stockaxis Market Intelligence (Commentary for September 2019; Outlook for October 2019)

October 07, 2019

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’ is a quick update on the markets for the month gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

Global Trends

- India and Russia agree to increase bilateral trade to USD 30 billion by 2025, step up international cooperation and focus on new tech and investment partnership as Modi visits Russia.

- International Air Transport Association (IATA) analysis indicates India a trend beater as domestic air passenger traffic higher by 8.9% in July 19.

- US-India Strategic Partnership Forum in a report notes Indian high-tech sectors can create 550,000 direct and 1,400,000 indirect jobs in next 5 years while holding the potential to attract USD 21 billion in investment.

- Frost & Sullivan’s market analysis indicates global grid analytics market will pick up from USD 1.15 billion in 2018 to USD 2.21 billion in 2025, a CAGR of 10.4%. IoT infrastructure spending by utilities expected to reach more than USD 2 billion by 2024, a CAGR of 20.5%.

- International Migrant Stock 2019 pegs Indian diaspora as the largest in the world at 17.5 million.

- US India Strategic and Partnership forum describes PM Modi’s 50,000 plus audience ‘Howdy Modi!’ event as triumphant and a showcase for bilateral ties and US-India partnership.

- Former Infosys CEO Vishal Sikka describes Artificial Intelligence as a potential major disruptor for Indian society, describes the country’s position as one of ‘inflection point’ with potential to become a world leader in the emerging tech.

- Private Equity (PE) investments in India at USD 2.11 billion in Aug 19, a 59% increase year-on-year.

- Cut in corporate taxes will improve India’s competitiveness in Asia according to IHS Markit. Lower taxes can help increase corporate investment in the medium term.

Domestic Trends

- As startups scramble for talent, employee pay packets become bigger, some employees seeing double salary hikes while companies are willing to pay 20% hike to new joiners.

- 110 multirole aircraft will be purchased for Indian Air Force as India on track to spend USD 130 billion for military modernization over the coming 5-7 years.

- As monsoon ushers in infectious diseases, Pharma companies see a boost of 15.3% (YoY) in Anti-infective segment in Aug 19 and 16.1% in Jul 19 against overall pharmaceutical market growth of 9.4%.

- Private Equity (PE) and Venture Capital (VC) investments reach a record USD 36.7 billion in the first eight months of 2019, according to Indian Private Equity and Venture Capital Association and EY. Infrastructure sector front runner for PE and VC investments.

- Escalating fares bring cheer to the aviation sector. Although domestic air fares lower than last year in festive season, trend is one of increase in fares as passengers book close to major festivals.

- RBI data indicates Indian forex reserves rise to life-time high of USD 429.60 billion, an increase of USD 1 billion in week to Sept 6, 2019 as foreign currency assets increase.

- Favourable policies by Chinese government may help Indian pharma exports touch USD 22 billion. Jul 2019 sees Indian pharma exports record 21.7% growth to USD 1.72 billion.

- Indian banking space presents a huge opportunity for Indian IT services companies as regulatory challenges evolve, fintech firms expand footprints and public sector banks go through a phase of consolidation.

- Zero tax for hotel room tariffs up to Rs. 1,000/night, reduction of GST on hotel room tariffs are a welcome relief for India’s hotel industry, a move welcomed by Federation of Associations in Indian Tourism and Hospitality.

- In a move that can bolster credit supply to small exporters, Reserve Bank enhances loan sanction limits to Rs. 40 crore per borrower from earlier Rs. 25 crore.

- Massive tax cut for corporates may bring India Inc’s savings to Rs. 50,000 crore and help companies cut prices by up to 5% having a rebound effect on consumer demand, according to State Bank of India.

- Cargo traffic at major Indian ports rises 1.85% to 294 Million Tonne (MT) in April-August 2019, with Cochin recording the highest growth, followed by Vishakhapatnam.

- White goods firms see a dual relief in FM Sitharaman’s tax relief measures: Tax relief and ‘Make in India’ which incentivizes setting up of Joint Ventures with foreign manufacturers.

- NASSCOM reports show chip and semiconductors hardware industry will be incentivized by tax rate of 17%. The industry will reach USD 15 billion mark by 2019 and is one of the fastest growing in India.

- Cut in corporate taxes will boost demand for commercial real estate and warehousing, particularly beneficial for developers operating in special economic zones (SEZs).

- Moody’s gauges positive effects on net income of companies due to corporate tax rate cut; final impact will depend on whether companies use surplus earnings for debt reduction, reinvestment in business or for high shareholder returns.

- 34 Non-Life Insurance companies see a rise of 17% in their combined new premium collection at Rs. 15,964 crore, according to IRDAI.

- ICRA issues a statement saying Auto industry will benefit from corporate tax cuts; Original Equipment Manufacturers (OEMs) and their vendors will see incentivization.

- Direct selling industry in India grows 13% in 2018-19 as sales total near Rs. 13,000 crore. Wellness products make up half the volume, according to IDSA report. North and West India top sales.

- RBI data shows bank credit rose 10.26% to Rs. 97.01 lakh crore, deposits by 10.02% to 127.22 lakh crore in fortnight ended Sep 13, 2019. Year-ago fortnight data shows bank advances at Rs. 87.98 lakh crore and deposits at 115.63 lakh crore.

- Student housing as well as co-housing can see investments worth USD 700 million, according to SAPFI-CBRE report. Expansion plans by top 15 student housing players in India is likely to add 6 lakh beds in coming 3-4 years.

Market Trends

- In 2019, Initial Public Offerings (IPOs) have done well with 8 out of 11 IPOs listed trading above their issue prices.

- Simplified norms for KYC by SEBI for FPIs a big hit as foreign investors bring in Rs. 7,714 crore into capital markets in September 2019. FPIs now have permission to carry out off-market transfers of securities.

- FIIs recorded a net outflow of Rs. 6,624.05 crore in September 2019 against net outflows of Rs. 14,828.76 crore in August 2019.

- The Nifty closed at 11,474.45 on 30th September 2019 against 11023.30 on 30th August 2019, having risen by 451.15 points over the previous month.

- The Nifty 50 P/E ratio was at 26.44 at end-September 2019 against 27.27 at end-August 2019. The average P/E ratio for the past 12 months is 27.21.

Highlights

- The Good: Good monsoons, Government’s initiatives on reviving economic growth, green shoots of economic revival

- The Bad: US China trade wars, US Iran conflict, Brexit

stockaxis’ Outlook for October 2019

Insurance sector – positive going forward

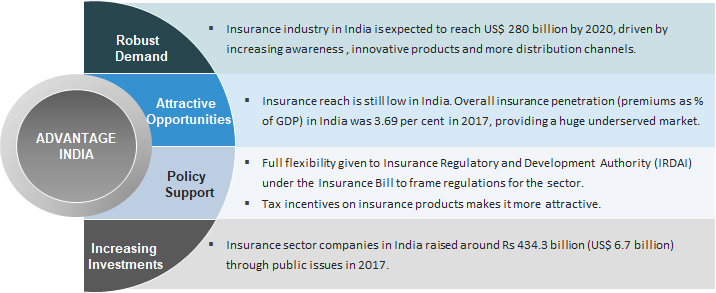

India’s Insurance industry comprises of 57 insurance companies, of which 24 are in life insurance and 33 are in general insurance business. In FY18, the gross premiums written in the country reached a figure of Rs.5,53,000 crore (USD 94.48 billion), with life insurance premiums being at Rs.4,58,000 crore (USD 71.1 billion) and non-life insurance premiums being at Rs.1,51,000 crore (USD 23.38 billion). In terms of insurance penetration (premiums as percentage of GDP), the figure has reached 3.69% in 2017 compared with 2.71% in 2001. These figures clearly indicate that Indians are grossly underinsured.

In FY19 (till October 2018), the premiums from new life insurance policies rose 3.66% on a y-o-y basis to Rs.1,09,000 crore (USD 15.46 billion) and premiums of non-life insurers rose to Rs.96,205 crore (USD 13.71 billion). This is a year-on-year (y-o-y) rise of 12.40%.

The Insurance sector in India is increasingly looking promising as recent policy changes make the sector more interesting and dynamic. In September 2018, the National Health Protection Scheme was launched under the Ayushman Bharat umbrella. This scheme will provide coverage of Rs. 5 lakh to more than 100 million families and increase the health penetration to 50% from the present 34%. The Insurance Regulatory and Development Authority of India (IRDAI) has plans to issue redesigned guidelines for insurance companies in India for issuance of Initial Public Offerings (IPOs). These guidelines are for those companies that seek to divest equity through the IPO route. Changes have been made by IRDAI that affect customers as well. These include:

- Raising withdrawal limits on pension plans from 33% to 60%

- Shortening the tenure of surrender of policies from 3 years to 2 years

- Guaranteeing a minimum surrender value even for policies where premium has only been paid for one year

- Giving customers the freedom to choose annuity providers

- Increasing flexibility in Unit Linked Insurance Plans (ULIPs) to carry out asset allocation

- Adding the option for direct payment for ULIP riders like accident or disability benefit instead of being forced to accept unit deduction.

Trends in the Indian insurance industry point towards increasing adoption of technology by customers. By 2022, there will be 859 million smartphone users in India, double that of 468 million in 2017. Cheap internet data and a young population means that customers are well informed and tech savvy. Further, the ongoing fourth industrial revolution has led to emergence of technologies such as artificial intelligence (AI), Internet of Things (IoT) and Blockchain. The amalgamation of these technologies and insurance has created the field of InsureTech with insurance companies adopting various technologies to deliver services such as chatbots to carry out customer service, drones to survey properties or blockchain to make and guarantee contracts. These trends have also translated into new business models and distribution avenues. Peer-2-Peer insurance has come into vogue, where people with common interests can form a pool to fund risk mitigation. Digital insurance is common now, with customers never having to even visit a website to get insured; as an example, train passengers can opt to be insured while buying a ticket. New distribution channels have come into play with robo-advisors providing insurance customers with a ‘seamless’ experience online.

Source: IBEF

Going forward, there are positive trends in the Indian insurance industry. Protection penetration for urban working population which is at just 8% as of 2019 is expected to grow at a CAGR of 18% between FY 19-25. New business premium (NBP) which has a growth of 40% YTD (year to date) will be sustained in the medium term as there are strong growth opportunities in the protection business. The Indian insurance industry is going through a phase of consolidation. Top seven private players in the country have seen their market share rise from 74% in FY12 to 80% in FY19 in terms of NBP. We can expect acquisitions and mergers on an industry-wide basis.

By 2020, the Indian insurance industry overall will reach USD 280 billion mark, with life insurance alone expected to grow by 12-15% annually in the next 3-5 years. On the general insurance side, strong punishments proposed under the new Motor Vehicles Act which include three months of imprisonment and a fine of Rs. 2,000 for an uninsured vehicle for the first offence means that insurance companies are seeing robust renewals and sales. Further, there are discussions to link insurance premiums with traffic violations, with offenders seeing an escalation in their premiums. We can say that in case of the insurance industry, there is perfect storm of a supportive regulator, strong government push towards increasing the ambit of coverage in both life and non-life segments, favourable demography of the country and fortuitous developments in technology that make this sector shine in the medium to long term.

We, at stockaxis, are constantly on the lookout for great businesses run by honest promoters that are available at the right price with sufficient margin of safety. Our stringent stock selection guidelines and clearly stipulated entry and exit points make equity investing a ‘rich’ experience for our investors!

Continue with Google

Continue with Google