Garbage In, Gold Out - The Uncanny Specialties in India’s Leading Scrapping Business

December 21, 2024

|

Garbage In, Gold Out - The Uncanny Specialties in India’s Leading Scrapping Business

December 21, 2024

|Nobody wants to touch scrap, right?

“It holds negligible value”, one would say.

“It’s true”, says the layman.

“But wait - let’s ask the founders of material recycling businesses in India”, says the intellectual. “I’m sure they would beg to differ.”

This conversation throws light on the opportunistic mindset of individuals who dreamt of making a business out of scrap! Yes, you heard that right: Scrap. While a layman is complacent and brushes off scrap as worth nothing, the intellectual thinks deeper and tries to figure out what he/she can make out of it.

And this is where businesses like Gravita India come in.

In this article, we take a look at Gravita India’s business, and its inherent advantages. Then we compare it to a global company in a similar line of business and explore its potential, and what optionalities it possesses for future growth and expansion in the scrap recycling and salvaging market.

Section 1: About Gravita India

Gravita India Ltd is a leading recycling company and one of the largest lead producers in India. The company's business is organized across four specialized verticals: Lead Recycling (flagship), Aluminum Recycling, Plastic Recycling, and Turnkey Projects. The company is headquartered in Jaipur, India, and has multiple scrap collection & recycling facilities within India and at overseas locations.

Understanding Gravitas business – Material Recycling

Material recycling is the process of turning materials that would otherwise be thrown away into new products:

This is a highly fragmented and shunned sector in India since setting up a recycling business is capital intensive, and it's often given less preference than other businesses.

Gravita is in the business of recycling scrap/industrial waste in the form of lead, aluminum, and plastic. It also specializes in producing value-added products from this process, which have higher value.

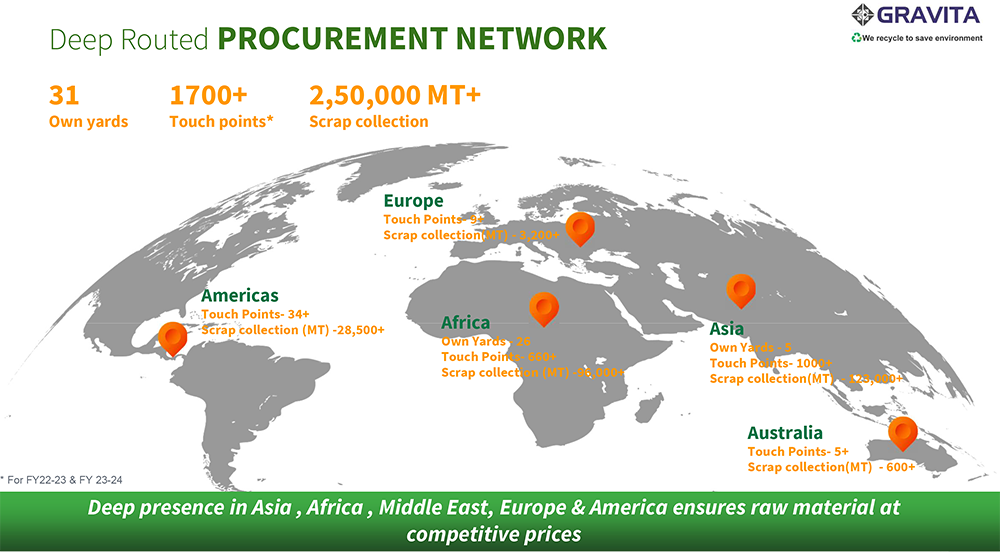

This is a well-established business, set across a wide geographical area globally. Gravita commands an extensive network including 31 dedicated yards and 1,700 touchpoints, enabling it to maintain a robust scrap collection capacity exceeding 250,000 MT. It possesses a recycling capacity of 3,02,859 MT, as of the end of FY24.

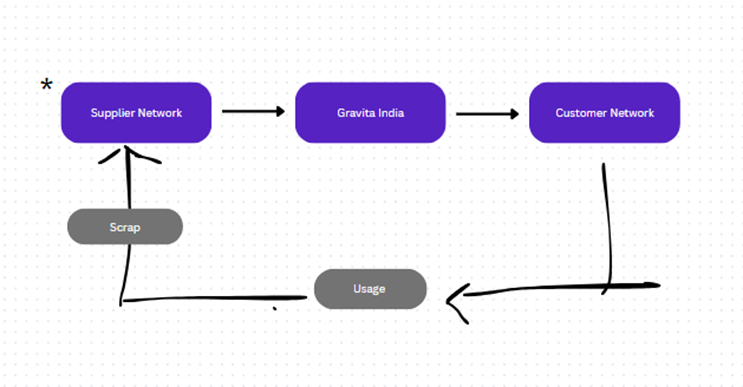

To explain simply, Gravita’s business has three foundational pillars to its business: Its Supplier Network, Itself, and its Customer Network, as illustrated in the chart below:

Gravita’s Supplier Network:

Gravita’s own facilities across the Globe:

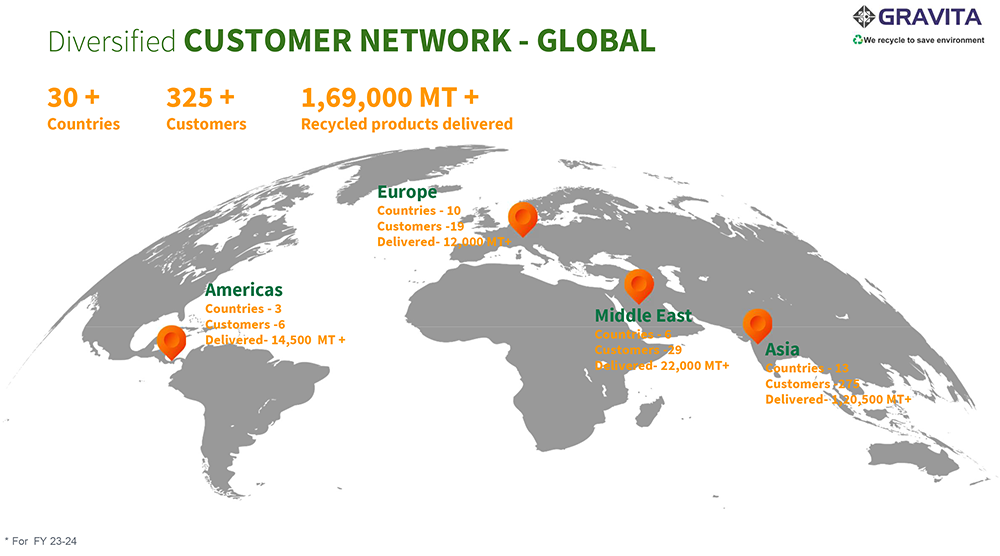

Gravita’s extensive customer network, across 30 countries and 325+ customers:

The images above show the global network of Gravita India’s operations. With over 1700 procurement touchpoints, 31 scrapyards, and over 325+ customers globally, Gravita boasts of an extensive network in the materials recycling space.

Drilling Down Further

Gravita derives 88% of its revenues from Lead recycling and related value-added products. (FY24), 8% from aluminum recycling, 2% from plastic recycling, and the balance from turnkey projects.

An image illustrating the finished output of the lead recycling process.

Looking forward, the management has stated their intention to reduce the share of lead recycling to ~70% from the current 88% by expanding into other categories of recycling and salvaging.

Battery Recycling (including Lithium Ion), Steel recycling, Tyre Recycling, and Aluminum recycling are the emerging areas the company is focusing on to drive its future growth and profitability.

So, what’s in the works?

- Revenues from lithium-ion battery recycling, steel, and paper recycling will contribute meaningfully by 2027, once the ongoing capex in these areas is completed.

- It’s first Lithium-Ion battery recycling cum rubber recycling plant is coming up at Mundra, Gujarat. (funded by the ₹ 1000cr QIP launched on the 16th of December)

- Additionally, the company has also ventured into tyre recycling by acquiring a tyre recycling facility in Romania, Europe with a capacity of 17,000MTPA.

- At the same time, the company plans to scale up its Aluminum recycling capacities by ~2x over the next 3 years.

- A new facility for battery scrapping in being set up in Oman, while new projects in the Middle East and South American markets are also underway.

- Work is on for new recycling facilities in the US as well. More developments on the same are expected.

The company is also eyeing certain acquisition opportunities abroad, in line with its plan to achieve scale at the overall business level.

Financials

The table below shows us the summary of its 5-year financials:

| Particulars | 2020 | 2021 | 2022 | 2023 | 2024 | CAGR |

|---|---|---|---|---|---|---|

| Revenue from Ops | 1352 | 1412 | 2223 | 2808 | 3164 | 24% |

| Gross Profit | 257 | 277 | 472 | 519 | 600 | |

| Gross Profit Margin% | 19.0% | 19.6% | 21.2% | 18.5% | 18.9% | |

| PAT | 37 | 57 | 148 | 204 | 242 | 60% |

| PAT Margin% | 2.7% | 4.0% | 6.7% | 7.3% | 7.7% | |

| Reserves and Surplus | 211 | 255 | 373 | 575 | 824 | 40% |

| Total Debt | 273 | 256 | 387 | 344 | 545 | 19% |

| ROCE (%) | 16.54 | 19.92 | 31.19 | 31.76 | 28.16 | |

| RONW (%) | 17.27 | 23.00 | 45.27 | 41.83 | 33.97 | |

| Adjusted EPS | 4.81 | 7.60 | 20.19 | 29.12 | 34.64 | 64% |

Consolidated Financials. Source: Company Filings All figures in Rs. Cr (except EPS) and margins.

The most important asset – The Scrapyard

The Scrapyard is the single most important asset of a recycling business. In a scrapyard, discarded materials are collected, sorted, dismantled, recycled, and resold for reuse or proper disposal.

Gravita owns 31 such yards, with 26 in Africa and 5 in Asia. These are located across India, Mozambique, Tanzania, Senegal, Togo, Ghana, Sri Lanka and the Netherlands.

Scrapyards are strategic assets for a company since:

- Scrapyards cater to a large peripheral area and are allocated very rarely by the local authorities in that region (for e.g. the Municipalities allocate such land in India). Hence, the approvals are few, take time to materialize, and make it difficult for the competition to acquire land. Once established, no one else can secure allocation for a scrapyard in that area, further solidifying the yard owner's advantages.

- The land on which scrapyards reside becomes very valuable, due to the scarcity of such hard assets;

- These scrapyards are not going anywhere, and generate perpetual revenue for the owner, on top of the land-value appreciation.

Gravita has built an unbeatable Business!

And here is why we believe so:

- Its portfolio of scrapyard assets not only enables it to execute large-scale capacity expansion but also gives it the right to further diversify its customer base.

- One of the biggest hurdles in this industry is sourcing raw materials. To tackle this, the company has smartly set up operations in regions where raw materials are readily available, helping streamline its processes and cut down on the net working capital cycle.

- Benefitting from the Circular Economy: As the global economy pushes for adoption of the circular economy, Gravita will benefit from the increased formalization of the recycling processes. The recent BWMR and EPR regulations, Vehicle Scrappage policy are examples of the same.

- Benefiting from electrification of vehicles, adoption of EVs and Aluminum: It is a lesser-known fact that the battery of an EV car accounts for ~40-50% its total manufacturing cost. With its aluminum, battery, and plastic recycling capacities, Gravita is well-positioned to benefit from the increased adoption of EVs and battery energy storage systems.

- An organized player in a highly fragmented market: India’s material recycling market is highly disorganized, across products, categories, and geographies. Being an organized player works in Gravita’s Favor, as it can grow at higher than industry rates and consolidate further on its market share.

- Self-reinforcing growth: led by a manufacturing economy: As India pursues its manufacturing ambitions at a rapid pace, the demand for scrap recycling is only going to rise.

Section 2: Gravita India vs Copart Inc.

There is a company on the other side of the world, Copart Inc., which operates in a business similar to Gravita India.

Copart Inc. is reportedly the largest Online Used Car Auction company in the world.

It acts as a platform for online auctions and vehicle remarketing services, thus connecting buyers and sellers. This not only helps in price discovery for the salvaged cars and car parts, but also enables the free-market forces to favourably influence this market.

How are these two similar? One may ask.

We’re using the word “similar” and not “same”. We got on to the drawing board and tried to see what makes these two businesses “similar”. And the results of our analysis are tabulated below:

| Particulars | Gravita | Copart |

|---|---|---|

| Business | Lead, Aluminum, Plastic. Upcoming - Lithium, Steel Recycling - processing and selling | Online Vehicle Auctions, recycled parts selling |

| Type of Activity | Production, Process, and selling | Resale, refurbish and resale |

| Number of Scrapyards Owned | 33 | 243+ |

| Scrapyard Regions | Africa, India, Sri Lanka, US (Upcoming), Europe -Romania, Oman (Upcoming) | 11 Countries - Dominant Player in the US |

| No. of Countries Selling to | 50+ | 185-190 |

| Revenue ($Mn) (TTM) | 418 | 4240 |

| Market Cap ($Bn) | 1.8 | 58.9 |

| Market Cap/Sales | 4.46 | 13.67 |

| TTM PE | 57.05 | 42.7 |

| EV/Revenue | 4.53 | 12.67 |

| EV/EBITDA | 40.89 | 30.98 |

Your guess it right. It’s the Scrapyards that these two companies own.

Although the kind of materials both companies collect, process, recycle and produce are slightly different, the core fundamental concept of material recycling remains. And this is where the beauty lies.

Copart started off a business that purchased used cars, took out the useful parts out of them, made them functional, and resold them in the market for a premium. The company also resold those used cars by making them functional and reusable.

The core asset needed for setting up this business were the scrapyards or the salvage yards, which the company acquired over the years, as it consolidated its position in North America’s salvaged car market. Today, Copart owns anywhere between over 243 scrapyards spread across the US, Canada, the UK, Germany, Ireland, Brazil, Spain, UAE, Bahrain, Oman, and Finland. These assets are worth billions of dollars today.

Copart transitioned from being a “traditional salvaged car trading company” to an “online salvaged car trader-cum-market maker” over the years.

It used its vast supplier and customer network and brought them on a common platform to do business, on which it would earn a commission.

Can Gravita take a few pages from Copart’s playbook?

Gravita is already venturing into tyre recycling and battery scrapping, which are specifically linked to the automotive market. In addition, its Aluminum recycling business is also another vertical that taps into the automotive used car/scrap/salvage market and the aftermarket/car parts market.

We’d like to point out a few points that we think can make Gravita even better than what it is today:

-

Climbing up the Car Scrapping Value Chain:

Step 1 would be gaining a foothold in the battery scrapping/recycling business. Step 2 would require a greater focus on recycling used car parts/scrap that can be repurposed into reusable car parts. Step 3 would be to expand recycling capabilities for the entire car. Step 4 would be converting/upgrading existing yards into full-scale salvaged car yards. Copart’s attempts to enter the salvaged car market in India and China have not seen much success, after which it decided to withdraw its focus from these regions.According to a report by Fortune India, as of September 2024, there are 63 operational scrapping centres in India, with 60 under construction and 40 in the pipeline. With the government incentivizing vehicle scrapping in India, and the advent of BWMR and EPR regulations, conditions are becoming conducive for recyclers like Gravita. As per the government, India requires 1000 scrapping centres and 100 fitness test centres for vehicles. (Source: Government Public Databases). Several Automakers in India have started setting up such centres, but the demand is so huge, that it may require an organized player of Copart’s scale in India.

The question is: Can Gravita capitalize on this opportunity?

-

Scrapyard acquisition spree:

Copart Inc.’s current scale can be attributed to its acquisition strategies. It has a track record of consistently acquiring these strategic assets to gain market share and scale.India’s scrapping-recycling market is very fragmented, and this serves as a window of opportunity for Gravita to consolidate its position further in its existing areas as well as newer areas. Acquiring scrapyards both in India and abroad seems to be the way ahead from here on for Gravita.

Taking heed to the prevailing trends, the company has already entered battery recycling, and aluminium and steel recycling. However, there is a lot of room to grow and consolidate.

- Over the long term, look to leverage the network of suppliers and customers to its own benefit:

As discussed earlier, one of Gravita’s inherent advantages is its long-standing network of suppliers and customers. Over the long term, Gravita must find a way to efficiently connect the two with the least amount of interreference possible, while also reducing gestation times and operating costs. This will be possible only with the help of technology. - Opportunities in the Used Car Parts market:

The used car parts market is an ancillary opportunity to the automotive recycling market. However, this is actually a faster-growing market, with the potential to tap into high-margin products. Copart already does this and has been doing it for a long time. It would accumulate the parts from cars that are no longer widely available in the market and sell them at a premium to its network of customers. It has become one of the most trusted car parts dealers globally. Gravita already recycles auto parts and has the opportunity to expand its value-added offerings here as well. It can gradually replicate Copart’s model to identify branded car parts and make a market for itself there.

To Conclude

When we compare Gravita to Copart, we are comparing two businesses that are fundamentally the same in nature, but one is more mature, seasoned, and evolved, with multiple streams of revenues, while the other is a fast-growing emerging business slowly discovering its true potential.

Copart evolution into what it is today is marked by its ability to add new sources of revenue to its business from the relevant adjacencies. From a single used car to a single scrapyard, to becoming USA’s largest car salvaging company, Copart has come a long way.

How well can Gravita emulate Copart’s business model? - only time will tell. Whether it will become a player of Copart’s scale, remains to be seen.