stockaxis Market Intelligence (Commentary for October 2018; Outlook for November 2018)

November 05, 2018

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’ is a quick update on the markets for the month gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

Global Trends

- India continues to lead the world in Business Process Management, generating nearly US$ 32.5 bln in revenue. Revenue growth is expected to be US$ 167 bln in FY 18.

- The World Bank has stated that Indian growth trajectory points northwards as the country has overcome disruptions caused by GST and demonetization. Growth is projected to accelerate to 7.3% in FY 18-19.

- The IMF projects Indian growth at 7.3% in 2018 and 7.4% in 2019 as the economy has overcome shocks amidst an environment of strong investments and private consumption.

- World Economic Outlook of the IMF projects steady world growth at 3.7% over 2018-19.

- EY survey indicates that 74 Indian companies in Germany generated revenues of EUR 11 bln, while generating employment for 23,000 people.

- India’s Venture Capital market saw investments worth US$ 2 bln in 2018 with Oyo Rooms alone accounting for USD 1 bln, according to KPMG.

- China has agreed to increase imports from India. A meeting is scheduled to be held in November 2018 to discuss market access and trade regulations, says Trade Minister, Suresh Prabhu.

Domestic Trends

- RBI’s Monetary Policy Committee (MPC) indicates that agricultural growth is high due to robust production of rice, pulses and cereals with production estimates higher by 1.9% from the May 2018 numbers.

- RBI’s MPC revised inflation projections to 3.9-4.5% for H2 FY19 from earlier 4.8%. Inflation in Q1 FY20 is expected to be 4.8%.

- India is expected to be the 11th wealthiest nation by 2022 in terms of personal wealth. Personal wealth is set to grow at 13% to USD 5tn, according to Boston Consulting Group.

- FICCI-Deloitte report shows that Indian retail industry will grow at CAGR of 10% to reach US$ 1.2 tln by 2021; by 2026, the retail industry is set to grow to US$ 1.7 tln.

- Housing sales were up by 24% even as new supply reduced by 35% in 9 cities, in July-Sept 2018.

- Lloyd’s survey shows that India is the second most uninsured country with insurance gap of US$ 27 bln.

- India will beat US to become the second largest consumer of steel in the world by 2019. Demand for steel in India has doubled in the last decade.

- NASSCOM reported that startups have seen 108% growth in funding from US$ 2 bln in 2017 to US$ 4.2 bln in 2018.

- India is expected to have 650 mln smartphone users with average data usage touching 18 GB per day by 2022, according to EY.

- India’s manufacturing increased to 53.10 in October 2018 from 52.20 in September 2018. A reading above 50 indicates an expansion of the manufacturing sector compared to the previous month.

- The Indian Rupee depreciated vis-à-vis the dollar; it was at INR 73.82 as on 1 November 2018 against INR 72.5121 as on end-September.

Market Trends

- India Inc.’s credit quality remained robust in H1 FY19, according to CRISIL. There were 685 upgrades to 408 downgrades in the first half of 2019.

- Maharashtra took steps to reform GST in order to promote ease of doing business; these changes came into effect October 1, 2018.

- Investments in Indian capital markets through Participatory Notes (P-Notes) rose to Rs. 86,647 crore till August-end. Investments levels rose for the first time in 10 months.

- 128 Initial Public Offerings (IPOs) gathered US$ 5.24 bln till August 2018, according to Market Insight report of EY.

- Net investment by Domestic Institutional Investors (DIIs) in October 2018 was Rs. 26,033.90 crore against net investment of Rs. 12,504.04 crore in September 2018.

- FIIs recorded a net outflow in Indian equities of Rs. 29,201.20 crore in October 2018 against a net outflow of Rs. 9,468.68 crore in September 2018.

- The Nifty closed at 10,386.60 as on 31st October 2018 against 10930.45 as on 28th September 2018, having fallen 543.85 points over the previous month.

- The Nifty 50 P/E ratio was at 25 at end-October 2018 against 26.44 at end-September 2018. The average P/E ratio for the past 12 months is 26.50.

Highlights

- The Good: Earnings growth, rural recovery, NPA resolution

- The Bad: Crude prices, weakening currency, trade wars

stockaxis’ Outlook for November 2018

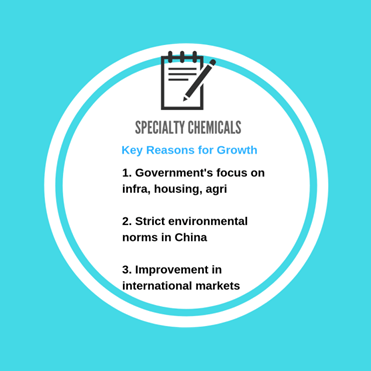

Specialty Chemicals

Specialty chemicals end-use industries such as textiles, automotive, personal care, construction chemicals and agrochemicals, as well as application-driven segments such as surfactants, paints, coatings and colorants are expected to continue experiencing high growth in the medium-term. Government’s focus on affordable housing, agriculture and increased expenditure on infrastructure development will further spur demand for performance-enhancing chemicals. This will be the main driver for the domestic specialty chemicals sector. India Ratings report on FY19 Outlook: Specialty Chemicals states -- “The Indian chemicals sector is a market worth about USD 160 billion, with specialty chemicals representing about 20 per cent of the value. We expect the specialty chemicals sector to grow by about 10 per cent annually to almost double the market size by FY25." Implementation of strict environmental norms in China has reduced the competitive advantages of Chinese firms, especially inefficient smaller firms that became unviable. In 2017, an estimated 40% of chemical manufacturing capacity in China was temporarily shut down for safety inspections, with over 80,000 manufacturing units charged and fined for breaching permissible emission limits. This has led to big opportunities for Indian specialty chemicals manufacturers. Despite rise in input costs (crude oil, benzene, coal etc.), Indian specialty chemicals companies should do well due to improved product prices, better product mix and moving up the value chain. Currency depreciation will further improve performance as most manufacturers have 40%-50% exposure to exports.

Consumer sector

Indian urban discretionary consumption is chugging along while rural consumption is improving. Rural demand continues to be higher than urban demand. Demand drivers have been farm loan waivers, land purchase for roads, increased budgets for rural employment programs and other government welfare. Private consumption has been holding strong due to government rural spending, stable demand, tepid inflation, and ease of credit at reasonable interest rates. This has been reflected in decent volume growth in FMCG, autos and consumer durables. Added demand push will come from higher minimum support prices (MSPs) and the forthcoming central elections. While crude prices are currently at high levels, there is an expectation of a decline in oil prices (they have declined over 10% from recent peaks) and consequently lower inflation, which will lead to volume growth in the defensive/consumption sector, going forward. Players in this sector are also expected to launch new products in FY19, which will further boost demand. Additionally, most FMCG players have witnessed a rise in export business due to improvement in consumer sentiments and favourable currency.

We, at stockaxis, are constantly on the lookout for great businesses run by honest promoters that are available at the right price with sufficient margin of safety. Our stringent stock selection guidelines and clearly stipulated entry and exit points make equity investing a ‘rich’ experience for our investors!

Continue with Google

Continue with Google