Stockaxis monthly insights outlook for april 2022

April 01, 2022

Glimpse of March 2022

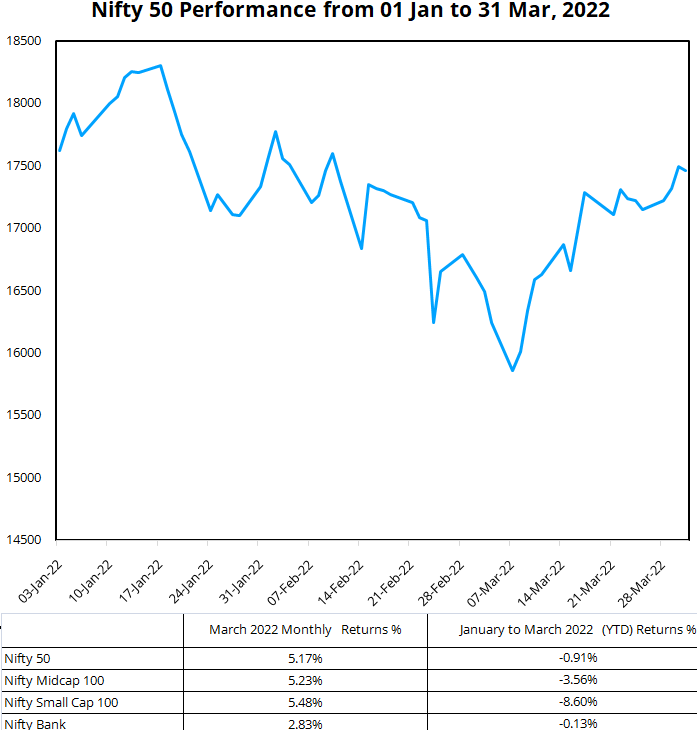

After 2 months of fall in CY22, Indian Equity markets gave positive returns in March 22 on hopes of some resolution of Russia-Ukraine crisis & benign USFED action

Due to global concerns since the start of the year most equity markets across the globe were under pressure. The escalation of Russia-Ukraine tussle towards the last week of FEB 22 made markets jittery all over the world. The tussle between the two also highlighted the vulnerability of European region in terms of energy supplies. Entire Europe witnessed extremely large increases in energy prices as an outcome of Russian oil/gas going out of market & ensuing sanctions on Russia for global trade. Crude oil prices went as high as 139 USD per barrel & natural gas prices increased by more than 40% for most European nations. In an environment of fragile economic recovery post the Pandemic, such high energy prices & supply side disruptions lead to substantial cut in expected growth in European region. Many other commodities like Aluminum , wheat, some edible oils etc also witnessed huge jump in prices on concerns of supply. However, in the middle of the month there were some reports that both sides were willing to solve issues through negotiations, Such hopes resulted in equity markets across the globe to rally as it was assumed the disturbance due to war may be short lived. Although later these hopes were belied.

Other factor which supported equities world over was the fact that USFED did not go aggressive on increasing interest rates amidst the turmoil in Ukraine. Before the FED meeting expectations were 50 bps hike in rates along with son=me plan to shrink FED balance sheet. However, the FED chose to go with first step of only increasing 25 bps & no announcement on reducing balance sheet. Temporarily for few days FED’s benign action aided equities in rally up. Indian equity markets too performed in line with global markets. All the headline indices such as Nifty 50, Nifty Midcap 100 & Nifty Small cap 100 increased by about 5% while Nifty Bank under performed with gains of just 2.8%. Sectors such as IT, metals, Oil & gas, realty, healthcare & FMCG all contributed on positive side while auto sector gave negative returns & BFSI was flat.

During the month as days passed the hopes of Ukraine issue getting settled wanned away & the talks that USFED is “behind the curve” in tackling inflation in US resulted in lot of volatility. News of Covid -19 resurgence in China leading to localized shut-downs in China also weighed on investors minds. However, unintended repercussion of China lockdown was reduced demand for crude & other commodities leading to a sharp cool-off in Crude prices (down from USD 139 to less than USD 100 /bbl).

Source: NSE Website

Source: Moneycontrol

Important considerations for April 2022

Important considerations for April 2022- Global as well as domestic inflation, Q4FY22/FY22 Earnings season

Global inflation

Inflation, has been persistent since many months in the US. From earlier expectation of a transitory inflation, the scenario has changed drastically. Supply side disruptions due to Covid & Russia-Ukraine tussle have only aggravated instead of receding. Consequently, US is witnessing about 40-year high inflation number . Since last 3 months every consecutive month has shown a higher inflation number thereby belying the expectation that US is near the peak inflation.

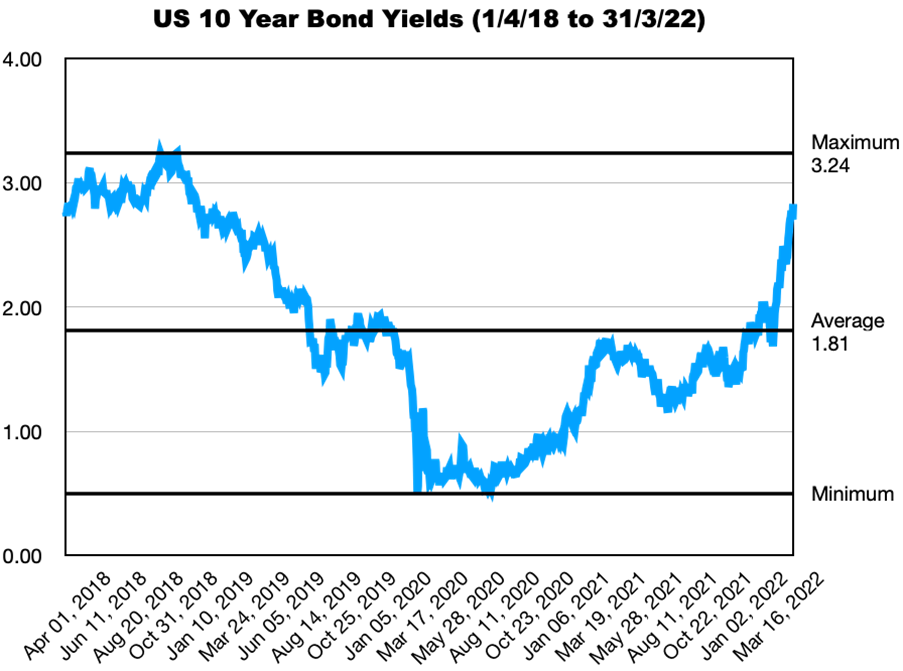

Despite much higher than target inflation rate of 2% the USFED has increased interest rates by just 25 bps in its March 15, 2022, meeting. The market participants believe this pace & quantum of rate hike is not sufficient to control 8.4 % inflation, hence markets believe Fed will have to increase the rates much higher & much faster than earlier anticipated. This is reflected in 10-year yields which have been consistently going up. Infact, short tenure yields have increased at much sharper pace leading to yield curve inversion.

Fears of recession in US

Usually yield curve inversion indicates impending recession. In the past every instance whenever inverted yield curve appeared, recession followed. However, the time gap between yield curve inversion & recession has varied between few months to couple of years.

High Global inflation & Fears of Recession in US

Source: investing.com

High Dollar Index - negative for emerging markets

Source: Yahoo Finance

While many economists & FED members are vocal about an impending recession in US, we believe it is too early to call out recession in US as of now. Nonetheless, in view of such high pitch calls on recession, the Fed will be forced to be seen as doing something & therefore it may become very aggressive on rate hikes.

In our view, US equity markets are currently factoring in multiple 50 bps hike in interest rates & $95 bn reduction in FED balance sheet. Many believe pace & size of reduction in balance sheet should also be increased even if it at the cost of near term growth.

Net effect of expected FED actions would be squeeze in liquidity & increase in cost of capital which is negative for equities as a whole & growth stocks in particular.

We believe markets are keenly waiting for FED’s decision in its next meeting scheduled for mid May 22

Domestic Inflation & RBI action

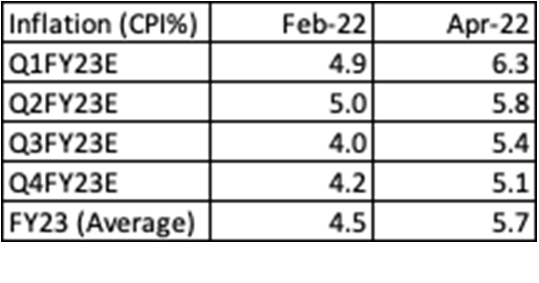

India's central bank (RBI) has been most dovish in last few months. In fact, amidst rising inflation throughout the world RBI reduced its inflation projections for FY23 in its last meeting in FEB 22.

However, post that meeting macro-economic conditions have only worsened- crude has gone up from $75-80 range to $100-110 (highest $140) & other commodity prices have also increased substantially. Inflation in India has been rising since last 3 months, but expectation was that it will cool-off in later part of the year due to seasonal effects. However, escalated geo-political tensions impacted negatively. The latest inflation data for March 22 shows inflation at 6.95% much above RBI’s comfort zone.

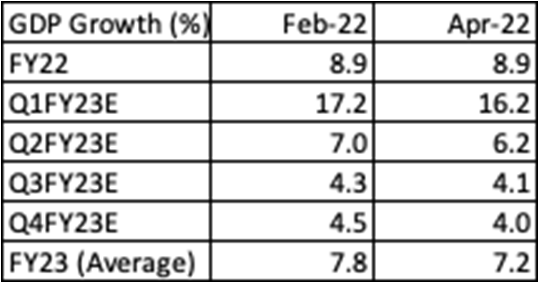

In its latest policy announcement on April 8., 2022, RBI has increased inflation projection for FY23 from earlier 4.5% to 5.7% & decreased the GDP growth projection from 7.8% to 7.2% for FY23.

Source: MoSPI First estimates & RBI

Source: RBI

Most of the economists are projecting inflation in India is likely to remain above RBI’s mandated target range of 6% for next many months. While RBI has not increased rates in April policy, we believe they will have to increase them in future policies. Hence, we expect cost of funds in India will go up (in our opinion at least 100 bps increase in cost of fund is possible).

Although RBI has clarified the liquidity withdrawal will be over “multi years” period and RBI will ensure adequate liquidity, it is clear that days of easy & abundant liquidity in India are over.

Impact of higher coast of funds & lesser liquidity is normally negative on equities

Earnings season for Q4FY22 & Full year FY22: Subdued performance at broader level hidden under performance of few sectors

We believe Q4FY22E & FY22E earnings to be announced from Mid April onwards will be key monitorable. Since last 2 quarters Indian corporates have been facing challenging situation on higher input costs (raw material as well as logistics). Many of them have taken regular price hikes to mitigate pressure on margins. However, in Q3FY22, we noted that most companies reported significant decline in EBITDA margins although top line was maintained despite taking price hikes. One explanation for this could be that entire benefit of price hikes may take some time. Hence in Q4FY22E market is expecting to see the impact of price increases on margins. If the top line is well maintained & margins come back then markets will cheer the corporate performance however in case the margin pressure persist then we can expect downgrade in projected earnings.

We are not expecting too many downgrades on headline indices due to the construct of indices NOT due to better corporate performance. At index level impact of lower earnings of consumption related sectors (like autos, consumer durables, FMCG) specialty chemicals, etc is offset by better earnings by Banks, metals, oil/gas & IT etc. The breadth of earnings is likely to be weak with the companies outside the index showing major decline in margins/profitability, as they are much more impacted negatively by increase in cost.

Overall FY22 Nifty EPS Is supported mainly by metals & oil/gas while dragged by Auto & Cement sectors.

Source: Consol EPS from various Brokerage reports,

Outlook for April 2022

What we expect in April 2022

We believe Indian markets performance will continue to be influenced by

- Escalation /Outcome of Russia-Ukraine war

- Global inflation

- US FED rate hike pace and quantum

- Crude oil prices

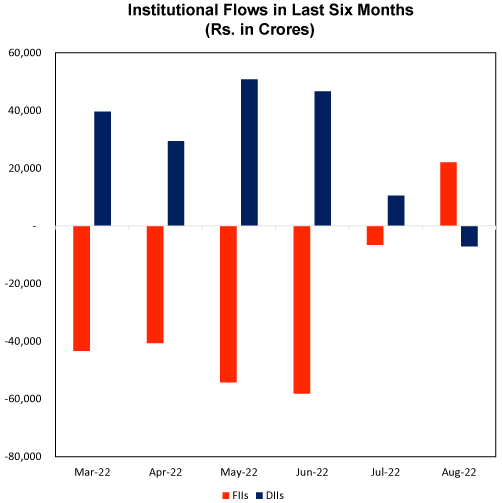

- FII inflows (impact of dollar index which is close to historic high levels)

- Indian Corporate Earnings for Q4FY22 & Full year FY22

- Rising Input costs & company’s ability to pass-on those will determine profitability

- Interest rates/cost of funds is likely to go up in future, hence growth-oriented stocks are likely to under perform

- High global inflation will negatively impact growth in US & Europe which in turn will determine capability of corporates in those countries to outsource services/goods from India. Hence outbound sector (export oriented) may remain under pressure due to uncertain demand scenario.

- We do not expect major downgrade in EPS for Nifty50 for FY23E/FY24E due to construct of index. Improvement in profitability of certain ectors may offset loss in some other. However, margin pain will be significant in broader markets (stocks outside index)

Portfolio Strategy For April 2022

What is our portfolio strategy for the month of April 2022 & view on some sectors

- We believe the markets are now in transition phase where EPS growth is more important than expansion in PE multiple, we would like to participate in those sectors where earnings visibility is high for next 2 years. Sectors/stocks which are trading at very high PE multiples will take a back seat. Our portfolios will be aligned accordingly.

- Economy facing sectors like cement, real estate/construction, infrastructure are likely to show high growth in earnings over next 2 years despite near term challenges on profit due to higher input costs & expected higher cost of funds. We remain positive on all these sectors.

- In view of elevated prices of crude & gas we are positive on upstream companies in Oil & Gas sector. Gas prices have increased substantially in last 1 year which will drive earnings of these companies. These companies are attractive on valuations & dividend yield parameters too.

- Since last 3 consecutive quarters Banks have been showing strong improvement in asset quality as well growth (both private as well as public). However, the sector has been a rank underperformer till now. We expect the sector to catch up in coming months.

- After several months of lack lustre performance, Pharma and healthcare is likely to show good performance. Companies focussed on India domestic formulation business &/or targeting niche injectable/biosimilar/complex generics in US are likely to deliver good performance. The companies in this sector which have taken large scale capex & awaiting USFDA approvals for new facilities may deliver very high returns. We have added a couple of names in our portfolios.

- Power sector has not performed for last more than a decade. Government has made several changes in policy which is helping the sector to come out of this long hibernation. Renewables is attracting lot of foreign & PE investment. We have added some of the companies from this sector into our portfolios.

- We expect IT sector to show pressure on margins due to high wages & return of travel related costs thereby margins in sector may be under pressure. Therefore, we have reduced exposure to IT in last few months although our view for long term remains constructive.

- Metals companies are likely to show high growth in topline aided by exports although profitability margin may be lower than previous quarters. We believe story of de-leveraging in metals is already played out. In fact, now companies have started talking of further capex so re-rating of sector is behind. Therefore, we have exited the sector in last few months. From hereon we believe incremental upside in metal stocks will be on basis of prices of underlying which is always highly volatile.

- Auto sector has been going through challenging times since last many months. All that could go wrong has gone wrong with the sector. As the economy reopens, we expect the demand to pick up. There are already signs of pickup in some subsegments. Similarly, the issues on supply of chips are also receding which will lead to normal production schedules. In last few months the companies have been able to pass-on increase in input costs without impacting demand in any meaningful manner. Valuation wise stocks are at attractive levels. The sector can be played as CONTRA play as of now.

Our preferred Sectors/stocks

1. Cement / Construction / real estate

- Demand for real estate strong. Record number of registrations happening especially in residential. Commercial is also coming back

- Demand visible across categories-luxury, mid & affordable housing

- Established developers are able to take price hikes without denting demand

- Balance sheets of companies in sector are much leaner & stronger now

- Cement companies have taken price hikes to mitigate rising input costs

- Cycle turning favorable.

- Strong demand on back of pick up in real estate & infra projects

- Strong order flow, visibility of revenue & earnings for next 2 years

- Many investors still under invested in these sectors

Stocks we like:

DLF | Brigade | L&T | Shree Cement | ACC | Ambuja | Ultratech | DalmiaBharat

2. Capital Goods / Industrials / Automation

- Current macro-economic scenario is conducive for a business cycle recovery backed by global and domestic policy response.

- India’s long awaited capex cycle is likely to restart. Government capex has already started improving, household capex (reflected through property buying) has reached decadal highs. Some green-shoots of private corporate capex is starting are selectively emerging in steel, renewable power, data centres through PLI schemes

- Focus of government on increasing share of manufacturing in GDP & Atmanirbhar

- Huge demand expected from industry out of automation/technological upgradation/Industry 4.0 etc

Stocks we like:

ABB | Hitachi Energy | Siemens

3. Oil & gas

- Oil is on boil. Globally Crude prices have moved up on supply related issues

- Gas prices are at all time high due to high demand as well as constrained supply

- Domestic pricing of these commodities is now market determined

- Recently APM price of gas increased by 50% after 62% increase in Oct 21

- Stocks are attractive on Dividend yield as well as valuation

- Avoid user industry & down stream companies. Play the theme through only upstream companies in production as well as exploration

Stocks we like:

ONGC | OIL | HOEC

4. Financials (Banks, NBFCs, intermediaries)

- Strong performance by large banks, sounded confident of gaining market share

- Stress amongst borrowers turned out to be much lesser than earlier anticipated

- Most large banks maintain adequate buffer in provisions in case asset quality stress deepens

- Sector has been laggard despite significant improvement in operational performance of many constituents, headroom for catchup with performance of rest of the market

Stocks we like:

Chola Invst & Finance | ICICI Bank HDFC Bank | Kotak Bank | Baja Finance | Muthoot

5. Pharmaceuticals

- Domestic pharma companies likely to show good Q4FY22 on back of growth in both chronic & acute segments

- Opportunities in companies focusing on niche injectable/biosimilar/complex generics in US

- Opportunities in companies which have undertaken large capex for setting up new facilities for US & awaiting USFDA approvals

Stocks we like:

Gland Pharma | Alembic Pharma | Divis

6. Power

- Beneficiary of several changes made in policy by the government

- Many PE & Foreign investors interested in investing in environment friendly Renewables space

- Many reforms initiated to improve health of Discoms which will lead to better financials for power generating & distribution & transmission companies

- Immense scope for increasing demand aided by low per capita consumption

- Highly under owned sector as it was a laggard for last more than 14-15 years

Stocks we like:

Tata Power | NTPC

7. Others / Miscellaneous

Stocks we like:

Reliance | Bharti Airtel | Dmart | Lemon Tree Hotels | Zee Entertainment | Balrampur Chini

Disclaimer: Stocks mentioned anywhere in this report are for illustration purpose only. These are not recommendation to buy. Any call to buy is given separately through regular means of communications.

Continue with Google

Continue with Google