Stockaxis monthly insights outlook for september 2022

September 01, 2022

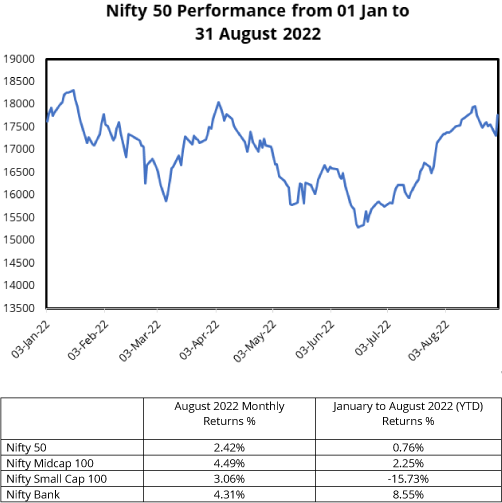

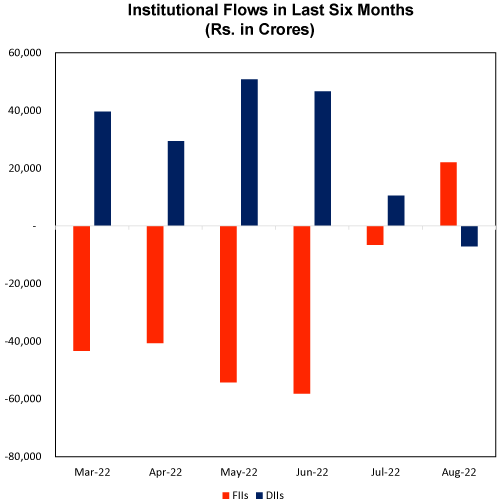

Nifty returned ~2.4% during the month of August 2022 following a strong rebound of ~9% in July 2022 backed by favourable macros like sharp fall in prices of oil & international commodities, turn around in FII inflows (buying Indian stocks by FIIs) sustained domestic SIP inflows easing of global supply chain, some moderation in US inflation.

Mid & Small cap lead the strong performance in last 2 months indicating broad based rally in the markets. Power, Capital goods, Oil/Gas, Auto & Banks showed very strong performance while external sector like IT was a major laggard. Nifty Bank gave returns of ~4.3% in the month while Nifty Midcap 100 index returned impressive 4.5% & Small cap 100 index returned 3.1%.

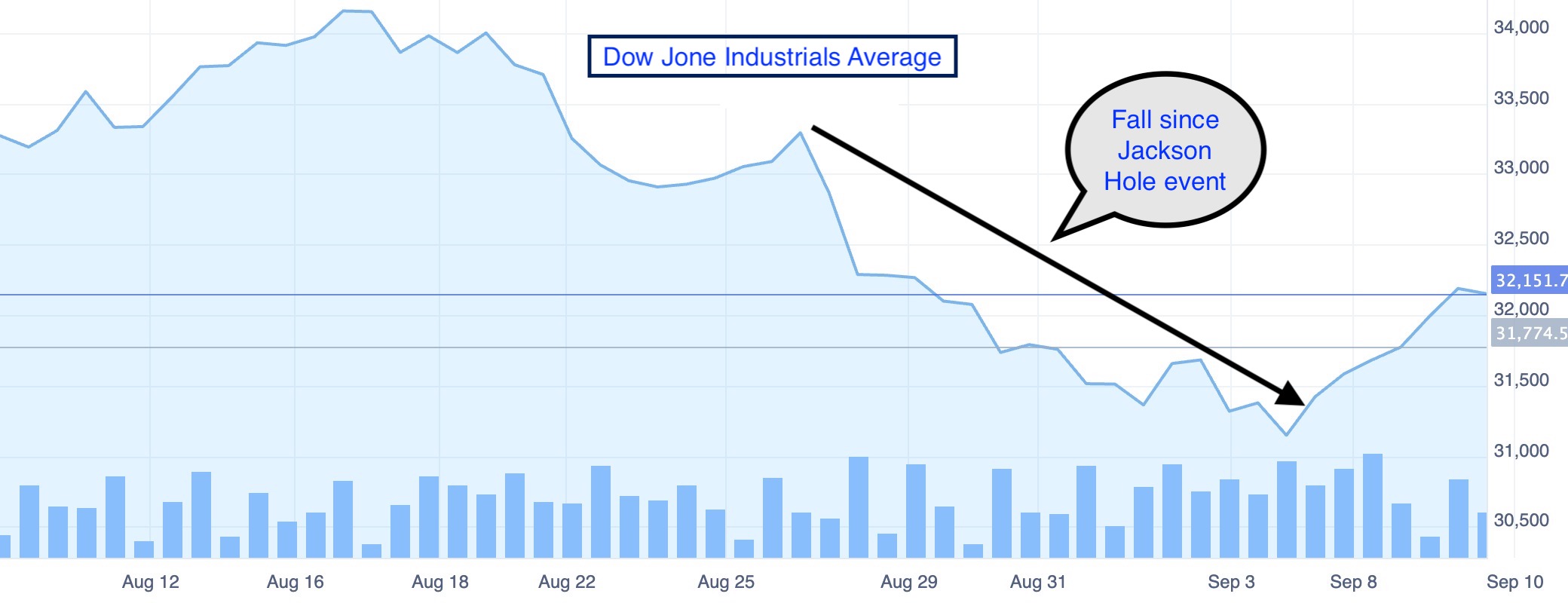

Indian stocks were a rank out performer versus all global markets. This outperformance actually accentuated towards the end of August post Jackson Hole symposium announcements wherein US markets declined ~6% in 7 trading sessions while India markets gave around +1.5% returns. Clearly “investing in Domestic sectors/stocks” has been the key theme during this period.

Source: NSE Website

Source: Moneycontrol

Continuing positive sentiment from July 2022, the US markets remained in positive territory till the comments from FED Chairman post Jackson hole meeting came out. Before the meeting markets were going with the view that USFED may start to go soft on pace of interest rate increases since the biggest reason for rate hikes-inflation -has started slowing down. Many market participants were expecting USFED to pivot to lower trajectory of inflation & not wait for actual inflation to come down significantly. Hence the expectation was probably two more 50 bps increases in September & December 2022 meetings. However the hawkish & extra cautious comments by FED Chair regarding FED’s thinking on fighting inflation implied that rates in US are going to be “higher for longer”. Markets immediately readjusted expectations to at least 75 bps increase in September 2022 & probably no rate cuts in early CY23. Consequent to changed expectations growth/momentum stocks (reflected in Nasdaq) witnessed sharp decline. All averages on US bourses decline consecutively for 7 trading sessions after Jackson Hole. We believe global macro set up remains quite volatile & is a big risk to our market’s performance in near term.

We believe such a wide outperformance (~6-7%) cannot continue for a long time. We believe current rally undermines risks & caps bull case. We expect high volatility in the index to continue, considering the wide swing in macro variables or estimates.

Factors that may influence markets in in near term

- India MSCI emerging markets weightage on the rise

- India’s weightage gain at the cost of other countries

- Domestic economy is holding up well. Recent data shows strength in overall consumption (Aug'22 GST collections +28%), August 2022 property registrations in Mumbai & Delhi +20%/+5% YoY respectively), manufacturing PMI remains elevated (Aug PMI 56.2), Auto sales numbers are up in double digits and bank credit growth very strong (bank loans mid-Aug'22 +15.3%)

- The US 10-yr treasury rates are up ~70bps MoM to 3.25%

- The dollar index (DXY) appreciated by ~4%.

- The US unemployment rate needs to double from the current 3% so as to achieve the inflation target – which implies more / continued rate hikes.

- MSCI India P/E valuation is the highest among global MSCI peers

- MSCI India index forward P/E premium to Asia peers surpasses (+2SD)

- The gap between bond yields & earnings yields is nearing high of `2%. In last 1 year this has happened on 3 occasions & every time the markets corrected by more than 10% from that level. 1st correction (Oct'21-Dec'21, 2nd correction (Jan'22-Mar'22) & 3rd correction (Apr'22-Jun'22)

- The results season ended June 2022 (Q1FY23E) led to FY23F-24F Bloomberg consensus EPS cut of 1-3% for Nifty-50 stocks and 3-5% for Nifty-200 stocks mainly due to disappointments from IT, Metals & pharma sectors. Sustained EBITDA margin pressure due to commodity cost inflation and lower yield on surplus funds led to a miss on consensus EPS estimate for Nifty-50 companies. Lower commodity costs may lead to further cuts for companies with international revenue streams.

Important event to watch for in September 2022

FOMC meeting on September 20 & 21. Market expectations are 75 bps increase in interest rates, doubling the quantum of bond purchases (QT-quantitative tightening) & hawkish commentary.

Our take: if the outcome of meeting is as above, US markets may stabilize/move up. However if the rate increase quantum is more than 75 bps or commentary is even more hawkish then probability of revisiting June lows becomes very high.

Our portfolio strategy & Long term view

- Long-term view on equity continues to remain positive, due to favourable demographics, strong & resilient India’s Macros, and India as one of the most favoured destination for China +1 theme

- Valuations have moderated from the highs seen last year although they are still above long-term average

- We remain positive on sectors/themes like Auto, Banks, Real Estate/Cement, Capital goods/Infrastructure, Chemicals & Oil/Gas where the earnings visibility is reasonable &/or valuations are comfortable.

- We keep IT & Pharma sectors under watch. We expect these sectors to offer investing opportunities in next few months

Themes to play

-

Real estate

- Housing demand continues to be strong and inventory overhang has receded significantly

- August 2022 property registrations in Mumbai & Delhi were up 20%/5% YoY respectively. In top 8 cities housing sales showed a 5% QoQ uptick Q1FY23

- Housing inventory is down to 34 months from 42 months during the last quarter aided by new project launches (28% qoq rise)

- Housing price inflation was 7% yoy in Q1FY23

-

Capital Goods / Infrastructure

- Conditions for private sector capex remains conducive given the low corporate leverage, rising capacity utilization, broad based improvement in profitability and robust balance sheet of banking sector.

- The sustained improvement in corporate credit ratings and banks’ improved lending growth will aid corporate capex

- PLI scheme (Production Linked incentive) in various sectors will support caoex

- While Government continues to maintain tight lease on spending (revenue expenditure declined YoY) Capital spending grew at a healthy pace led by higher spending on road, railways and defence

-

Corporates/sectors that have ability to maintain margin in inflationary environment

- Corporates who have a long-term track record of resilient & sustained gross/EBITDA margin. In Q1FY23 across the sectors the corporates have been able to pass on price hikes reflected by increase in average selling price however very few were able to sustain margins. Overall there was a cut of ~4% in consensus EPS estimates for Nifty 50 companies

- DuringQ1FY23, the sectors with major EPS beat were banking, defence, bearings, and infrastructure. However, the major miss was in IT, FMCG, automobile, cement, metal, and pharmaceutical sectors

- Companies operating in sectors like mining and metals, oil & gas, utilities, and bearings stand out with a high gross margin

Sectors we like

Auto

- Sales volumes have picked up & are surprising on positive side

- lower commodity cost benefit will be extended to customers, via discounts (especially in the 2W segment) in the coming festival season to revive demand

- After 2018 sector is witnessing revival in demand

- Issues related to high commodity costs/supply chain disruptions, chip shortages are behind

Stocks that we like: Eicher, Tata Motors, Maruti, Sona BLW, JBM Auto,

Real Estate / Cement / Home improvement/Building materials

- Housing demand continues to be strong and inventory overhang has receded significantly

- August 2022 property registrations in Mumbai & Delhi were up 20%/5% YoY respectively. In top 8 cities housing sales showed a 5% qoq uptick Q1FY23

- Housing inventory is down to 34 months from 42 months during the last quarter aided by new project launches (28% qoq rise)

- Housing price inflation was 7% yoy in Q1FY23

- Some companies have expanded their portfolio into bathware (faucet/sanitaryware) and paints.

- On the supply side, imports continue to be low, helping incumbents to maintain market share. Supply chains have now stabilized, leading to normalized supply from outsourcing vendors.

- Sales mix has been increasing continuously with the focus on premium products. Topline growth was driven largely by price hikes.

- For Cement industry overall volume increased by ~17% yoy (down ~6% qoq) in Q1FY23, led by a revival in housing and government infrastructure projects

- Cement producers continue to focus on efficiency improvement with a further capex for waste heat recovery system or WHRS/solar power.

- Sector valuations have reverted to near or above average after the recent pull-back

- Long-term outlook for the sector remains strong, powered by the rise in demand for rural and urban housing and a pick-up in government-led infrastructure projects.

- Our channel checks on pricing indicate that industry has seen decent price increase recently

Stocks we like: DLF, Brigade, Cera Sanitary, Greenply Inds, Shree Cement, Ultratech, Dalmia Bharat

Banking / Financials / NBFC

- Many Banks/NBFCs have reported rising credit demand during Q1FY23 backed by pick-up in consumption demand, especially in retail and SME segments.

- Most bankers, in their post-results commentary, remain optimistic on future credit demand, healthy monsoon along with the rise in government spending could continue to support overall demand

- Margins remained stable sequentially due to lower cost of funds and an elevated share of floating rate loans.

- Asset quality trend continued to improve, resulting in lower provisioning Post Covid-19 pandemic, India’s financial system is at the best of asset quality cycle coupled with sufficient buffer provision

- Efficiency and technology will play a key role in future. large banks/NBFCs with deeper geographic penetration, strong brand recollect, and advanced technology platform are likely to gain market share from public sector banks as well as smaller banks

Stocks we like: HDFC Bank, ICICI bank, Kotak Bank, Chola Finance, SBI, Muthoot Fin

Capital goods sector

- After many years demand showing revival signs

- Order pipeline is strong in case of large orders with metals, cement, and oil & gas sectors investing in large projects, and the trend seems to be very bullish going ahead.

- Order inflow has shown a positive surprise for ABB and L&T

- Better tender-to-award ratio

- improving public capex

- expected pick-up in private capex

- Defence companies have shown outperformance on back of Government’s focus on indigenization and exports

Stocks we like: L&T, Elecon Engg, ABB, Siemen, Hitachi, Honeywell Automation, Schaeffler India, Timken, SKF,

Chemicals sector

- Most chemical companies are going for expansion or diversifying into new molecules to add value to their existing portfolio of products.

- Overall margins to be maintained by better product mix and higher value addition

- High energy prices in Europe leading to curtailed production or closure of various facilities which in turn would mean Indian producers with available capacities & lower costs of production will gain market share as well have pricing power.

- Integrated producers(who can use output from one step as input for another) will be at significant advantage

- Product pipeline for CSM/CDMO players remain very strong. Future growth to be aided by launch /development of molecules & scale up in existing ones

Stocks we like: SRF, Hikal, PI Inds, Navin Flourine, Astec

Oil & Gas

- Some analysts suggest globally diesel will remain in short supply for the next three to four years as capacity addition will lag demand. Already, OECD countries’ inventory is below 2006 levels and given the drawdown of inventory it is likely to go down further

- Given the diesel shortage and high production cost in Europe, diesel cracks are likely to remain high

- Indian refiners are mainly diesel producers.

- Globally Crude prices have moved up on supply related issues

- Gas prices are at all time high due to high demand as well as constrained supply

- Domestic pricing of these commodities is now market determined

- APM price of gas is continuously increasing

- Stocks are attractive on Dividend yield as well as valuation

- Avoid user industry & down stream companies. Play the theme through only upstream companies in production as well as exploration

Stocks we like: Reliance, ONGC, OIL, IOC, HOEC,

Sectors under watch

Information technology

- Deal pipeline commentary has been encouraging till now but LTM (long term) order book growth moderated qoq and suggests Q2FY23E bookings are critical to sustain current consensus growth assumptions.

- Q1FY23 saw a sharp divergence in the execution of Tier-I and Tier-II companies and indicates that instead of top-down industry approach it will be better to have selective/ individual stock approach

- Q1FY23F execution suggests that sector tailwinds may be largely behind and the current growth momentum can be sustained since pressure from manpower side is easing as the fresher supply equation is turning favourable.

- Sector valuations have come off post P/E derating, although they are still higher than historical multiples especially at a time when consensus has already cut FY23E/FY24E estimates post higher-than- anticipated miss on EBIT margin in Q1FY23

- We believe sector will probably become attractive for investment in next few quarters as most of the negatives/ macro headwinds get priced in & some clarity on impending US recession or growth slowdown emerges. We keep sector under watch for next few months

Stocks we like: Infosys, Wipro, Eclerx, LatentView, Intellect Design, KPIT

Pharma

- Although US generics business performance remained mixed across companies in Q1FY23 there are signs of the pricing pressure easing in that market as indicated by management commentary post results

- We expect a significant improvement in the pricing scenario in the US market in coming quarters and probably there could be case for the beginning of a major pricing upcycle in the US generics market.

- Major CDMO companies witnessed a decline in growth and profitability as the benefits of the Covid pandemic receded. These companies benefited significantly from the heightened demand for certain active pharmaceutical ingredients or APIs, injectables and some Covid-specific products during the pandemic.

- We believe sector will become attractive for investment in next few quarters as the base effect goes away & investor expectations will be realistic/rational

- We keep sector under watch for next few months

Stocks we like: Gland Pharma, Alembic Pharma, Divis Lab, Abbott India,

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

Continue with Google

Continue with Google