22 years after liberation from Japanese rule. As urbanization accelerated, Mr. Chung sought to build a legacy in the bustling capital of Seoul.

Born into a poor farming family in North Korea, Mr. Chung moved to Seoul at 18, driven by the desire for a better life. He worked various jobs and launched multiple businesses, embodying the success possible through hard work and discipline. He exemplifies how individuals from modest backgrounds can achieve remarkable success in life. “Even at the peak of his success, he remained disciplined, lived simply, and worked hard”

Born into a poor farming family in North Korea, Mr. Chung moved to Seoul at 18, driven by the desire for a better life. He worked various jobs and launched multiple businesses, embodying the success possible through hard work and discipline. He exemplifies how individuals from modest backgrounds can achieve remarkable success in life. “Even at the peak of his success, he remained disciplined, lived simply, and worked hard”

Mr. Chung Ju Yung’s Career Timeline:

| Year | Event |

|---|---|

| 1933 | Worked various jobs: railway construction, bookkeeping and dockwork |

| 1938 | Delivery man at a rice store - later inherited it - but shut down by the Japanese later |

| 1946 | Service Garage businessTruck repairing for the US Armed Forces - once again shut down by the Japanese |

| 1950 | Engineering and Construction business - built multi-billion dollar mega-projects around the world |

| 1957 | Founded a shipbuilding company - bagged millions of $ worth of orders |

| 1967 | Hyundai Motor Company incorporated |

Key Milestone

In 1975, HMC launched the "Pony," South Korea's first passenger car, which sold over 50,000 units domestically within five years and exported 30,000 units to Canada by 1985, symbolizing national industrial progress.

The Global PV Industry

In CY2023, global PV sales were dominated by the Toyota Group at 11.1mn units, followed by the Volkswagen Group with 9.2mn units, and the Hyundai Motor Group (Hyundai +Kia) with 7.3mn units. Renault-Nissan-Mitsubishi and Stellantis secured the fourth and fifth spot with 6.4 million units each.

On conducting a visual analysis of the top 3 carmakers globally, we can observe that:

| Particulars | Toyota | Volkswagen | Hyundai |

|---|---|---|---|

| Mcap ($Bn) | 251 | 54 | 47 |

| Revenue ($Bn) | 320 | 361 | 126 |

| PAT ($Bn) | 34 | 17 | 12 |

| PAT Margin% | 10.7% | 4.8% | 10.0% |

| P/E | 7.3 | 3.3 | 4.6 |

| ROE% | 15.0% | 8.6% | 12.4% |

| Price to Sales | 0.8 | 0.2 | 0.4 |

| EBITDA Margin% | 12.0% | 7.3% | 9.0% |

| Total D/E | 1.09 | 1.44 | 1.40 |

- Toyota: is the most valuable carmaker globally (excluding Tesla); ~5x more valuable than Volkswagen and Hyundai.

- Hyundai: Hyundai has similar margins (in fact, almost +150 bps better gross margins vs Toyota) to Toyota but a cheaper valuation. HMC serves the highest number of countries (193); and the highest market share in high-growth markets like India, Brazil, and the UK.

- Volkswagen: is the largest carmaker by revenue, but lowest margins, ROE, and highest D/E ratio. Valued at 1/5th of Toyota's market cap.

There are several other carmakers that have a presence across various global markets. However, the above three companies are “truly global players”, with extensive brand + product + supply chain presence across the largest global markets.

Hyundai Motor Company (HMC): A Rising Giant in the Global PV Market

Here’s why we believe that Hyundai could be shaping up as “the rising giant” in the global Private Vehicle market:

- Lesser exposure to home country

While this is not a necessary criterion for performance, it makes sense to pay attention to the geographic concentration(s). Sales from the respective home countries accounted for ~35% of overall sales for Toyota and Volkswagen, while the same number was only ~18% for the Hyundai group. - Market share dominance in strategic markets

We believe that Hyundai has exposure to a superior mix of markets as compared to the Toyota and Volkswagen groups. HMC commands an average delta of >=3.5% in market share as compared to Toyota, in the key markets of India, Brazil, the UK, and the whole of Europe. In contrast, Toyota Motor Company has a delta over HMC in the markets of Japan, China, and Germany. In the US, both these companies have a strong ~15% market share each. With Japan and China facing growth-related woes, it might be difficult for the Toyota group to generate the growth needed to create value in the future. - Feature-rich, elegant product portfolio:

HMC is known for its eccentric designs and futuristic features in its models. Some of the product innovations Hyundai has done for its models here in India are:- Panoramic sunroofs, air purifiers, and wireless charging pods are offered in several vehicles.

- Bluelink (Connected Car feature): Embedded voice commands without an internet connection. As of 31st Dec, 2023, ~29.3% of Hyundai vehicles are sold with the Bluelink feature.

- Home to car feature: is a connected car technology through which customers can remotely lock and unlock the door of their passenger vehicles, check the status or condition of their passenger vehicles, locate their passenger vehicles using the “find my car” feature, obtain fuel level information and tire pressure information, among others.

- ADAS (Advanced Driver Assistance System): is offered in 5-7 models, which is a guidance system to assist the driver to avoid collisions, lane following assistance, etc.

Clockwise: Hyundai I20, Hyundai Grand I10 NIOS, Hyundai IONIQ 6 EV, Hyundai Venue.

A glimpse of the interior of the Hyundai IONIQ 6.

India: An incredibly young market for private vehicles...

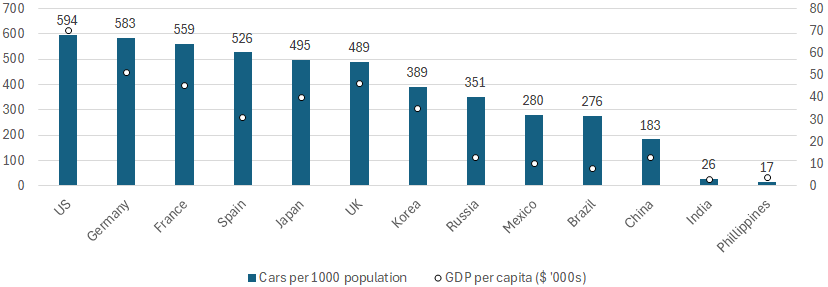

India has just 26 vehicles per 1000 people, which is significantly lower than that of countries like Brazil, Russia, Mexico, and the UK. This could be attributed to the lower income levels of the Indians compared to their global counterparts. However, India has always been a fast-growing economy, with a decade-over-decade of improvement in the per capita income levels.

Who are the key players in India?

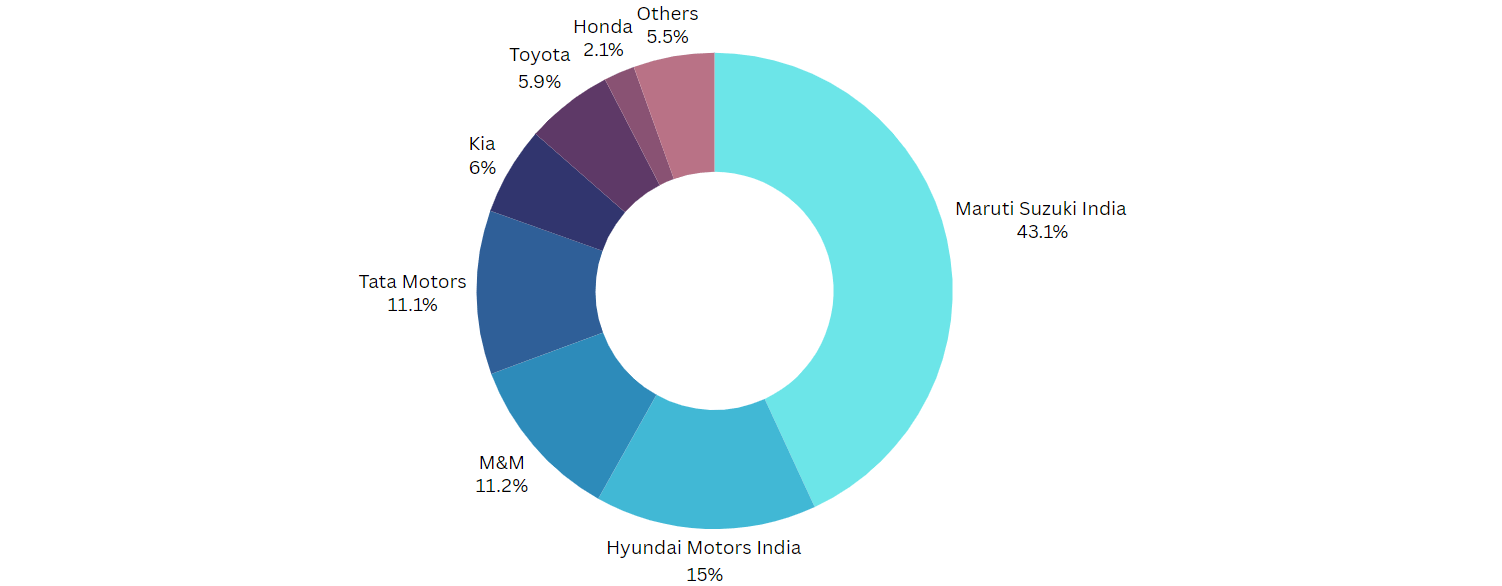

The following chart succinctly illustrates the companies in the Indian PV market:

The above chart illustrates the volume market share of the top players in the Indian PV market (2024)

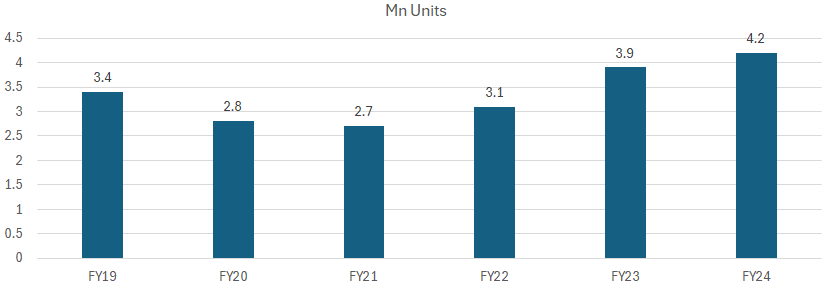

Over the last 5 years, the PV industry has shown resilience against pandemic-related shocks and surpassed the pre-covid highs within 2 years of the pandemic. The following chart shows the domestic sales volumes for FY19-24:

PV sales volumes grew at a 5% CAGR over FY19-24, and a 16% CAGR post the covid-19 pandemic

The Indian market is Indispensable for Hyundai

Here are some reasons why we believe so:

- Key international market for the Parent: HMIL contributed 18% of global sales of HMC in CY23.

- 2nd largest supply chain outside Korea: India is HMC’s 2nd largest supply chain outside Korea with 194 tier-1 suppliers and 1083 tier-2 suppliers (by location). HMC aims to make HMIL the largest foreign manufacturing hub in Asia.

- Thriving in a competitive market: Hyundai is one of the few multinational PV makers who have managed to thrive in India’s extremely competitive automotive market, where players like Ford, Fiat, Chevrolet, General Motors, Mitsubishi, Daewoo Motors, and Datsun have failed due to a host of operational and product woes.

- Established business: creates a platform for future growth: Hyundai Motors has been in business in India for 28 years now. With an established business in place, all Hyundai has to do is execute efficiently.

- Multi-decade investments in India:

- 1998 was a key year for HMIL, with its 1st plant in India being set up 2 years after entering the Indian PV market.

- It also established a second plant at the same location in Chennai in 2007 to facilitate further expansion.

- In FY2024, HMC has committed to pump in $4 billion over the next decade into HMIL. HMIL recently acquired a manufacturing plant at Talegaon, Maharashtra, which is expected to commence commercial operations partly in H2FY26. This acquisition will take the total capacity to 9,94,000 units after phase 1 and 10,74,000 units after the full completion. The capacity as of March 2024 stands at 8,24,000 units.

- Kia Motors: HMC also has an interest in India through Kia Motors, which has garnered a 6% volume market share in just 5 years!

HMIL commands superior ROCEs and margins, owing to the following factors:

-

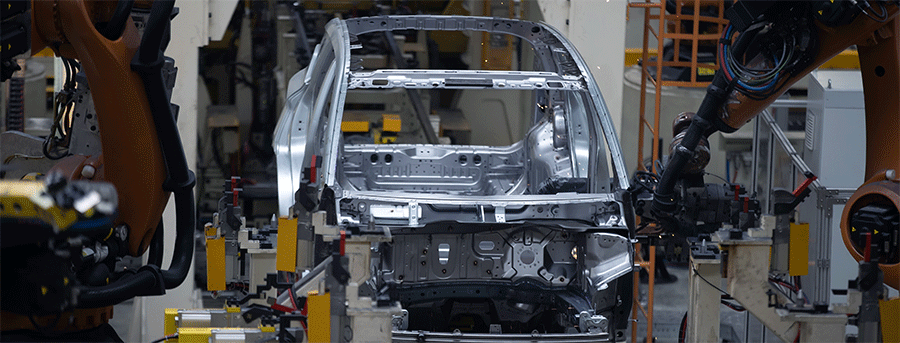

Manufacturing prowess: HMIL’s modular, state-of-the-art manufacturing facility at Chennai produces 131 vehicles per hour (~2 PVs per minute!). Capabilities extend to being able to manufacture several models from a single line, along with its variants. The factory has 740 robots. ~63% of energy needs are sourced from renewable sources.

- Products & Pricing: HMIL has been successful at consistently offering eccentric product designs that appeal to the average Indian consumer, and bringing global competence in design to the Indian market.

A reliable after-sales ecosystem, with the availability of parts, gives the customer comfort during emergencies.

There is also reason to believe that HMCs products command superior pricing in the market vs peers. In fiscal 2023, ~50% of the overall sales occurred at an ASP of >₹10,00,000. - Sales Channels: 3rd largest dealer network & the 2nd largest service network in India – ranked highest in terms of dealer relationship management.

- Supply chains: Well-established, localized supply chain, with 90% of sourcing done from the 4 adjoining districts near Sriperumbudur Chennai, thus reducing the sourcing time.

- 2nd largest exporter of PVs in India: HMIL is the 2nd highest exporter of cars in India. It commands a 25% share in India’s total car exports in FY24 (RHP). If we add Kia Motor’s exports, the share increases to 33%. The next largest exporter is Volkswagen at 6.5%. It exports to over 83 international distributors outside India, across 190 countries. Export revenues are favorable since exporters get the exchange rate benefit on those sales.

- Global dominance serves as a competitive advantage: Third largest PV maker globally – access to emerging global trends and consumer preferences – and the right to bring it to newer markets first. Synergy benefits with global R&D centres.

Recent trends in the Indian PV market

The EV explosion

- From FY19-24, EV sales have grown ~50x in volumes! (~118% CAGR). Today, one in every 5 cars sold in India are EVs.

- Tata Motors has taken a massive lead in the EV segment and commands a 71% market share in the EV 4-wheeler market (2024).

- With reduced subsidies, the establishment of EV battery facilities, and associated infrastructure, the competitive landscape is poised for significant changes.

EV charging points to see exponential growth

- India saw a ninefold increase in EV charging stations from 1,800 stations in February 2022 to 16,347 by March 2024. It is estimated that India will require 4,00,000 stations/points annually to meet its demand for EV charging.

The CNG variant: A consumer preference shift

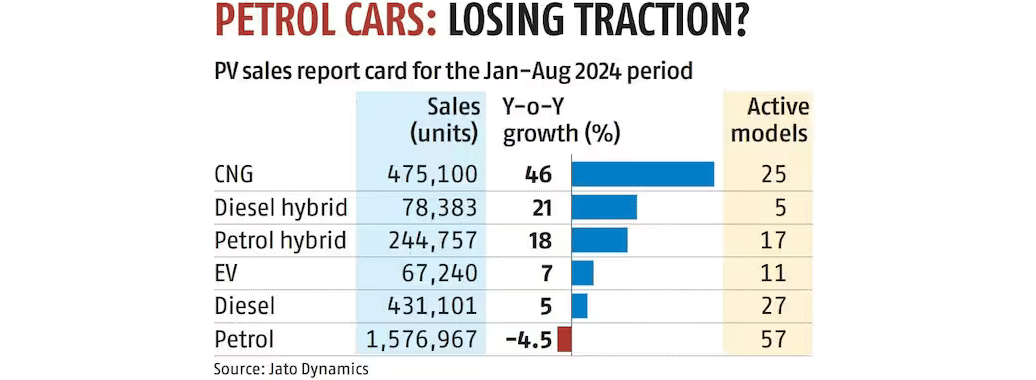

Indian consumers are increasingly choosing CNG variants over petrol diesel, or even EV or Hybrid variants - the PV sales data from Jan-Aug of 2024 shows:

Many underestimated the potential of CNG cars in India, back in 2019, when Maruti Suzuki India Chairman Mr. R.C Bhargava announced that MSIL would introduce CNG variants for most of its models. Now, in 2024, about 1/3rd of all vehicles sold by MSIL are CNG variants.

The primary reasons for consumers choosing CNG are:

- Better mileage vs petrol and diesel variants

- Cost efficiency: CNG is the cheapest in terms of the running costs/refuelling costs.

- Environmental benefits: CNG cars emit drastically fewer pollutants than petrol and diesel cars.

Continue with Google

Continue with Google