India Stack & Digital India – Seizing the ‘Tech-ade’

January 01, 2025

|

India Stack & Digital India – Seizing the ‘Tech-ade’

January 01, 2025

|Today, India is recognized globally as a technology powerhouse, boasting a rapidly expanding market of digital consumers—over 954mn million internet users, the world’s largest digital identity program, Aadhaar, with over 1.2 billion enrollees, and a flourishing e-payment ecosystem, processing over 14 billion Unified Payment Interface (UPI) transactions each month. The Indian IT industry generates USD 254 billion in revenues, supported by a robust talent pool of 5.4 million engineers. Most of the top 10 global systems integrators are based in India, and the country is home to over 31,000 tech start-ups. India’s vast population is a key driver of tech adoption, fueling an insatiable demand for digital services.

This creates a strong impetus for the tech ecosystem to develop affordable, scalable, and profitable solutions. As this dynamic environment continues to evolve, several emerging technologies will play a crucial role in helping India reach its goal of becoming a trillion-dollar digital economy.

Data is at the heart of this transformation, as the digital economy relies on high-quality, data-driven decision-making. India is already on its way to digitizing data, but modern technologies require even more robust data systems.

This Digitalization of India is driven by several initiatives carried out by the government, the public as well as the private sector.

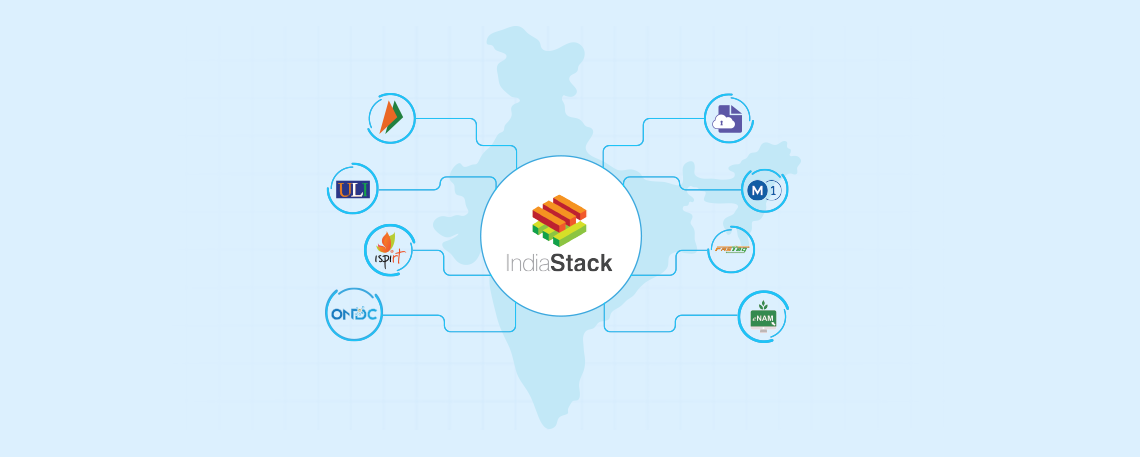

Our motive for this article is twofold: 1) To talk about the emergence of the “India Stack” – a set of digital tools that are driving national-scale digital adoption in India; &

2.) How the ‘India Stack + Digital India’ duo is proving to be pivotal in awakening the animal spirits of our economy.

So, let's begin.

What is the India Stack?

India Stack is a set of APIs (we recommend readers to click on the link to know what is an API, for a better understanding of the topic at hand) or digital products that aim to unlock economic value by enabling: (i) greater and wider access to data, (ii) faster transactions, (iii) enhanced security and (iv) lower turn-around-times and greater productivity for the consumers, businesses, and governments as a whole.

With the advent of the UPI, payment transactions saw efficiencies at a scale never seen before:

| Particulars | Oct'21 | Oct'22 | Oct'23 | Oct'24 |

|---|---|---|---|---|

| Volume (bn) | 4.21 | 7.3 | 11.4 | 16.58 |

| Growth % | 73% | 56% | 45% | |

| Value (₹ Trillion) | 7.71 | 12.11 | 17.15 | 23.49 |

| %Growth | 57% | 42% | 37% |

The table above highlights the growth in the value and volume of UPI transactions, based on the most recent data released for October.

Such is the power of the India Stack. The government has built a host of other “digital public goods” that have/are expected to deliver such record-breaking efficiencies for our economy.

The beauty of the India Stack lies in the fact that these digital public goods are open-source, i.e these can be integrated into any application with ease and at no cost, thus significantly enhancing productivity.

India Stack 1.0 was characterized by digital products that helped promote financial and social inclusion in the country. (Namely: Aadhaar-based verification, DigiLocker, UPI etc.)

India Stack 2.0 on the other hand, is going to take it a step further, integrating more sophisticated technologies like AI/ML and LLMs, in addition to existing technologies to further optimize the ease of living for individuals and the ease of doing business for the even smallest of businesses in the country. India Stack 2.0 is yet to launch, and awaits further updates. A prominent example would be open-source indigenous AI modules that can be used to create solutions based on the need of the business/organisation/individual. Other examples include AI-powered chatbots, conversational AI etc. The applications are spread across healthcare, education, manufacturing, among others.

India Stack + Digital India: Foundations for decadal growth

To awaken the so-called “animal spirits” of the country, the decision-makers needed to inculcate changes at the micro-level, i.e. the smallest of businesses and the most underprivileged individuals. This meant equipping them with an ecosystem that encouraged agility, efficiency, growth, entrepreneurship, and innovation.

Such an ecosystem is slowly coming to fruition in our country, and the emergence of digital public goods is playing an important role in the same.

Hence, we’ve taken a holistic view of these digital public goods developed over the last few years, and believe that they will be crucial in driving India's economic growth over the next decade.

Let’s dive into each of these innovations to learn more about them:

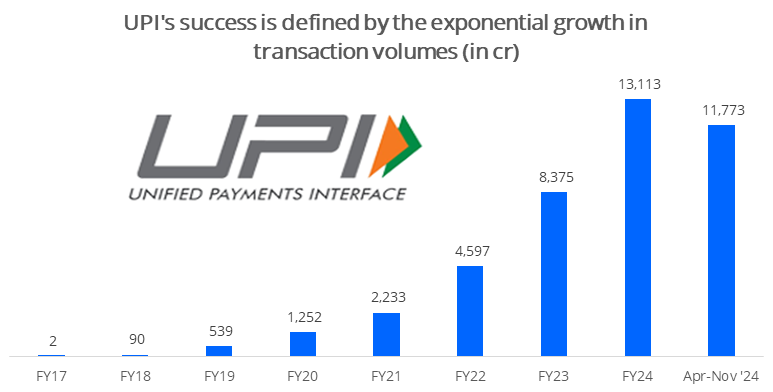

1. Unified Payments Interface (UPI)

UPI is a real-time payment system that allows users to transfer money between bank accounts through a mobile app. The rise of third-party payment apps like Paytm, PhonePe, and GooglePay etc. have played a huge role in the grand success of the UPI. As of today, there are over forty 3rd party UPI apps in India.

UPI transaction volumes have grown at a ~257% CAGR from FY17-24.

As of FY2024, UPI now accounts for 80% of the total digital payment volumes in India, overshadowing other modes like RTGS, IMPS, and NEFT.

2. Unified Lending Interface (ULI)

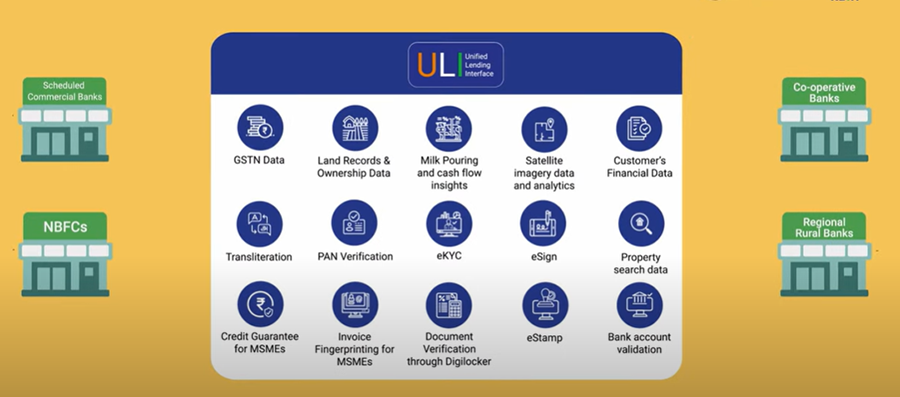

Our erstwhile RBI Governor, Shri Shaktikanta Das, announced the Unified Lending Interface (ULI) at the RBI@90 Global Conference on August 26, 2024, in Bengaluru.

During his speech, the Governor mentioned that the new trinity of JAM-UPI-ULI will be a revolutionary step forward in India’s digital infrastructure journey. Just like the UPI transformed the payments ecosystem, the ULI is expected to play a similar role in transforming the lending space in India.

As per the most recent data unveiled by the government, the ULI’s 16-month-long pilot has shown encouraging results:

Over 6,00,000 loans were disbursed through the ULI, amounting to over ₹27,000cr. Of this, ~50% of the loans were made to MSMEs. (Worth ₹14,500cr).

The loans were disbursed across categories like Kisan Credit Card (KCC), digital cattle, MSME (unsecured loans), tractor loans, micro business loans, vehicle loans, digital gold, e-Mudra, pension and dairy maintenance loans. (Source:RBI)

The ULI runs on a ‘plug and play’ model. With a one-time integration with the platform, lenders can leverage information from all these sources, eliminating the need for them to carry out multiple bilateral integrations with each data and service provider. This information can be classified into basic-to-critical data sources, that every lender needs, right from marketing, onboarding, and eventually underwriting the loans and the collections.

An image illustrating the information sources available to any lender, who is integrating the ULI into its lending process.

Consequently, the cost of processing a loan application via an AA (Account Aggregator) has come down to INR 100 from INR 440, offering significant cost efficiencies to lenders.

The ULI is expected to democratize credit availability in India.

3. Open Credit Enablement Network (OCEN)

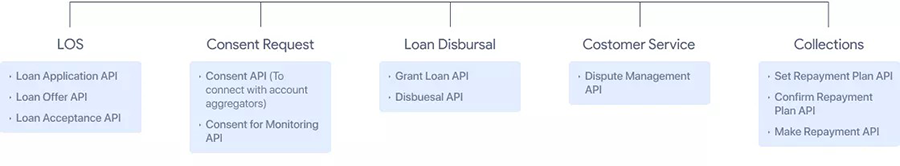

OCEN is a framework of APIs for the digital lending ecosystem that connects borrowers, lenders, loan service providers (LSPs) and technological service providers (TSPs).

It is a set of standardized APIs/ protocols, that have eliminated the hassle in the flow of digital credit.

OCEN contains an API for each step of the lending lifecycle, as shown in the images below:

Source: Industry reports, stockaxis research

What is the difference between OCEN & ULI?

The table below throws light on the differences between OCEN and ULI:

| Particulars | OCEN | ULI |

|---|---|---|

| What is it? | A Framework for Digital Lending | A Sophisticated API for seamless lending |

| Direct Beneficiaries | Lenders, Borrowers, TSPs and LSPs | Lenders |

| Types of Loans | Short-Term, Low-Ticket Size, CashFlow-based Loans | Broad Range of Credit Products, typically longer-term loans |

| Customer Segments | MSMEs, New to Credit Borrowers | Rural borrowers, MSMEs, general public |

Source: Industry Reports, stockaxis research.

4. MuleHunter.ai

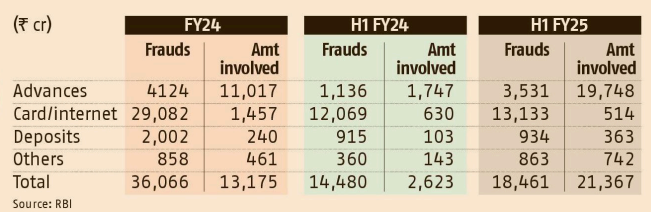

With both the incidences and the amount of financial frauds increasing in FY25 vs FY24, the need for a robust fraud detection model became imminent. Consequently, RBI’s innovation hub has developed MuleHunter.ai – a fraud detection model that leverages AI/ML to identify suspicious accounts by tracking illicit fund flows. This model has been developed in collaboration with several banks and can detect as many as 19 distinct patterns of mule account activity.

Financial institutions are prioritizing robust fraud detection systems, given the surge in financial crimes within the lending sector. Models like Mulehunter.ai are crucial in bolstering industry-wide defenses against sophisticated financial fraud schemes.

5. DigiLocker

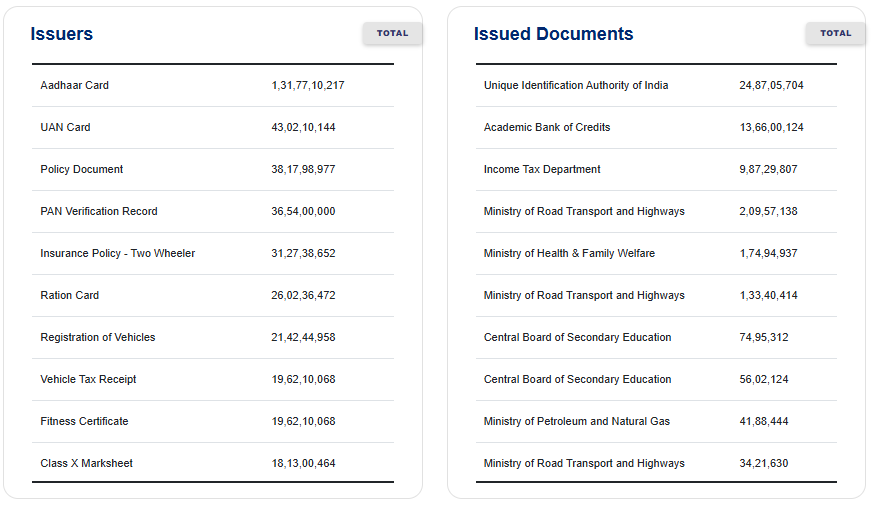

DigiLocker is the Government’s initiative for providing citizens with access to their authentic digital documents via a digital document wallet.

Till date, DigiLocker has over 42.7cr users, over 940cr issued documents, and over 1645 issuers on its platform.

The table below illustrates the number of documents issued by document type and by the issuing authority:

Source: DigiLocker

6. Open Network for Digital Commerce (ONDC)

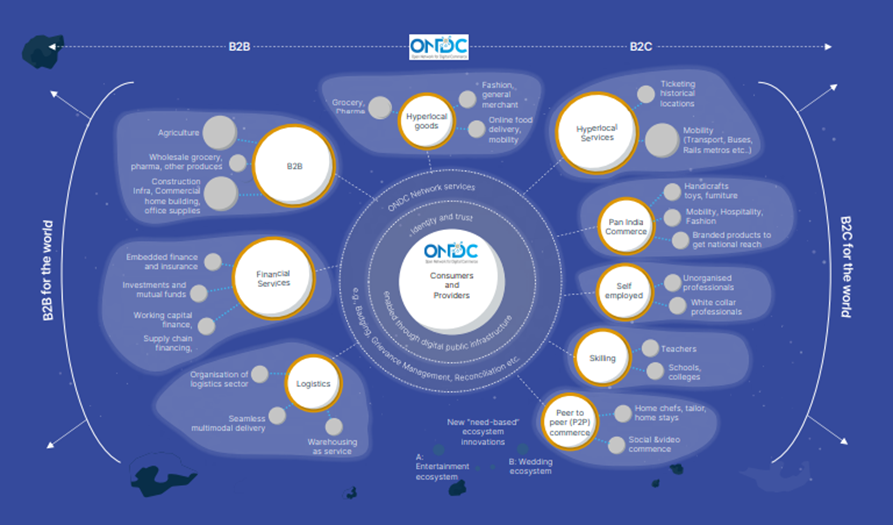

ONDC is basically a government-backed technology infrastructure for online commerce (or e-commerce). It can be seen as a network of networks. ONDC is determined to democratize online commerce, just like UPI did with payments and ULI is doing with lending.

ONDC is bringing together the entire ecosystem of buyers, sellers, merchants, financial institutions, service providers, and logistics companies under one roof – the result being: (i) a drastic reduction in logistics costs, (ii) heightened network effects and (iii) faster throughput of goods and services, meaning more revenue for businesses.

The ONDC must be seen as an ecosystem that covers the entire e-commerce value chain, including both B2B and B2C e-commerce.

ONDC’s main advantages are that:

- It’s flexible: The ONDC platform connects the buyers to the sellers who sell via a seller app of their preference. This flexibility makes ONDC very powerful, as it can be integrated across apps and platforms without any restrictions to one particular platform.

- It is an unbundled offering: For example, in an e-commerce transaction, the seller-side, logistics, payments, and buyer-side activities can be handled by separate entities.

7. Government Open Data Initiative

Open data is freely accessible information that anyone can use and share. Government agencies and organizations often release open data as part of their commitment to transparency and accountability, making publicly collected information available to the public.

It can be used for various purposes, like research, policy analysis, or developing new products and services. By making data accessible to a broad audience, open data fosters collaboration, sparks innovation, and contributes to economic growth and social progress.

To support open data initiatives, many organizations create online portals and platforms where users can easily find, access, and download datasets.

Case Studies of the Open Data Initiative:

Case Study 1: Telangana Southern Power Distribution Company Limited (TSSPDCL)

Data from Power Discoms can be used to track industrial activity in the region, along with hands-on data for government level decision making and capital allocation. The same can be replicated across the country.

Case Study 2: Open data for Indian Family Health and Welfare.

Freely accessible datasets like the Global Youth Tobacco Survey, National Family Health Survey, Public Health Facilities across states, etc. can be used for data analysis for both commercial and non-commercial purposes.

Case Study 3: Visualizing Data for Trade Statistics

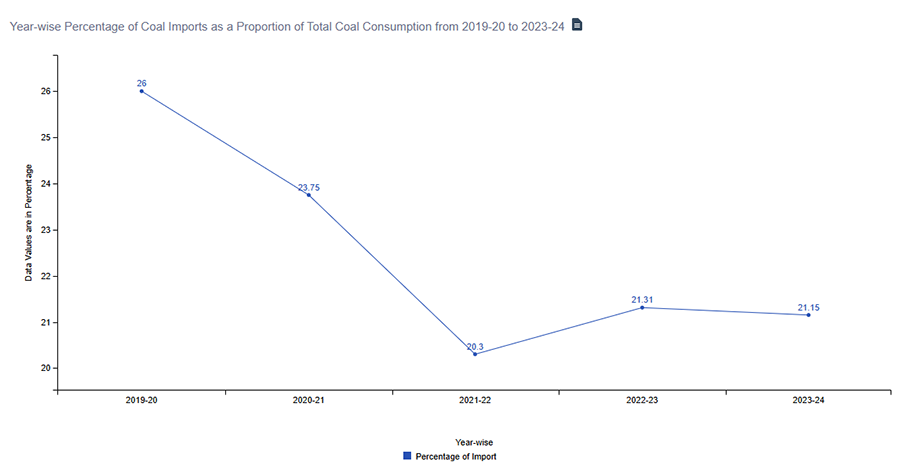

The chart below shows the percentage of coal imports as a proportion of total coal consumption from the year 2019-20 to 2023-24:

Source: Ministry of Coal, India

8. TReDS

TReDS is a platform for bill discounting and purchase, allowing MSMEs to upload, accept, discount, trade, and settle invoices or bills. It facilitates factoring for both receivables and payables.

The platform aims to onboard up to 1 million MSMEs in the next few years. Currently, there are three TReDS platforms: Receivables Exchange of India, M1xchange, and Invoicemart. The eligibility threshold for companies has been lowered from ₹500 crore to ₹250 crore, and all Public Sector Enterprises are mandated to list on these platforms.

9. Other Initiatives

Several other significant initiatives under the Digital India Mission include:

- FASTag: An electronic toll collection system using radio-frequency technology to collect toll payments in real-time as vehicles pass through toll booths.

- e-NAM (National Agriculture Market): A pan-India electronic trading portal that connects existing Agriculture Produce Market Committee (APMC) mandis, creating a unified national market for agricultural commodities. e-NAM provides farmers with better marketing opportunities through competitive and transparent price discovery and online payment options.

- Multi-Lingual Interaction and Resources: With regional language content consumption growing rapidly, initiatives like MeitY’s Bhashini and Google’s Project Vaani aim to enhance AI-driven language models for diverse Indian languages and dialects. These efforts support better digital experiences and foster vernacular content creation.

- e-Sanjeevani: The e-Sanjeevani scheme, a cornerstone of India's digital health revolution, aims to bridge geographical divides in healthcare access. By leveraging telemedicine, it connects patients in remote areas with qualified doctors, providing crucial consultations and second opinions. This initiative seamlessly integrates with the National Electronic Health Record (NEHR), a comprehensive digital repository of an individual's health information. The NEHR serves as a foundational pillar, enabling seamless data sharing across the healthcare ecosystem. This interconnectivity fosters improved patient care, facilitates research, and empowers individuals with greater control over their health data, ultimately transforming India's healthcare landscape. As per the most recent data, the scheme has provided over 276 million consultations till date, up almost 2.76x over last year, when it delivered over 10 crore consultations.

Summing up!

At the heart of all this lies three important stakeholders:

- The Indian consumer, who has access to the cheapest internet in the world.

- The Indian Business, that is growth-hungry and wants to become competitive and expand globally.

- The Government, that aims to be an efficient administrator to the Indian economic development story.

Technology integrates all three.

India is thinking ahead of its time when it comes to technology. The India Stack and the Digital India mission are foundational pillars on which the next decade of economic growth of India will ride. Amongst the other government initiatives, these two perhaps are the most significant, since they have democratized the area that they touched upon. Take for instance this:

Aadhaar democratised identity norms

Jan Dhan democratised financial inclusion,

The UPI democratised payments,

The OCEN & ULI are democratizing loans,

ONDC is democratising e-commerce,

Open Data is democratising data sharing,

India Stack 2.0 aims to democratize AI for India.

This democratisation of resources for Indians should be a major driver of economy-scale improvement in efficiencies. And thus, the unlocking of economic value and the so-called “animal spirits”.

In essence, the purpose of these initiatives is to make Indians, and Indian businesses more competitive on a global stage, placing them at par with their global counterparts. The accrual of substantial profits then, is a natural outcome of the same!