Stockaxis Sector Insights - Metals

May 17, 2021

Nifty Metal Index performance 2004 - April 2021

Source: NSC Website

Inferences from above Chart

- Bullish phase in metals is driven by global headwinds (2004-08, 2016-18 & current Mid 2020 onwards

- Normally bull rallies are very steep/sharp & for short duration (each rally was for around 2 years in last 17 years)

- Similarly corrections are also deep & fast (2008-09 & 2018-20)

- Bearish phase from 2010 to 2016 (much longer duration than bullish phase & driven by dwindling macro economic parameters)

- Returns generated in bull phase are almost wiped out in bearish phase

- Current rally is fastest & in shortest time duration (less than 1 year) the Nifty Metal index has crossed the peaks attained in 2008 & 2010 which in earlier periods it reached in 4 years & 2 years respectively

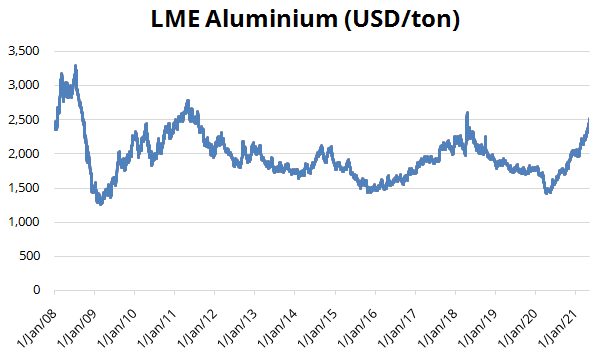

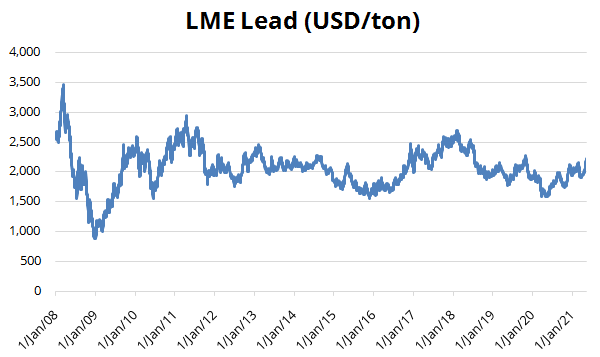

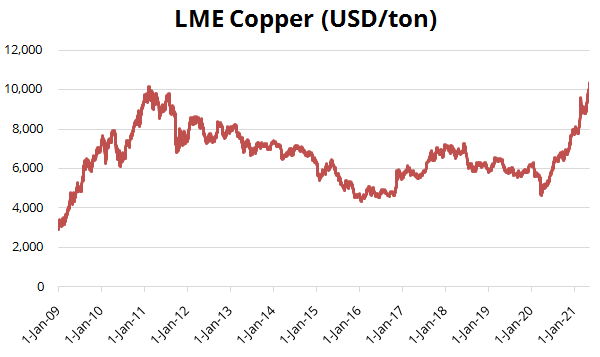

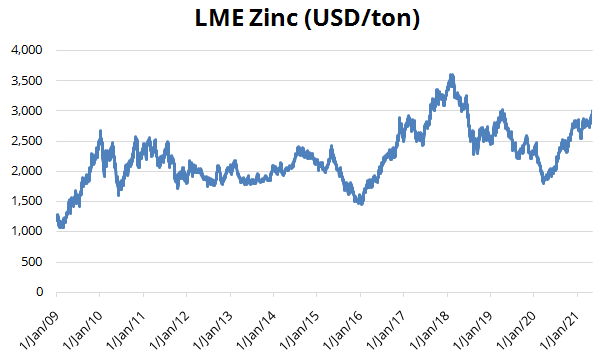

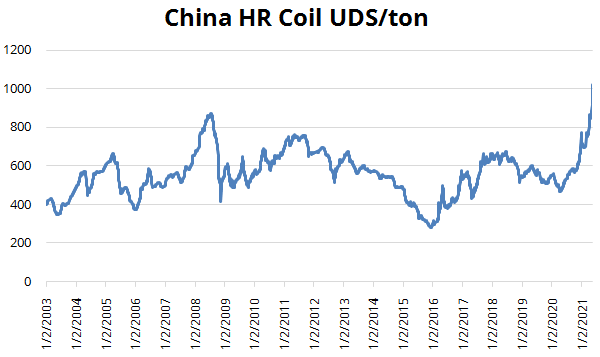

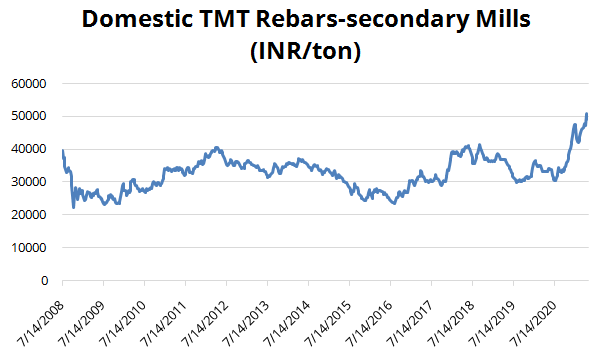

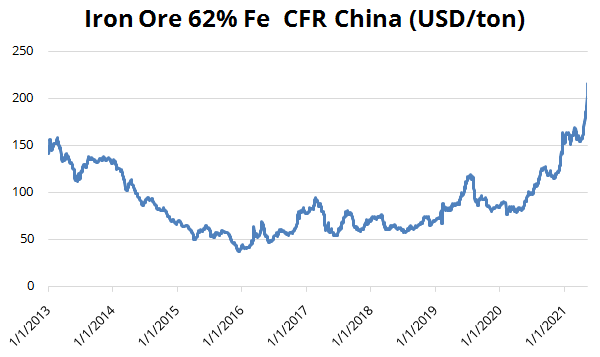

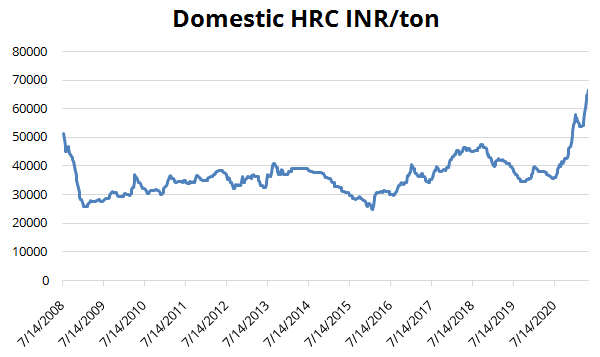

Prices of underlying commodities

Source: Bloomberg, StockAxis Research

Source: Bloomberg, StockAxis Research

Source: Bloomberg, StockAxis Research

Source: Bloomberg, StockAxis Research

Source: Bloomberg, StockAxis Research

Source: Bloomberg, StockAxis Research

Source: Bloomberg, StockAxis Research

Source: Bloomberg, StockAxis Research

Factors driving current metals rally

Short term (mostly global in nature)

- Huge liquidity into the system pumped by most of central banks around the world specially US FED (FED balance sheet expanded multi fold in last few months in response to Covid 19)

- Dollar weakness against many global currencies as fallout of excessive printing

- Supply chain disruptions due to Covid induced movement restrictions etc

- As is evident from charts above all the underlying metal commodity are trading at all time highs driven by liquidity & demand

Long term (combination of global as well as domestic)

- Post pandemic reviving economies, creating jobs, restoring income levels of population is the main objective of all governments across the world. Many countries are announcing large scale capital expenditure plans for building infrastructure like ports, airports, roads, etc.

- US has announced USD 2 trn expense plan on various infra initiatives. Indian government has announced INR 111 lakh cr National Infrastructure Projects. All these projects will create immense demand for materials like steel, Aluminium, Copper, cement etc.

- No new capacity has been added in metals space. In fact there has been a consolidation in the industry by buying out of insolvent producers who were reeling under huge debt. This resulted in incumbent players becoming stronger & gave them an opportunity to add assets at relatively cheaper valuation.

- Decarbonisation of production process to manage environment concerns: China has been closing many units in order to reduce carbon footprint resulting in tighter supply & better pricing.

- In contest of Indian players, almost all of them have used the windfall gains in last 2-3 quarters to repay the debt & reduce leverage. The strength in balance sheet will help these players in taking advantage of upcoming cycle.

- Concept of EV (enterprise value driving metal stock prices: EV=mcap + net debt (net debt is equal to total debt minus cash or cash equivalents) Assuming EV remains at same levels as before paying & after paying debt, then the co that pays off its debt, its equity value will go up.

Current market scenario the above thesis is driving the stock prices of most metal (specially steel) companies. We have seen SAIL, Tata Steel, Jindal steel have repaid significant amount of debt in FY21. - Expansion in EV/EBITDA multiple When the company repays debt out of its accruals /increased profits, its perception in the market changes. Participants ascribe higher valuation to the companies that are less levered.

Metals – Is there more shine left?---YES

As shown in above charts all metals underlying commodities are trading at all time high as well as stock valuations are also near all time high.

Over & above that in just last six months metal stocks have given returns between ~60% to more than 300%. After such a sharp run-up in investors are asking pertinent question

Is there any more shine left in metal sector stocks?

Near term view

- We believe in the very short term there could be profit booking/ correction in metal stocks as the sector has moved very sharply in last 6 months.

- Sector rotation: As Covid induced disruptions reduce market participants may want to rotate out of external facing sectors (IT/metals) & defensives like (pharma) to opening up trade like domestic consumption

- Fear of regulatory intervention: Since the metal commodity prices are reaching new highs fear of inflation is rearing its head. Central bankers across the globe & regulatory authorities may intervene in free pricing of commodities through artificial barriers like tariffs/duties etc thereby cooling off the commodities markets

Longer term view

Often we have heard term Super Cycle in context of metals.

We have seen that usually bullish phase in commodities is short duration & very steep which has already played out in last few months. However at present many market participants are saying “this time it is different”.

We want to draw your attention to below mentioned quote from John Templeton

“The investor who says, this time is different, when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.” John Templeton

Whether actually there will be a super cycle & a long sustained bull phase that only time will tell. We are of the opinion that as of now there are some strong long term reasons pointing towards sustained rally

- Very large Infra capex lead demand from various countries

- No significant capacity addition anywhere in the world

- Most companies in the sector have repaired their balance sheet significantly & probably learned lessons from the past on irrational expansion

Recommended Strategy

Fresh buy on dips, Early entrants can book partial profit at current levels & reinitiate buying on dips or continue to ride on profits for more returns

Our Preferred picks

- Tata Steel

- SAIL

- JSW Steel

- Jindal Steel & Power

- Hindalco

- NMDC

- Rain Industries

- Graphite India

- HEG

Disclaimer: Stocks mentioned above are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

Stocks Performance

Preferred Stocks performance over last six months

| Name of the Company | Returns (%) | ||

|---|---|---|---|

| 1M | 3M | 6M | |

| Tata Steel | 29.67% | 65.67% | 120.85% |

| SAIL | 43.18% | 103.02% | 225.43% |

| JSW Steel | 16.40% | 76.41% | 111.47% |

| Jindal Steel | 16.44% | 76.46% | 111.53% |

| Hindalco | 6.07% | 29.14% | 83.77% |

| NMDC | 31.61% | 60.99% | 95.26% |

| Rain Industries | 3.96% | 20.42% | 63.50% |

| Graphite | 15.13% | 51.46% | 309.23% |

| HEG | 3.46% | 45.94% | 215.20% |

Source: MoneyControl

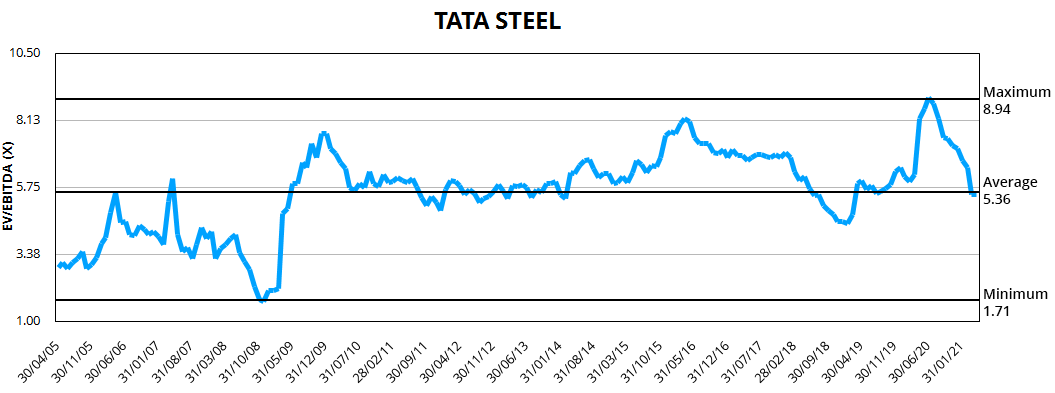

TATA Steel

- Domestic Steel prices at discount to international prices, room for further price hikes

- Reduced debt by Rs 28 thousand cr in FY21

- Fully integrated, most cost efficient producer of steel

- European operations turning EBITDA positive after a very long period

- Valuation comfortable, despite 225% return in 6 months stock is available at near long term average EV/EBITDA

Source: Bloomberg, StockAxis Research

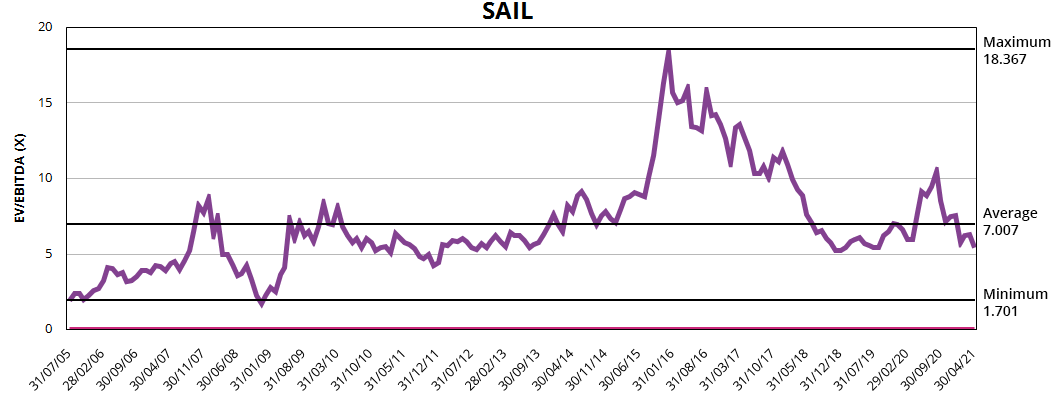

Steel Authority of India (SAIL)

- Domestic Steel prices at discount to international prices, room for further price hikes

- Reduced debt by ~Rs 14 thousand cr in FY21

- Operating efficiencies to lead to operating leverage

- Iron ore sales to aid EBITDA growth in next couple of years

- Valuation comfortable, despite 120% return in 6 months stock is available at lower than long term average EV/EBITDA

Source: Bloomberg, StockAxis Research

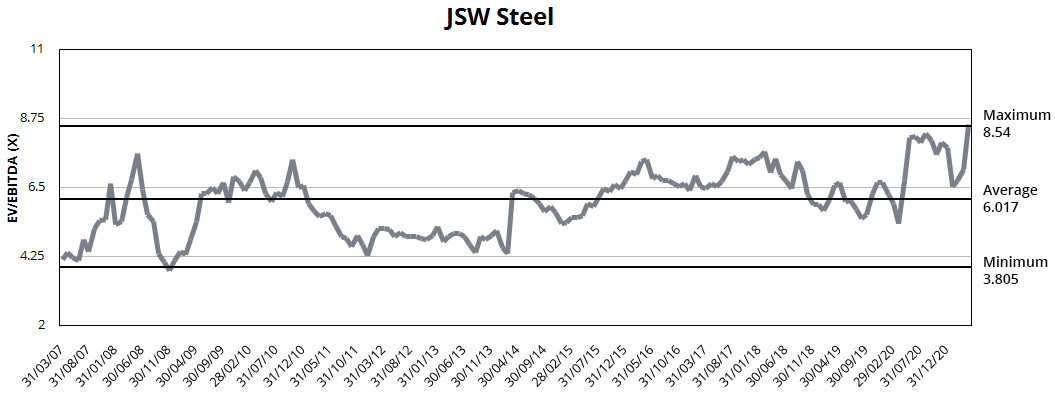

JSW Steel

- Domestic Steel prices at discount to international prices, room for further price hikes

- Sustainable margins led by cost savings & downstream products

- Bhushan Power & steel acquisition opens new growth avenues

- Capacity to increase from 18 mt to 29 mt from FY21 to FY25

- Valuation rich trading at near peak long term EV/EBITDA. Further rerating only on visibility of benefits from capacity expansion

Source: Bloomberg, StockAxis Research

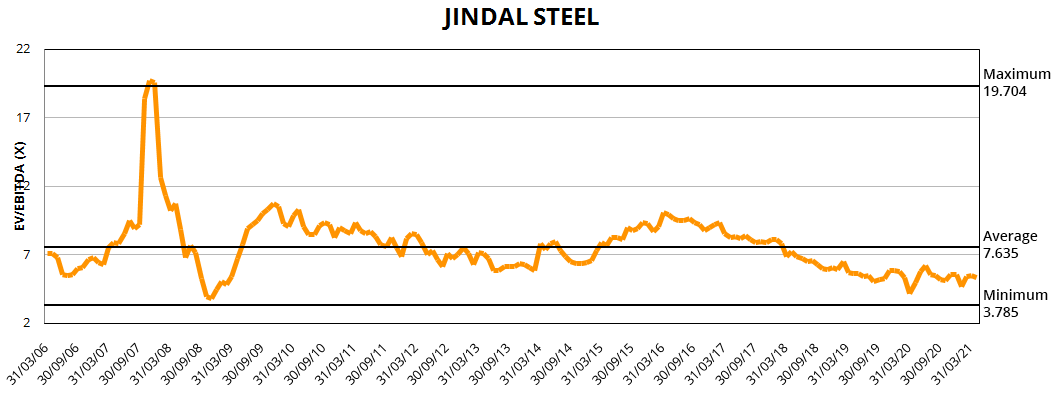

Jindal Steel & Power (JSPL)

- Domestic Steel prices at discount to international prices, l room for further price hikes

- Reduced debt by Rs 138 bn in FY21

- Sale of power business (JSP) makes it pure play steel company

- Cheapest steel stock in India, historically traded at lower multiples due to issues with mines allocation & heavy debt both if which are past now.

- Despite doubling in 6 months stock is available at near the minimum long term EV/EBITDA

Source: Bloomberg, StockAxis Research

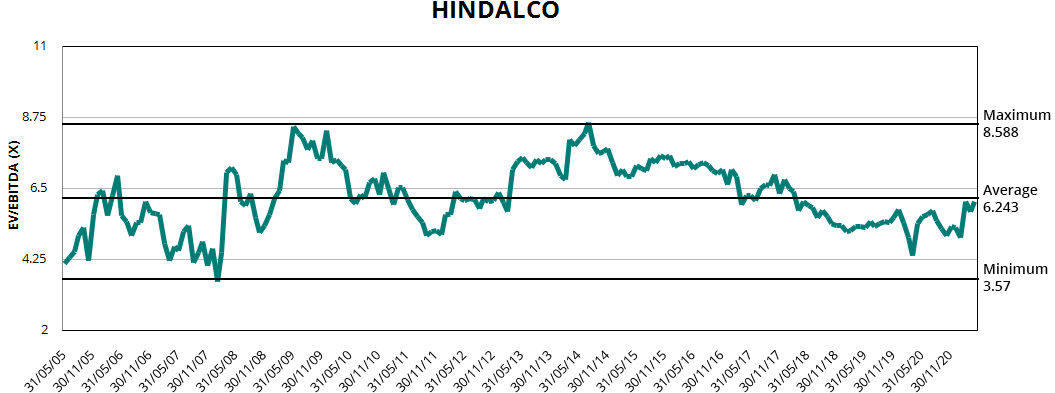

Hindalco

- Novelis performance has improved significantly (EBITDA of ~$500/ton v/s $380/ton in FY18) on back of robust demand from automotive & beverages can industry

- Stand alone robust Aluminium business with competitive cost of production & >50% contribution from value added aluminium products

- Defined capital allocation framework, Management focused on deleveraging, aiming to reduce debt/ebitda from current 2.9x to 2,5x. Debt reduced by USD 2.6bn in FY21

- Valuation comfortable, despite 83% return in 6 months stock is available at near the long term average EV/EBITDA

Source: Bloomberg, StockAxis Research

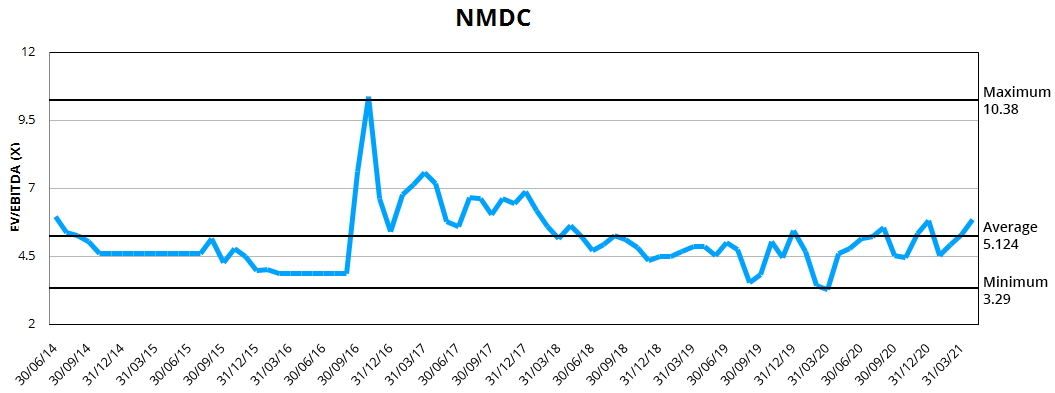

NMDC

- Donamalai mines resumption will lead to step jump in volumes

- Improving pricing power (Iron ore prices ruling at all time high, tightness in supply to continue)

- Huge scope of increasing average sales realization per ton, currently ~45% discount to int’l ptices

- Value unlocking through demerger & sale of steel plant

- Valuation comfortable, despite ~95% return in 6 months stock is available at close to long term average EV/EBITDA

Source: Bloomberg, StockAxis Research

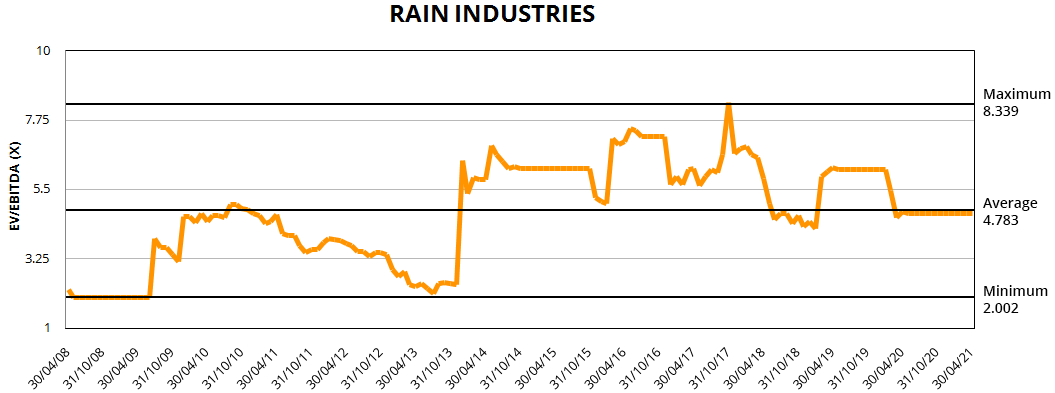

Rain Industries

- Rain is one of the largest producers of calcined petroleum coke (CPC) and coal tar pitch (CTP) in the world with operations spread across North America, Europe, India and Russia. Rain has long standing relationships with suppliers of key raw materials - green petroleum coke (GPC) and coal tar.

- Co has 3 divisions-Carbon (64% of rev 70% of Op profit), Advanced materials (28% of rev, 19%)of OP & Cement 4 mt capacity (8% of rev & 10% of OP)

- Fortunes directly linked to Aluminium industry which is growing on electrification of automobiles. Other user Inds- Construction, Carbon Black & Graphite

- New product launches & commencement of facilities to aid growth

- Deep cyclical stock, valuations also fluctuate, currently available near comfortable level of long term average EV/EBITDA

Source: Bloomberg, StockAxis Research

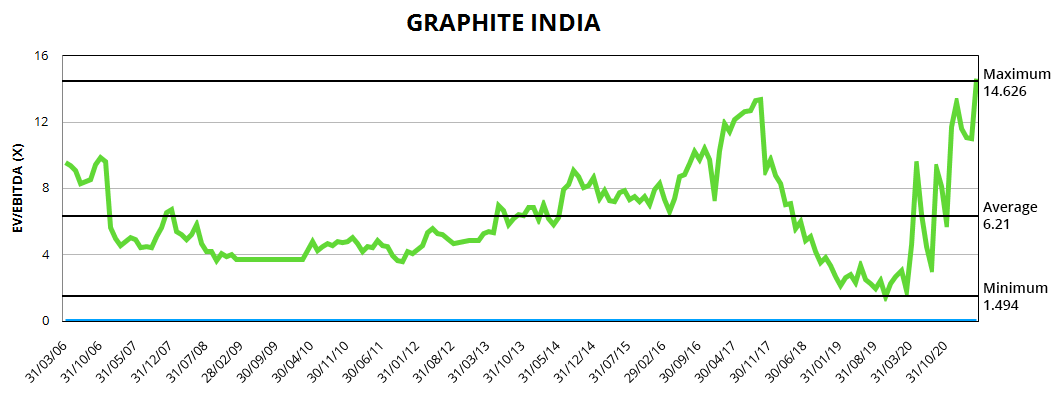

Graphite India

- High correlation with steel demand, after 2 weak demand years steel cycle picking up

- Share of EAF route of steel making to increase as China shuts many facilities on pollution/carbon footprint concerns. Hence demand for electrodes to remain elevated

- Needle coke-key raw material prices are benign

- ASP (average sale price per ton) likely to witness significant up-move as they are still 40-50% lower than peak of previous upcycle

- Large cash & cash equivalent balance with no fresh capex plans provides comfort

- Trading at all time high EV/EBITDA multiple.

Source: Bloomberg, StockAxis Research

HEG

- Expanding capacity by 20k tons to be commissioned by first quarter of CY22

- Share of EAF route of steel making to increase, hence demand for electrodes to remain elevated

- Needle coke-key raw material prices are benign

- ASP (average sale price per ton) likely to witness significant up-move as they are still 40-50% lower than peak of previous upcycle

- Strong balance sheet with large cash & cash equivalents

- Valuation comfort, Trading at near long term average EV/EBITDA. Historical Peak multiple is distant away

Continue with Google

Continue with Google