Markets In February 2017 : Movers & Shakers Of The Month

March 07, 2017

|

At the start of every month, we collect and publish the top news that affected Indian equity markets the month before, to help our readers be in touch with the overall market conditions and thereby make smarter and informed investment decisions. Continuing our trend of our exclusive monthly newsletter, we again bring to you, all movers and shakers for the second month of CY2017. Hope you find the newsletter insightful and have a good time reading it. Sit back, and enjoy:

Good Corporate Earnings

As of 28th February 2017, all 50 companies that form the benchmark Nifty50 index had declared their Q3FY17 results.

Total combined revenue of the 50 companies stood at Rs. 798099 crores as against Rs. 735027 crores in the same period last year, thereby registering a pleasing rise of 8.58%. Following a similar trend, in fact comprehensively outperforming it, the combined PAT during Q3FY17 was Rs. 71827 crores as against Rs. 61222 crores in Q3FY16 showing a robust 17.32% Y-o-Y growth.

Automobile Sales

Continuing on the path of recovery post demonetization, after a happy January 2016, auto makers reported a modest increase in their numbers in February 2017, from that in 2016 last year. The month also witnessed the launch of quite a few cars from the leaders in the market. Also, the Union Budget again declared no major announcements for the automobile industry.

Non-Indian brands like Ford and Renault continue strengthening their bases in the country, whereas the leading car-maker Maruti Suzuki reported a pleasing 10.92% growth in number of units sold. Have a look at the numbers:

| Company Name | Feb 2017 Sales | Feb 2016 Sales | Growth% |

|---|---|---|---|

| Ford India | 24026 | 17306 | 38.83% |

| Escorts | 4247 | 3280 | 29.48% |

| Renault India | 11198 | 8834 | 26.76% |

| Royal Enfield | 58439 | 49156 | 18.88% |

| Maruti Suzuki | 130280 | 117451 | 10.92% |

| Toyota India | 12113 | 11215 | 8.01% |

| Hyundai | 52734 | 49729 | 6.04% |

| Ashok Leyland | 14067 | 13406 | 4.93% |

| Tata Motors | 47573 | 46674 | 1.93% |

| Bajaj Auto | 273513 | 272719 | 0.299% |

| M&M | 42714 | 44002 | -2.93% |

| TVS Motor | 211470 | 219467 | -3.64% |

| Hero MotoCorp | 524766 | 550992 | -4.76% |

FII/FPI Finally Net Buyers, DII Inflow Marginally Reduces

After 4 straight months of being in the red, FIIs/FPIs were back with a bang, thereby making a handsome comeback in terms of buying Indian securities. DIIs too continued their buying spree; in fact, the last time they were net sellers was back in May 2016. Have a look at the last four months’ data:

| FII/FPI Inflows (Rs. Cr) | February-17 | January-17 | December-16 | November-16 |

|---|---|---|---|---|

| Equity | 9902 | -1177 | -8176 | -18244 |

| Debt | 5960 | -2319 | -18935 | -21152 |

| Total | 15862 | -3496 | -27111 | -39396 |

| DII Inflows (Rs. Cr) | February-17 | January-17 | December-16 | November-16 |

|---|---|---|---|---|

| Equity | 1855 | 6185.4 | 8032.8 | 13610.4 |

| Debt | 38627.1 | 35770.7 | 23995.5 | 11498.1 |

| Total | 40482.1 | 41956.1 | 32028.3 | 25108.5 |

TCS Announces Buy-Back Of Shares

India’s largest listed company in terms of market capitalization, Tata Consultancy Services Ltd. (TCS), last month announced India’s biggest buyback offer till date, worth almost Rs. 16000 crores (5.61 crore equity shares at Rs. 2850 per share, accounting to a 2.85% of the total equity share capital). It surpassed Reliance Industries Ltd.’s 2012 share buyback offer of Rs. 10400 crores. Notably, TCS has more than Rs. 38000 crores of cash sitting idle in its balance sheets. This comes at a time when the Indian IT industry is showing signs of slowdown, which is due to a combination of technological and business-model shifts. The question on the cards is, will other IT behemoths follow the trend? One can only wait to see.

RBI Doesn’t Cut Repo Rates

The Reserve Bank of India (RBI), in its sixth bi-monthly policy statement for the year, again decided to go against the rate cut, still waiting for clarity on the impact of demonetization and inflation trends. The monetary policy committee has also changed its policy stance to "neutral" from "accommodative", which signals that RBI could go for a prolonged pause on further cuts. With a neutral stance, the RBI projects inflation to be in the range of 4%-4.5% in H1FY18 and 4.5%-5% in H2FY18. It also pegs a 7.4% economic growth in FY18, as against 6.9% for FY17.

Nifty P/E, P/B & Dividend Yield

The ratio which measures the average PE ratio of the Nifty 50 companies, continued showed signs of growth, thereby indicating the positive earnings which are well received by the investors in the market. Basically, Nifty50 P/E ratio is broadly used to identify how cheap or expensive the index is. (Formula: sum of all market capitalizations/sum of consolidated earnings).

Applying the same analogy as above, P/B ratio of an index is the weighted average P/B ratio of all the stocks covered by the index, Nifty50 in our case. (Formula: closing level of the Nifty50/latest quarters’ book value per share (average of all companies))

Like the above two ratios, it is basically the weighted average dividend yield of all the Nifty50 companies.

| End of Month | P/E | P/B | Div. Yield |

|---|---|---|---|

| November 2016 | 21.61 | 3.12 | 1.34 |

| December 2016 | 21.93 | 3.10 | 1.35 |

| January 2017 | 22.86 | 3.25 | 1.29 |

| February 2017 | 23.13 | 3.37 | 1.25 |

(For more on this topic, please click here)

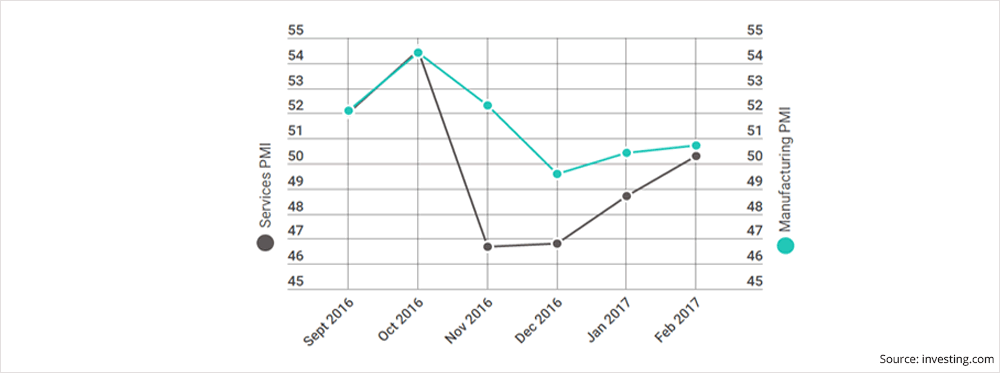

Indian Services Activity Finally Expands, Manufacturing Activity Grows Again

The India Nikkei Services Purchasing Managers’ Index (PMI) rose to 50.3 in the month of February 2017 as against 48.7 in January 2017, thereby denoting expansion for the first time since October 2016. This was after three straight months of contraction. Notably, a reading above 50 denotes an expansion in business activity while one below 50 implies a contraction. On the other hand, the India Nikkei Markit Manufacturing Purchasing Managers Index (PMI) with levels of 50.7, sustained growth for the second straight month from its value of 50.4 in January 2017. Have a look at the historical data:

Overall indicators suggest that Asia's third-largest economy is convincingly back on its track to growth after the demonetization episode, as Indian manufacturers benefited from recovering demand and raised production volumes. However, growth rates are still well below-par, with many areas yet to develop.

Performance Of Domestic Airlines For January 2017

As per the statistics released by Directorate General of Civil Aviation, Government of India (DGCA) in mid February for the month of January, the total number of passengers carried during the January 2017 stood at 95.79 lakhs, compared to 76.55 lakhs during the same month previous year, thereby registering a growth of 25.13% Y-o-Y. The figures for February 2017 are awaited.

Budget 2017

Markets have no doubt cheered the Budget 2017. It had a bit for almost everyone. The biggest positive, especially for the markets was no long term capital gains tax for equities. To know more about the highlights, click here.

Market Performance & Concluding Thoughts

Nifty50, after giving a robust 4.59% positive monthly returns for first month of CY2017, has continued on its momentum, thereby given investors another sturdy 3.72% return in February 2017. This was primarily due to the thumbs-up given to the Budget 2017, complemented by better than expected Q3FY17 results and an overall improvement in global economic conditions. Have a look at the performances of Nifty50, S&P BSE Mid-Cap and S&P BSE Small Cap for the month of February 2017:

| Index | Performance in February 2017 |

|---|---|

| Nifty50 | (+)3.72% |

| S&P BSE Mid-Cap | (+)5.84% |

| S&P BSE Small Cap | (+)5.40% |

After a disappointing CY2016, the market is now satisfactorily on its merry run from the past two months, with the broader Nifty50 index gaining 8.48% in just 2 months time. Most of the index’s companies too reported better than expected Q3FY17 results, which was complemented by a consumer friendly Budget 2017 that played the kingmaker.

Also, apart from the upcoming Federal Reserve meeting in the mid-March 2017 (during which the Fed is expected to further raise interest rates, after raising it only for the second time in a decade in its December 2016 meet, which will most probably result in a selloff in emerging markets), there is no visible event that can possibly dampen current market sentiment. But, like we have always been advising our clients, such events should be looked forward to as opportunities to BUY quality businesses at bargain valuations, when the entire market is them selling in panic, and then make the most of the almost obvious comeback rally. Hence, make sure you don’t miss out on them. Happy Investing!

Continue with Google

Continue with Google