Stockaxis monthly insights outlook for october 2021

October 01, 2021

Glimpse of September 2021

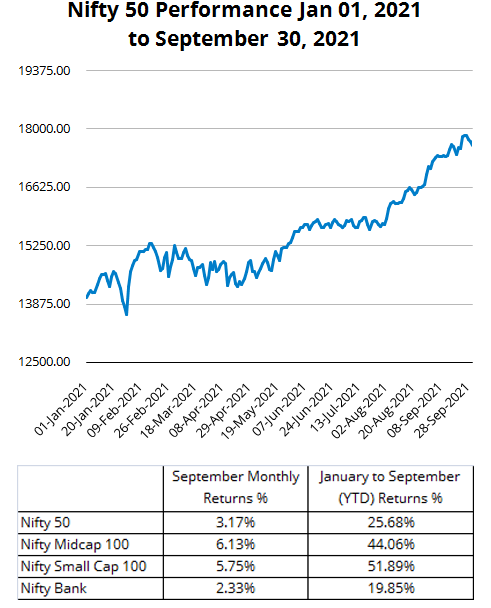

Despite strong global headwinds Nifty continued its upward journey

Indian markets were best performing markets through out the world despite strong headwinds from China (real estate company default) & expectations of tapering by the FED. More than 23% y-y growth in GST collection in the month of September, lower than expected increase in domestic inflation, government relief measures on various sectors & steady news flow on Pandemic aided the markets’ up move.

USFED’s lucidly worded policy on tapering of bond purchases & trajectory of interest rates in US was well accepted by the markets & it unleased big risk-on rally across the global markets. However major risk to global equity rally has emerged from China where its second largest real estate developer has defaulted & there is a severe power crisis in the country resulting into closure of many industrial zones specially in chemicals & metals.

The impact of Chinese crisis is two fold-Already crumpled global supply chain has further deteriorated which will hit production of companies dependant on global supplies. Second order impact will be on profitability as supply side issues will result in higher input costs resulting in risk to corporate earnings expectation.

Towards the end of month the market was nervous ahead of Jackson Hole symposium outcome. Hence markets witnessed bout of sharp volatility.

Overall for the month, Nifty returned ~3% & Nifty Midcap 100 yielded ~ 6%. Markets’ up move was aided by strong move in Realty, Consumer durables, Autos, banks & Oil/Gas. Pharma & metals gave negative returns while IT was subdued.

Source: NSE Website

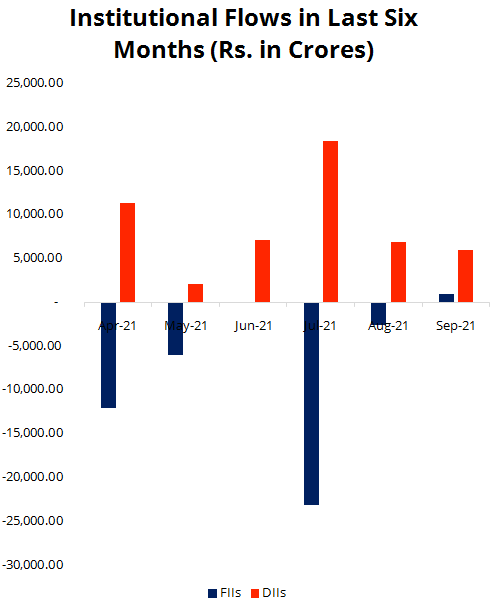

Source: Moneycontrol

Important considerations for October 2021

With Nifty/BSE Sensex at All Time high investors are asking What to do Now?

Factors that are supporting the market’s up move

- Global liquidity, Local central bank’s support

- Corporate earnings growth & very strong cash flows. Not only EPS growth for next 2 years is likely to be strong, but cash flows are even stronger. In last 2 years corporates have deleveraged significantly. Corporate debt is now at lowest level resulting in savings on finance costs.. Result is Current EV to Debt is ~16x (in 2008 this was 25x).

- Time for laggards to catch up. There are many sectors which have still not participated in rally in last 8-9 months. Autos, Banks & NBFC have a long runway to catch up

- Many pockets of market are still giving buying opportunity at reasonable valuation eg Capital goods/industrials, oil & gas, Autos & Auto ancillaries etc

-

10-year hiatus in India’s capex cycle to re-start. There are 3 legs of capex cycle- 1) Private household capex 2) Private Corporate capex & 3) Government Capex

- Private Household capex is manifested in property buying. Residential property registrations are highest in the last 10 years.

- Private corporate capex has still not fully started however, there are some green shoots emerging. Capex in selected sectors like steel, new energy/renewable business and production linked incentives induced capex in various sectors has already started

- Government capex is increasing steadily. As tax collections come to normal levels in current year & next year, government capex will speed up

Factors that will spook the markets

- Hyperinflation. Already most input costs across industries have gone up by 20-30%. Till now inflation is due to supply side constraints. However, upon re-opening we expect demand side pressures to emerge. Daily household items -apparels, consumables, paints, tiles, appliances, construction items have all gone up between 20-30%

- Central banks will start thinking of increasing rates at some point in time over next 1 year. We expect RBI to start economic policy normalization from end CY21 or Q1CY22 & increase interest rates around April 2022. Similarly, US FED is likely to announce tapering from November 2021

- Any news flow around third wave of Corona & resultant disruption in economic activity

- Contagion from Chinese policies on various sectors & any default by major Chinese conglomerate.

Outlook for October 2021

Corporate Performance in Q2FY22 & RBI as well as FED’s policy stance will determine the market direction

- Q1FY22 corporate earnings were strong & in-line with estimates. Markets will watch out for sustained momentum in Q2FY22 earnings

- Commentary of corporates, especially on inflation in input costs, will determine potential upgrade/downgrade to FY22E & FY23E Nifty 50 EPS.

- We are expecting topline growth momentum to continue in IT & Metals. However, wage hikes & break in pricing momentum for metals may result in some retardation in earnings of these sectors.

- We expect investors to reduce positions in IT/Metals & move into laggards like Autos, BFSI & reopening themes.

- Festive season has started well in September as reflected in high growth of jwellery, auto numbers. We expect unlock trade viz aviation, entertainment, travel, leisure, hospitality can be preferred sectors.

Portfolio Strategy For October 2021

What is our portfolio strategy for the month of October 2021

- We believe market performance in October will be driven by corporate results & RBI’s policy stance

- We expect economy facing sectors to out-perform as the economy reopens & green shoots of capex cycle revival are visible. We will look for opportunities in industrial automation, new age technology (EV etc), infrastructure, power

- Autos have not performed in last few months & have witnessed decent correction. We believe negatives in these sectors have been priced in & valuations are attractive. Festive season demand has shown signs of pickup

- Reopening themes-based stocks , capital goods, Autos, Banks /NBFC, Real estate & FMCG will be our preferred sectors

- Oil & Gas sector has come to forefront after almost a decade due to rising oil prices globally & historically all-time high prices of gas. Upstream companies are direct beneficiaries. These stocks are available at attractive valuation & have high dividend yield. We may participate in some oil producers & exploration companies

Themes to play in October 2021

1. Corporate results for Q2FY22

- We expect earnings momentum witnessed in Q1FY22 to continue in September quarter too. However, management commentary especially on input costs related inflation will be critical for further upgrade of FY22E & FY23E Nifty 50 EPS.

- We expect IT sector to continue strong top-line growth. However, wage hikes & spike in attrition may impact profitability of the sector. Management commentary in this regard will be critical for future projections.

- In metals space there has been a break in pricing momentum in last few months. Also there has ben some softness in demand (exports) of commodities like steel. While Q2FY22 is expected to be the decade best quarter but growth momentum is expected to retard.

- Performance of BFSI (accounts for about one third weightage in the index) is crucial both in terms of growth as well as asset quality. We expect strong performance by private corporate banks, retail banks, housing finance companies, top quality NBFCs (both retail & CV financiers

- Taking cues from monthly numbers Auto sector is likely to show muted Q2FY22 performance.

2. RBI’s policy stance

- Since the pandemic, globally all the central banks have been pumping liquidity into the economies to support growth & face the after shock of pandemic induced lockdowns. However, now with risks of pandemic receding, the economists are expecting all central banks to start normalization process soon.

- We have heard USFED talking of tapering down bond purchase program soon (probably from November 2021 onwards), ECB has already started reduction in bond purchases. RBI is also expected to reduce system liquidity through various means & an indication of that may be given in policy statement scheduled for October 08, 2021.

- Market will also keenly watch RBI’s stance on inflation. While food inflation is well under control, energy prices are significantly higher. Supply side issues in various sectors are imparting pressure on various raw materials. Hence inflation may not be just a “Transitory” issue & has potential to convert into more serious threat to economic recovery.

Our preferred Sectors/stocks

1. Financials (Banks, NBFCs, intermediaries)

- Sector has been under performer for last several months due to apprehension on asset quality, but the banks have managed asset quality remarkably well

- Credit growth to pick up as the economy reopens

- India’s long awaited capex cycle to revive soon

- Resolution of many past insolvency cases will result in write back of provisions

- Most banks are well equipped to handle asset quality stress through adequate buffer in provisions

Stocks we like:

HDFC Bank | ICICI banks | Axis bank | Kotak Bank | Baja Finance | SBI

2. Autos/FMCG

- Auto numbers have started improving m-o-m

- Semi conductor shortage issues seem to be receding

- Response to new launches in last couple of days has been extremely encouraging

- Most Auto stocks are available at attractive valuation (not participated in rally in last many months)

- Consumer durables are witnessing very strong demand on back of Festive cheer & reopening

Stocks we like:

StoveKraft | Voltas | Hero Moto | Bajaj Auto | Tata Consumer

3. Oil & Gas

- Oil is on boil. Globally Crude prices have moved up on supply related issues

- Gas prices are at all time high due to high demand as well as constrained supply

- Domestic pricing of these commodities is now market determined

- Recently APM price of gas was increased by 62%

- Stocks are attractive on Dividend yield as well as valuation

- Avoid user industry & down stream companies. Play the theme through only upstream companies in production as well as exploration

Stocks we like:

ONGC | OIL | HOEC

4. Capital goods / Economy facing sectors & Industry automation

- Current macro-economic scenario is conducive for a business cycle recovery backed by global and domestic policy response.

- India’s long awaited capex cycle is likely to restart. Government capex has already started improving, household capex (reflected through property buying) has reached decadal highs. Some green-shoots of private corporate capex have started emerging like steel, renewable power, data centres through PLI schemes

- Theme can be played through Infrastructure, Industrial automation, Power renewables, New age technology, Real estate/home improvement, Cement, etc

Stocks we like:

L&T | Corborundum Universal | Schaeffler India

5. Basic Chemicals/Spl Chemicals

- Due to closure of many industrial zones in China many chemicals are witnessing steep increase in prices. Those companies which have low raw material dependency on China but finished goods pricing is linked to global availability will be benefited the most

- Basic chemicals like Caustic Soda, H Acid, Vinyl Sulphone, Yellow Phosphorus, Ethyl Acetate, Aniline etc are witnessing very strong price moves

- Although the benefit of higher prices may be short lived, it can still make significant impact on earnings of producers of these cos. Hence this could a tactical short-term opportunity

Stocks we like:

Sudarshan | Shree Pushkar | Astec Life | Privi Spl | Deepak Nitrite | Navin Flourine

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

Continue with Google

Continue with Google