How Market Sentiments Can Affect Your Investments

16266 Views | April 11, 2020

“History provides a crucial insight regarding market crises: they are inevitable, painful and ultimately surmountable.”

-Shelby M.C. Davis

There is a famous saying in Dalal street, ‘The markets run on three things - The fundamentals, The technicals & Investor sentiments’. Although the former two factors can be explained by mainly logic and statistics, the same cannot be said for the latter. It is difficult to understand and predict the market sentiment, if not impossible. It relies mostly on Investor psychology, emotions & their risk perception. It cannot be measured in definitive tools or formulas. However, it is way too important to be ignored. Its relevance in the markets is undoubtedly significant. It is oftentimes, the difference between extraordinary gains & heavy losses. It is also the difference between skilled investors and investors who usually lose major opportunities.

If one closely observes the investment style & strategies of the greatest investors of all times, he will clearly discover that they all possess one golden trait - Understanding of the market sentiments.

One of the most popular quotes by Warren Buffet - “Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” clearly implies that an investor’s perception with regards to risk and market dynamics plays a vital role in the art of investing. It also indicates that most investors lack the discipline and are often driven by their emotions, rather than logic. It is quintessential to stay objective & calm while investing in equities.

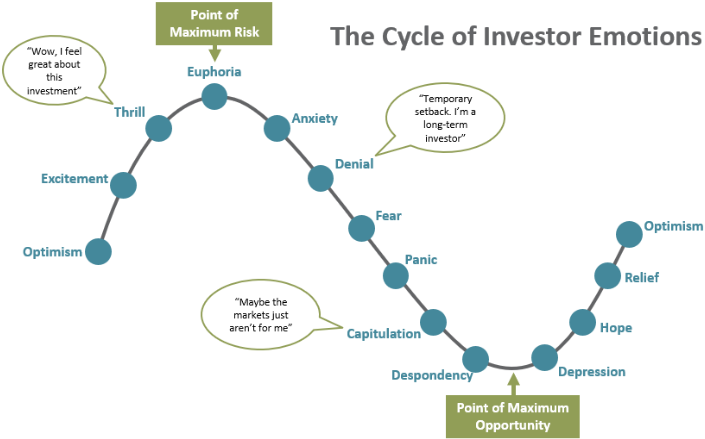

Generally, Investors are more confident when the market reaches higher levels. This phase is also defined as Euphoria. Euphoria is preceded by excitement & thrill. Usually, equity portfolios are trading in green at this point. Investors feel great about their investments. But what an average investor fails to realise is that this is in actuality a ‘point of maximum financial risk.’ Although his risk perception is low, this is the point when the actual risk is high. A skilled investor understands that there is a significant gap between perceived risk & actual risk. Hence he is always fearful in this situation when others are being greedy.

Similarly, When the markets are trading at lower levels, investors display low confidence, often watching the news with their friends wherein the anchors are panicking over the drop in market levels and questioning whether it is a sign of recession, failing to realise that the general media focuses more on the ‘impact’ aspect of news reporting rather than the ‘fact’ aspect. It is easy to get swayed by such noise. Even experienced investors can start doubting their decisions when they are bombarded with such skepticism. It is simply human psychology. When things are fantastic we feel nothing can stop us. And we look to take drastic actions when things are going bad. Since emotions can be such a threat to the financial health of an investor, it's important to be aware of them.

This very awareness can protect you against the negative effects of impulsive and irrational reactions to these emotions.

In actuality, when the markets are trading at the lowest levels, the actual risk is considerably lower, despite the fact that the perceived risk is higher. This point is also known as the ‘point of maximum opportunity’. Ironically, this also happens to be the point when the majority of the average investors have exited their positions by booking losses. A skilled investor intends to capitalise on this gap between perceived risk and actual risk. He starts investing in quality businesses available at opportune valuations. In other words, he is greedy when others are fearful.

As of this moment, amid the COVID-19 contagion, we are witnessing a classic point of maximum opportunity. The downfall which the Indian equity market has witnessed recently has been a direct result of fear and panic, among other pessimistic investor emotions. Many popular proficient investors such as Warren Buffet, Peter Lynch, Benjamin Graham, Sir John Templeton etc actually welcome bear markets, as they truly believe it to be the time to make more money. More importantly, they not only realise, but also practice the art of incorporating ultimate discipline in their investments by not giving in to their emotions and constantly capitalize on the gap between investor perception and actuality.

stockaxis encourages retail investors to base their investments on hard facts rather than sentimentality and truly believes that with constant commitment, each and every investor can turn into a skilled and successful investor. We sincerely hope that your portfolio remains healthy along with you and your families during this contagion. Happy Investing!

Continue with Google

Continue with Google