stockaxis Market Intelligence (Commentary for April 2020; Outlook for May 2020)

May 09, 2020

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’is a quick update on the markets for the month gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

Global Trends

- US India Strategic and Partnership Forum (USISPF) president Mukesh Aghi stated that India has the best opportunity to attract foreign investment and replace China as the world's manufacturing hub as a result of the COVID-19 crisis.

- India received support from The World Bank through a fast-track USD 1 billion India COVID-19 Emergency Response and Health Systems Preparedness Project to help the country deal with the COVID-19 pandemic.

- As per RBI, India’s forex reserves surged by $5.65 billion to $475.56 billion as on March 27 as a result of higher foreign currency assets.

- Gartner’s 2019 Digital Workplace Survey found that India is the most digitally dexterous country in the world with 67% of Indian digital workers stating that emerging technologies such as machine learning, artificial intelligence, Internet of Things have enhanced work effectiveness.

Domestic Trends

- According to a report by CBRE South Asia, investments in the Indian real estate market increased 27% to touch $6 billion in 2019.

- India’s chemical sector became the top exporting sector during the period April 19 – January 20 period rising 7% to Rs 2.68 lakh crore.

- As per a Capgemini survey, the Covid-19 pandemic and resulting lockdown will see a rise in online shopping to 64% from 46% over the next 6-9 months.

- The Indian Meteorological Department (IMD) has forecast normal monsoons this year.

- Paytm, a digital payment platform, has registered over 200% rise in payments for broadband services and online entertainment streaming.

Market Trends

- FIIs recorded a net outflow of Rs. 7,177.30 crore against a net outflow of Rs. 65,816.70 crore in March 2020.

- The Nifty closed at9,859.90 on 30th April 2020 against 8,597.75 on 31st March 2020, having risenby 1,262.15points over the previous month.

- The Nifty 50 P/E ratio was at22.35 at end-April 2020 against 19.38 at end-March 2020. The average P/E ratio for the past 12 months is26.69.

Highlights

- The Good: Low oil prices, efforts to contain Covid-19, Lower health impact of Covid-19 on Indian citizens

- The Bad: Corona virus impact on world economies

stockaxis’ Outlook for May 2020

Fall in crude prices: Advantage India

With the ongoing Covid-19 pandemic, life has come to a standstill. Flights have been grounded, vehicles are permanently parked, factories have shut down and demand has vanished. On the other side, the lifeblood of production, transport and commuting, oil, has seen supply continue at pre-Covid-19 levels. This has resulted in a supply glut and no buyers. In an unprecedented situation with excessive supplies and all the world’s oil storage capacities full to the brim, oil, which has so far been called ‘black gold’, is crying for buyers. Oil suppliers are willing to pay buyers to get rid of their oil stock (Western Texas Intermediate (WTI) sweet crude oil was quoting at (-)$37.6 a barrel on 20 April 2020; this is a 305% fall from $55.90 per barrel).

Oil and India

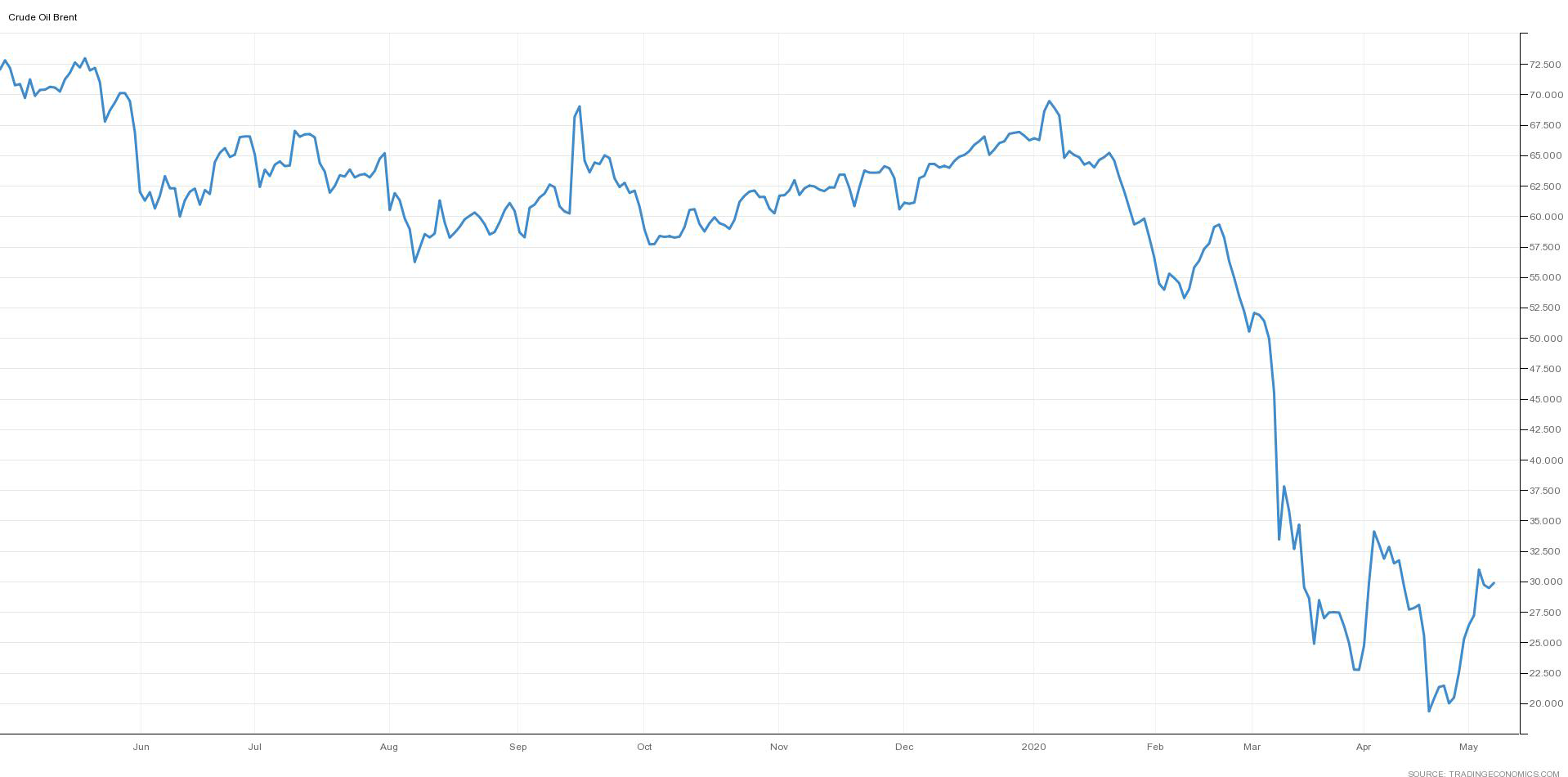

Crude oil is categorised as - Western Texas Intermediate (WTI) and Brent. India primarily imports Brent. Brent was quoting at around $20-25 a barrel, the lowest in 18 years.

India is the world’s third largest oil consumer with about 84% of its oil requirements being imported in 2018-19. Mineral fuels (including oil) imports constituted about 32% of India’s total imports with the country’s oil import bills running into billions of dollars. Most of India’s oil imports (about 80%) is from OPEC countries (Organization of the Petroleum Exporting Countries). India’s strategic petroleum reserves (SPR) (the oil it holds) constitutes about 85-90 days of the country’s crude requirement.

Falling oil prices will naturally reduce India’s import bill. This will not only reduce India’s dollar requirements, but will also lead to stability of the Indian rupee. This is an opportunity for India to stock up its oil requirements at the current low prices in order to achieve energy security and revive the economy once Covid-19 pandemic is brought under control.

To take advantage of low oil prices, India has decided to fill its strategic petroleum reserves (SPR) to their full capacity. The government has set up nearly 5 million metric tons (MMT) of strategic crude oil storages at three locations - Visakhapatnam, Mangalore, and Padur.