Mastering Stop Losses: A Deep Dive into Risk Management

February 22, 2025

|

Mastering Stop Losses: A Deep Dive into Risk Management

February 22, 2025

|The Importance of Stop Loss in Investing

Successful investing is not about impulsive decisions or gut feelings—it’s about preserving capital and managing risk. The key to longevity in the stock market is ensuring that losses don’t erase hard-earned gains. The core principles that apply to both traders and investors include: preserving capital by avoiding large drawdowns that hinder long-term growth and cutting losses early to prevent small losses. Mastering stop losses is one of the most effective ways to implement these principles, ensuring a disciplined approach to risk management.

The Biggest Mistake Long-Term Investors Make

A common mistake among long-term investors is viewing their holdings as a unified portfolio rather than assessing each stock individually. While a long-term perspective is valuable, blindly holding underperforming stocks can lead to unnecessary capital erosion. The best way to maintain a strong portfolio is by systematically removing weaker stocks and reallocating capital to better opportunities.

What is a Stop Loss?

A stop loss is a predefined price level at which an investor exits a position to limit downside risk. Without stop losses, investors often fall victim to emotional biases like overconfidence, hope, and denial—leading to substantial losses. Even legendary investors like Warren Buffett exit positions when fundamentals weaken. Stop losses ensure capital efficiency and free up funds for superior investment opportunities. A misconception among many investors is that stop losses are only for traders. However, long-term investors also need them to prevent value erosion when a stock’s fundamentals deteriorate. A well-planned stop-loss strategy enforces financial discipline and enables investors to cut losers early while riding winners.

Key Requirements for Implementing Stop Losses

To use stop losses effectively, consider the following:

- Think of Each Stock Separately: Avoid viewing your portfolio as one large entity. Treat each stock as an individual trade with its own risk profile and exit strategy.

- Set Stop Losses in Advance: The best time to set a stop loss is at the time of purchase, when emotions are not yet involved. However, it’s never too late to introduce them.

- Choose a Stop Loss Method: Different methods exist for determining stop-loss levels. The key is to use one that aligns with your risk tolerance and market conditions.

Discipline and Risk Management in Stock Market Investing

The most successful investors are those who maintain discipline and actively manage risk. Many investors hold onto underperforming stocks, hoping for a turnaround, despite clear signs of deterioration. While diversification helps spread risk, failing to monitor individual stocks can lead to major capital losses. A professional investor assesses each stock individually rather than treating the portfolio as a single entity. If a stock underperforms beyond a set threshold, it should be exited—just as a portfolio manager trims weak holdings to strengthen overall returns. The market is dynamic, and clinging to loss-making positions without valid reasons can be detrimental. Stop losses reinforce discipline by acting as automatic triggers, preventing losses from spiralling out of control.

Many investors make the mistake of increasing their position size in a losing trade, assuming that averaging down will eventually lead to profits. However, this can be a dangerous strategy if the stock continues to decline. A stop loss ensures that an investor exits a bad trade early instead of letting emotions dictate their decisions.

Methods for Setting Stop-Loss Levels

A stop loss is an automatic order that triggers a sale when a stock reaches a predefined price. However, choosing the right stop-loss strategy depends on factors such as risk appetite, investment horizon, and stock volatility. Below are widely used stop-loss methods:

1. Fixed Percentage Stop Loss

The simplest approach is setting a flat percentage loss threshold, such as 5% or 10%. If a stock drops by that amount, it is automatically sold. However, market volatility can make this approach challenging since short-term fluctuations may trigger the stop loss unnecessarily.

Example: An investor buys Reliance Industries (NSE: RELIANCE) at ₹2,500 and sets a 10% stop loss. If the stock price falls to ₹2,250, the position is exited.

While simple, this method does not account for stock-specific volatility. Some stocks exhibit higher fluctuations, and rigid percentage-based stops may trigger premature exits.

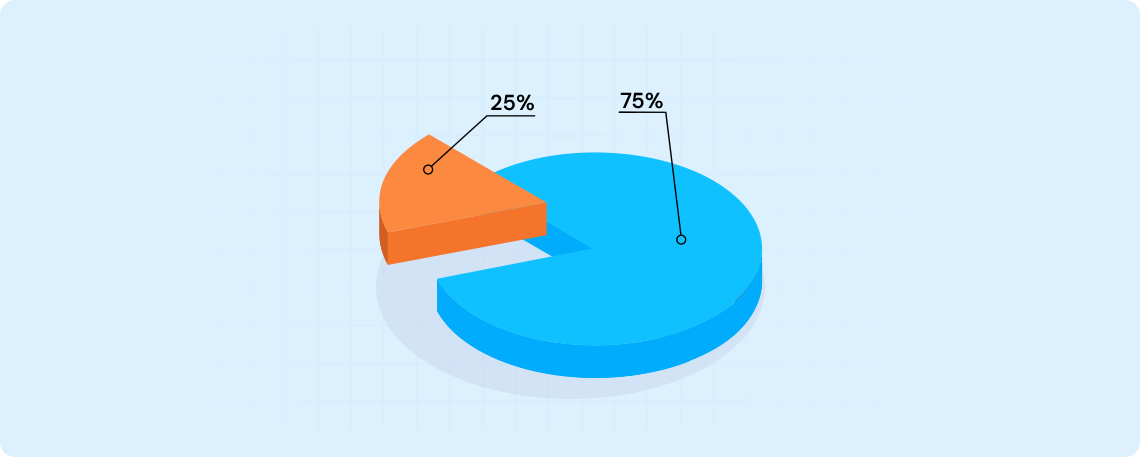

2. The 2% Rule for Position Sizing

Experienced traders often follow the 2% rule, which limits the risk on any single trade to 2% of total trading capital. This means that an investor with a portfolio worth ₹10,00,000 should not risk losing more than ₹20,000 on any single trade.

Notably, this is not the same as a 2% drop in share price. If an investor allocates ₹1,00,000 to a trade within their ₹10,00,000 portfolio, a ₹20,000 loss on that position represents a 20% decline in that specific trade. The 2% rule ensures that no single trade can significantly impact overall portfolio performance.

Example: An investor with ₹10,00,000 capital should not risk more than ₹20,000 per trade. If they purchase TCS (NSE: TCS) at ₹4,000 per share, the stop-loss level must be set such that the maximum loss does not exceed ₹20,000.

3. Support & Resistance-Based Stop Loss

Instead of using fixed percentages, investors can place stop losses based on key technical levels. If a stock is bought at a breakout above resistance, the stop loss is set just below that level.

Example: If HDFC Bank (NSE: HDFCBANK) breaks out above ₹1,600 resistance, a stop loss may be placed at ₹1,550 to protect against a false breakout.

4. Trailing Stop Loss for Maximizing Profits

A trailing stop loss moves upward as the stock price rises, allowing investors to protect gains while still participating in further upside.

Example: An investor sets a 10% trailing stop on Infosys (NSE: INFY) at ₹1,400. If the stock climbs to ₹1,600, the stop-loss level adjusts to ₹1,440 (10% below ₹1,600). If the price later drops below ₹1,440, the position is exited, securing a profit.

5. ATR-Based Stop Loss (Volatility Adjusted)

A more sophisticated approach involves using the Average True Range (ATR) indicator to account for stock volatility. ATR measures how much a stock typically moves in a given period. More volatile stocks require wider stop losses, while stable stocks can have tighter stops.

Example: If a ₹300 stock has an ATR of ₹10, an investor using a 2x ATR stop loss would set it at ₹280. This ensures the stop loss is not triggered by normal daily price swings.

Calculating ATR-Based Stop Losses

- Calculate True Range (TR) for Each Period:

- TR = max[(High - Low), |High - Previous Close|, |Low - Previous Close|]

- Calculate ATR

- ATR = Moving average of TR over 14 periods (daily or weekly).

- Determine Stop-Loss Level:

- Stop Loss = Entry Price - (ATR × Multiplier)

- If ATR = ₹15 and the entry price is ₹500, a 1.5x ATR stop loss would be set at ₹477.50.

The Role of Discipline in Stop Loss Execution

A stop loss is not a magical solution; it is an alert system that reminds investors when a position is no longer viable. However, stop losses only work if they are respected and executed. Ignoring stop losses defeats their purpose and often leads to significant losses.

Key benefits of using stop losses:

- Reduces stress: Knowing that losses are controlled eliminates fear and panic.

- Prevents emotional decision-making: It removes hesitation and second-guessing.

- Improves risk management: Helps maintain a balanced portfolio by removing underperforming stocks.

Using Stop Losses for Long-Term Investors

Even long-term investors can benefit from stop losses by setting wider stop levels and reviewing their positions periodically. For example, checking stop-loss levels monthly rather than daily can prevent overreacting to short-term price fluctuations.

Common Mistakes Investors Make with Stop Losses

- Not Using a Stop Loss at All – Many retail investors buy stocks based on speculation and hold them indefinitely, leading to huge losses.

- Placing Stop Losses Too Tight – Stocks naturally fluctuate. Setting stops too close leads to premature exits.

- Moving Stop Losses Emotionally – Investors often shift stop losses upwards or remove them entirely when in loss, leading to bigger drawdowns.

Conclusion: The Core Principle of Stop Losses

Stock market investing is fundamentally about risk management, not just stock selection. A well-defined stop-loss strategy ensures that losses remain within acceptable limits, helping investors navigate volatile markets with confidence and maximize long-term profitability.

Continue with Google

Continue with Google