Stockaxis monthly insights outlook for september 2021

September 01, 2021

Glimpse of August 2021

August was the month of laggards & large caps as expected by us.

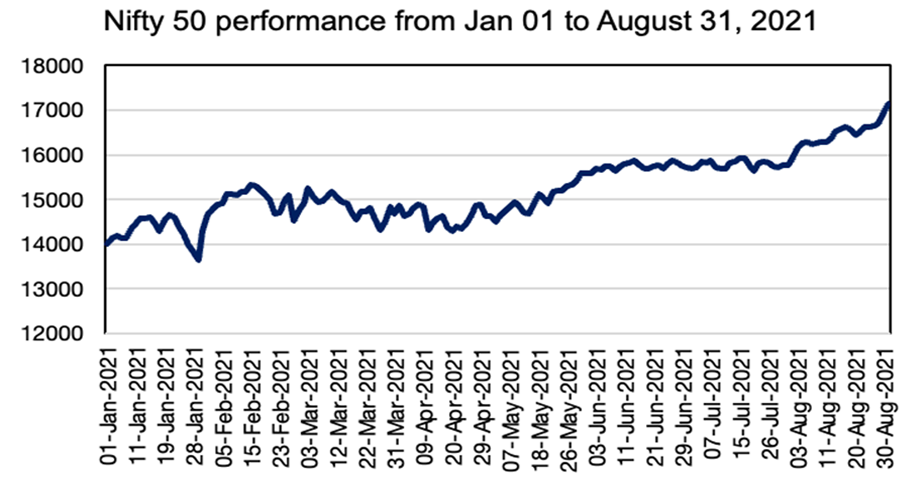

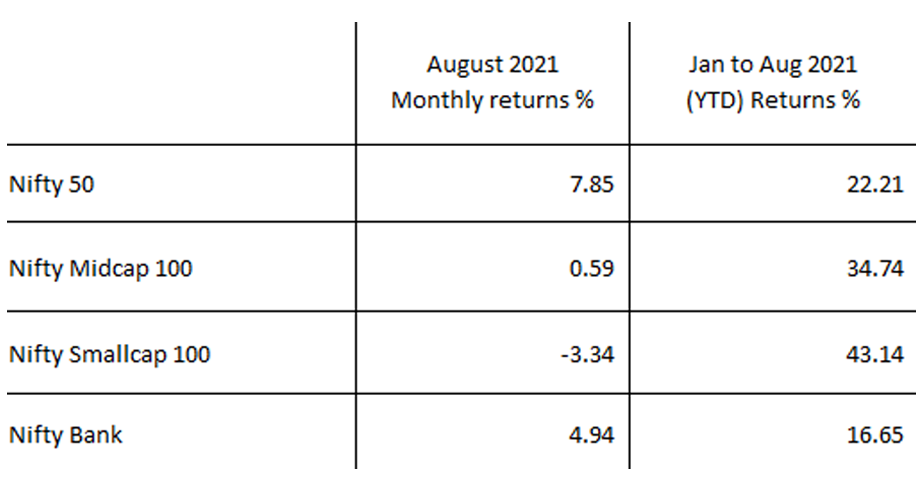

Nifty returned ~8% during the month of August 2021 backed by strong performance by banks, Reliance & other laggards of the past. Nifty Bank gave returns of ~5% in the month while broader markets continued to under perform. Nifty Midcap 100 index returned a meagre 0.5% while the Small cap 100 index returned -3.35%. Sector rotation was visible.

Index Heavyweight stocks like Reliance, HDFC bank, ICICI Bank, Axis Bank, Kotak Bank, Bharti Airtel were major contributors to the rally.

After many months Mid & small cap (broader markets) under-performed mainly due to concerns of frothy valuations (in some cases), fear of reduction in benign global liquidity, higher cost of capital in future due to expectation of higher interest rates. At one point of time Mid/Small caps were down about 10%.

Overall sentiment was subdued through out the month on the back of apprehensions that US Fed may start tapering program much earlier than previously expected & high inflation in US may force FED to take rate increase call much before earlier anticipated end CY22. All eyes were on cues from Jackson Hole symposium (scheduled for August 27,2021). Markets took a big sigh of relief post the symposium whereby the FED Chair clearly explained that Tapering & increase in interest rates are two independent actions & that tapering may start sooner (by end of CY21) but there is still long way to cover before interest rates in US will start increasing. Such clarity of FED strategy led to sharp Risk-On rally across the global markets.

While Q1FY22 corporate earnings were mixed bag there were a few upgrades especially in IT, Metals & cement sectors. Autos & Pharma were major disappointments. Real estate continued to witness strong up move. August saw the highest number of residential registrations in a decade On macroeconomic front, many high frequency indicators are pointing towards month on month improvement. June quarter reported GDP number were better than estimates. Normalization of economic activities continued through the month of August & Inflation for July also softened.

Sequential economic recovery & increase in pace of vaccination is cheering the markets. However, third time rising Covid cases across the world & India (impending third wave) may weigh on markets in September.

Going forward, we expect markets to be driven by 1) news flow on incremental covid cases (third wave or new variants), 2) pace of vaccinations, and 3) impact of covid related restrictions on mobility, re-opening of cities etc.

We believe few global risks that may confront the markets in the month of September will be actual announcement on Tapering by FED (in its meeting during September) & market’s reaction post that

Source : NSE Website

Source : NSE Website

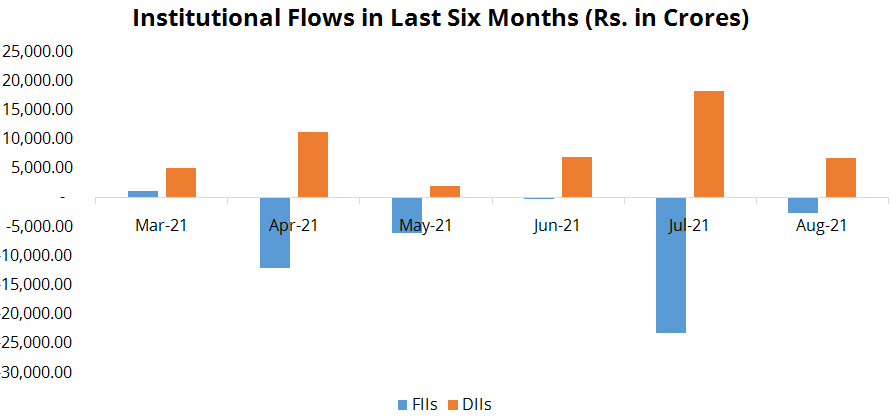

Source : Money Control

Important considerations for September 2021

We believe more steam is left for Large caps to perform aided by Reliance, BFSI & Cap goods

August was the month of laggards. Stocks which had not participated in the rally from Jan to July 2021 started participating. Stocks like Reliance, HDFC twins, Axis Bank, Kotak Bank & Bharti airtel showed strong revival. At the start of the month of August we had expected Large cap stocks to take the lead & catch up with their Mid/Small cap peers. Good bit of that under performance has been covered in August. However, we believe there is more steam left for frontline stocks to perform in September.

The big heavy weights such as Reliance & BFSI sector have strong tailwinds which will help them in scaling further highs.

Reliance is likely to launch its next generation Jio phone in collaboration with Google. There are expectations that new launch will help Jio to take much larger pie of telecom market from its peers, especially the 4G customers. Later on all telecom players are likely to launch 5G services also which will usher in new round of growth in this sector. Reliance has announced ambitious new energy initiative in 2021 AGM. Execution has already started on some of these plans. Any visibility on new energy will qualify Reliance for investment by ESG themed investors who were till now apprehensive about investing in fossil fuel or not so environment -friendly company. Such new investors may provide re-rating potential for the stock. Any news flow on monetization of OIL business through sale to Aramco or any other bidder will provide more cushion to the stock's performance going forward. Under performance of the stock since almost last one year & heavy weightage of stock in Index will also support stock price.

BFSI which accounts for about one third weightage in the index has not been a great performer in last many months due to apprehensions on asset quality & growth post the pandemic. Some private banks have rebounded in August & Nifty Bank gave returns of ~5% in the month. However, we believe there is a lot more to catch up for this sector.

Since the onslaught of pandemic in March 2020 till now, banks have shown very prudent asset quality management with no reckless lending & no major deterioration in asset quality. We expect the credit demand to pick up in near future as the economy unlocks. India’s long awaited capex cycle is likely to restart. Government capex has already started improving, household capex (reflected through property buying) has reached decadal highs. Only Private corporate capex is yet to start. Some green-shoots of that too are emerging by way of capex announcements in steel, renewable power, data centres through PLI schemes etc. Revival of capex cycle will augur well for BFSI sector. We expect strong performance by private corporate banks, retail banks, housing finance companies, top quality NBFCs (both retail & CV financiers)

Current macroeconomic scenario appears to be more conducive to business cycle recovery. Hence we are positive on economy facing sectors like Cement, steel, real estate/home improvement, infrastructure (L&T), power, industry automation etc.

Outlook for September 2021

Performance of index heavy weights-Reliance & Private banks will determine the market direction

- Performance of index heavy weights-Reliance & Private banks will determine the market direction

- There are some signs of capex cycle reviving. Out of three legs of capex cycle two have already started showing signs of revival (Government expenditure & Household capex-property) while the third leg-private corporate capex has started selectively

- Festive season will start in September & lock down restrictions are likely to reduce implying pick up in consumer activity. We can play this theme via aviation, entertainment, travel, leisure, hospitality sectors.

Risks

- There is a clear risk of third wave of covid. Likelihood of a new variety of virus is being talked about.. Many countries have seen resurge in number of covid cases to almost last year levels

- Elevated commodity prices to put pressure on corporate margins

- Inflation threat is visible across the globe (including India).

Portfolio Strategy For September 2021

What is our portfolio strategy for the month of September 2021

- We believe market performance in September will be driven by continued performance of Banks & financials & Reliance.

- We expect economy facing sectors to out-perform in September as the economy reopens & green shoots of capex cycle revival are visible. We will look for opportunities in industrial automation, new age technology (EV etc), infrastructure, power

- Autos have not performed in last few months & have witnessed decent correction. We believe negatives in this sector have been priced in & valuations are attractive. Festive season demand pickup & any positive news flow in this sector especially on chip shortages can result in sharp rebound as the sector is relatively under invested.

- Metals (steel) & IT sector remain our preferred sectors

- Real estate sector has started performing after almost a decade. The sector has undergone many structural changes that are helping it.

Themes to play in September 2021

1. We believe more steam is left for Large caps to perform aided by Reliance, BFSI & Cap goods

-

Reliance-on back of expected launch of its next generation Jio phone

Launch of 5G services will usher in new round of growth in this sector.

Ambitious new energy initiative will qualify Reliance for investment by ESG themed investors

Any news flow on monetization of OIL business through sale to Aramco or any other bidder

Under performance of the stock since almost last one year &

heavy weightage of stock in Index will also support stock price. -

BFSI which accounts for about one third weightage in the index has not been a great performer in last many months due to apprehensions on asset quality & growth post the pandemic.

Since the onslaught of pandemic in March 2020 till now, banks have shown very prudent asset quality management with no reckless lending & no major deterioration in asset quality. Credit demand to pick up in near future as the economy unlocks.

India’s long-awaited capex cycle is likely to restart. - We expect strong performance by private corporate banks, retail banks, housing finance companies, top quality NBFCs (both retail & CV financiers .

2. Economy facing sectors

- Post the decline in number of covid cases in last few weeks many states have started to lift off restrictions & localized lockdowns. The early high frequency indicators confirm a sequential improvement in July & August 2021

- We believe, the current macro-economic scenario is conducive for a business cycle recovery backed by global and domestic policy response.

- India’s long awaited capex cycle is likely to restart. Government capex has already started improving, household capex (reflected through property buying) has reached decadal highs. Only Private corporate capex is yet to start. Some green-shoots of that too are emerging by way of capex announcements in steel, renewable power, data centres through PLI schemes etc. Revival of capex cycle will augur well for BFSI sector too.

- Vaccination drive has picked up significantly v/s vaccine shortages in previous months. With this supply conditions should normalize & reduce disturbances

3. Cyclicals especially steel & other metals to remain preferred

- As the countries across the globe reopen & focus on rebuilding their economies there is huge impetus on building new or upgrading existing infrastructure. Strong demand on back of infra push has resulted in significant price uptrend in most of the metals

- US Fed’s clear stance on maintain accommodative loose policy for a long time has resulted in new risk-on rally across most asset classes including metals. After a small correction in metals during August on apprehension of strengthening dollar & dollar index crossing 94 mark, the metals have regained investor favour

- Once again China has tried to supress commodity prices via inventory sales. However, till now these efforts have not dented the strong pricing environment in the sector.

- After minor reduction in steel prices in domestic markets due to slowing of demand (effect of monsoon), the companies are expecting to increase the prices again as demand is returning in September. We remain confident of strong pricing scenario & demand in sector.

4. IT sector showed strong growth in Q1FY22 & likely to maintain that over next 2 years

- In line with our expectations strong growth momentum of Indian IT companies continued in Q1FY22.

- Most companies including mid & small have revised upwards their full year guidance on revenue/profitability.

- We expect this sector to continue robust growth on back of strong tailwind of digitization & work form home

- We want to draw attention towards the fact that IT sector is witnessing sharp wage inflation as demand for talent has suddenly spiked. Our channel checks indicate wage hikes across the sector are in double digits. Such a wage hike may result in squeeze on IT company’s margins. In the meantime, the IT stocks are trading at multi year high valuation multiples. There could be risk on IT company’s future earnings hence on valuations but as of now we are maintaining positive view on the sector. We will wait till actual impact of wage hikes on earnings

Our preferred Sectors/stocks

1. Financials (Banks, NBFCs, intermediaries)

- Sector has been under performer for last several months due to apprehension on asset quality, but the banks have managed asset quality remarkably well

- Credit growth to pick up as the economy reopens

- India’s long awaited capex cycle to revive soon

- Resolution of many past insolvency cases will result in write back of provisions

- Most banks are well equipped to handle asset quality stress through adequate buffer in provisions

Stocks we like:

HDFC Bank | ICICI banks | Axis bank | Kotak Bank | Baja Finance | SBI

2. Reliance

- on back of expected launch of its next generation Jio phone

- Launch 5G services also which will usher in new round of growth in this sector.

- New energy initiative will qualify Reliance for investment by ESG themed investors

- Any new flow on monetization of OIL business through sale to Aramco/ any other

- Under performance of the stock since almost last one year

- heavy weightage of stock in Index will also support stock price

Stocks we like:

Reliance

3. Capital goods & Economy facing sectors

- Current macro-economic scenario is conducive for a business cycle recovery backed by global and domestic policy response.

- India’s long awaited capex cycle is likely to restart. Government capex has already started improving, household capex (reflected through property buying) has reached decadal highs. Some green-shoots of private corporate capex is starting are selectively emerging in steel, renewable power, data centres through PLI schemes

- Theme can be played through Infrastructure, Industrial automation, Power renewables, New age technology, Real estate/home improvement, Cement, etc

Stocks we like:

L&T | Corborundum Universal | Schaeffler India | DLF |Polycab

4. IT- both large cap as well as mid cap

- Visibility of high earnings in next couple of years through all time high deal wins

- Many new areas of action opening up which will be revenue driver for the companies

- User base expanding as everyone realize need of IT for Work from Home

- High wage hikes may become a headwind to earnings in future

Stocks we like:

Intellect Design | KPIT | Happiest Minds | Wipro | Mastek | Route Mobile

5. Metals (Steel, Aluminum, Zinc, Copper)

- High demand (likely to be created by aggressive infra spending by various governments)

- Post monsoon demand is back & the companies are likely to regain pricing power in domestic markets

- De-leveraging of balance sheets to continue in Q1FY22E also on back of strong expected numbers.

- No major impact on commodity prices witnessed despite China trying to manage prices through inventory off-loading

Metals - allied segments

- Iron ore, Graphite, Calcined Coke, various Alloys are allied sectors to steel, aluminum etc . Demand for these products is directly proportional to demand for metal, hence these companies are also witnessing high demand coupled with strong pricing power.

Stocks we like:

Tata steel | JSW steel | SAIL | JSPL | Hindalco | NMDC | Godawari Power | Graphite Inds | HEG | Rain Inds

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

Continue with Google

Continue with Google