Using the Debt-Equity Ratio Smartly!

July 17, 2018

|

The debt-equity ratio is the ratio which shows how much debt the company has vis-à-vis its equity. It is also known as the “risk ratio” or “gearing”. It is a balance sheet ratio which analyses the capital structure of the company, whether it is more shareholders’ funds or outside debt.

Understanding the ratio

A ratio of higher than 1 means that the company is more dependent on debt than equity, and vice-versa. A ratio of 1 will mean the capital structure is equally contributed by debt and equity. What number is considered better will depend on the industry in which the company is operating. For example, sectors like power & steel, telecom and shipping are considered capital intensive, whereas service sectors like IT, which is labor-intensive and where revenue is often measured per employee, are capital surplus; companies like TCS and Infosys are zero-debt companies. This means all sectors are not capital intensive. Although, the ratio varies from industry to industry, generally a company should have a D/E ratio of lesser than 2.

- Debt to equity ratio = Total debt / Total equity

- where, Total debt = secured + unsecured borrowings (long-term + short term)

- and, Total equity = shareholders’ funds

Debt is considered inherently risky because the company may default in paying off the interest/ principal during adverse conditions. However, a company which is totally debt-free may lose out on important growth opportunities offered by financial leverage (using debt with equity). How debt helps in increasing returns for the shareholders is explained below.

Using Debt to improve Returns on Equity

Suppose, the RoA (Return on Assets = Net Income / Total Assets) is 15%, and total assets are Rs. 100,000 for both, Company A and Company B. Company A has no debt and has equity of Rs. 100,000. Company B has debt of Rs. 50,000 with a cost of debt of 12% annually, and equity of Rs. 50,000.

RoE (Return on Equity = Net Income / Shareholders' Equity) for Company A = (RoA – Cost of debt)/ Equity = (15% of 100,000 – 0) / 100,000 = 0.15 or 15%

RoE for Company B = (RoA – Cost of debt)/ Equity = [15,000 – (50,000*12%)] / 50,000 = 0.18 or 18%

As one can see, RoE for Company B is higher because the company has used debt for growth (and has a lower equity component than Company A). Thus, benefit of a high Debt-to-Equity ratio is a high return on equity, provided a firm can sufficiently service its debt obligations by generating cash flows. The other advantage of debt is that it allows businesses to leverage large projects and repay the debt over a long period of time. This way the company can become big through leverage and increase returns on equity.

Drawbacks of high debt

A company with a high D/E ratio and making losses will experience greater stress since interest payouts will compound losses and negatively impact its balance sheet. If losses extend for longer, it may result in the company becoming insolvent.

Also, a company with higher debt will have difficulty in keeping the cost of debt down because the company will be considered risky by lenders, who, in turn, will demand higher interest on loans to the company. Investors will also hesitate to put their money in a high-debt company. So, raising equity capital can also become very difficult.

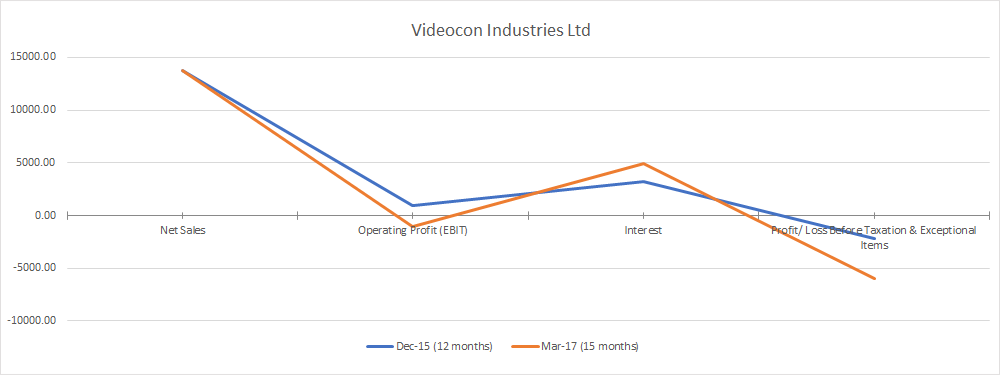

Videocon – A textbook example of what debt can do to a company

| Description | Dec-15 (12 months) | Mar-17 (15 months) |

|---|---|---|

| Net Sales | 13803.59 | 13743.28 |

| Operating Profit (EBIT) | 990.00 | -1072.86 |

| Interest | 3208.08 | 4890.58 |

| Profit/ Loss Before Taxation & Exceptional Items | -2218.08 | -5963.44 |

As you can see from above graph, during the period ending Dec-15, the company was making operating profit, but interest outgo of Rs. 3,208.08 crores washed away all the profits and there was a loss before tax & exceptional items. In the next reported period of 15 months, the company faced harsher business challenges and sales degrowth was registered. Consequently, there was a loss before even interest expense. And, the increase in loss was magnified due to interest expenses, which is reflected in the loss before taxation & exceptional items of a whopping Rs. 5,963.44 crores.

Optimum mix – a trade-off balancing

A company should therefore not over-leverage its balance sheet. It should work out a mix which best suits the dynamics of its business and raise debt only to such an extent till it increases the return for shareholders by decreasing the WACC (weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its debt & equity holders to finance its assets). Any further increase will only aggravate the problems during loss-making years, also creating difficulty in raising equity capital.

Continue with Google

Continue with Google