Stockaxis monthly insights outlook for june 2021?

June 01, 2021

Glimpse of May 2021

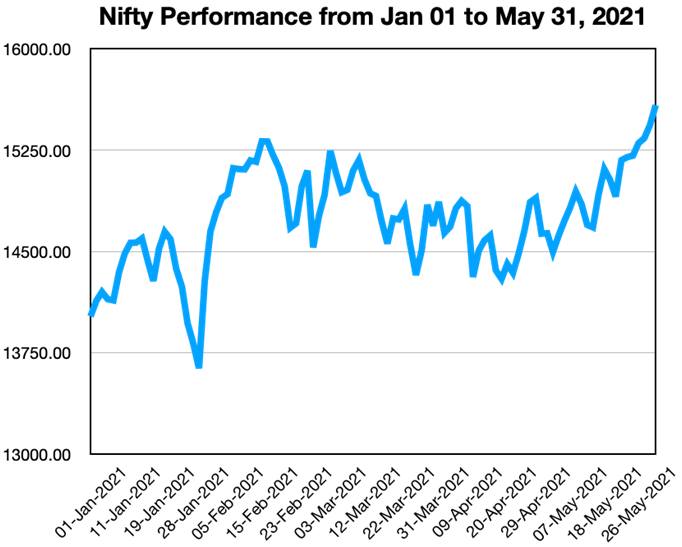

Amidst very high number of Covid-19 cases & struggling for first half of the month, Nifty managed to reach new all time high on the last day of May 2021

During the first half of the month, the market was range-bound as the concerns over restricted movement and the localized lockdowns were overwhelming. However, the overall market trend was constructive with mid & small caps continued out performance driven by specific company’s Q4FY21 results. During the second half of May 2021, as the number of incremental Covid-19 cases started declining, the markets gained strength. Nifty 50 scaled to a record high of 15582 on the last trading day thereby making new all time high.

Earnings season for Q4FY21 has been more or less in-line with estimates with no major disappointment till date. FMCG, Power, Oil & Gas sectors witnessed downgrades in earnings estimates for FY22E while metals continued to witness upgrades.

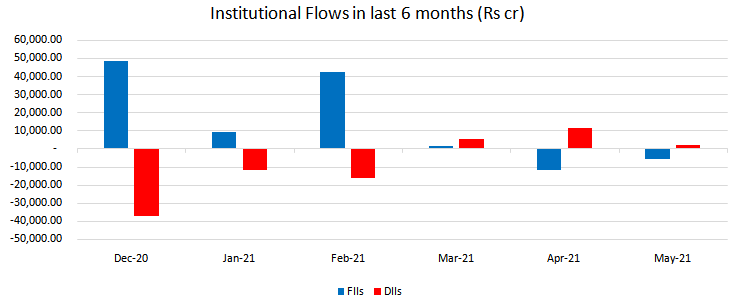

We note that during the month investors have inclined towards defensives & cyclical sectors. There was clear indications of rotation out of BFSI, Autos & Consumption related sectors since these are expected to be most negatively impacted by second Covid-19 wave.

Contrary to our expectations, till date there has been consensus upgrade of ~2% in Nifty EPS estimates for FY22E due to upgrade in metals is much more than downgrades in other sectors. We believe the market has not yet factored the full impact of second wave of Covid-19 in April & May 2021. In our opinion more clarity will emerge post Q1FY22E results due in July 2021 when consensus is likely to reduce Nifty EPS expectations for FY22E

Important considerations for June 2021

We believe we are not out of woods yet. In our view market has not yet factored full impact of demand destruction due to second wave of Covid 19. Most company managements in post results concalls have mentioned that they are not expecting V-shaped demand recovery as was seen after the first Covid 19 wave. On top of that input costs across all sectors have witnessed a huge increase (as reflected in shrinkage of gross margins of some large companies like Maruti, Hero Moto, Asian Paints etc). We believe the impact of twin pressures of decelerating revenue & accelerating input costs on corporate earnings will be visible in/after Q1FY22E results.

While reported Q4FY21 Indian GDP numbers were better than estimates but initial high frequency data for the month of April show steep decline in economic activity (as a fall out of Covid induced lockdowns. Example on month on month basis Steel & cement consumption has declined 23% & 15% respectively).

Going ahead, In our opinion, market is awaiting further decline in incremental numbers of second wave of Covid and full unlocking of economy. Any delay in unlocking the economy beyond June will be a key risk in the near term. Other risks may emanate from rising inflation concerns in India as well as US leading to reversal of benign/near Zero interest rate cycle of past many years & contraction in PE multiples of high growth companies.

Despite near-term challenges, the overall market structure continues to remain positive. We believe Sector rotation and the stock-specific approach will be keys for outperformance.

Metal sector has witnessed yet again upgrade in earnings post Q4FY21 earnings. Specially steel stocks have witnessed price increase led upgrades as well as benefits of deleveraging. Cement, Specialty chemicals, agrichemicals , IT & pharma are other sectors that are likely to remain out performers. Healthcare in particular is likely to remain buoyant on back of near term spurt in earnings from Covid related medications & vaccines.

We expect interest rate sensitive sectors like BFSI, Autos & other consumption related stocks to remain under pressure. Though we do not expect any rate increase by RBI till at least H2FY22E but commentary & language used by RBI in its policy statements will impact market sentiment/movement.

For the very short period of June there is a high possibility of market preferring re-opening trade via consumption stocks like home improvement items like tiles, paints, air conditioners & white goods, FMEG,/Cables/wires, luggage: Retail like apparels: Entrainment-multiplexes.

Outlook for June 2021

Market direction will depend on how quickly economy returns to pre-covid levels

- Till now reported results for Q4FY21 & full year FY21 are in-line with expectations but there have been downgrades in Auto/consumption stocks. However upgrades in metals stocks have made up for loss in other sectors, hence net impact on Nifty earnings is still upgrade of ~2%.

- Full impact of localized lockdowns & demand destruction due to second wave of Covid yet not factored

- Pace of Vaccination roll out (still not accelerated to the desired rate)

- High inflation expectations & any hint of reversal in RBI stance on monetary policy may lead to profit booking in high growth sectors.

- Expectation of some kind of stimulus package from government for specific sectors

- Continually rising crude prices is negative for import dependent countries like India

- Risk of declining support from global liquidity due to fears of high inflation/ high bond yields in US.

Portfolio Strategy For June 2021

What is our portfolio strategy for the month of June 2021

- We believe market performance in June will be driven by how fast unlocking of economy happens & how severe is the impact of second wave on corporate profits.

- We will continue to participate in those sectors where earnings visibility is high & risk to future earnings is low/minimal over next 2 years.

- Metals sector remains our top preferred sector with highest weightage in portfolio

- We remain invested in IT sector especially through mid cap stocks

- Economy facing sectors like cement & capital goods are likely to outperform as economy unlocks. We will participate in some stocks in this sector

- Reopening theme based stocks like multiplex, travel, home improvements may find space in our portfolios

Themes to play in June 2021

1. Re-opening trades

- With decline in number of Covid cases since mid May 2021, markets are awaiting unlocking of economy. Post the first wave of Covid economy reversed as a coil & witnessed steep increase. There are expectations this time too there would be huge pent up demand & economy would rebound like a spring.

- Globally wherever the economies have opened stocks related to reopening theme have given quick & sharp returns. Retailers in US such as Walmart, Home Depot, Target etc have shown remarkable growth of sales personal hygiene products like deodorant, teeth whiteners, face creams, shaving equipment, apparel, activewear, and travel accessories: Walmart saw luggage sales climb 400% last quarter & Target reported 60% increase in apparel sales driven by demand for swimwear and dresses.

- We can play the above theme in our markets through aviation stocks like Spicejet, Indigo, Travel/hotel related stocks like Thomas cook, Mahindra Holidays, Luggage stocks like VIP Inds, Safari, consumption items like United spirits, Radico Khaitan, United Breweries, Apparel plays like Raymond, ABFRL, home improvement items like tiles, paints, cables, white goods.

2. Expectation of stimulus from government

- Due to fears of large scale demand destruction in many sectors & wide impact on income levels of large population due to second wave, many economists are expecting government to come out with some stimulus plan to revive economy.

- Although Q4FY21 GDP numbers were better than expectation, macro economic condition after that (April & May) have deteriorated significantly. There have been major downgrades on expected GDP for FY22E. Thus we believe government is likely to provide some stimulus.

- Since too much of fiscal headroom is not available with the government, we expect sector specific schemes to be announced.

- Sectors like Hotels, Aviation. Travel may get some help

3. Healthcare & pharma driven by near term gains from Vaccination

- Pace of vaccination has been much lower than desired due to supply constraints & uneconomical pricing. However, with changes in pricing & distribution policy many vaccine makers have expedited efforts to produce large quantities of vaccine.

- India is vaccine factory for the world. There are many companies which have partnered with foreign entities to produce vaccine in India for India & global usage.

- We believe vaccine theme can be played for at least next 2-3 quarters till such time vast majority of Indian population is vaccinated.

- We can play this theme through Vaccine producers, vaccine distributors & vaccine administrators (hospitals)

- Pharma companies like Cadila, Dr Reddys, Gland pharma, Shilpa Medicare, Panacea biotech, Wockhardt are producing vaccines, Logistics provider Snowman, Hospital chains for administering vaccine like Apollo hospital, Max healthcare & Fortis,

4. Cyclicals especially steel & other metals to remain most preferred

- Despite regular negative comments by China on applying caps on steel prices & regulating iron ore the prices of steel & other metals continue to rise due to elevated demand

- Domestic steel have taken another price hike of between Rs 2500 to Rs 5000/ton in first week of June. Domestic steel prices are still lower than landed import prices.

- Other way to play metals theme is through investing in allied stocks like Iron Ore, Graphite, calcined Coke, manganese, alloys producers. Most players in the allied sector have increased production & increased or are on the verge of increasing prices

5. IT sector showed strong growth in Q4FY21 & likely to maintain that over next 2 years

- For last few quarters the sector has been showing strong earnings growth & likely to continue in future too. We expect this sector to continue robust growth on back of strong tailwind of digitization & work form home

6. Specialty Chemicals / Agro Chemicals / basic chemicals

- As per the projections of IMD India is likely to witness Normal monsoon for the 3rd consecutive time in FY22. This augurs well for agriculture sector in-turn good for agro chemical sector.

- The specialty chemicals has been a clear beneficiary of China plus 1 strategy of many multinationals in last many years. Many of Indian producers have expanded capacities & broaden their capabilities to cater to new demand from global players which is helping these companies in gaining scale & high margins.

- Many chemical companies have changed their working to cater to increased demand from pharmaceutical sector which helps them in moving up the value chain & provide sticky long term business.

- Many basic chemicals are witnessing increased spreads on back of strong demand by user industry resulting in increased pricing power for these manufacturers.

Our preferred Sectors / stocks

1. Metals (Steel, Aluminum, Zinc, Copper)

- Very strong pricing environment on back of high demand & favorable Chinese export policy

- Landed price of some imported commodities (Steel) is still higher than domestic price, implying scope of further increase in domestic prices

- Companies in the sector have used high realizations for de-leveraging. Company Balance sheets are now in much better shape

- All over the world most governments are focusing on economic revival which means demand for various commodities is likely to remain elevated

Metals - allied segments

- Iron ore, Graphite, Calcined Coke, various Alloys are allied sectors to steel, aluminum etc. Demand for these products is directly proportional to demand for metal, hence these companies are also witnessing high demand coupled with strong pricing power.

Stocks we like:

Tata Steel | JSW Steel | SAIL | JSPL | Hindalco | NMDC | Godawari Power | Graphite Inds | HEG | Rain Inds

2. Specialty Chemicals / Agro Chemicals / Basic Chemicals

- Beneficiary of China plus one policy

- Strong proven execution capabilities by Indian companies

- Strong relationships with global major chemical giants

- Few companies in the sector have potential to increase their size multi fold

Stocks we like:

Atul | Astec | Supreme Petrochem | Hikal

3. IT - both large cap as well as mid cap

- Sector continues to deliver strong earnings growth

- Visibility of high earnings in next couple of years through all time high deal wins

- Many new areas of action opening up which will be revenue driver for the companies

- High margins maintained despite wage hikes due to savings on SGA & travel costs

- User base expanding as every one realize need of IT for Work from Home

Stocks we like:

Intellect Design | KPIT | HCL Tech | Wipro | Mastek | Route Mobile

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

Continue with Google

Continue with Google