Stockaxis monthly insights outlook for december 2022

December 01, 2022

Glimpse of November ‘22

Global positive sentiment rub-off & sharp rebound rally in Dow/Nasdaq kept out performance of Indian markets intact in November’22

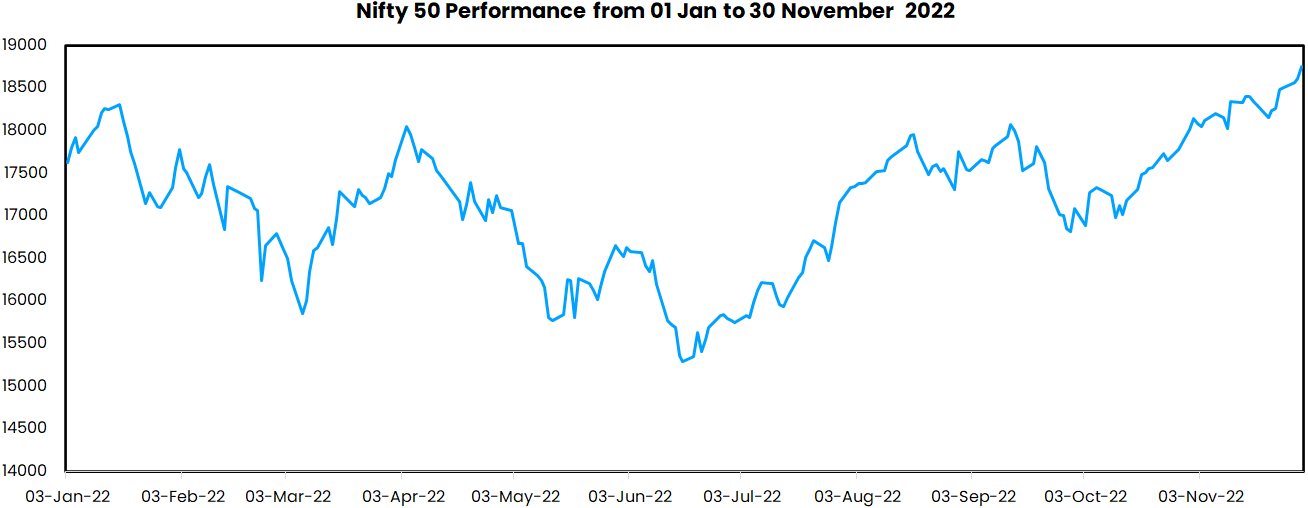

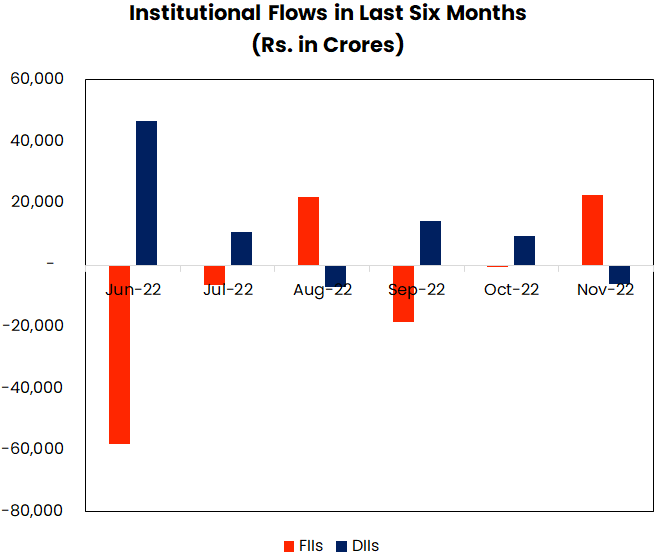

Nifty returned ~3.4% during the month of November 2022 following a strong rebound of ~6.7% in October 2022 backed by favourable macros like expectations of slower pace of rate hikes by USFED, fall in prices of oil & international commodities, & large scale purchases by FIIs & sustained domestic SIP inflows.

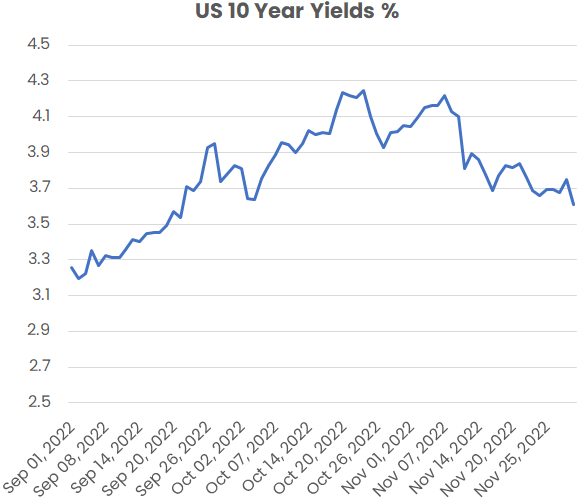

Headline inflation number in US turned out to be lower than expectation for the fourth consecutive month. For the month of October’22 the reported data was at 7.7%, decisively lower than 8% handle in last many months. Lower inflation lead to market expectations that USFED will now have NO reason to remain as hawkish as it was earlier & the pace of rate hikes will now slow down to 50 bps after 3 consecutive rate hikes of 75 bps each between June to September‘22. Although FED speak remained hawkish as many FED governors continued to echo concerns on high inflation, the markets chose to ignore those hawkish bites & Dow as well as Nasdaq rebounded sharply from September’22 lows.

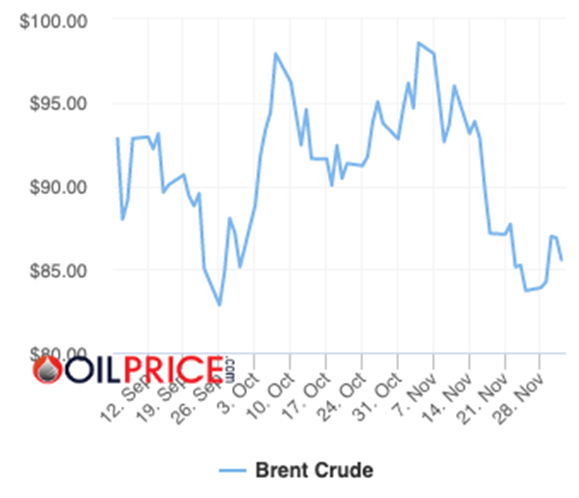

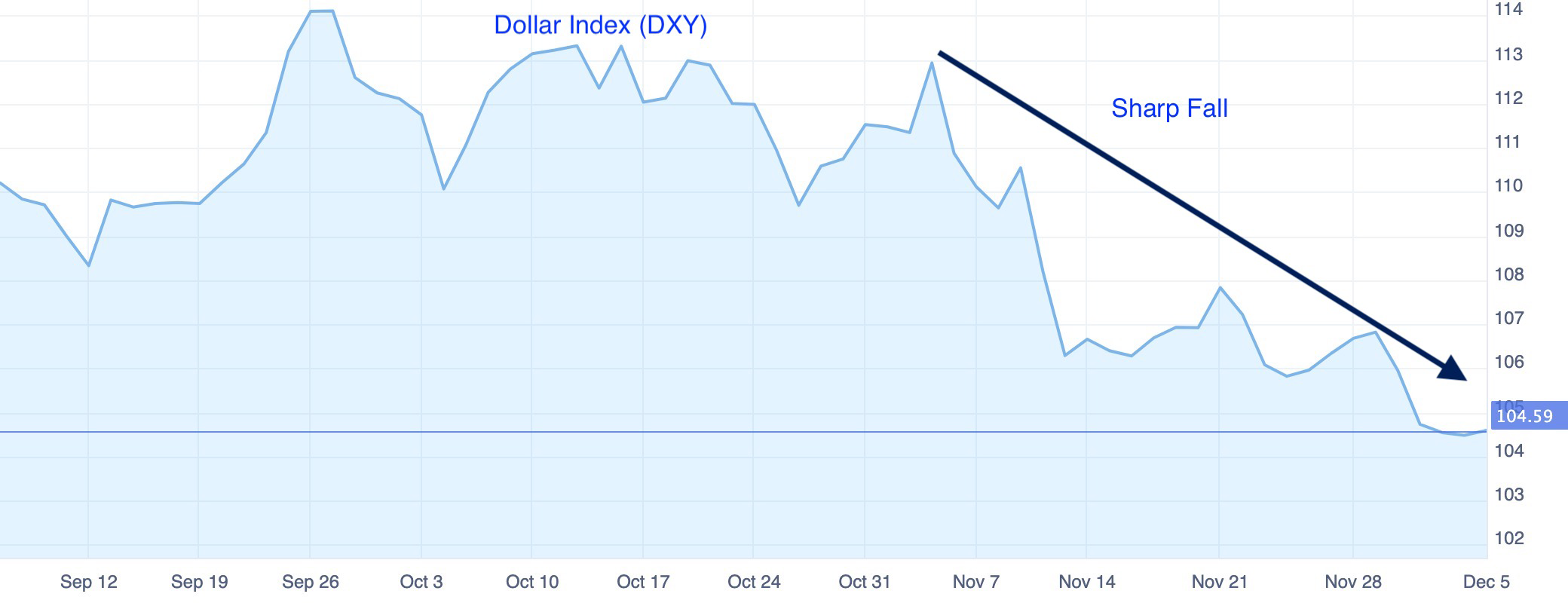

Due to lower rate hike execrations US treasury yields turned downwards sharply & Dollar Index also reversed its trajectory from as high as 114 levels in August to as low as ~105 in November ’22. In the last 3 months Crude Oil prices kept on fluctuating wildly in the range of ~$100/bbl to finally settle in range of ~$85/bbl.

Global risk-on rally, benign crude prices & lower Dollar aided Indian markets to show strong momentum during the period from September to November making our markets probably the best performing markets in the world. Since June lows of Nifty at 15183 to 18758 (as on 30 Nov 2022) Nifty has returned ~24%.

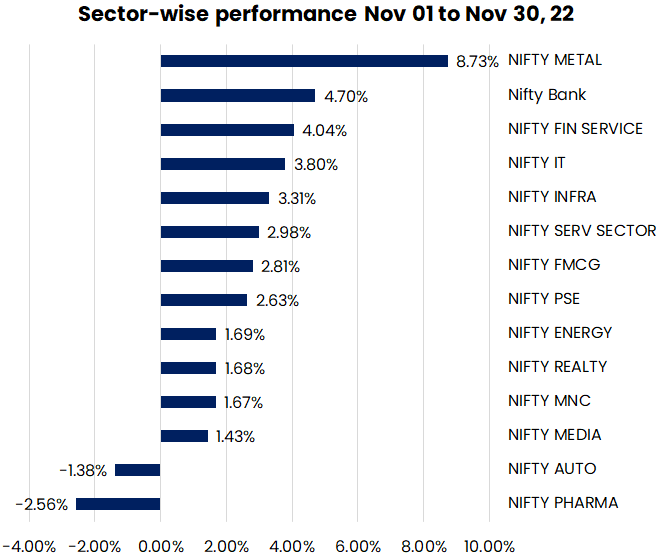

Since the entire November rally was on back of global cues, external facing sectors like metals & IT showed remarkable up move. Banks & financial services, Infra also participated in rally. Pharma & autos were two major laggards for the month. However Mid & Small cap broadly did not show the similar strong up moves. The rally remained confined to some frontline large/mega caps & public sector enterprises. Nifty Midcap 100 returned only ~1% & the Nifty Small Cap 100 gave returns of ~2..8% in November month.

| November August 2022 Monthly Returns % | January to November 2022 (YTD) Returns % | |

|---|---|---|

| Nifty 50 | 3.38% | 6.43% |

| Nifty Midcap 100 | 1.05% | 4.06% |

| Nifty Small Cap 100 | 2.76% | -12.63% |

| Nifty Bank | 4.70% | 18.70% |

Key considerations for December 2022

- US FED action in meeting on Dec 13-14

- Cooling off in various commodities (both agri & non agri) may result in pull back of margins for many sectors like Cement, Steel, FMCG

- RBI’s action on rates in India. As of now market expectation is 35-50 bps hike in Dec 05-07 meeting

- Pre budget discussions will lead to rumours/expectations especially in regards to taxation as well as specific sector wise relaxations like Railways/fertilizer/defence etc

- Q3FY23 results will be due in mid-Jan 23. Markets will start factoring improvement or deterioration in quarterly numbers for various sectors.

- We expect sectors like cement, steel, power have seen worst of input costs impact in Q2FY23 & likely to see sharp bounce back in their margins

- Similarly in FMCG sector where many inputs like edible oils, packaging costs etc have come off by 30-40% may see significant improvement in margins in Q3FY23, although volume growth may still be lack lustre here

- Usually market trends do not change towards the end of year. History suggests market trends continues in the same direction in which it is prior to December month. Since we are in uptrend since September’22 onwards, we expect this sentiment to continue in December too

Important event to watch for in December 2022

- USFED FOMC meeting on December 13-14. Market expectations are 50 bps increase in interest rates & less hawkish commentary about terminal FED fund rate.

Our take: if the outcome of meeting is as above, US markets may continue their up move. However if the rate increase quantum is more than 50 bps or commentary is not according to expectations because labour market conditions are still not in favour of any loosening of FED policy, then current risk on rally may come in danger. - RBI policy meeting on Dec 05-07 on interest rates trajectory in India. Market expectation is 35-50 bps increase in this policy & indications about pause in further rate hikes at least for FY23.

Our Take: We believe inflation in India is well under control, although above RBI’s mandated threshold, but as commodity & crude prices come off, gradually inflation will fall into desired trajectory. Concern on depreciation of Rupee have also eased a lot post huge decline in Dollar index. Hence RBI may not be as hawkish as its global counterparts are. However issue of high Current account deficit will remain a cause of worry & a key consideration for RBI while taking decision

Our portfolio strategy, overall market view & expectations from various sectors

- After a prolong year of consolidation we expect broader markets to start participating in equity rallies Large & mega caps have already shown strong moves in bringing headline indices back to previous highs.

- Amidst all the global challenges India has remained an island of hope & resilience. Till now our markets have been rank out performer mainly because many of the issues that plague the world at this time, either do not impact us or impact much lesser. In fact some of the global disturbances are creating opportunities for India . For example global supply chain disruptions in China due to their Zero Covid policy has made India a preferred destination for China +1 theme. Similarly high energy costs in Europe is making many conglomerates there to look for alternate destinations for outsourcing manufacturing.

- Although valuations of our markets are at elevated levels both in absolute terms as well as relative to many global markets but we believe barring front liners & mega or large caps there are pockets of market where valuation is still reasonable. We highlight that valuations of Indian stocks have always been at a premium to many of its peers in MSCI index or Emerging markets, however India has always been a stock pickers paradise. Therefore returns in Indian markets are more driven by CHOICE of stock/sector

- We remain positive on sectors/themes like Autos/Auto ancillaries, Banks/Financial Services, Real Estate/Cement, Capital goods/Infrastructure, Chemicals, Metals, Telecom & Oil/Gas where the earnings visibility is reasonable &/or valuations are comfortable

- We continue to keep IT & Pharma sectors under watch

Sectors we like

1. Autos & Auto Ancillaries

- Sales volumes have picked up & are surprising on positive side

- lower commodity cost benefit s & increased prices of vehicles is now showing in numbers

- After 2018 sector is witnessing revival in demand

- Issues related to supply chain disruptions, chip shortages are behind

Our preferred picks:

Eicher | Maruti | Sona BLW | Uno Minda | Lumax Autotech

2. Banking / Financials / NBFC

- Many Banks/NBFCs have reported rising credit demand during Q2FY23 backed by pick-up in consumption demand, especially in retail and SME segments.

- Most bankers, in their post-results commentary, remain optimistic on future credit demand, healthy monsoon along with the rise in government spending could continue to support overall demand

- Margins remained stable sequentially due to lower cost of funds and an elevated share of floating rate loans.

- Asset quality trend continued to improve, resulting in lower provisioning Post Covid-19 pandemic, India’s financial system is at the best of asset quality cycle coupled with sufficient buffer provision

- Public sector banks have shown remarkable improvement in asset quality and growth. It appears most of the cleaning up of books in PSB is over after last 7-8 years of rigorous efforts. Market seems to be rewarding them for past effort & expects asset quality will not falter from here.

- Except SBI we have NOT added any public sector bank in our portfolio till now. We will wait for some more time to see sustainability of this asset quality & growth.

- We are apprehensive of large scale fund raise by public sector banks because in last many years these banks have been supported by government through capital infusions which may not be the case going forward. In our view that can be dilutive & detrimental to minority shareholders.

Our preferred picks:

HDFC Bank | ICICI bank | Kotak Bank | SBI | Muthoot Fin

3. Real Estate & Cement

- Housing demand continues to be strong and inventory overhang has receded significantly

- After a month lull in October, property registrations in top cities are back with Mumbai recording highest ever numbers.

- Demand for high end luxury real estate is intact (DLF commentary very strong).

- Builders & developers have taken reasonable calibrated price hikes which is sufficient to take care of escalation in input costs.

- We believe worst for Cement sector is behind. Power & fuel costs for them have come off significantly & realizations have started inching up,

- We expect Cement producers to show significant improvement in margins & profitability in Q3FY23

In near term we prefer Cement stocks over Real estate

Our preferred picks:

Dalmia Bharat | Shree Cement | Ultratech | DLF

4. Capital Goods / Infrastructure

- Conditions for private sector capex remains conducive given the low corporate leverage, rising capacity utilization, broad based improvement in profitability and robust balance sheet of banking sector.

- The sustained improvement in corporate credit ratings and banks’ improved lending growth will aid corporate capex

- PLI scheme (Production Linked incentive) in various sectors will support caoex

- While Government continues to remain tight fisted on spending till now, we expect this situation to change since CY23 will be year of several state elections & CY24 will be general elections. Hence government may want to showcase its achievements & provide impetus to many stalled or slow moving projects in penultimate year of elections

- Indian Railways has been promising huge amount of capex although much of it is still only in papers. However we expect some of it to see light of the day

- Creating capabilities for self-dependence in defence is also another area where government intends to spend a lot of amount which will create opportunities for companies in this space

- There will be lot of opportunities for companies in this sector that will help other companies be more smart like better energy efficiency, smart buildings, power management, reduce gas emissions, modernization & automation,

Our preferred picks:

L&T | Elecon Engineering | Bosch | ABB | Siemen | Hitachi | Honeywell Automation | Schaeffler India | Timken | SKF

5. Chemicals Sector

- Europe plus 1: High energy prices in Europe leading to curtailed production or closure of various facilities which in turn would mean Indian producers with available capacities & lower costs of production will gain market share.

- China plus 1: Continued supply disruptions from China due to their Zero Covid policy is compelling clients to look for alternatives. India fits into that very well

- PLI schemes for intermediates/API & other chemicals to boost availability of these products for international supplies

- Most chemical companies are going for expansion or diversifying into new molecules to add value to their existing portfolio of products.

- Overall margins to be maintained by better product mix and higher value addition

- Integrated producers(who can use output from one step as input for another) will be at significant advantage

- Product pipeline for CSM/CDMO players remain very strong. Future growth to be aided by launch /development of molecules & scale up in existing ones

Our preferred picks:

Vinati Organics | Hikal | PI Inds | Astec | Aether | Jubilant Ingrevia

6. Metals

- With expectations of China re-opening there can be a spurt in demand for various metals

- Worst of high power/fuel & raw material costs is behind

- Realizations have started inching up

- Restrictions on export have subsided (government has revoked export duty on steel/ore etc)

- Cool off in dollar index is positive for metals

- Post the Ukraine-Russia conflict, the need for building capabilities & physical assets in home country is taking precedence. Almost all countries are looking to invest heavily in physical assets to reduce dependence on other countries for supply chains. This shall result in sustained demand for metals

Our preferred picks:

Tata Steel | JSW Steel | JSPL

7. Telecom

- After many months of consolidation & gradual tariff hikes telecom players have seen significant improvement in their earnings

- Last year government announced slew of measures to support the sector. Combined effect of government support & disciplined approach of industry has started yielding results. For consecutive quarters we are witnessing improvement in ARPUs & other metrices of the sector

- Competitive intensity seems to have abated a bit

- 5G launch is picking up in various regions. Benefits of 5G on ARPUs is yet to play out

Our preferred picks:

Bharti Airtel | Reliance

8. Oil & Gas

- Global diesel will remain in short supply for the next three to four years as capacity addition will lag demand.

- Given the diesel shortage and high production cost in Europe, diesel cracks are likely to remain high

- Indian refiners are mainly diesel producers.

- Government has been taking rational decisions on windfall tax for the sector. Regular revisions have been taking place. We expect soon this tax may be totally revoked

- Government has implied its comfort with net realization of $75/bbl for oil producers

- Gas pricing has been favourable for the upstream companies

Our preferred picks:

Reliance | ONGC | OIL | IOC | HOEC

Sectors under watch

Information technology

- Although deal pipeline commentary has been encouraging post Q2FY23 results but LTM (long term) order book growth moderated qoq

- Q2FY23 saw a sharp decline in margins. Q-o-Q growth in topline decelerated significantly

- While sector tailwinds may be largely behind as pressure from manpower side is easing, concerns over sustained topline growth are intact

- Impact of impending recession & FED induced growth slowdown is still NOT known

- While sector valuations have come off very significantly to the extent of multiples reverting to 10 year/5 year averages post P/E derating, in some cases they are still higher than historical multiples especially in times of uncertainty on topline itself

- We believe sector will probably become attractive for investment in next few months as most of the negatives/ macro headwinds get priced in & some clarity on impending US recession or growth slowdown emerges. We keep sector under watch for next few months

Stocks we like:

Infosys

Pharma

- US generics business performance remained muted across companies in Q2FY23 amidst continued pricing pressure

- We expect an improvement in the generic pricing scenario in the US market in coming quarters as lot of vendor consolidation has been done. Most participants have also rationalized their product portfolios to manage balance between growth & profitability

- Major CDMO companies witnessed a decline in growth and profitability as the benefits of the Covid pandemic receded. These companies benefited significantly from the heightened demand for certain APIs, injectables and Covid-specific products during the pandemic.

- We believe inventory rationalization especially with regard to API/Bulk drugs manufacturers is now complete & price escalations due to higher input costs have stabilized

- We expect API/Bulk drugs & speciality chemicals/intermediates producers should show better performance in coming quarters

- We believe sector will become attractive for investment in next few quarters as the base effect goes away & investor expectations will be realistic/rational

Stocks we like:

Gland Pharma | Alembic Pharma | Divis Lab | Granules

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

Continue with Google

Continue with Google