When To Buy A Stock – The GREAT PARADOX!

January 02, 2016

|

Last time we discussed about some success stories which were facilitated by a change in the management or a new product rollout. These events caused the stock price to swell multifold, infact more than 5000% in some cases. For example, if you would have invested Rs. 100 in Eicher Motors back in April 2008, it would have become Rs.9865 in July 2015 i.e. a 9765% increase in over seven years. Fascinating enough right?

There is another fascinating phenomenon, called the ‘Great Paradox’. Life is full of paradoxes and it's not surprising that the same goes for our very own stock market too. As they call it, the ‘Great Paradox’ means that the stocks which seem too high in price and risky for most investors usually go higher and those that seem low and cheap, usually go lower. This may be hard for you to digest, but don’t worry, by the end of this article, we’ll be on the same page.

In our study, we have found that most of the retail investors, if truth be told more than 95% of them take delightful comfort in buying stocks that are substantially off their highs and have made their way into the ‘new lows’ list, thinking that they are now great bargains. What they fail to realize is that they are trading at such degraded values for a reason. They chase these laggards in hope of a turnaround which does not happen in most of the cases; and even if it does, it takes a hell lot of time. They have to learn and accept the fact that those decisions have FAILED and it’s time to park that money into better prospects. If you are one of them, well you too belong to the ‘Bottom Buyer’ category.

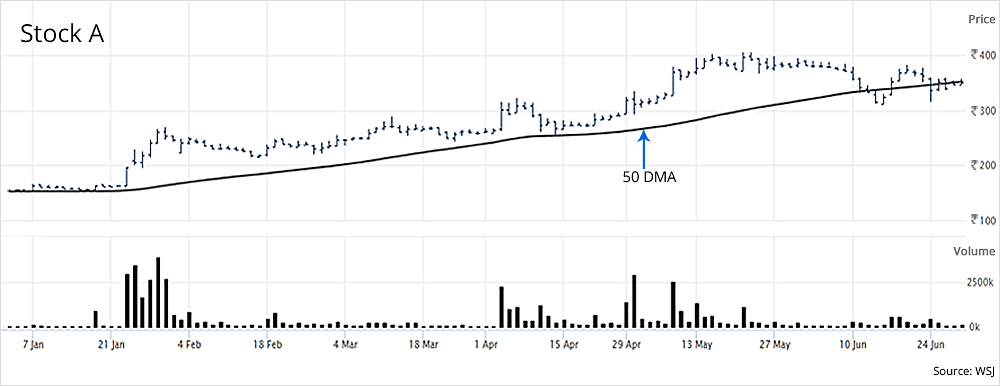

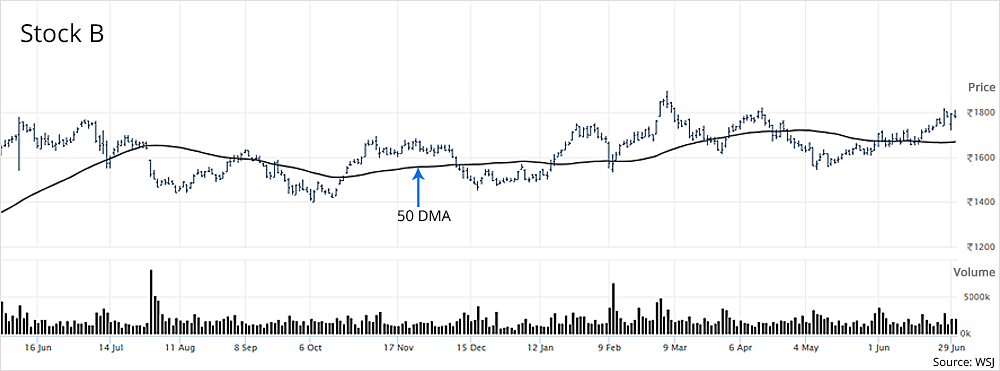

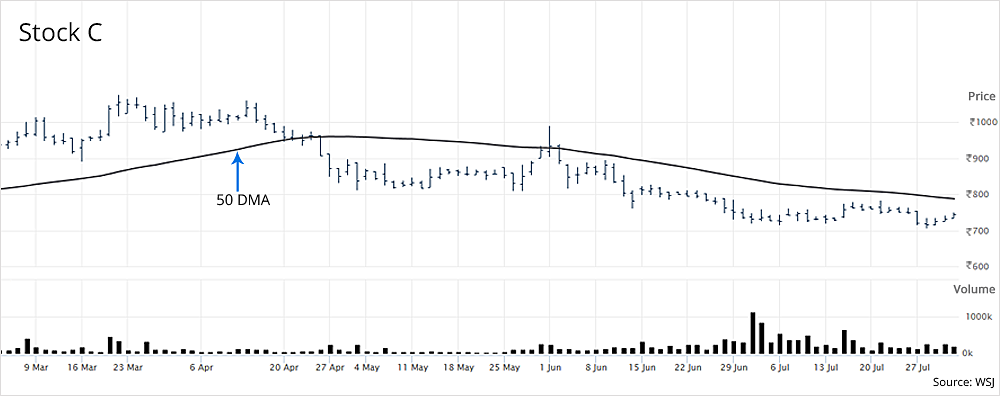

You can check for yourself by performing this small experiment. Below given are three stocks (names to be disclosed at the end of the experiment) accompanied by their graphs. The question to be asked here is, which one looks like the best BUY to you considering a 5-6 month horizon?

As you can clearly see, Stock A has been making new highs consistently over the period from January 2013 till the end of June 2013. So you have to ask yourself, whether it is wise to purchase such a stock considering the fact that it has been rallying continuously for the past 6 months. The biggest concern that you must have is whether the stock has any more fuel left to take its price higher…

Moving on to the daily chart of Stock B, you can see the consolidation that it is going through which is supported by some consistent volumes. This consolidation has been going on from June 2014 till June 2015. So what do you think? What happens next? Do you see an uptrend?

Coming to our final chart i.e. Stock C, you can see the correction that the scrip went through during the 5 month period from March 2015 to July 2015 where it witnessed a 33% decline from its 52 week high of Rs. 1077 to Rs. 720. This is a good enough correction for any stock in such a short duration. So the final question you should be asking yourself is whether the stock has corrected enough to restart its upward journey.

Now that you’ve analyzed the stock charts and know what the ‘Great Paradox’ is, which stock would you bet your hard earned money on? As per our research, most of the investors went for the third option i.e. Stock C. the reason being, as mentioned earlier, the stock seemed to be trading at a bargain price. But, let us see what happened next.

Stock C: Plunged more than 50% in less than 5 months.

Stock B: Down close to 27% in less than 6 months.

Stock A: Rallied more than 285% in over 5 months.

Shocking right? In a separate study that we conducted, we found that, out of the two groups of stocks which made new highs and lows during a bull market, those on the ‘new-highs’ list continued their rally and those in the ‘new-lows’ went even lower. Remember, a stock which making it into the ‘new-highs’ list during a bull run on solid volumes and that too for the first time can be that next multibagger you’ve been looking out for. And just to make it clear,

Stock C: Kaveri Seed Company Ltd.

Stock B: Larsen & Toubro Ltd.

Stock A: Ajanta Pharma Ltd.

Moving on, if you were reluctant to buy Stock A, ask yourself: how does a stock go from Rs. 270 to Rs.1050? The answer is very simple. It must first hit 271. Then 272. Then 273 and so on. In other words, it has to reach the levels it has never seen before and this is what will make it a winner. So rejecting such a stock might not be a great idea after all, especially if it is breaking out of solid bases on big volumes during a bull market. As an astute investor, your job is to identify stocks and buy them when they look expensive for the majority of the conventional investors and sell them after they move substantially higher and begin to appear attractive to the same set of investors. A great example to prove this point is the NASDAQ listed Cisco Systems Inc. Cisco sold at its highest price in November 1990 at $0.17 (which was scary during the time) and went on to make a monumental 76300% rise from that point in the next 10 years. It then traded close to $130. I hope you get my point now.

Getting to the final part of the article, we’ll understand what a base formation is. In the simplest words possible, base formation can be defined as a period in which a stock or other traded security is taking a break from its previous trend (be it a rally or a downtrend). It serves as a breather for the stock. A sound basing can last from 7-8 weeks up to 15 months or sometimes even more which is followed by a breakout. Tremendous price advances can be possible if a stock is starting to break out of its price base during the start of a bull market. Consider the example of our above mentioned winner, Ajanta Pharma Ltd. As you can see there are three base formations before every price rise of time durations like 6 months, 3months and 2 months. The approximate percentage stock price rise after each of these bases is 77%, 66% and 57% respectively which is HUGE.

Remember, just because a stock is making new highs doesn’t mean that it can be bought. There’s always a right time and then, there are other times. If you study and prepare yourself, you too will be able to pick out those future MULTIBAGGERS as and when they appear. Happy Investing!

Continue with Google

Continue with Google