September 2024: Market Insights, Global Impact, and Future Trends

September 12, 2024

|

Market Overview

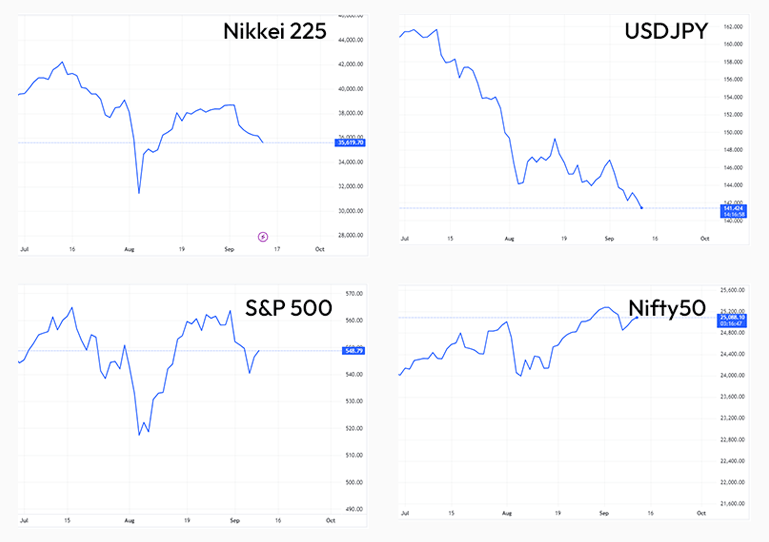

August 2024 was a remarkable month for the markets, with Nifty 100 was up by 0.96%, Nifty MidCap 150 up by 0.30%, and Nifty SmallCap rose by 1.24%. The month also witnessed the Nifty index touching an all-time high, closing at 25,235.9 by the end of August, reflecting continued investor confidence in the Indian economy.

However, amid these positive indicators, global factors weighed heavily on the market dynamics. On August 5, major stock markets experienced their sharpest decline in decades, with the Dow Jones plummeting over 800 points. This sudden downturn was triggered by the unwinding of the yen carry trade, a popular strategy involving borrowing money at low-interest rates in Japan to invest in other assets.

US Federal Reserve Update

The Federal Reserve has indicated that the interest rate cycle has reached its peak and is shifting towards an expansionary policy. This means that interest rates will likely decrease, making borrowing cheaper and boosting economic growth. An initial rate cut is potentially occurring as soon as mid-September. This easing cycle is expected to stimulate capital inflows into emerging markets and facilitate a reduction in interest rates domestically, boosting growth.

While the US economy continues to show signs of a potential slowdown, particularly in the manufacturing sector, the anticipated rate cuts could mitigate some of the risks of a harsher economic landing. Additionally, the underperformance of US and Chinese markets relative to India's could play to India's advantage, further enhancing its appeal as an investment destination.

Indian Market Update

Robust domestic inflows have made the Indian market resilient against global news events. The anticipated shift in the interest rate cycle towards a more accommodative approach is expected to make equities a more attractive investment opportunity relative to other asset classes. This is because lower interest rates reduce the cost of borrowing, making it easier for companies to invest and grow.

We believe new liquidity entering the market may be balanced by the supply of new paper from promoters, private equity investors, and large capital raises through Qualified Institutional Placements (QIPs)

The Yen Carry Trade: A Global Trigger for Market Declines

While Indian investors may often focus on domestic companies and markets, it is crucial to stay informed about global macroeconomic trends. The unwinding of the yen carry trade, which has been a cornerstone of global financial strategies for years, is a prime example of how international events can influence portfolio returns back home in India.

The sudden panic in the markets can largely be traced back to the unexpected actions of the Bank of Japan (BoJ). In late July, the BoJ made the surprising decision to raise interest rates after 17 years, sparking widespread concern. The yen carry trade, a widely used investment strategy, was significantly affected by this move.

The yen's appreciation by nearly 10% in just over three weeks added fuel to the fire, forcing investors to cut their losses. This scenario exemplifies how interconnected the global financial system is and how an event in one part of the world can ripple across multiple markets, including India.

The recent sell-off in the Japanese Yen and the consequential impact on the global financial markets

Global Impact: The Yen-Carry Trade Unwind Explained

So, what exactly triggered this sell-off in USDJPY (US Dollar to Japanese Yen exchange rate)?

The key driver was the Bank of Japan's interest rate hike in late July. After maintaining ultra-loose monetary policies for 17 years, the BoJ raised rates to 0.1%, marking the end of an era of negative interest rates. The BoJ also announced a gradual reduction in its monthly bond purchases, aimed at strengthening the yen and supporting economic growth. A secondary reason for the decline was a weak print in the US CPI data, which was a classic market reaction that invigorated the braoder decline. In short the US CPI acted as a trigger to help the market discover what was fundamentally happening to it.

For years, global investors borrowed money in Japan at ultra-low interest rates to invest in higher-yielding assets abroad, particularly in the US stock market. The BoJ's decision to increase rates disrupted this strategy, leading to an abrupt unwinding of these positions, triggering panic selling across various markets.

What Is a Carry Trade?

The carry trade is a financial strategy where investors borrow money in a country with low interest rates and invest it in assets in countries with higher returns. This strategy is particularly popular in the forex markets, where currencies like the yen, known for its stability and low borrowing costs, are used to fund investments in higher-yielding markets like the US.

With the BoJ's rate hike and the yen's sudden appreciation, investors were forced to unwind their carry trade positions, triggering a global market sell-off. The carry trade unwind is not a new phenomenon, but this particular episode stood out due to the rapid appreciation of the yen and its ripple effects across multiple global markets.

Japan’s Monetary Policy: Lessons in Economic Management

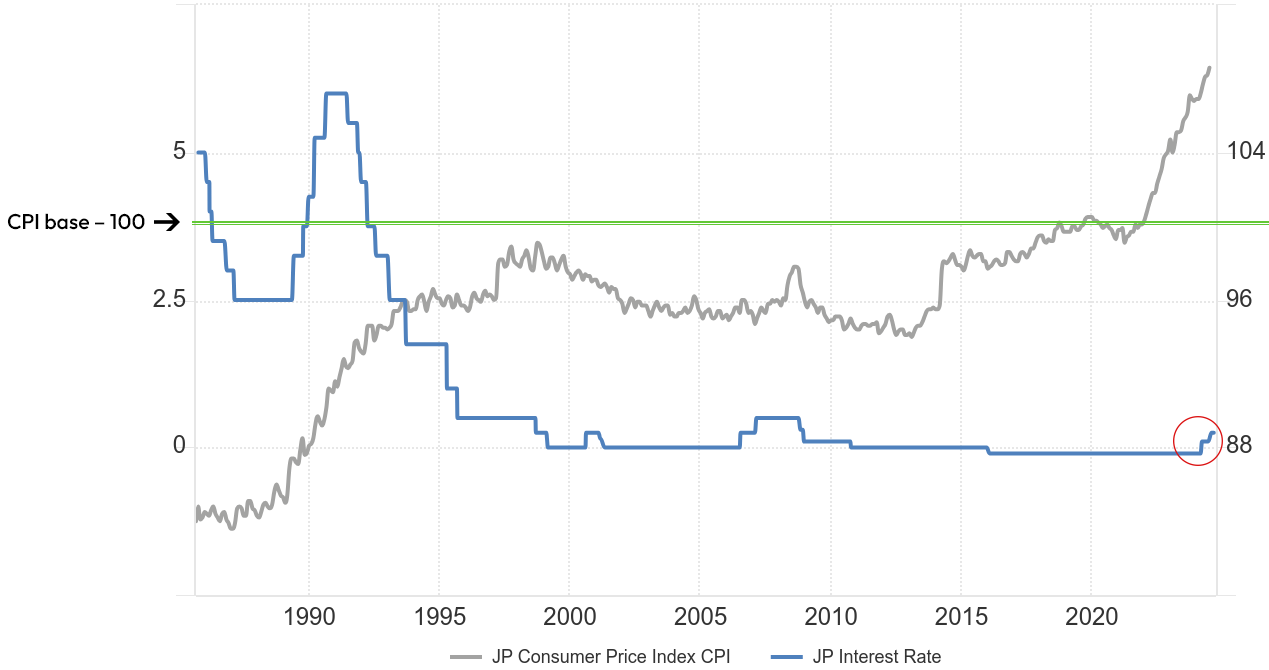

Japan's economic journey offers valuable lessons in monetary policy. After years of maintaining ultra-low interest rates and battling deflation, the BoJ's decision to raise rates in 2024 marked a significant shift. This move ended Japan's historic era of negative interest rates, which had been in place since 2016. However, the journey to this point is marked by a series of policy decisions that, while aimed at stimulating growth, have had mixed results.

Japan's GDP did experience a temporary boost following the introduction of ultra-low interest rates in the early 2000s, but the country struggled to maintain consistent growth. Japan's aging population, a declining birth rate, and competition from emerging economies like China have all contributed to the country's economic challenges.

Despite efforts to combat deflation and stimulate growth, Japan's economy has remained in a low-wage, low-price equilibrium for much of the last two decades. The Consumer Price Index (CPI) in Japan has stayed below 100 for extended periods, indicating mild deflation or no inflation at all. This has made it difficult for the BoJ to achieve its inflation targets, even with aggressive monetary easing.

While an economy of any country has several moving parts to it, its reserve bank plays a pivotal role in shaping its monetary policy. However, making monetary policy decisions is truly a dauting task, requiring both experience and competency. We will use the example of Japan's economy to understand what went wrong for it in terms of monetary policy, and what matters for any economy to run as a well-oiled engine of growth in an ever-globalising world.

The Bank of Japan raised interest rates in March 2024, ending the country’s historic era of negative interest rates.

One would ask, why did this happen?

The answer to this is that the problem was deeply structural:

- the burst of the bubble economy and its scarring effect in 1990s,

- rapid decrease and aging of population that no advanced economies had experienced, and

- emerging China and the following increases in cheap imports, have all combined and exerted tremendously negative pressures on Japan’s economic growth and inflation.

- In the period leading up to and after the GFC (global financial crisis) of 2007-08, interest rates saw a bump up. But as conditions normalized, the BOJ reverted to the policy of using ultra-low interest rates to support the economy.

- They went to the extent of making the rates negative to continue supporting the economy.

- From 2016 to March 2024, BOJ kept the rates at -0.1%. (Meaning that if a bank borrowed money from the central bank, the central bank itself would pay interest to the borrowing bank for taking a loan from it!!

- As an article from the World Economic Forum writes, "Under the new environment, small non-manufacturing companies kept their businesses by cutting costs, for example by hiring more non-regular workers. This strategy was successful in maintaining the 'status quo' of the domestic economy for a while, but it was a fatal mistake for future growth, as innovations to create new business and values were disturbed."

- This underscores the fact that although the BOJ tried to improve the inflation situation by consistently cutting rates, what they failed to understand was that the underlying problems in the economy were still there, and some more fundamental policies were required to be implemented to spur Japan's competitiveness in the global market.

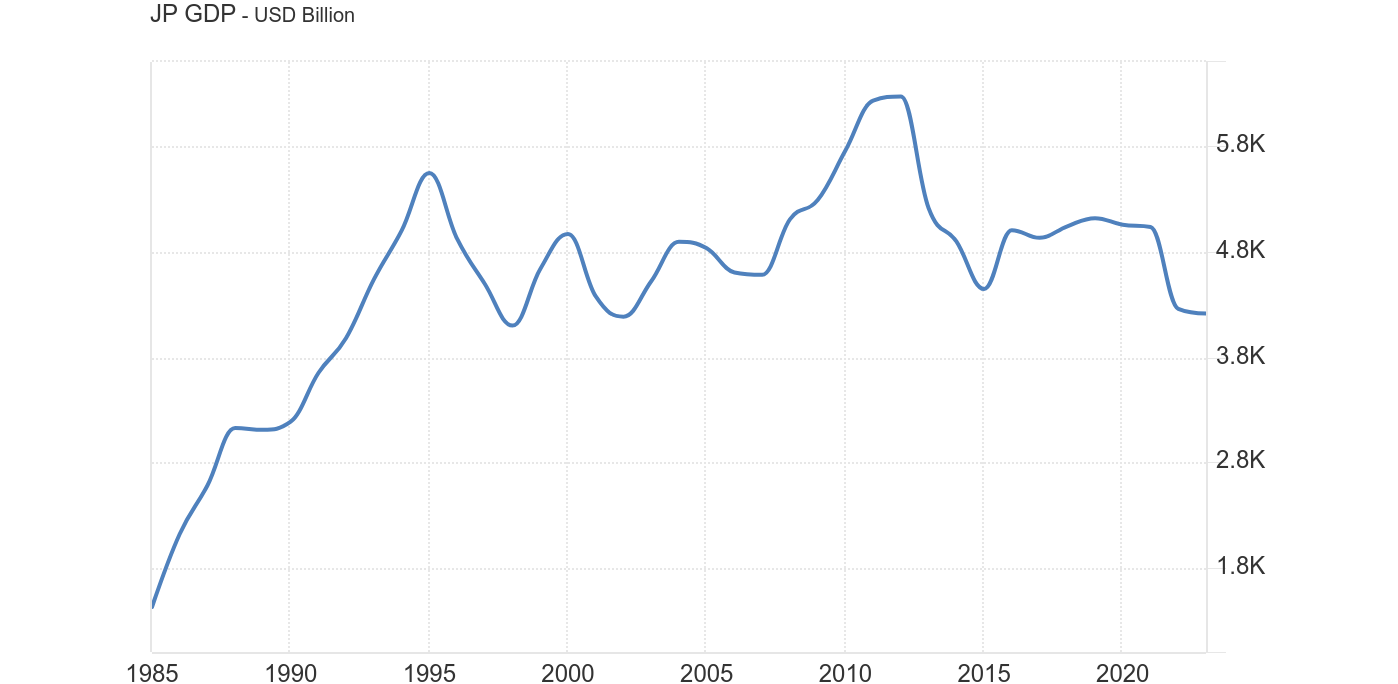

The above chart shows Japan's GDP (actual figures in USD Bn), over the last 40 years. Now that we are aware of the monetary policy that was implemented over this period, it makes sense to look at the actual results those policies had on Japan's economy.

The GDP did benefit from the ultra-loose interest rates regime from the 2000s to 2011-12, as seen by the rise in GDP levels above the peak (~$5.6 trillion) made in 1995s. However, Japan was never able to surpass that peak by a huge margin, as the GDP quickly started to shrink after 2012, due to factors like a rapidly aging population and the inability to compete with the rising manufacturing might of China in the global export markets.

The Path Forward for Japan

In 2024, Japanese Prime Minister Fumio Kishida outlined a strategy to shift Japan’s economic paradigm by integrating social issues into growth opportunities. His vision for a "new form of capitalism" aims to create a "virtuous cycle of growth and distribution," driven by increased corporate earnings, transparency in financial markets, and investments in human capital. The expansion of NISA (Nippon Individual Savings Account), aimed at encouraging retail investment, and corporate governance reforms are among the key measures introduced to stimulate Japan's economic revival.

Government Measures:

- Expansion of NISA: The NISA is a tax exemption scheme for retail investors to shift household savings into productive investments.

- Corporate Governance Reforms: Enhanced transparency and encouraged investments in human capital and wage increases, including a new Tokyo Stock Exchange initiative to disclose companies’ market valuation efforts.

- Reformation of Asset Management and Ownership: Planned reforms to improve asset management practices, promote entry of both domestic and international firms, and develop “Asset Owner Principles” to clarify investment roles.

- Support for Startups: Encouraged investment in innovation and productivity improvements by expanding venture capital flows and developing a code of conduct for better governance and investment in startups.

- Establishment of Asset Management Forum: Set up a forum for Japanese and global investors to facilitate communication and ensure the effective implementation of these measures.

RBI Monetary Policy – A Steady Approach for India

Back in India, the RBI's Monetary Policy Committee (MPC) held its meeting in August 2024, keeping the policy repo rate unchanged at 6.50%. The MPC projected real GDP growth for FY 2024-25 at 7%, signaling confidence in India's economic momentum. With inflation projections also showing signs of stability, the Indian economy is well-positioned to continue its growth trajectory, buoyed by strong domestic demand and investment.

Key Highlights of RBI Policy

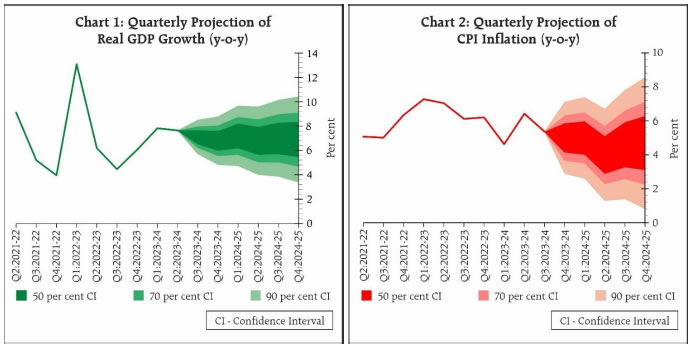

GDP Growth Projections: Real GDP growth for 2024-25 is projected at 7%, with growth in Q1 at 7.2%, followed by slightly moderated growth in the subsequent quarters.

GDP Advance Estimates

The First Advance Estimates of GDP for FY 2023-24 released by the National Statistical Office placed year-on-year real GDP growth for FY 2023-24 at 7.3 percent, exceeding the 7.2 percent in the previous year.

For FY24-25, the real GDP growth has now been projected at 7% with: quarterly growth of 7.2%, 6.8%, 7% and 6.9% in Q1 to Q4, respectively.

CPI Inflation

CPI inflation is projected at 5.4 percent for 2023-24 with Q4 at 5.0 percent. Assuming a normal monsoon next year, CPI inflation for 2024-25 is projected at 4.5 percent with Q1 at 5.0 percent; Q2 at 4.0 percent; Q3 at 4.6 percent; and Q4 at 4.7 percent (Chart 2).

Comments on Economic Activity

The MPC noted that domestic economic activity is holding up well and is expected to be backed by the momentum in investment demand, optimistic business sentiments and rising consumer confidence.

Noteworthy comment on Private Capex

“Indian growth has also exceeded expectations, demonstrating resilience to global shocks. However, many high-frequency indicators softened in November and December. Even so, imports continue to grow in volume terms and there is no slowing in credit growth. That capacity utilization has not risen despite good growth suggests private investment is taking place”

Sector-wise Pricing trends

- FMCG majors are cutting prices because of local competitors.

- Oil majors also have room to cut prices.

- Current perceptions and long-term household inflation expectations have softened.

- There seems to be overall acceptance that inflation is moving towards the target. This should anchor core inflation around 4%.

- Faster than expected fiscal consolidation and a continuing better composition of government expenditure, will also lower inflationary pressures.

Comment by MPC member; gives key insights into future monetary policy expectations.

Prof. Jayanth Verma:

- “Inflation is projected to average 4.5% in 2024-25, and, therefore, the current policy rate of 6.5% translates into a real rate of 2%. I do not believe that such a high real rate is required at this stage to drive inflation down to the target of 4%. Economic growth is indeed holding up well, but there is no evidence at all that the economy is overheating.

- If the potential growth rate of the economy is close to 8%, then the economy is not at risk of overheating in 2024-25. A real interest rate of 1-1.5% would then be sufficient to glide inflation to the target of 4%. A real interest rate of 2% creates the very real risk of turning growth pessimism into a self-fulfilling prophecy.”

“I therefore vote to reduce the repo rate by 25 basis points, and to change the stance to neutral.”

The Jackson Hole Symposium: A Global Perspective

‘Humility and a questioning spirit’ as the inflation and employment scenarios evolve

Around the 22nd of August, was the annual central bankers meeting at Kansas City, Jackson Hole, Wyoming in the American Rockies, a noteworthy event for one and all in economic policymaking. This event also served as a platform for exchange of ideas and insights. The event is quite private in its nature, with very limited people having access to the discussions and ideas that are put forth.

From left: Christine Lagarde, president of the European Central Bank; Kazuo Ueda, governor of the Bank of Japan, and Jay Powell, chair of the US Federal Reserve, at Jackson Hole in Wyoming.

We drill down on key takeaways from this year’s Jackson Hole Symposium below:

Four and a half years post-COVID-19, the worst economic distortions from the pandemic are receding. Inflation has notably decreased, the labour market has cooled but remains solid, and supply constraints have eased. The Federal Open Market Committee (FOMC) has made significant progress toward its dual mandate of price stability and a strong labour market, though the task is ongoing.

Near-Term Policy Outlook:

Inflation is now closer to the 2% target, with prices rising 2.5% over the past year. The Fed's restrictive monetary policy helped restore balance between aggregate supply and demand, easing inflationary pressures and ensuring that inflation expectations remained well anchored. The FOMC's current policy is aimed at further reducing inflation while supporting the labour market.

The labor market, while cooling from its previous overheated state, remains robust. Unemployment has risen to 4.3%, but job gains are steady, and conditions are less tight than pre-pandemic.

Inflation Trajectory

The inflation trajectory since the onset of the pandemic has been notably volatile. Initially, inflation was subdued but surged sharply in early 2021 due to pandemic-related supply chain disruptions and a spike in consumer demand for goods. This surge was initially thought to be temporary or "transitory." However, inflation broadened and persisted, reaching peaks of 7.1% by mid-2022, driven by new supply shocks and global events such as Russia’s invasion of Ukraine. Throughout 2022, inflation rates hovered around 5-6% in the early part of the year, reflecting ongoing supply constraints and persistent demand pressures. The subsequent decline in inflation, starting in the summer of 2022, has been supported by moderated demand, improvements in supply conditions, and the stabilization of inflation expectations, bringing inflation closer to the Federal Reserve’s 2% target.

Employment

Job vacancies have decreased, and the ratio of vacancies to unemployment has returned to its pre-pandemic range. The hiring and quits rates are now below the levels observed in 2018 and 2019, and nominal wage gains have moderated. Overall, labour market conditions are less tight than they were just before the pandemic in 2019—a period when inflation was below 2 percent. This suggests that the labour market is unlikely to contribute to elevated inflationary pressures in the near future.

The Fed believes that there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labour market. Their commentary gives confidence owing to the fact that the current level of the policy rate has ample room to respond to any risks that the economy might face, including the risk of unwelcome further weakening in labour market conditions.

It also aims to maintain a “Humble and a questioning spirit’’: that focuses on learning from the past and not repeating those mistakes again, while also being flexible to the ever-evolving market conditions.

Conclusion: Navigating the Road Ahead

As we look ahead, the Indian market continues to benefit from strong domestic inflows, resilience in economic activity, and a favorable global interest rate environment. However, global factors, such as geopolitical tensions and shifts in monetary policy, will continue to play a crucial role in shaping market dynamics.

For investors, staying informed about both domestic and global trends will be key to making sound investment decisions. As always, our team at Stockaxis remains committed to providing you with the latest market insights and research-driven recommendations to help you navigate these complex times and achieve your financial goals.

Continue with Google

Continue with Google