Growth Investing Vs Value Investing: Which One Is Right For You?

April 21, 2021

There is simply no doubt that investing is done by investors everywhere to create wealth by earning profits. While there have been many investing styles & strategies that have made headlines or are mentioned every now and then, two investment styles stand out due to their popularity and effectiveness ie Growth investing & Value investing. Although both these types are basically fundamental in their approach, they possess their own sets of merits & demerits.

Investors often measure both these styles of investing against each other to discover which of these they can adopt to maximize their profits. The pandemic has only amplified this question further.

We believe that the real question investors need to adopt is not just that but also which of these two investing styles is equipped to perform during the prevailing economic conditions. After all, businesses & the stock market are heavily dependent on the economy.

It is age-old wisdom that value stocks outperform growth stocks over the long run. However, it is important to note that growth has been outperforming value for roughly a decade now!

Let us understand the difference between Value investing and Growth investing first.

Value Investing

Simply put, Value investors look out for hidden gems that they perceive to be low priced compared to their intrinsic value. The reason could be anything from a short term event like a few bad quarters or a long term phenomenon like a depressed industry or sector.

Value stocks are believed to be underpriced either within a specific industry or the market more broadly. Investors buy such stocks hoping that the price will rebound once others catch on. Generally speaking, these stocks have low price-to-earnings ratios and high dividend yields. There is always the risk that the price may not appreciate as expected, especially if the stock belongs to a poor quality company that has fallen out of business due to unethical reasons.

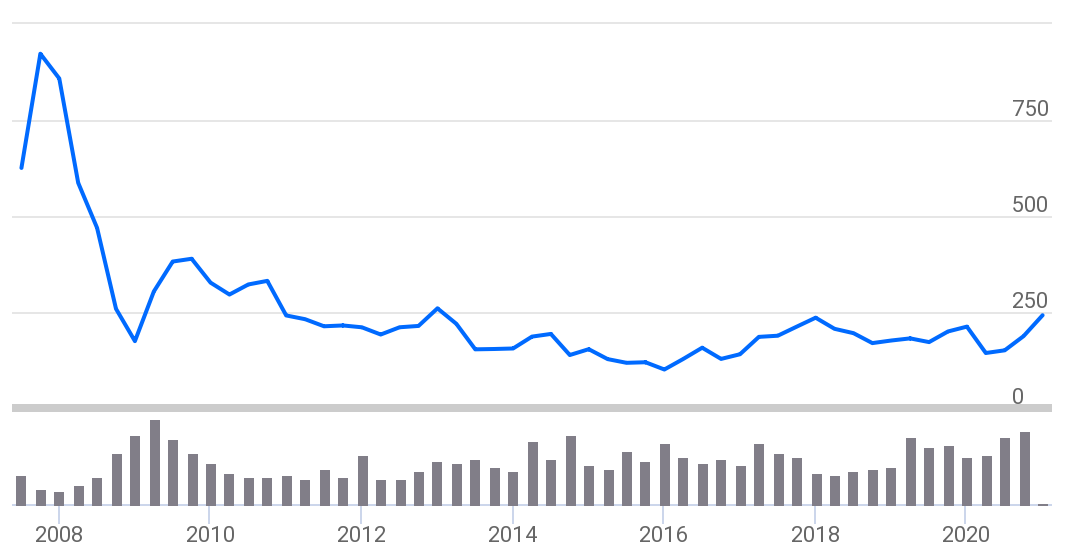

For instance, DLF has often been considered a value buy, but its returns have hardly measured up to the hype especially for ultra long term investors.

DLF Ltd chart (2008-2020)

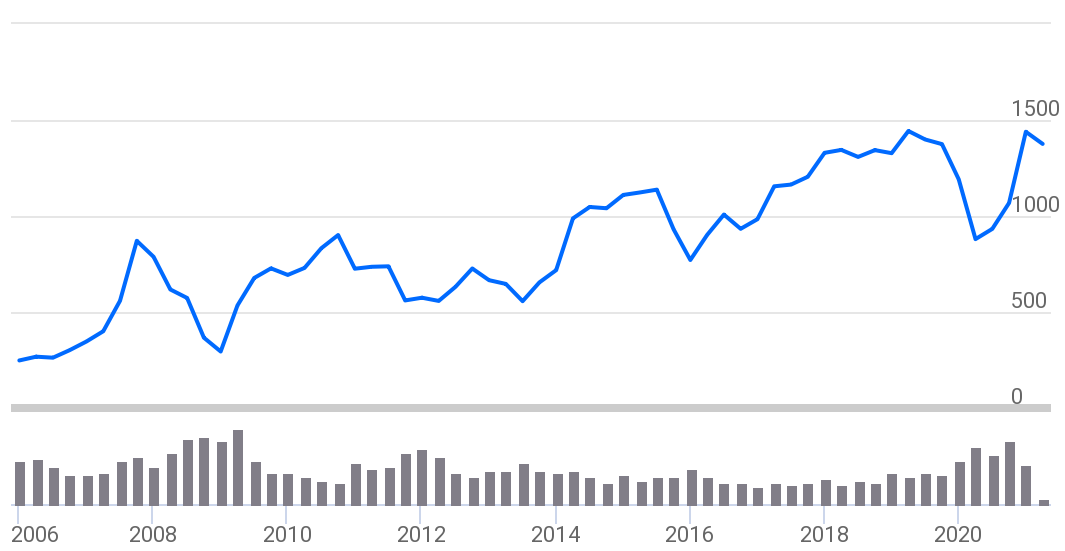

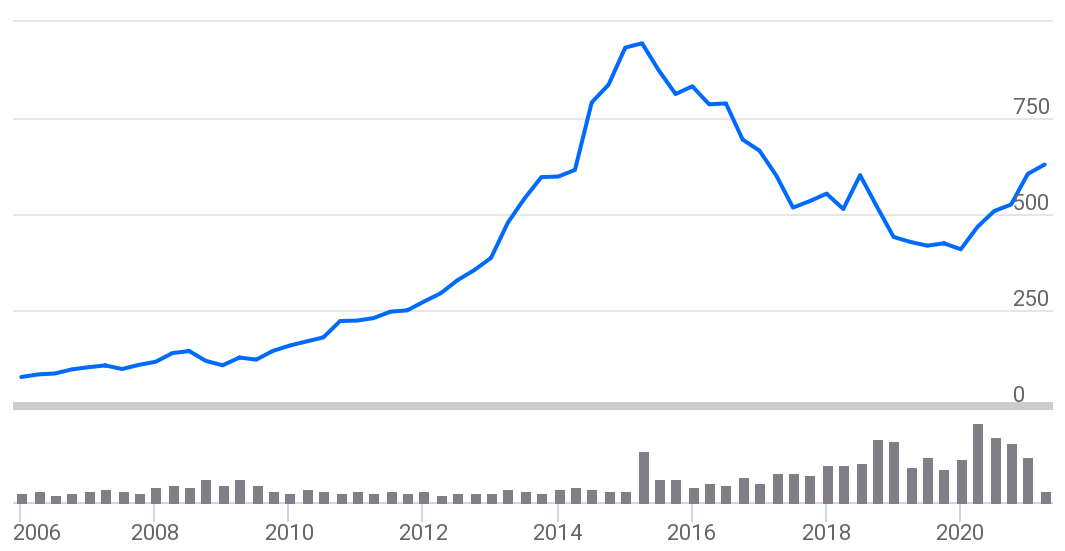

However, other renowned value buys like L&T & Sun Pharma have generated decent returns over the years.

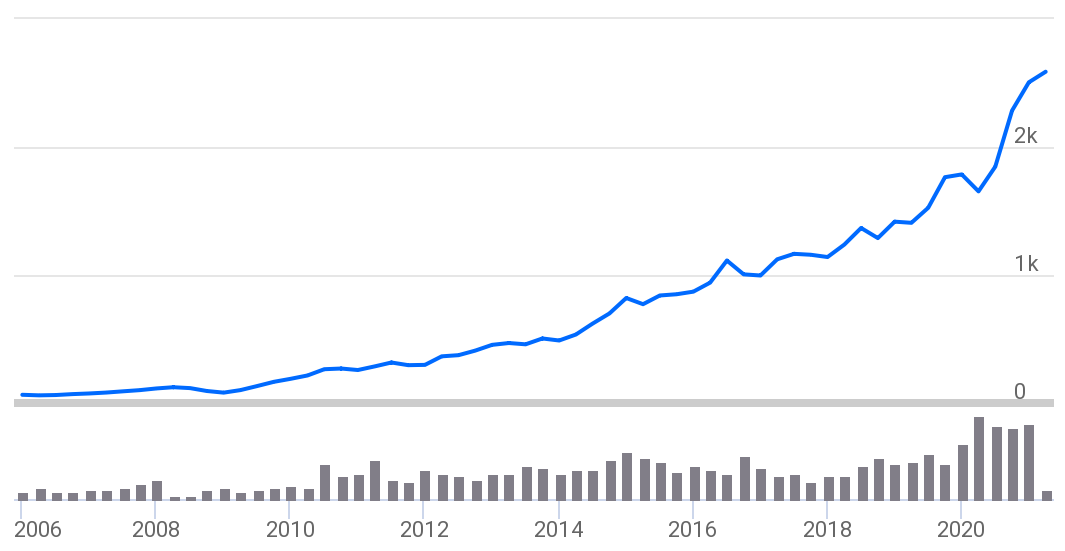

L&T Ltd chart (2006-2021)

Sun Pharmaceuticals Ltd chart (2006-2021)

Benjamin Graham is known as the father of value investing & arguably one of the most famous investors, Warren Buffet is also known for his value investing style. However, that does not mean that he doesn’t invest in growth stocks. His Portfolios boast of profitable growth stocks such as Snowflake, Moody’s, Costco, American Express, Visa, Apple, Amazon, Mastercard, Synchrony Financial & so on.

Growth Investing

Growth investors usually seek out young, early-stage companies that are seeing rapid growth in profits, revenue or cash flow. Such stocks are also known as Multibaggers & are actively sought out by investors seeking to build substantial wealth.

Growth stocks represent companies that have demonstrated better-than-average gains in earnings in recent years and are expected to continue delivering high levels of profit growth. Typically, these companies are leaders in their respective industries and are higher priced than the broader market. They also tend to be more volatile & the risk in buying a given growth stock is that its price could fall sharply on any negative news about the company, particularly if its earnings disappoint the investor expectations.

One infamous growth stock that has displayed quality growth but also increased volatility during recent times is Bajaj Finance Ltd.

Bajaj Finance Ltd Chart (2016-2021)

Other growth stocks which have generated multifold returns over the years include HUL, Nestle & Asian paints.

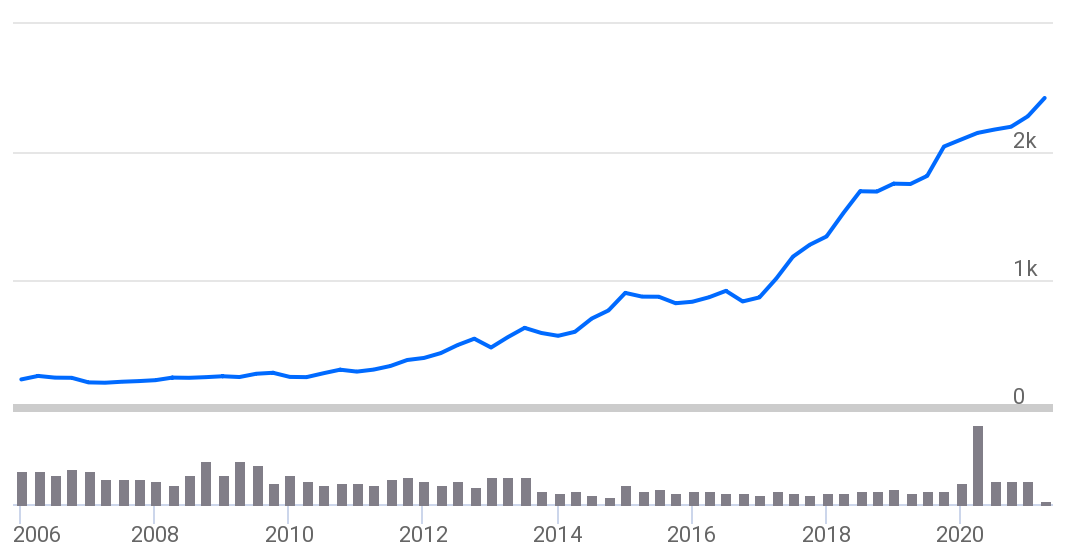

Hindustan Unilever Limited Chart (2006-2021)

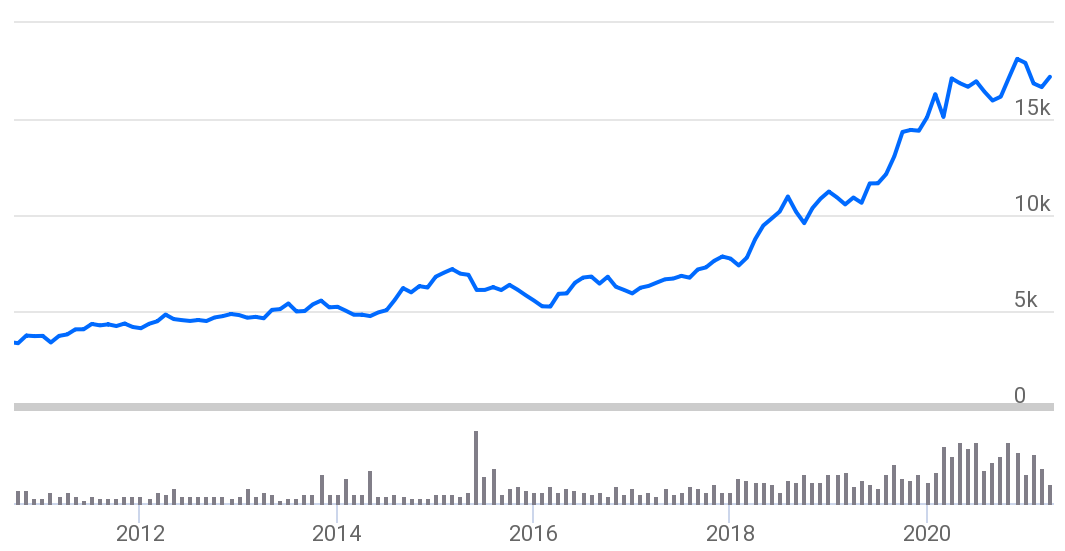

Nestle Ltd Chart (2011-2021)

Asian Paints Ltd Chart (2006-2021)

This style’s father, Thomas Rowe Price Jr. developed this philosophy in the 1930s and later went on to create the asset management firm that still bears his name: T. Rowe Price. Most of the new-age industries like Technology & IT tend to consist of growth stocks and are actively sought after by savvy investors.

Value Investing Vs Growth Investing

| Investing styles | Price | P/E ratio | Dividends | Risk |

|---|---|---|---|---|

| Value stocks | Perceived to be undervalued | Generally low | Generally high dividend yields | May not appreciate as much |

| Growth stocks | Perceived to be Overvalued | Generally above average | Generally low or no dividend yields | Chances of relatively high volatility |

The below table indicates the earnings growth P/E or P/B expansion of the mentioned Value & Growth Stocks:

| Company name | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|

| Growth | ||||||||

| Asian Paints | P/E | 43x | 55x | 48x | 53x | 53x | 66x | 59x |

| EPS | 12.71 | 14.54 | 18.19 | 20.22 | 21.26 | 22.48 | 28.2 | |

| Nestle | P/E | 52x | 99x | 58x | 62x | 67x | 72x | 70x |

| EPS | 122.87 | 58.42 | 103.85 | 127 | 166.6 | 204.2 | 215.9 | |

| HUL | P/E | 33x | 43x | 45x | 44x | 55x | 60x | 74x |

| EPS | 18.24 | 20.17 | 19.2 | 20.72 | 24.14 | 28.03 | 31.24 | |

| Bajaj Finance | P/B | 2.2x | 4.3x | 5.1x | 6.7x | 6.5x | 8.9x | 4.1x |

| EPS | 14.45 | 17.96 | 23.88 | 33.58 | 43.4 | 69.26 | 87.74 | |

| BV | 80.2 | 95.9 | 136.7 | 175.5 | 274.1 | 339.1 | 535.2 | |

| Value | ||||||||

| Sun Pharma | P/E | 38x | 47x | 43x | 24x | 57x | 43x | 22x |

| EPS | 15.17 | 21.92 | 18.89 | 29.03 | 8.73 | 11.11 | 15.69 | |

| DLF | P/E | 49x | 52x | 67x | 37x | 8x | 33x | |

| EPS | 3.63 | 3.03 | 1.72 | 4.01 | 25.02 | 5.98 | -2.36 | |

| L&T | P/E | 24x | 34x | 27x | 24x | 25x | 22x | 12x |

| EPS | 35.26 | 24.17 | 30.29 | 43.17 | 52.59 | 63.48 | 68.02 |

Continue with Google

Continue with Google