stockaxis Market Intelligence (Commentary for February 2020; Outlook for March 2020)

March 03, 2020

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’ is a quick update on the markets for the month gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

Global Trends

- India will import crude oil from Russia's Far East region based on a trade deal with Russia. This will bring the annual bilateral trade between the two countries from the current USD 11 billion to USD 25 billion.

- According a report by Deloitte India titled, 'Retail FDI in India', increasing FDI in retail will result in consumption-led growth.

- "Fintech investments in India nearly doubled to $3.7 billion in 2019 from $1.9 billion the previous year, putting the country as the world's third largest fintech centre, behind only the US and UK," an Accenture analysis of data from CB Insights said.

Domestic Trends

- As per a report by IDC, the Indian wearables market recorded a y-o-y growth of over 168% in 2019, with shipments touching 14.9 million units.

- According to a report by Boston Consulting Group (BCG), the Indian retail market is expected to cross the trillion-dollar mark by 2025 as a result of higher demand-driven consumption.

- Indian companies can now list their global depository receipts either by a public offering on private placement, which will help companies get another avenue for raising funds.

- Government data shows that India will record wheat production of 106.21 million tonne in 2019-20 as a result of good monsoons.

Market Trends

- FIIs recorded a net outflow of Rs. 12,684.30 crore in February 2020 against a net outflow of Rs. 5,359.51 crore in January 2020.

- The Nifty closed at 11,201.75 on 29th February 2020 against 11962.10 on 31st January 2020, having fallen by 760.35 points over the previous month.

- The Nifty 50 P/E ratio was at 25.49 at end-February 2020 against 26.41 at end-January 2020. The average P/E ratio for the past 12 months is 27.89.

Highlights

- The Good: Expected US-China trade resolution, positive Q3 corporate results, GDP growth expected to rise

- The Bad: Corona virus impact on world markets

stockaxis’ Outlook for March 2020

Impact of Coronavirus on your investments

Corona virus, which has been termed in technical jargon as CoVid-19, has created a strong negative impact on markets across the world. The virus, which appears to have originated from the Hubei province and specifically from Wuhan city in Hubei, has spread to citizens in 32 countries and recorded 2,622 deaths as per recent reports.

While in the short term, markets are expected to record a downtrend, the past has repeatedly shown us that the impact of these epidemics on the stock markets are often short-lived. We have seen markets gyrate downwards and then recover during the SARS (severe acute respiratory syndrome) scare, the Ebola virus and other such health scares. There are a number of laboratories, universities, etc. in the process of creating a vaccine to prevent further spread of this virus. Besides, there is consensus that the virus is expected to be contained by the last quarter of this year.

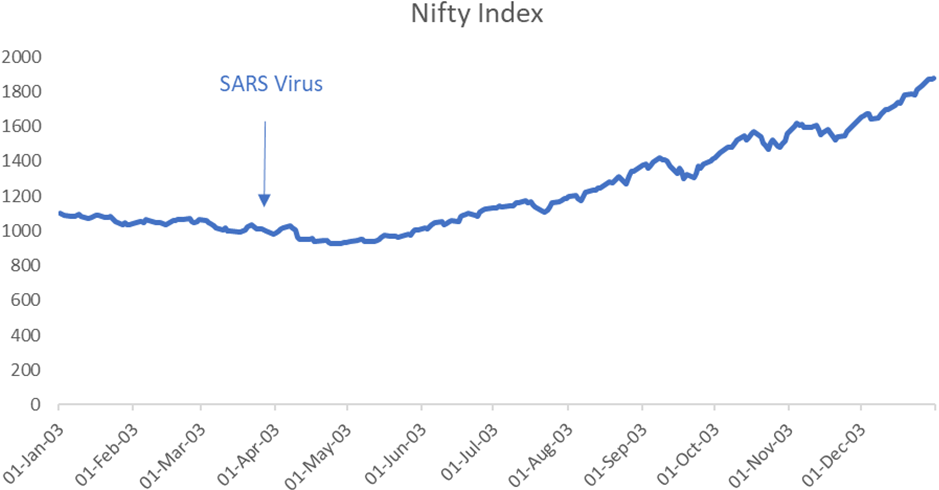

The SARS virus outbreak took place in April 2003. The markets touched a low of 924.3 on 25 April 2003. By December 2003, the market had risen to 1879.75, recording an annualized return of 151%.

The impact of the recent Corona virus on the stock markets across the world has been more pronounced especially due to the current high valuations that markets have recorded and the spread of (mis)information via social media channels.

Black Swan-like incidents such as the Corona virus provide long term investors an opportunity to pick quality stocks at very attractive prices, which, in turn, provide superlative returns over the long term. We strongly advice our investors to view this situation as an opportunity to build a strong equity portfolio with top-rung companies which are leaders in their industry group and have the potential to grow exponentially.

We, at stockaxis, are constantly on the lookout for great businesses run by honest promoters that are available at the right price with sufficient margin of safety. Our stringent stock selection guidelines and clearly stipulated entry and exit points make equity investing a ‘rich’ experience for our investors!

Continue with Google

Continue with Google