Why Do Few Investors Make Most Of The Money In The Stock Market?

January 06, 2017

|

Update (15th Feb, 2017):

Before we start anything, here is a powerful quote from the man whom the great Warren Buffet describes as his 'partner', Charlie Munger : “The big money is not in the buying and selling … but in the waiting.”

There has always been this notion in the minds of investors, that, “If I am smart enough, I’ll definitely compound my profits by dealing in stocks.” But what exactly does ‘smart enough’ mean?

(a) Is it knowing all the publicly available information about the company?

-You can know everything about a business in which you are allocating your hard earned cash into. But what’s the use of it if you start doubting yourself and your research, when your stock is down 5%-10% due to some negative market sentiment? 8/10 times, you will end up selling your holdings and play the waiting game and eventually end up seeing the stock making new highs before you could enter again. So, is it worth it?

(b) Or is it following the most pleasing-to-the-ear stock tips from the financial press, whose daily mission is to explain reasons for the rise or fall in the market in those 2 small minutes?

Just think over it: is the global or even the Indian economy for that matter, so straightforward that implications of macro or micro events can be explained in 2 minutes or some 500-word articles? No!! Definitely NOT!!!

In our article on “Why Trade Intraday? Go To Las Vegas Instead!!!”, we’ve tried and explained (at least we hope we have), all possible cons of being an intraday trader, like asymmetric or you can say illogical competition in the form of professional D-Street traders, like losing a good night’s sleep over constant anxiety and greed to make profits or like what to do after trading fails and you are out of money? All these nothing but pointed out the snags of being on the retail side of the story. But wait, there are these huge advantages that individual investors have over professional traders, but simply choose not to understand:

1) We (individual investors) do not have any mandates that dictate the type of stocks that we must buy or avoid. We can simply buy a company if it has a fundamentally sound business model at a buyable valuation.

2) We do not have to endure the quarterly performance pressure the traders constantly face. We can buy any quantity of stocks and hold them as long as we like. This size and time advantage is so huge, but we still never ever exploit it.

It is always like: “The casino is open and we must go play, that too now itself.”

Every morning at 09:15 AM when the market opens, the urge to do something on our trading terminals has infected us for the longest possible times. And adding fuel to this fire inside us is the media, which is always either cheerleading or always booing a particular sector or a set of stocks. Everything around us makes us feel, that ‘now’ is always the right time to do something using the brand new tools and all sorts of charts and numbers. But here’s the harsh reality: All these are not made to make you trade efficiently and thereby make you rich, but to fill their own coffers and pay those studio bills.

Remember, whenever you invest in a company, the only things that you require are not the media, not the super efficient charts and tools, not the global events that are ‘perceived’ by the market gurus to ruin economic growth, but only:

(a) A sound business model

(b) A hard working management towards that business model

(c) Confidence on your research

And finally,

(d) Patience, so that the hard working management aids you to grow your investment in their company.

Here’s the simplest of the examples to prove this theory:

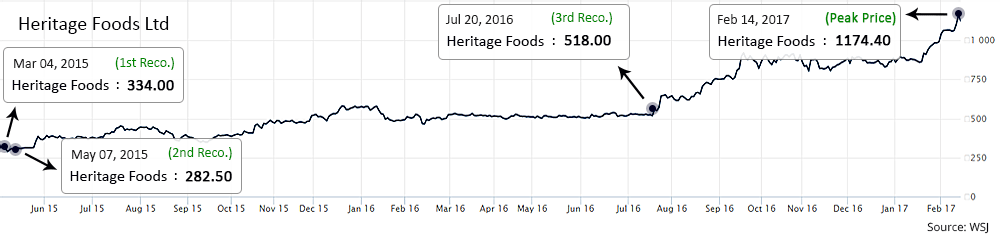

We had recommended Heritage Foods Ltd. to our Multibagger Package Clients on 4th March 2015 at a price range of Rs. 345-350. Post our recommendation, Heritage dipped by close to 20%, making the then lows of around Rs. 285-288 due to negative economic cues triggered by huge FII sell-offs and concerns over the GST Bill getting tabled. Slowdown in the services and manufacturing sectors as also persistent taxation worries added to the pressure.

Most investors would’ve preferred opting out of further investments, but since, this is no way affected the business model of Heritage, we at StockAxis saw this as an opportunity to enter the business at a pleasing 20% discount. Hence, we made our Multibagger Package Clients add more of Heritage Foods in their portfolios. What happened in the next 15 months is known by all. The stock from its lows of Rs. 285-290, rose by over 310% making an all time high of Rs. 1174.40. Also, another thing that might interest you is that, we again gave a BUY recommendation to our clients for Heritage Foods Ltd. at around Rs. 515-530 as we were still bullish and convinced about the company's future growth. The result, Hertiage's stock price still doubled from its already doubled value!!!

Pleasing, Right???

Some call this a bet gone right, but to true long term investors this was a well calculated and a bold move. Luck is often surrounded by a small sample size. That's why speculators attribute their successes to their wisdom and investing skill and their failures to bad luck. Few realize that their successes are also the result of sheer patience and conviction.

The logic behind this is no rocket science. Informed investors buy stocks when the sentiments in the economy are not that great, but great business models available at bargain prices. They then hold them for a full business cycle or two and sell them in five years or so at a huge gain when conditions have improved substantially. They hardly care about the opening or closing prices, candlestick patterns, or even the expert opinions. In one line, valuations and patience are the keys to stock market profits; buy businesses at a cheap stock price and hold them until they are no longer cheap.

A vast amount of information is available to investors. Fortunately, you only need to understand a small portion of it to be a successful investor. Patience is more important than being fast and smart — which explains why most investors don't achieve the returns that the market freely offers, like it is doing right now. With the Midcap and Smallcap indices already fallen by around 15%-16% each from their 3-month highs and again gaining momentum to make new highs, with most negative sentiments like the Demonetization Scheme, US Polls, Fed-rate hike, Earnings surprises, Rising crude prices already discounted by the market, one can satisfactorily say that many good companies are now available at pleasing-to-buy valuations. So, what are you waiting for? Make sure you don’t miss out on another potential rally like the one we witnessed after the Budget 2016. Just for your information, the Midcap and Smallcap indices had rallied colossally by 44%-46% each from their lows during the Budget 2016. Can history repeat itself? And can you capitalize this time? We can only hope you do! And in the process, make sure you chose the right businesses, with clearer growth stories, and not any random companies with no great past earnings.

Also, remember what the legendary Warren Buffet quotes about the importance of PATIENCE: “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.” Two legends can’t supposedly be wrong about such a straightforward habit, right? All you need to do is implement this simple strategy and no one can stop you from becoming the next big thing. All the best!

Continue with Google

Continue with Google