Fundamental Analysis in the Modern Era: Is It Enough?

February 26, 2025

|

Fundamental Analysis in the Modern Era: Is It Enough?

February 26, 2025

|The Problem with Relying Solely on Fundamentals

One of the biggest misconceptions in stock market investing is that fundamental analysis is the only reliable way to assess stocks. While fundamental analysis is important for evaluating well-established companies, it has limitations that investors must recognize. There exists a segment of the market where traditional metrics like price-to-earnings (P/E) ratios, intrinsic value calculations, and earnings reports provide little insight. These are stocks with high growth potential, sometimes without current earnings, which can generate good returns despite being fundamentally "weak."

For example, Kaynes Technology India Ltd., a company operating in the electronics manufacturing services sector, has seen rapid growth despite being in an aggressive expansion phase with fluctuating profitability. Similarly, Power Mech Projects Ltd., which specializes in infrastructure and engineering services, has demonstrated significant growth potential even when traditional earnings-based valuations might not justify it.

Additionally, company like, Zomato (NSE: ZOMATO), a leading food delivery company in India, had little to no profits for years but continued growing due to its aggressive expansion and market dominance.

The Competitive Nature of the Market

Stock investing is not just about analysing numbers; it is about understanding market psychology and competition. Every stock trade involves a buyer and a seller, meaning you need an edge over others to be successful. Relying purely on fundamental analysis makes you part of the herd—analysing the same data, reading the same reports, and drawing the same conclusions as countless other investors. This leaves little room for gaining a true advantage.

Consider Trent Ltd., which has been a high-growth retail stock, defying traditional valuation norms due to its strong brand positioning and expansion plans. Investors who understood the company's long-term strategy benefited, while those who relied solely on traditional fundamentals might have hesitated.

Similarly, Elecon Engineering Company Ltd., a leading player in industrial gears and material handling equipment, has expanded aggressively, offered high growth potential despite conventional valuation concerns.

Growth Stocks and the "No Earnings" Dilemma

One of the primary limitations of fundamental analysis is its focus on earnings. Many high-growth companies reinvest all their earnings into expansion, product development, and customer acquisition. This results in little to no profits in the short term, making them unattractive to fundamental investors who seek steady earnings and dividends.

For example, Newgen Software Technologies Ltd. has focused on scaling its business and investing in technology rather than maximizing short-term earnings. Investors who recognized its long-term potential have been rewarded.

Similarly, Global Health Ltd., which operates hospitals under the Medanta brand, has aggressively expanded its healthcare infrastructure, making it a strong growth play despite lower immediate profitability.

The Risk-Reward Balance: Value vs. Growth Investing

Investors who strictly follow fundamental analysis often attract towards large, stable companies with consistent earnings and dividends. While these "blue-chip" stocks provide stability, they often lack the explosive growth potential of smaller, high-growth companies.

For instance, HDFC Bank (NSE: HDFCBANK) and Infosys (NSE: INFY) are excellent companies with strong fundamentals, but their growth rate is relatively steady compared to high-risk, high-reward stocks like Polycab India Ltd., which is rapidly expanding in the electricals and cable industry.

It is a matter of risk appetite. Conservative investors may prefer ITC (NSE: ITC) for its consistent dividends, while aggressive investors might prefer Strides Pharma Science Ltd., which has taken bold steps in expanding its pharmaceutical operations despite earnings volatility.

When Growth Stocks Outperform Value Stocks

During bull markets, stocks with high P/E ratios, no earnings, and ambitious growth stories often outperform fundamentally sound, slow-moving stocks. This is because investor sentiment drives valuations higher, and the market rewards companies with strong narratives, industry disruption potential, and rapid expansion.

For instance, Ircon International Ltd., which specializes in railway and infrastructure projects, has seen strong momentum despite not always fitting traditional valuation models. Similarly, Anant Raj Ltd., a real estate player, has benefited from rising demand in the data center sector, showing that growth investing can outperform during favourable market conditions.

However, in bear markets or economic downturns, these high-growth stocks tend to decline sharply, as investors flock to safety. Growth stocks require higher attention and active management to capitalize on opportunities.

The Case for a Balanced Approach

While fundamental analysis is a valuable tool, it should not be the sole determinant of investment decisions. A well-rounded strategy incorporates:

- Fundamentals: Understanding company finances, business models, and competitive advantages.

- Market Trends & Sentiment: Analysing investor behaviour, sector momentum, and economic conditions.

- Technical Analysis: Studying stock price movements, volume patterns, and chart signals.

- Macro & Microeconomic Factors: Evaluating inflation, interest rates, and global market trends.

For example, investors who combined fundamental analysis with sector trends saw opportunities in Tata Motors Ltd., given its strong push into electric vehicles, making it a growth stock that traditional fundamental analysis might have undervalued.

The Bottom Line

Fundamental analysis is an essential part of investing, but it has its limitations. Many of the best investment opportunities arise in companies that do not yet have strong earnings or traditional valuation metrics. Growth investors must be willing to look beyond standard financial reports and consider companies based on market trends, disruptive potential, and investor sentiment.

Successful investors recognize that stock markets are driven by more than just numbers—they are driven by people, trends, and innovation. Those who seek high returns must be willing to explore beyond the limitations of fundamental analysis and embrace a broader investment perspective.

Footnote: The Importance of Active Management

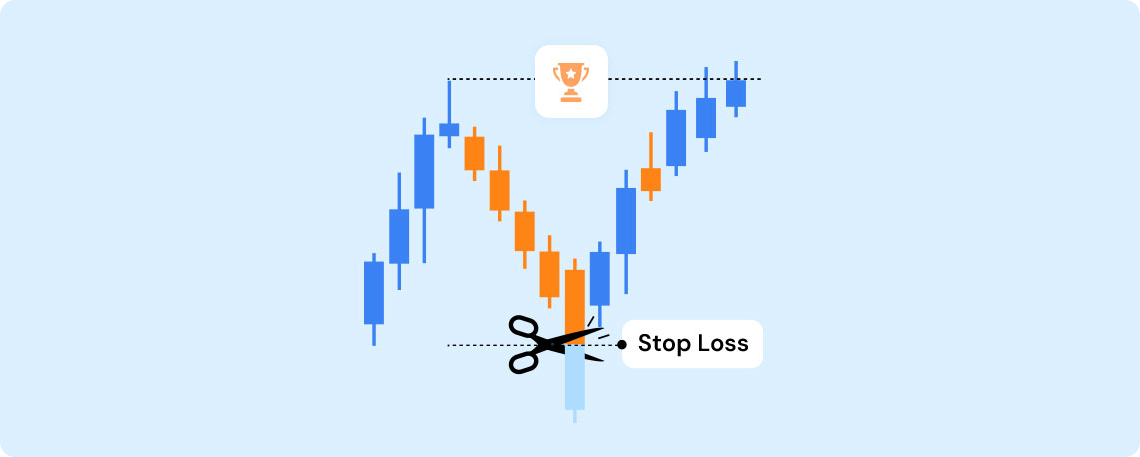

Growth stocks require active monitoring. Unlike blue-chip investments, where you can "buy and hold," high-growth stocks demand careful entry and exit strategies. Investors must be prepared to:

- Take profits when stocks become overvalued

- Hold cash during downturns to buy dips

- Stay updated on industry trends

Some experienced focus on just a few growth stocks, understanding their behaviour, earnings cycles, and news-driven movements. This approach allows them to time the market effectively while minimizing unnecessary diversification.

By combining multiple investing strategies, investors can maximize returns while mitigating risks. Fundamental analysis remains a valuable foundation, but adaptability is key to long-term success in today's dynamic market.

MILARS® Approach to Growth Stock Selection

We use the MILARS® strategy for stock selection: Market direction, Industries & sectors, Leading stocks, Acceleration in earnings, Relative price strength, and Selling Rules. This comprehensive approach helps us identify high-potential growth stocks beyond just fundamental metrics.