Stockaxis monthly insights outlook for august 2021

August 01, 2021

Glimpse of July 2021

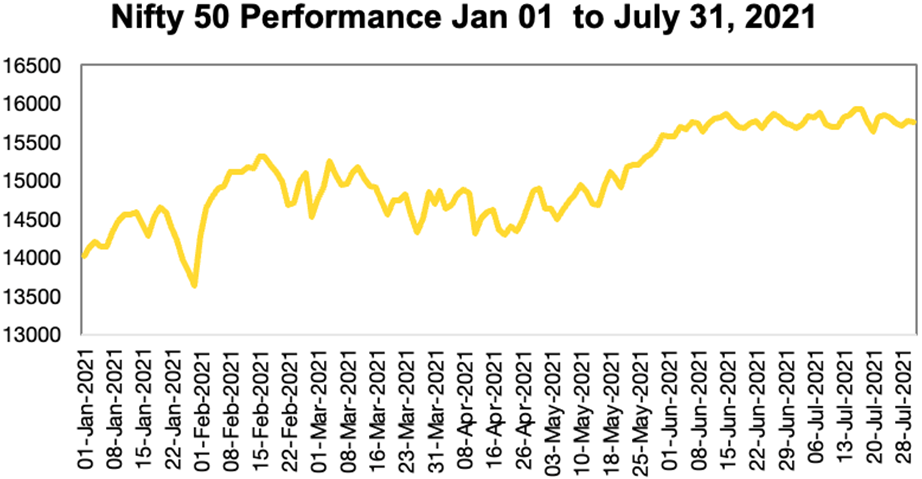

Throughout the month the coveted 16000 mark remained elusive on Nifty 50 despite making several attempts

Nifty returned 0.2% for the month of July 2021 & made an all time high of 15962 around middle of month however could not get past 16000 mark despite making several attempts. Through out the month some how every time close to 15900 market faced some or the other negative news while near 15500 some positive news flow kicked in to provide support. Consequently in the entire month headline indices hovered in narrow range of 15500-15900.

Mid & small cap (broader markets) continued strong out-performance just like past many months.

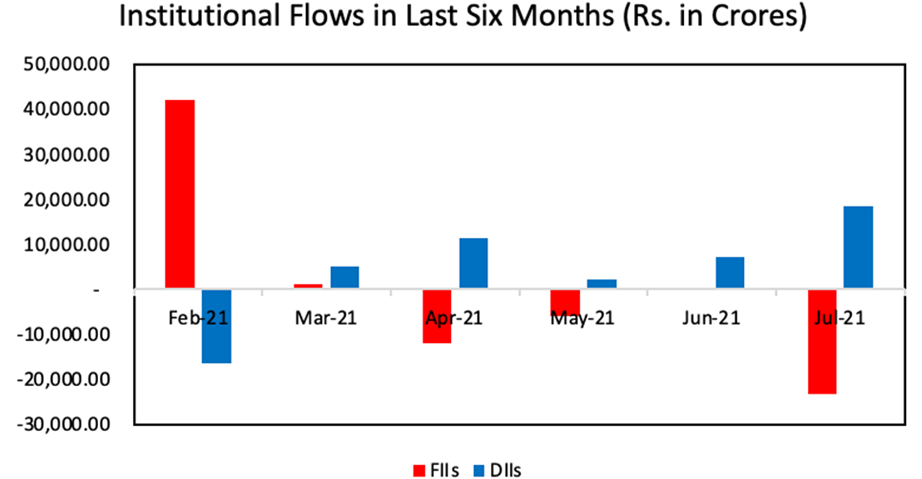

Global liquidity & support of central banks remained favourable with US Fed maintaining near zero interest rates despite high inflation in US as well as clarifying that they (US Fed) are not in a hurry to start tapering quantitative easing (QE) measures of the past.

No negative surprise from Q1FY22 corporate earnings, encouraging domestic macroeconomic data indicating better economic recovery & increase in pace of vaccination cheered the markets. However rising Covid cases across the world (due to delta variant) & slew of restrictive measures announced by China for various sectors weighed on markets.

July witnessed the many year high number of new property registrations in Mumbai indicating buoyant demand in real estate sector. Realty & Metals were the best performing sectors for the month. Auto & energy were the laggards in July.

Going forward, we expect markets to be driven by 1) news flow on incremental covid cases being reported across the world especially arising out of delta variant, 2) pace of vaccinations, and 3) impact of covid related restrictions on mobility, re-opening of cities etc.

We believe few global risks that may confront the markets over next few months could be 1) Fast pace of inflation in US, which may not be transitory, & Fed is compelled to acknowledge that and 2) FED’s trajectory of tapering QE

Q1FY22 Corporate Earnings Snapshot

Q1FY22 earnings snapshot (according to results declared till date)

IT sector results were mixed with diverse performance within sector leaders while mid cap IT continued strong growth momentum. Auto & FMCG company results reflected pressure on margins although top line was maintained. We had expected top line to be disturbed due to 2 months (April & May) wasted on account of second wave of Covid. However it appears the companies have manged covid induced disruptions well. Most of them have taken hit on margins & not disturbed the sales momentum.

Within BFSI banks like HDFC Bank & Axis Bank reported below expectation numbers while ICICI & SBI showed good set of numbers. Similarly in Pharma Dr Reddy’s was negative surprise while Sun Pharma turned out significant positive surprise. US generics pricing pressure once again came to forefront however complex generics/speciality & domestic segments showed strong performance.

In post results concalls, most managements have indicated significant improvement in economic activity during June & July indicating Q2FY22 should be better than Q1FY22 Overall from the results declared till now, we can infer that due to margin pressure there have been downgrades in EPS estimates for FY22 but FY23 estimates have remained unchanged as analysts believe the economic recovery will pickup over H2FY22 & FY23

Important considerations for August 2021

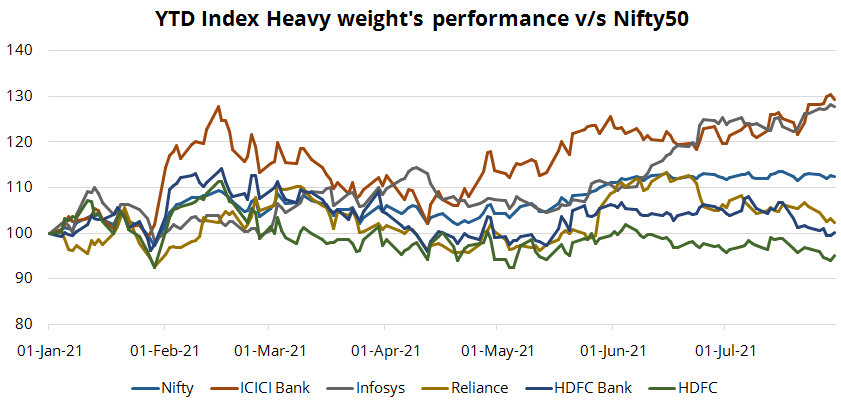

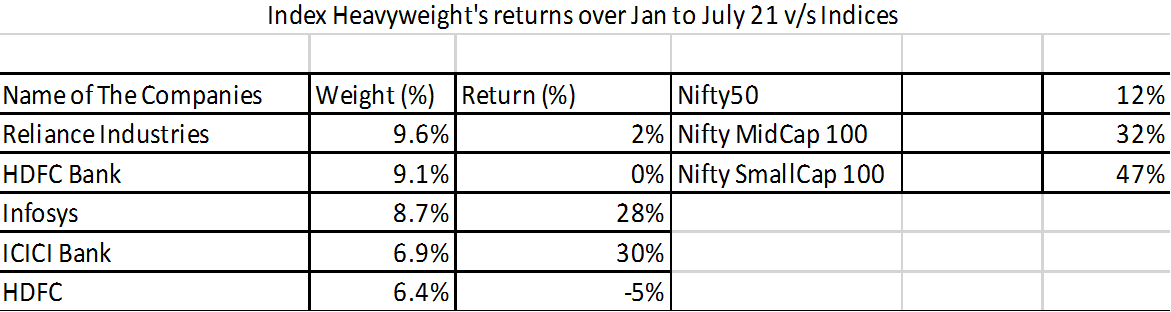

YTD Nifty 50 has returned ~12% v/s Nifty Midcap 100 return of ~32% & Nifty Small Cap index return of 47%. We believe the marked under performance of headline index is because of non participation of index heavy weights. Out of 5 stocks with maximum weightage in Nifty 50, 3 have not participated at all in current rally. Chart & table below gives returns by these 5 stocks v/s returns given by broader markets.

Source : NSE Website

In the past few months we have witnessed some froth building up in certain stocks. Many inferior quality stocks have gone up multi fold some without backing of any noticeable change in fundamentals. We believe the wide difference in quality large cap & mid /small cap will narrow in near term. We are of the opinion that time has come for large cap stocks to catch up with their smaller peers.

We believe mid & small caps which witnessed deep drawdowns after the steep rally that ended in Jan 2018 have covered almost all the lost ground & now valuation premium of mid & small cap to large cap is near its historical level. From here onwards any further rerating in these can take them to euphoric valuation zone.

Current macroeconomic scenario appears to be more conducive to business cycle recovery. Hence we are positive on economy facing sectors. Most stocks in these sectors are by nature in large cap category.

After several attempts in last 2 months headline Nifty has been able to cross the hump of 16000 level. Usually when a market comes out of a long consolidation range the breakout on either side is of large magnitude. We expect current breakout to be of significant intensity backed by sharp up moves in large index heavy weight companies.

During the month of August 2021, on overall basis, we expect the market to be impacted by domestic cues such as

- pick up in economic activity post opening after second wave,

- pace of vaccination, expected third wave of Covid,

- Impact of delta plus variant.

On the global front factors that may impact market direction are

- US Fed’s stance on US inflation,

- US bond yields,

- Fed’s view on tapering QE

Outlook for August 2021

Market direction in August will depend on news flow on likely third wave of Covid (delta plus variant) & pace of recovery in economic activity post lift-off of restrictions imposed during second wave

- Q1FY22 results till now have not shown any major negative surprise. However, pressure on margins due to inflation is clearly visible.

- Upgrades in earnings estimates of Nifty 50 companies for FY23E have halted & large number of companies have witnessed downgrades for FY22E EPS.

- There is a clear risk of third wave of covid. More virulent variety of virus (Delta Plus) is creating panic across the globe. US. UK & many Asian countries have seen resurge in number of covid cases to almost last year levels

- Inflation threat is visible across the globe (including India) . It may not remain “Transitory” & can delay the return to normalcy by Central Banks & governments

Portfolio Strategy For August 2021

What is our portfolio strategy for the month of August 2021

- We believe market performance in August will be driven by degree of participation in rally by the large index heavy weight companies which till now have not participated. We will look for some catch-up opportunities to add into our portfolios.

- We expect economy facing sectors to out-perform in August as the economy reopens after second wave. We will look for opportunities in reopening trades.

- Banks & Financials, FMCG & Autos have not performed in last few months & have witnessed decent correction. We believe negatives in these sectors have been priced in & valuations are attractive. Any positive news flow in these sectors can result in sharp rebound as these sectors are relatively under invested.

- Metals & IT sector remains our preferred sectors.

- Real estate sector has started performing after almost a decade. The sector has undergone many structural changes that are helping it. We are likely to add this sector after a gap of about a decade.

Themes to play in August 2021

1. Large cap stocks catch-up trade

- Data shows that YTD top index heavy weights have not participated in the market since Jan 2021. Out of 5 most weighted stocks in Nifty50 , three have given negative or meagre returns. While in the same period Nifty Mid Cap & Small cap have given very high returns of 32% & 47% respectively.

- Nifty headline index made several attempts to cross the 16000 mark in last 2 months. Usually whenever such consolidation range breaks the move in the direction of break is quite large. We believe large up move on headline index will not be possible without the contribution from heavyweight large caps.

- Many economy facing sectors are poised for strong up move.

- Valuation catch up of Mid & small cap has already reached previous historical highs. There are signs of froth building in broader markets.

- Quality stocks may be in flavor as these are more sustainable & provide safety/comfort at a time when overall markets are scaling new highs.

2. Economy facing sectors

- Post the decline in number of covid cases in last few weeks many states have started to lift off restrictions & localized lockdowns. The early high frequency indicators confirm a sequential improvement in June 2021.

- We believe, the current macro-economic scenario is conducive for a business cycle recovery backed by global and domestic policy response.

- E-Way bill activities have increased significantly in July over June. Similarly, Core sector data, Auto sales (especially commercial vehicles) numbers for the month of July show month on month improvement.

- Vaccination drive has picked up significantly v/s vaccine shortages in previous months. With this supply conditions should normalize & reduce disturbances.

- We expect the speed of implementation of various government reform programs announced in budget to pick up substantially.

3. Cyclicals especially steel & other metals to remain most preferred

- Improvement in global scenario has resulted in significant price uptrend in most of the metals.

- World is witnessing unprecedented growth in steel demand. All global majors (recently Arcelor Mittal) have revised guidance on expected growth.

- Chinese government’s vacillating stance on de-carbonization/pollution control & dictatorial style of intervening in various sectors did create volatility in metals/mining sector. China has tried to supress commodity prices via inventory sales. However, none of these efforts have cooled off the strong pricing environment in the sector.

- We remain confident of string pricing scenario & demand in sector.

- Other way to play metals theme is through investing in allied stocks like Iron Ore, Graphite, calcined Coke, manganese, alloys producers. Most players in the allied sector have increased production & increased or are on the verge of increasing prices.

4. IT sector showed strong growth in Q1FY22 & likely to maintain that over next 2 years

- In line with our expectations strong growth momentum of Indian IT companies continued in Q1FY22.

- Most companies including mid & small have revised upwards their full year guidance on revenue/profitability.

- Specialized services providers like CPaas, Cloud implementation, Product engineering & services, Cyber security, workplace automation, digital transformation etc are gaining traction. Global top players in these areas are giving business to Indian players.

- We expect this sector to continue robust growth on back of strong tailwind of digitization & work form home.

Our preferred Sectors / stocks

1. Metals (Steel, Aluminum, Zinc, Copper)

- Very strong pricing environment on back of high demand (likely to be created by aggressive infra spending by various governments).

- Despite likelihood of reduction in steel prices in July, we expect the impact on companies' profitability to be limited as this decline in prices will be temporary & landed price of imported Steel is still higher than domestic price.

- De-leveraging of balance sheets to continue in Q1FY22E also on back of strong expected numbers.

- No major impact on commodity prices witnessed despite China trying to manage prices through inventory off-loading.

Metals -allied segments

- Iron ore, Graphite, Calcined Coke, various Alloys are allied sectors to steel, aluminum etc . Demand for these products is directly proportional to demand for metal, hence these companies are also witnessing high demand coupled with strong pricing power.

Stocks we like:

Tata Steel | JSW Steel | SAIL | JSPL | Hindalco | NMDC | Godawari Power | Graphite Inds | HEG | Rain Inds

2. IT- both large cap as well as mid cap

- Sector likely to deliver strong earnings growth in Q1FY22

- Visibility of high earnings in next couple of years through all time high deal wins

- Many new areas of action opening up which will be revenue driver for the companies

- High margins maintained despite wage hikes due to savings on SGA & travel costs

- User base expanding as every one realize need of IT for Work from Home

Stocks we like:

Intellect Design | KPIT | HCL Tech | Wipro | Mastek | Route Mobile

3. Financials (Banks, NBFCs, intermediaries)

- Sector has been under performer for last several months due to apprehension on asset quality

- Large borrowers repaying in time due to better pricing in environment especially in commodities, resources, power etc

- Stress visible in retail, SME & MSME but government helping through credit guarantees

- Resolution of many past insolvency cases will result in write back of provisions

- Most banks are well equipped to handle asset quality stress through adequate buffer in provisions

Stocks we like:

HDFC Bank | ICICI bank | Axis bank | Kotak Bank | Baja Finance | SBI

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

4. Financials (Banks, NBFCs, intermediaries)

- Sector has been under performer for last several months due to apprehension on asset quality

- Large borrowers repaying in time due to better pricing environment especially in commodities, resources, power etc

- Stress visible in retail, SME & MSME but government helping through credit guarantees

- Resolution of many past insolvency cases will result in write back of provisions

- Most banks are well equipped to handle asset quality stress through adequate buffer in provisions

Stocks we like:

HDFC Bank | ICICI bank | Axis bank | Kotak Bank | Baja Finance | SBI

Continue with Google

Continue with Google