Stockaxis monthly insights outlook for november 2021

November 01, 2021

Glimpse of October 2021

After touching all time high, Nifty slipped on nervousness ahead of crucial FED meeting

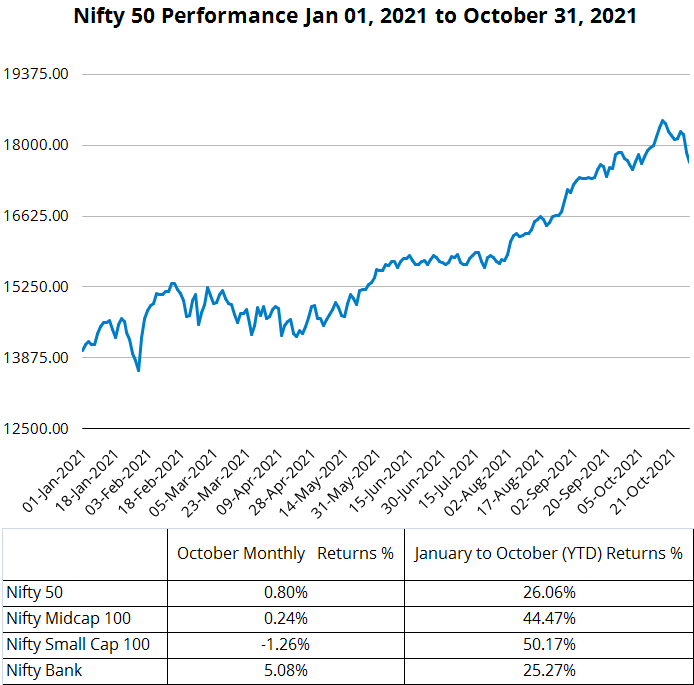

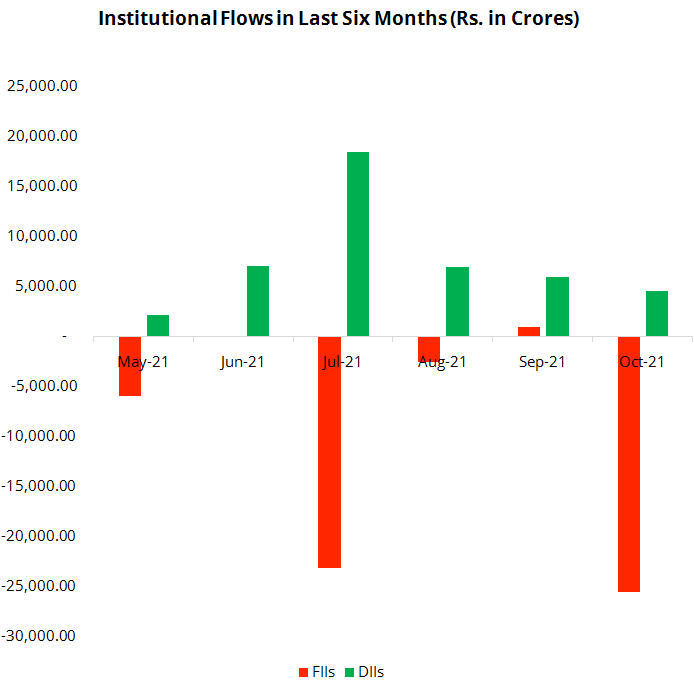

Indian markets continued their upward journey with Nifty scaling new all time high level of 18477 on 18 Oct 22 (intraday high was 18604 on 19 oct,22). However the markets could not sustain high levels as nervousness from upcoming crucial FED meeting in the first week of November weighed on markets. On concerns that FED will soon start tapering program as well as change its stance on interest rates due to persistently high inflation resulted in heightened volatility in the markets. Domestic corporate earnings season for Q2FY22 also aggravated pressure as most large companies came out with good top line growth but reported serious pressure on margins due to higher input costs. Consequently over second half of the month all headline indices lost momentum aided by large FII selling.

Overall for the month of October, Nifty ended on flat note with minor gains of 0.8%. Pressure on gross margin is expected to be even higher on mid & smaller companies, hence the price correction/profit booking in these segments was even more. Nifty Midcap 100 closed flat with gain of meagre 0.24 % while Nifty SmallCap recorded loss of 1.26% in the month.

While the market welcomed sequential recovery in key high-frequency indicators such as Services PMI & monthly GST collection, the market volatility increased substantially from 11-12 to 17-18 levels. However this level of volatility is lower than long term average of 22, indicating limited further downside.

Large caps maintained outperformance with Power, Utilities, Banking & Realty as best performing sectors for the month. Metals continued to witness profit booking.

Source: NSE Website

Source: Moneycontrol

Important considerations for November 2021

With major policy overhang from FED out of way, we expect markets to regain momentum.

Factors that are likely to support the market’s upward trajectory

Global

- USFED taper program is well calibrated & it is not likely to reduce Global liquidity in any significant manner

- USFED has clearly articulated its stance on interest rates. Though the market is factoring at least 2 rate hikes in US (one in July 2022 & other around Nov 22), The FED has clearly mentioned that many more parameters must be achieved to start rate increase cycle. This means loose monetary policy will probably continue till end CY22 as expected earlier.

- Global Supply side disruptions have continued longer than earlier expected & chances are that inflation due to supply constraints may last longer. However high inflation may not be too detrimental to growth as demand scenario is very strong across all geographies & across sectors implying capability of corporates to pass higher input costs without disturbing top line growth . Secondly there are some green shoots appearing on easing supply issues (e.g. Semi conductor shortage is likely to reduce significantly over next 1-2 quarters)

Domestic

- Q2FY22 Corporate earnings: Reported earnings till now have been in line with expectations. Corporates have shown strong growth in top line reflective of strong recovery in economy/demand. However, results also show severe pressure on gross/operating margin for most of the companies mainly due to high raw material costs. In the quarter gone by, most companies have taken a hit on margins without passing the increased costs . We expect companies with strong brand name/moat will be able to pass on the hike in input costs thereby not impacting their full year margin profile. We wish to highlight that passing on of increased costs will be the key driver for corporate profitability in Q3FY22 & beyond.

- There are many sectors which have still not participated in rally in last few months. Industrials, Cap-goods, Banks & NBFC & Autos have a long runway to catch up

- We expect RBI to continue to give precedence to growth over inflation. If there is any withdrawal of monetary stimulus by RBI, in our opinion, that will be gradual

- We believe that economy will continue to revive, supported by reduction in Covid cases, the robust pace of vaccination, Govt’s focus on capital expenditure, supportive monetary and fiscal measures and buoyant demand

Factors that will spook the markets

- Most market participants (especially US based) think that USFED is behind the curve in tackling inflation. They expect USFED to undertake steeper & faster rate hikes in CY22, Although USFED has been maintaining that inflation is temporary & they have tools to manage it, but in case the inflation worries deepen & USFED is forced to act earlier than currently factored in then markets may react negatively

- Most of the other central banks are likely to follow USFED on withdrawal of loose monetary policies & change stance on rates. Simultaneous action by various Central banks can have negative effect on markets

- Persistent high inflation. As of now most participants are believing inflation to be a temporary problem. However over last many months inflation has only gone up instead of receding, Corporate's ability to pass on this input hike is crucial in order to maintain profitability. Only companies with strong moats/brand etc will be able to effect price hikes while others may have to bear the brunt

Outlook for November 2021

Corporate’s capability to hike prices without impacting demand will be critical for maintaining FY22E full year earnings expectations.

Sector & Style rotation is likely to continue. We expect profit booking / rotation out of expensive / growth stocks to value stocks and the sectors which have yet not participated

- Q2FY22 corporate earnings (announced till date) are in-line with estimates. However, they show severe pressure on margins due to high raw material costs.

- Some companies with strong moat or brand maybe able to increase prices however for others it may be difficult. Commentary on price increases by corporates will be crucial & determine potential upgrade/downgrade to FY22E & FY23E Nifty 50 EPS.

- Since demand scenario is strong & economy is on recovery path. increasing prices may not be difficulty for most of the listed companies, in our opinion. Therefore, we believe full year margin trajectory of most corporate will be maintained.

- We expect investors to reduce positions in sectors/stocks that were trading at very high PE/PB or other valuation multiples. Since in near term there is risk to growth as well as margins for these stocks it will not be out of sync to expect a bout of serious profit booking in these sectors/stocks.

Portfolio Strategy For November 2021

What is our portfolio strategy for the month of November 2021

- We believe market performance in November will be driven by corporate’s ability to pass on input price increases

- We expect serious profit booking in highly over-valued stocks /sectors. We will look for reducing exposure to Chemicals (specialty/agro), metals, FMCG, IT, & those sectors where multiple expansion theme has played out & there is likelihood of retardation in earnings growth

- We expect economy facing sectors to out-perform. We will look for opportunities in industrial automation, new age technology (EV etc), infrastructure, power

- With much better balance sheets of realty companies coupled with favorable demand-supply scenario & better legal framework (RERA), we expect real estate sector to be preferred sector for next few years

- Oil & Gas sector has come to forefront after almost a decade on back of rising Crude & gas prices globally. Upstream companies are direct beneficiaries of this & many of these stocks are available at attractive valuation with high dividend yield.

Themes to play in November 2021

1. Sector rotation-out of expensive & high valuation stocks, get into capex related & manufacturing-oriented sectors

- We expect sharp profit booking from sectors that have witnessed re-rating & expansion in valuation multiples. Extremely low interest rates & abundant liquidity resulted in cost of capital reducing significantly in last few years. As a result, sectors that throw out large amount of cash /do not need too much capex for expansion, have witnessed very sharp multiple expansions. In some cases, PE multiples moved up from 15-20 ranges in 2014-15 to 60-70 range currently. Similarly other valuation parameters also expanded significantly.

- However, now with expected change in policy stance by Central Banks across the globe, cost of capital is likely to increase, which means most of these growth /momentum companies may witness some slowdown in their growth momentum (not absolute growth). In such a change, it is expected that investors would want to book out of these sectors/stocks & reposition themselves into new sectors where there is potential for multiples to expand. Hence, we expect investors to book out from sectors like Tech (Platform business), metals, Chemicals (Speciality/agro), FMCG etc.

- We expect laggard sectors hitherto like infra, cap goods, industrials, realty, telecom & textiles to come to forefront both due to changes in the specific industry as well as support form government in terms of policies.

- The government’s Capex cycle continues to be robust and house registrations in the Metro cities continue to witness strong traction. The private Capex cycle is expected to pick up soon, further supporting the Capital Goods sector. Policies like PLI will help manufacturing sector

- Performance of BFSI (accounts for about one third weightage in the index) is crucial both in terms of growth as well as asset quality. We expect strong performance by private corporate banks, retail banks, housing finance companies, top quality NBFCs (both retail & CV financiers

- The Real Estate sector is witnessing record registrations in the metro cities. Demand has picked up as real estate prices are low and interest rates are very attractive. The sector is likely to see more traction in 2021

- Telecom has become the most critical sector during the current challenging times to keep the businesses up and running. The industry is highly consolidated with two strong and one weak player in the wireless space

- Oil/Gas & Textiles could be other sectors that can find favour with investors in coming months

2. Value as investing style to take precedence with bias towards Large caps

- We believe focus on quality and momentum will deliver better returns in near future. We are of the opinion that the market bias towards the Large Caps is likely to continue over the medium term.

- Q2FY22 numbers have signalled margin pressures due to the shortage of products globally which imply price hikes are critical. We believe any pass-on of input prices will be dependant on demand scenario. The companies having stronger brands, larger economies of scale, and cost leadership will be the winners in the coming quarters.

- We will move out of stocks that have less pricing power versus competitors & stay with those that have moat/strong brand & capability to affect meaningful price increases & maintain their margin trajectory.

Our preferred Sectors/stocks

1. Capital goods / Economy facing sectors & Industry automation

- Current macro-economic scenario is conducive for a business cycle recovery backed by global and domestic policy response.

- India’s long awaited capex cycle is likely to restart. Government capex has already started improving, household capex (reflected through property buying) has reached decadal highs. Some green-shoots of private corporate capex is starting are selectively emerging in steel, renewable power, data centres through PLI schemes

- Theme can be played through Infrastructure, Industrial automation, Power renewables, New age technology, Real estate/home improvement, Cement, etc

Stocks we like:

L&T | ABB | TCI | Forbes & co | CG Power

2. Oil & Gas

- Oil is on boil. Globally Crude prices have moved up on supply related issues

- Gas prices are at all time high due to high demand as well as constrained supply

- Domestic pricing of these commodities is now market determined

- Recently APM price of gas increased by 62%

- Stocks are attractive on Dividend yield as well as valuation

- Avoid user industry & down stream companies. Play the theme through only upstream companies in production as well as exploration

Stocks we like:

ONGC | OIL | HOEC

3. Financials (Banks, NBFCs, intermediaries)

- Sector has been under performer for last several months due to apprehension on asset quality, but the banks have managed asset quality remarkably well

- Credit growth to pick up as the economy reopens

- India’s long awaited capex cycle to revive soon

- Resolution of many past insolvency cases will result in write back of provisions

- Most banks are well equipped to handle asset quality stress through adequate buffer in provisions

Stocks we like:

HDFC Bank | ICICI Bank | Axis Bank | Kotak Bank | Baja Finance | SBI

4. Others

Stocks we like:

Reliance | United Spirit | DLF | Brigade Enterprises | Sona BLW | Piramal Enterprises

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

Continue with Google

Continue with Google