Markets in march 2017: Movers & shakers of the month

April 10, 2017

|

At the start of every month, we collect and publish the top news that affected Indian equity markets the month before, to help our readers be in touch with the overall market conditions and thereby make smarter and informed investment decisions. Continuing our trend of our exclusive monthly newsletter, we again bring to you, all movers and shakers for the last month of FY2017. Hope you find the newsletter insightful and have a good time reading it. Sit back, and enjoy:

Automobile Sales

The Supreme Court of India, at the end of March 2017, announced a ban on the sale and registration of vehicles which are complaint with BS-III emission norms, from the start of the very next month. This led to a frenzy of discounts from automakers as well as the dealers, who were looking forward to clearing their huge ~800,000 BS-III inventory. The result – there was a huge surge in the people rushing towards showrooms and standing in queues to get their vehicles at a pleasing 30-50% discount, which eventually helped the stakeholders clear a major chunk of their inventories. But this can be said to have an impact on the next month’s sales numbers, especially the two-wheeler section, as pre-buying happened in the last two days owing to high discounts.

The month witnessed some handsome growth in numbers for automakers like Toyota India, Escorts, Ford India and Royal Enfield. Ford and Royal Enfield continued on their merry runs, whereas India’s second-largest automaker Bajaj Auto reported a disappointing -10.99% drop in the number of units it sold. Have a look at the numbers:

| Company Name | Mar 2017 Sales | Mar 2016 Sales | Growth% |

|---|---|---|---|

| Toyota India | 14,432 | 9,007 | 60.23% |

| Escorts | 7,079 | 5,403 | 31.02% |

| Ford India | 24,832 | 21,198 | 17.14% |

| Royal Enfield | 60,113 | 51,320 | 17.13% |

| Ashok Leyland | 18,682 | 16,702 | 11.85% |

| TVS Motor | 256,341 | 232,517 | 10.25% |

| Hyundai | 55,614 | 51,452 | 8.09% |

| Maruti Suzuki | 139,763 | 129,345 | 8.05% |

| Tata Motors | 57,145 | 53,057 | 7.70% |

| M&M | 56,031 | 52,718 | 6.28% |

| Hero MotoCorp | 609,951 | 606,542 | 0.56% |

| Renault India | 12,188 | 12,424 | -1.90% |

| Bajaj Auto | 272,197 | 305,800 | -10.99% |

FII/FPI Inflow At 15-Year High, Overall DII Inflow Steady

After finally becoming net buyers last month, post 4 straight months of being the opposite, FIIs/FPIs were on a roll in March 2017. The net investments made by FIIs in Indian stocks in March 2017 alone exceeded that in the entire CY2016, on the back of BJP’s resounding win in the UP. That win, complemented by a clear growth mandate and a to-be-rolled-out GST later this year proved to be the kingmakers. DIIs too did not shy away from the party. Have a look at the last four months’ data:

| FII/FPI Inflows (Rs. Cr) | Mar 17 | Feb 17 | Jan 17 | Dec 16 |

|---|---|---|---|---|

| Equity | 30906 | 9902 | -1177 | -8176 |

| Debt | 25355 | 5960 | -2319 | -18935 |

| Total | 56261 | 15862 | -3496 | -3496 |

| DII Inflows (Rs. Cr) | Mar 17 | Feb 17 | Jan 17 | Dec 16 |

|---|---|---|---|---|

| Equity | 2367.60 | 1855.00 | 6185.40 | 8032.80 |

| Debt | 40085.10 | 38627.10 | 35770.70 | 23995.50 |

| Total | 42452.70 | 40482.10 | 41956.10 | 32028.30 |

Nifty P/E, P/B & Dividend Yield

With a lot of investors comparing this market scenario to that of the 2008 saga, one should keep in mind that the Nifty50 was trading at a P/E of around 28.25 during January 2008, which is 23.26 as of March 2017 end. Basically, Nifty50 P/E ratio is broadly used to identify how cheap or expensive the index is.

(Formula: sum of all market capitalizations/sum of consolidated earnings).

Applying the same analogy as above, P/B ratio of an index is the weighted average P/B ratio of all the stocks covered by the index, Nifty50 in our case. (Formula: closing level of the Nifty50/latest quarters’ book value per share (average of all companies))

Like the above two ratios, it is basically the weighted average dividend yield of all the Nifty50 companies.

Have a look at the numbers for the last 4 months:

| End of Month | P/E | P/B | Div. Yield |

|---|---|---|---|

| Dec 2016 | 21.93 | 3.10 | 1.35 |

| Jan 2017 | 22.86 | 3.25 | 1.29 |

| Feb 2017 | 23.13 | 3.37 | 1.25 |

| Mar 2017 | 23.26 | 3.50 | 1.25 |

(For more on this topic, please click here)

Indian Services & Manufacturing Activity Continues Expansion

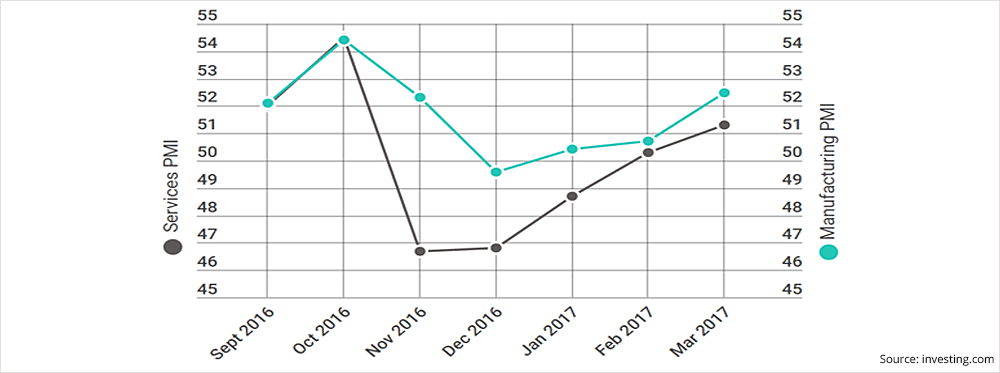

The India Nikkei Services Purchasing Managers’ Index (PMI) rose to 51.5 in the month of March 2017 as against 50.3 in February 2017, thereby continuing on its path for expansion, since three straight months of contraction, from October 2016. On the other hand, the India Nikkei Markit Manufacturing Purchasing Managers Index (PMI), with levels of 52.5, sustained growth for the third straight month from its value of 50.7 in February 2017 and 50.4 in January 2017. Notably, a reading above 50 denotes an expansion in business activity while one below 50 implies a contraction.

Have a look at the historical data:

Performance of domestic airlines for January 2017

As per the statistics released by Directorate General of Civil Aviation, Government of India (DGCA) in mid March for the month of February, the total number of passengers carried during the February 2017 stood at 86.40 lakhs, compared to 74.76 lakhs during the same month previous year, thereby registering a growth of 15.57% Y-o-Y. The figures for March 2017 are awaited.

Market Performance & Concluding Thoughts

Nifty50 continued on its merry path for the third straight month, giving 3.12% positive monthly returns for last month of FY2017. Overall, in FY2017, the Nifty50 index value has swelled by a phenomenal 18.55%. This overall rally primarily gained legs in the last quarter of the financial year, with FIIs on a buying spree, after a quite couple of quarters. Have a look at the performances of Nifty50, S&P BSE Mid-Cap and S&P BSE Small Cap for the month of February 2017:

| Index | Performance in Feb 2017 | Performance in FY2017 |

|---|---|---|

| Nifty50 | (+)3.12% | (+)18.55% |

| S&P BSE Mid-Cap | (+)4.01% | (+)32.75% |

| S&P BSE Small Cap | (+)5.43% | (+)36.92% |

Now, after some impressive and heavy buying from the institutionals, which led to the recent rally in the market, the quarterly earnings season will now be the next point of focus. Post witnessing a liquidity driven rally, investors on the street now look forward to the Q4FY17 earnings numbers, which are expected to be relatively better than Q3FY17 numbers. You, as a long term investor, should not get over-cautious by the current Nifty50 levels, but, like always, should focus on the earnings and quality of the businesses. Remember, there are always buyable businesses of great operational models available in the market, irrespective of the market levels. Make sure you don’t miss out on them. Happy Investing!

Continue with Google

Continue with Google