Stockaxis monthly insights outlook for december 2021

December 01, 2021

Glimpse of November 2021

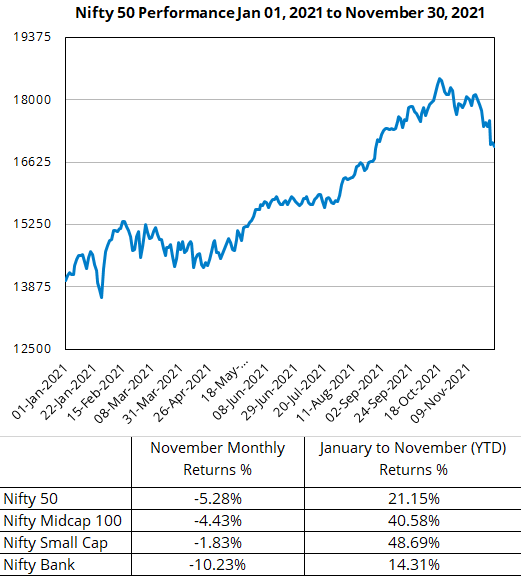

Slide in Nifty (started in October) accentuated in November leading to ~1000 points fall in Nifty from the peak

Post the FED’s decision to start tapering from November, all round selling has been witnessed in global equity markets. In the initial part of the month, the Indian markets, tried to shrug off some concerns & made several attempts to recover. However, relentless selling by FIIs did not allow Nifty to regain its previous month’s peak. All pullback attempts were thwarted.

Towards the third week of the month, the news about new variant of Covid (Omicron) put the nail in coffin & Nifty hit its lowest point of the month at 16782 , a fall of about 1000 points from its peak of 18604 achieved on 19 October 21. USFED Chair’s comments on persistency in inflation & likelihood of increase in pace of tapering from December added further to the negative sentiment of the markets.

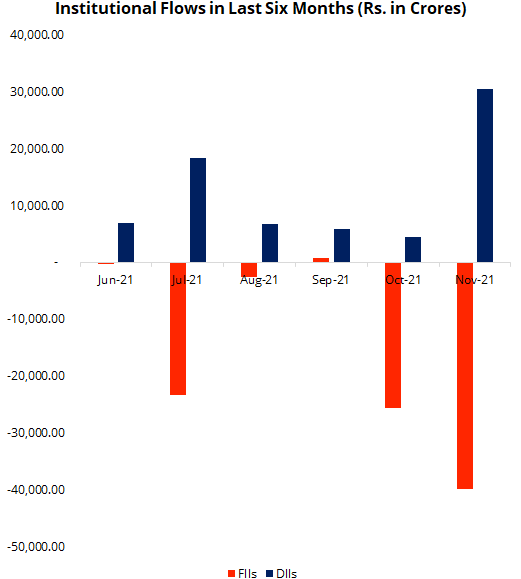

During November 2021, FIIs sold equites worth ~Rs 39900 cr in cash segment. Although DIIs tried to counter this heavy selling by buying equities worth ~Rs 30560 cr, but it was not enough to stop the sharp sell off in overall markets.

On domestic front, after a long spree of successful IPO listings, Paytm listing disappointed significantly with the stock clocking almost 40% decline from its IPO offer price in just 3 trading sessions. To some investors, this revived the memories of high flying listing of Reliance Power IPO in 2008 & the steep fall immediately after that listing.

Overall for the month of November, Nifty ended on negative note with loss of 5.28%. Nifty Midcap 100 closed the month at a loss of 4.43% while Nifty SmallCap recorded loss of 1.83% in the same period. Bank Nifty recorded steep fall of 10,23% in the month.

Except IT all other sectors ended in red. Banks & Metals were most negatively impacted.

While the market welcomed sequential recovery in key high-frequency indicators such as monthly GST collection, the market volatility increased substantially to above 20-25 levels. Volatility indicators are hinting that market is indecisive at this juncture. Perhaps market is waiting for clarity from Central banks across the globe (specially USFED) on their policy stance on growth v/s inflation.

Source: NSE Website

Source: Moneycontrol

Important considerations for December 2021

Central banks grappling with dilemma on Growth or Inflation

Heightened volatility in markets is hinting indecisive phase where markets are looking for clarity from Central Banks on policy stance in the changed macro environment. Many economies had just started recovering from Covid shock & grappling with high inflation. Age old dilemma of Central banks to choose between Growth & inflation is rearing its head high.

Since last few months there has been dichotomy between USFED thinking on inflation & interest rates trajectory over next couple of years & the market expectations from policy makers. Most market participants/ economists have been airing their view that USFED is behind the curve on attacking inflation & it (FED) was following too loose a monetary policy.

Till recently USFED has been maintaining that inflation was a temporary issue which will sort out on its own in few months & the conditions for interest rate changes are far away.

Post the announcement regarding new Covid variant – Omicron, concerns on disruption in supply chain have aggravated. There is a possibility of lockdowns or travel restrictions in various parts of the world which may further strain the already stretched global supply chain effectively implying that inflation may further rise &/or remain sticky for much longer than earlier expected.

USFED has now changed its stance on inflation & has dropped the word temporary implying that it expects inflation to be persistent. The FED has also hinted at increasing the pace of tapering program which again is implying rate change cycle to begin much earlier than previously expected timeline of end CY22.

This transition from loose monetary policy to tight monetary policy & its impact on fragile economic revival is creating nervousness amongst the market participants. As of now it is not clear weather the Central banks will choose growth over inflation or vice versa.

We believe markets will take some direction/cues for further movement from USFED’s next meeting due in middle of December. Till then, we expect immense volatility in the markets across the globe. Since most Central banks across the major economies follow USFED, all other markets (including India) will take cues from US action.

On Domestic cues, we do not see any significant change in fundamentals. Q2FY22 Corporate earnings were in line despite showing steep decline in gross margins due to high input costs. Overall, still the consensus has increased FY22 EPS post Q2FY22 results. We will monitor Q3FY22 earnings to check impact of price increases taken by many of them & if any downgrade is likely in consensus Nifty EPS for next 2 years

We expect RBI to continue to give precedence to growth over inflation & the economy will continue to revive, supported by Govt’s focus on capital expenditure, supportive monetary and fiscal measures and buoyant demand

Outlook for December 2021

Central Bank’s change in policy stance will lead to immense volatility

Incremental cases of new Covid variant-Omicron will also be a key monitorable

- After following extremely loose monetary policy for a very long time, most central banks are now inclined to revert to policy normalization

- Pace of normalization will determine market direction

- Usually, markets are most volatile at times of transition

- Markets are awaiting Central bank’s choice between Growth & inflation

- News flow on incremental cases & severity of Omicron will be key monitorable over the month

- Commentary by corporates on price increases & its impact on demand will determine potential upgrade/downgrade to FY22E & FY23E Nifty 50 EPS

- We expect investors to reduce positions in sectors/stocks that were trading at very high PE/PB or other valuation multiples

- We believe market performance in December will be driven by news flow related to policy stance of USFED in its upcoming meeting on 14-15 December & incremental number of cases / severity of new Covid variant Omicron

- We will decrease exposure to markets & stay light in times of high volatility

- We will try to lock-in profits wherever possible

- We strictly avoid averaging down stocks. Even if an existing stock in the portfolio has corrected significantly, we will not buy it immediately. We will take a fresh look at it & if it qualifies all our buying parameters at this time (under changed circumstances), we will recommend it to add or top up

- We will look for reducing exposure to Chemicals (specialty/agro), metals, FMCG, IT, & those sectors where multiple expansion theme has played out & there is likelihood of retardation in earnings growth

- Although we would like to stay cautious & light this month, we may look for opportunities in our preferred sectors like industrial automation, new age technology (EV etc), infrastructure, power, real estate, oil/gas etc.

Our preferred Sectors / stocks

1. Capital goods / Economy facing sectors & Industry automation

- Current macro-economic scenario is conducive for a business cycle recovery backed by global and domestic policy response.

- India’s long awaited capex cycle is likely to restart. Government capex has already started improving, household capex (reflected through property buying) has reached decadal highs. Some green-shoots of private corporate capex is starting are selectively emerging in steel, renewable power, data centres through PLI schemes

- Theme can be played through Infrastructure, Industrial automation, Power renewables, New age technology, Real estate/home improvement, Cement, etc

Stocks we like:

L&T | ABB | TCI | Forbes & co | CG Power

2. Oil & Gas

- Oil is on boil. Globally Crude prices have moved up on supply related issues

- Gas prices are at all time high due to high demand as well as constrained supply

- Domestic pricing of these commodities is now market determined

- Recently APM price of gas increased by 62%

- Stocks are attractive on Dividend yield as well as valuation

- Avoid user industry & down stream companies. Play the theme through only upstream companies in production as well as exploration

Stocks we like:

ONGC | OIL | HOEC

3. Financials (Banks, NBFCs, intermediaries)

- Sector has been under performer for last several months due to apprehension on asset quality, but the banks have managed asset quality remarkably well

- Credit growth to pick up as the economy reopens

- India’s long awaited capex cycle to revive soon

- Resolution of many past insolvency cases will result in write back of provisions

- Most banks are well equipped to handle asset quality stress through adequate buffer in provisions

Stocks we like:

HDFC Bank | ICICI Bank | Axis Bank | Kotak Bank | Baja Finance | SBI

4. Others

Stocks we like:

Reliance | United Spirit | DLF | Brigade Enterprises | Sona BLW | Piramal Enterprises

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

Continue with Google

Continue with Google