Scaling Swiggy – Bringing Blaze from Bengaluru’s Backyard

November 04, 2024

|

Garbage In, Gold Out - The Uncanny Specialties in India’s Leading Scrapping Business

December 21, 2024

|We’d like to introduce to you a very special company - the one that has technically doubled its revenues every year since 2016. Being a 10-year-old company, Swiggy has compounded its scale at a 100% CAGR since FY16 - So much to speak for the power of consumer technology in a booming consumer market like India!

Today (As of Q1FY25), Swiggy has:

- Revenues of Rs. 3,222 crores (FY24: 11,247cr)

- Present across 600 cities in India.

- 5.71mn Swiggy One members

- 15.99mn Monthly transacting users (14.03mn Food Delivery and 5.24mn in Quick Commerce)

- 156mn Orders (FY24: 578mn)

- 2,23,671 Average Monthly Transacting Restaurant Partners

- 457,249 Delivery Partners

- 557 Dark stores (Quick Commerce)

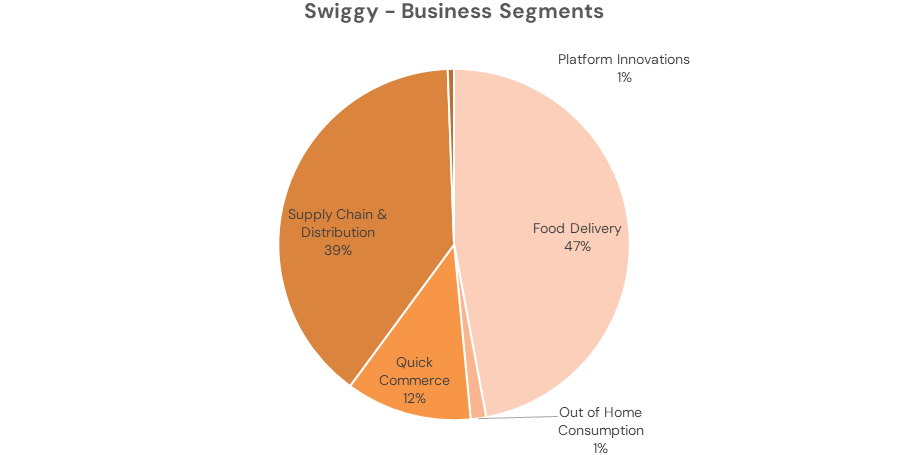

Swiggy seems to be coming to the street around a time when it appears to be confident in its abilities to become a profitable entity. Being a company that initially made heavy losses in the first half of its decade-long existence, Swiggy has consistently narrowed its cash burns over the last 5 years and its food delivery business, which accounts for ~47% of its total revenues has reported a positive EBITDA margin of 0.8% in Q1FY25.

In this article, we discuss this unique company that is about to hit the bourses for listing in just a decade after its incorporation.

History and Founders

Swiggy emerged as an offshoot of Bundl Technologies in 2014, a logistical solution that solved the shipping needs of small and medium-sized businesses. Co-founded by Sriharsha Majety and Nandan Reddy, alumni of BITS, Pilani, the two founders shifted their focus on food deliveries, marking a noteworthy change in business strategy.

The founders identified the inherent consumer need for convenience in food delivery while keeping in mind the time-sensitive nature of the food business. For example, An ice cream melts in 25 minutes, while a pizza becomes soggy in 35 minutes.

Sriharsha Majety

(Co-Founder)

Nandan Reddy

(Co-Founder)

Rahul Jaimini

(Ex-Chief Technology Officer)

Early Days

Swiggy started as a lean operation in Koramangala region of Bengaluru, with 5-6 delivery partners and 15-20 restaurant partners. Marketing was done via pamphlets, word of mouth, and mutual connections. The founders toiled day and night to set up the operation, handling sales, customer success, firefighting and also helping the delivery partners navigate through the Koramangala streets, and sometimes making deliveries themselves.

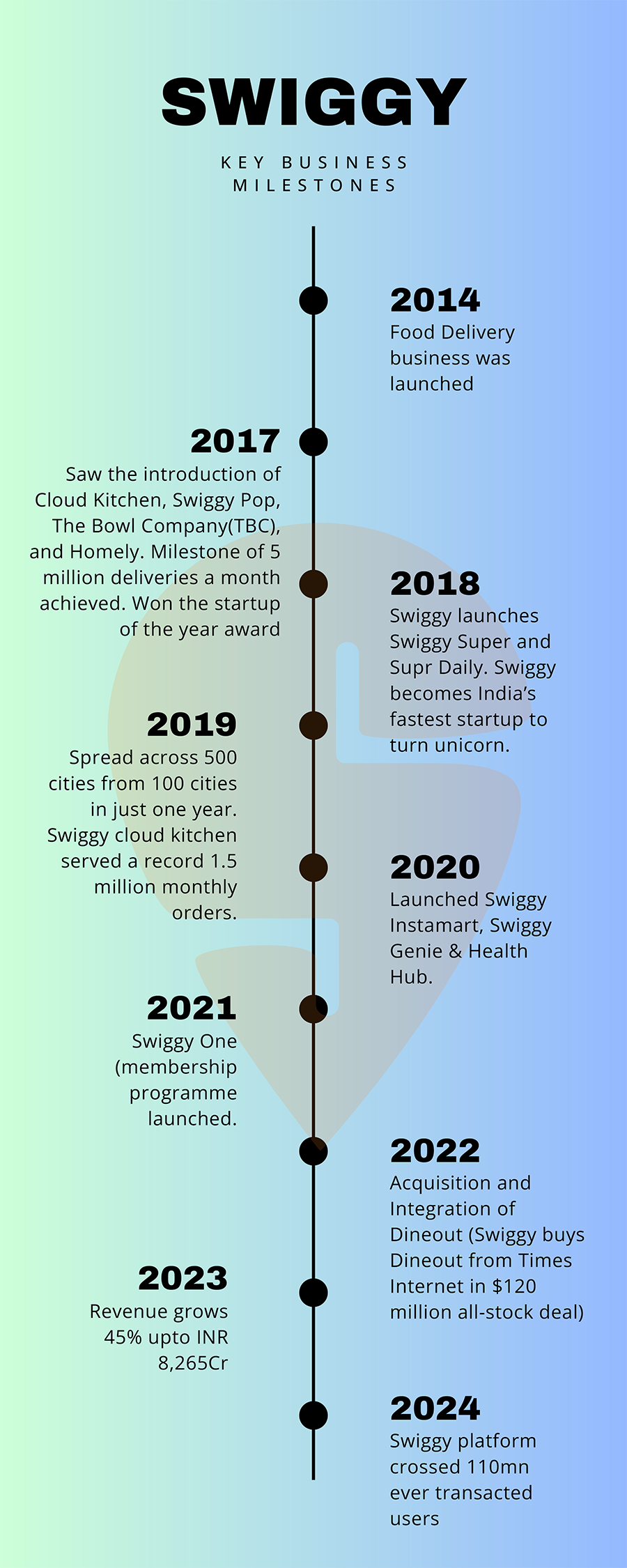

Swiggy’s Journey & Key Milestones

Over the last decade, Swiggy has raised a cumulative $3.85bn (~INR 32,350cr) across 15 rounds of funding.

Swiggy’s Business Model

Let’s dive into Swiggy’s unique business model. Swiggy generates its revenue from 4 main sources:

- Commissions: Swiggy charges restaurant and merchant partners a commission based on the perceived value of its offerings.

- Ad Revenue: The platform earns income from restaurants, merchants, and brand partners through its advertising tools.

- Platform Fees: Fees are collected from users and delivery partners for accessing the technology platform.

- Subscription Revenue: The Swiggy One membership program contributes revenue through user subscription fees.

Business Segments

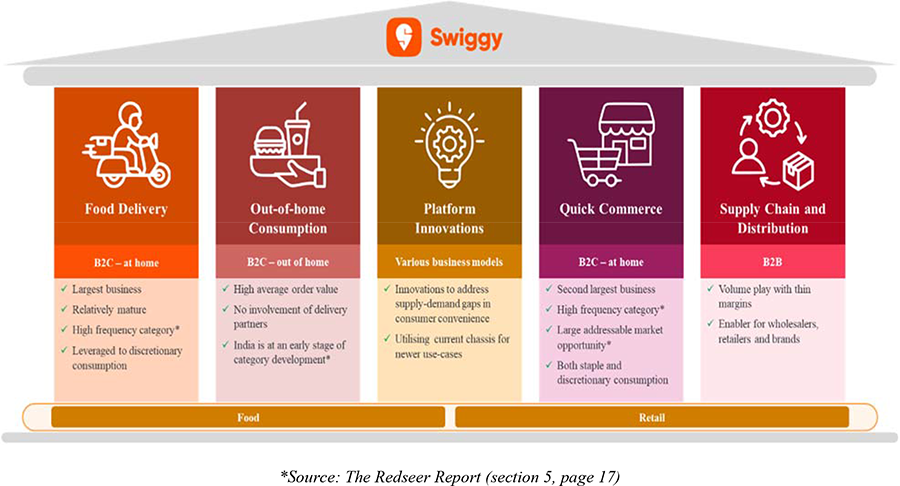

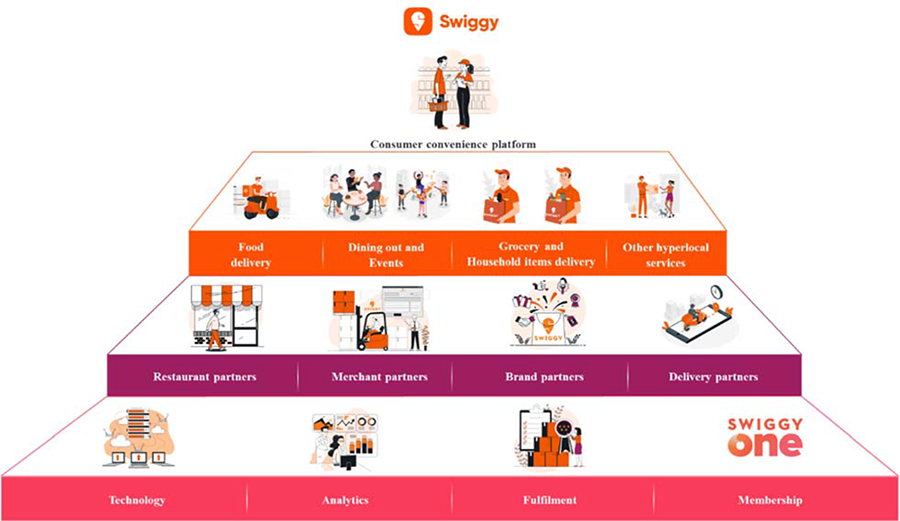

The following image illustrates the key business verticals of Swiggy:

The figure above illustrates the various business segments from which Swiggy derives its revenues, as of Q1FY25.

- Swiggy calls itself India’s pioneering on-demand e-commerce platform. Although food delivery accounts for a major portion the overall business, the company looks to continuously expand its offerings across new categories, year after year.

- Under its Supply Chain and Distribution segment, Swiggy provides a wide range of supply chain service (order-fulfilment services) tailored to wholesalers, retailers, and fast-moving consumer goods (FMCG) brands, utilizing its robust warehousing capabilities.

- Swiggy Instamart (Swiggy’s quick commerce offering): Consumer expectations are evolving quickly across various categories. In 2021-22, Swiggy surprised customers by delivering everyday household items, such as batteries, right to their doorsteps. By 2023, the platform expanded its offerings even further with products like bedsheets. Swiggy is actively adding new categories, continuously broadening the range of products available to its users.

- Swiggy has leveraged its DNA in logistics supply chains to offer services like Swiggy Genie, which is an on-demand product pick-up/ drop-off service for users & Scootsy, which is a one-stop intra-city delivery platform.

- Other businesses include Swiggy Minis which is an in-app offering where local brands can set up their mini store on Swiggy’s platform.

- Swiggy also delivers its private label brands like “The Bowl Company”, via its app.

Swiggy ONE

Swiggy One is a membership program that offers members discounts and promotions across the platform, including free delivery on select orders. Launched in 2021, Swiggy One enhances the platform's network effects, boosting user engagement and transaction frequency. As of June 30, 2024, Swiggy ONE had 5.71 million members. During the three months ending June 30, 2024, Swiggy ONE members ordered an average of 7.40 times, compared to the platform average of 4.50 times.

This membership program is akin to Amazon’s Prime membership, which has been a cornerstone of Amazon's e-commerce strategy since its inception. These programs serve as tools for customer acquisition and retention, enabling the platform to expand its offerings and services in the future.

More on the business Model:

The illustration below showcases how Swiggy has effectively created a “Consumer Convenience Platform” by offering four main service areas. This has been achieved by connecting various stakeholders and integrating them with advanced technology, analytics, and a robust fulfillment center network.

The platform model, or the marketplace model of Swiggy has enabled it to leverage the network effects of connecting consumers and restaurant owners, in the food consumption space.

Lessons to be learnt from Amazon

The “marketplace” model of doing business or offering a platform that connects people for business has been the key ingredient in the success of behemoths like Amazon and recently turned-profitable companies like Zomato.

Amazon has a proven track record of acquiring customers via its platform, through various channels, including the notable Amazon Prime membership, and then offering layer after layer of services to the same customers. This results in a continuous addition of revenue streams to the core businesses. Swiggy is following a similar path, by expanding across product & service categories with each passing year.

Another lesson to be learned from Amazon is the strength of its fulfilment network, which is the largest in the US and has been built over the last 25 years. This country-wide fulfilment network enables Amazon to achieve a dramatically lower “Cost to serve” and “Time to serve” than any of its peers. This can be compared to Swiggy’s pan-India network of dark stores and fulfilment centres, which is poised for aggressive expansion over the next 18-20 months. Swiggy plans to add ~1500 dark stores over the next 18-20 months, to its existing network of 557 dark stores, at an estimated cost of 980-1000crs. Swiggy has added 12 warehouses in FY24 taking the total count to 54, from 32 in FY23.

Amazon is much larger in scale as compared to Swiggy and is diversified across multiple businesses. However, as an e-commerce company, Swiggy has a lot to learn from Amazon’s playbook. This also speaks volumes about the kind of growth potential companies like Blinkit and Swiggy possess.

Swiggy vs Zomato

In perhaps the most interesting section of the article, we dive into the notable differences between Swiggy and Zomato:

Leadership styles of Deepinder Goyal and Sriharsha Majety

While Majety is known to know nothing about on-ground operations and delegate as much as possible, Goyal is known for exercising stricter controls across the organisation from the top.

Swiggy’s philosophy is to build an institution and not a founder-led organisation. However, Goyal’s way of running the business in a more visible manner has also worked well for him.

Majety has been hardly visible in the media and prefers to stay out of the limelight, while Goyal has had an extensive presence as well as media coverage before and after Zomato’s IPO.

ESOPs and Employees

In 2021, Zomato’s Goyal was allocated 74% of the total ESOP pool, whereas Majety was allocated 57% of Swiggy’s ESOP pool, while the rest was distributed among the top executives. Swiggy’s ESOP terms are also more employee-friendly, with equal vesting of 25% over 4 years, as compared to Zomato’s backloaded schedule of 10%, 20%, 30%, and 40% over the same period.

Zomato’s bold move of firing a large majority of its board post the IPO, citing complacency and loss of the growth-oriented mindset is starkly different from Swiggy’s calibrated approach. Swiggy is apparently following Amazon’s style of delegation, which has created a conducive environment to attract top-notch talent very early in the company’s journey. This resonates with their policies of hiring the right people for the top jobs.

App strategy

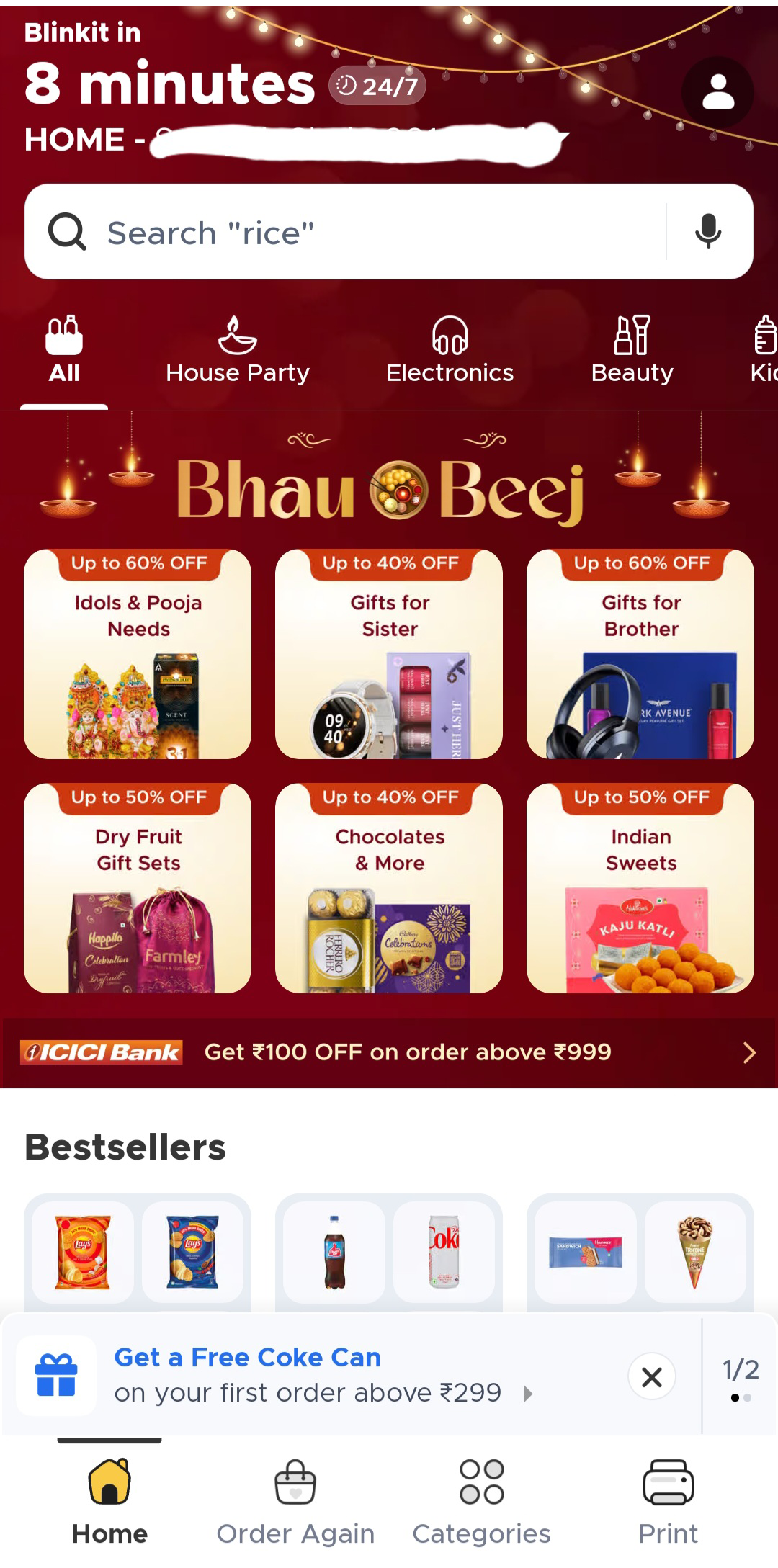

Zomato has chosen to maintain separate apps for i) food delivery, ii) quick commerce and iii) eating out and events ticketing, namely: Zomato, Blinkit, and District respectively. (“The unbundled approach”)

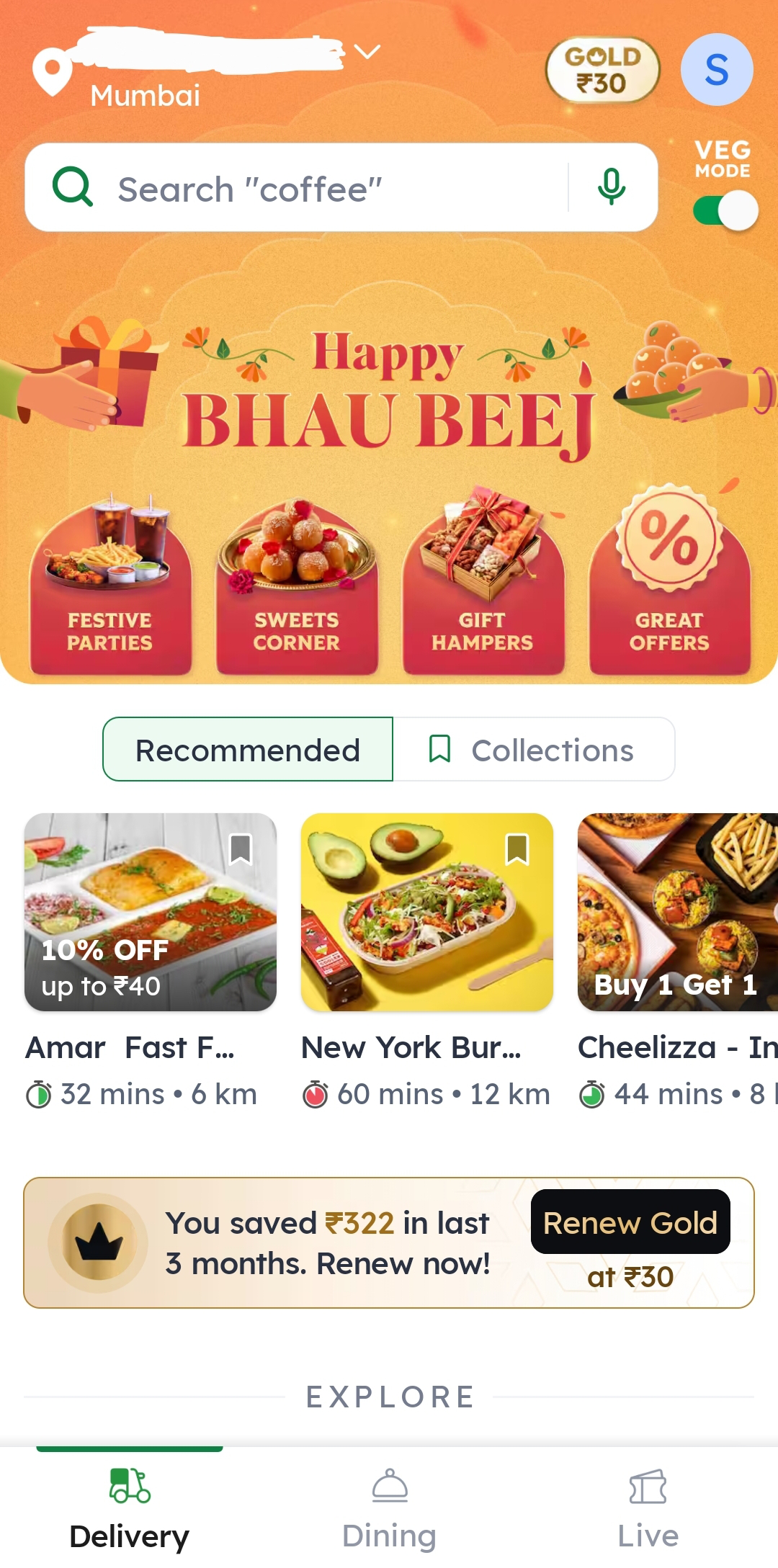

Swiggy is following Tencent’s model of Super Apps, in which food delivery, quick commerce (Instamart), eating out (Dineout), and package drop-off (Genie) are offered through the same platform.

Snippets of the app interfaces of Swiggy, Zomato and Blinkit apps, taken on the day of Bhai Beej, celebrated by people across the country. Notice the super app structure of Swiggy vs the unbundled approach used by Zomato.

Presence

Zomato is present across 800+ cities while Swiggy is present across ~600 cities pan-India, in their respective food delivery businesses, yet both are at similar levels of revenue. (FY24 Zomato: Rs. 12,114cr, Swiggy: Rs 11,247cr)

What makes Swiggy stand out from its peers?

- Seasoned Founders with a vision:

Swiggy’s founder Sriharsha Majety, is known for his long-term mindset, and for sticking with the ideas that would give Swiggy incomparable advantages over the long run, like maintaining an in-house delivery fleet, at a time when peers like Zomato openly stated that such a strategy would not be beneficial going forward. However, Zomato ended up following Majety’s strategy by acquiring Runnr’s fleet in 2017.

Tech watchers liken Majety to Tencent’s Pony Ma and Zomato’s Deepinder Goyal to Alibaba’s Jack Ma, the two Chinese entrepreneurs with contrasting leadership styles. Tencent popularized the super app concept, which Majety is pursuing now. (Tencent is a shareholder in Swiggy). Alibaba has grown through acquisitions and was once a strategic investor in Swiggy.

People who have known Majety describe him as a private, introspective founder with a passion for reading, considerable curiosity, and a high degree of self-awareness. At Swiggy, he doesn’t thrive in day-to-day execution, a responsibility he delegates to his team members. He would rather work on the product and focus on improving the customer experience than tracking the number of restaurant partnerships or consumer brand deals Swiggy signs.

- Sharp focus on logistics:

Swiggy has invested heavily on logistics and data, giving it a visible edge over its competition in execution and performance metrics. As we will discuss later in the article, big data is an important pillar on which Swiggy is built. Many would agree that Swiggy’s delivery fleet is considered more reliable, faster, and efficient than any other peer in the industry. - Customer-focused superfast deliveries

- An unparalleled offering of user convenience via the app:

With a super convenient user interface, an easy-to-operate all-in-one app, and superior customer services like ultra-fast order cancellation, modification, order tracking, etc, Swiggy offers a superior experience to its users that keeps them hooked to the app. -

Big data is pivotal to what Swiggy is today:

Swiggy leverages the power of data analytics to give users the experience they are getting today.

Each time the app is opened, thousands of calculations occur instantaneously — your food preferences, the live snapshot of delivery executives in your area, which restaurants are live, are you seeing enough variety, the range across all price points and cuisines, and many more.

Other metrics such as delivery volumes and restaurant volumes are also tracked. Swiggy maintains a hyperlocal focus, and tracks KPIs in each area to bring about greater efficiencies.

KPIs such as (Delivery Executive) DE login volumes in a certain area, zone-wise cancellation rates, and demand-supply match in that area for both food and DEs are tracked.

Source: SwiggyBytes - Tech Blog

- Maintaining relationships with restaurant partners by offering value-added services like Swiggy’s Market Intelligence Dashboard, which gives restaurant owners a hyperlocal view of the competitive landscape and the distribution of the consumers wallet share among the restaurants. The tool covers insights for partners PAN India across 350+ cities and 9000+ consumer zones and is anchored on 30+ key metrics related to business and operations. An average of ~30 similar players have been considered for each partner from their respective cities and zones.

A word of caution!

The prospect of a startup growing exponentially can be alluring, but there are obvious areas where caution needs to be exercised by investors:

- The need to prove the business model’s profitability.

- Tackling Zomato’s dominant market share and regaining the first-mover advantages it once enjoyed.

- Competing against players like Zepto in Quick Commerce, who are closing in on the 2nd place, currently commanded by Swiggy.

- To prove the efficacy and the inherent advantages of the super app model.

- Food and grocery delivery companies have the potential to attain a 5% steady state EBITDA margin, as quoted by Swiggy’s CFO. This is quite low, but the operating leverage and scale are the profit drivers here. How, when, and whether the same will be achieved in the future is a topic for further discussion.

Continue with Google

Continue with Google