Should You Worry About The Corona Virus Impact On Your Investments?

17106 Views | March 03, 2020

The news of the Corona virus (Covid-19) appears to have shaken the markets with the BSE Sensex recording a 4% single day drop. Every media publication has been upping the fear of the virus and its impact on the global economy and domestic economies of countries. The numbers too appear to be worrisome with about 80,000 cases and over 2,600 reported deaths so far.

There is, so far, no cure for this virus and the number of countries where the virus has travelled to, is rising. In this situation, we understand that investors are fearful and are looking to reduce their exposure to the markets with some even looking to exit. However, should you do so? Or does it make more sense to be patient and avoid making hasty decisions that you may regret later?

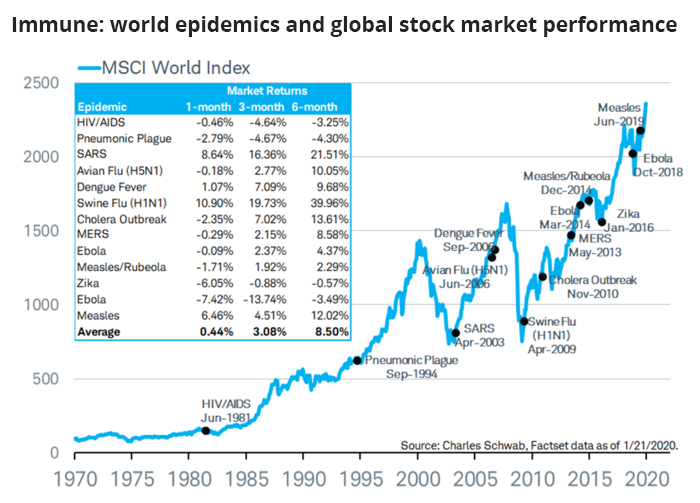

Let’s consider the Covid-19 virus. Is this the first time in the history of mankind that such a virus has resulted in this kind of panic? The answer is – no. We have faced numerous such health challenges including the Ebola and SARS viruses. In fact, the Swine flu pandemic (global epidemic) that took place during the year 2009-10 had a greater impact that the present Covid-19. Nearly 1 billion people, about 20% of the global population, were infected and nearly 3 lakh people died of the infection.

In fact, when the Swine flu struck, the global economy was fragile with both investor and consumer confidence being low. However, going forward, the markets saw the longest bull market in a century. Clearly, such health scares result in greater negative psychology than warranted.

Here is another surprising aspect of the Corona virus. While the number of infected persons is high, the death rate is marginal. In fact, as per the Centers for Disease Control (CDC), the Covid-19 death rate is lower than the death rate of the common flu.

There could be those who might rightly state that during the SARS outbreak, the Chinese economy had a smaller share of the global economy and hence, the SARS virus had a lower impact on world markets. However, with China now forming about 1/6th of the world market, being the world’s manufacturing hub, and the Covid-19 impacting China the most, the overall impact will be greater. While there is a near-certainty of the virus impacting global markets in the short term, there is also a high probability of a vaccine/cure being released over the next six months, which will arrest the spread of Covid-19. In any case, history has proven that such health outbreaks do not impact the long term trend of economic expansion.

The markets have seen scarier headlines and breaking news such as the military strikes on Iran, US-China trade war and so on, which have seen stock traders sell in panic. However, these incidents have not had a long term impact on the markets. We expect a similar situation with Covid-19.

Our advice to investors is to stay invested for the long term and avoid making hasty decisions based on media headlines. In fact, now is the time to look for quality stocks of companies run by top-rung management with great prospects.

Continue with Google

Continue with Google