stockaxis Market Intelligence (Commentary for February 2019; Outlook for March 2019)

March 02, 2019

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’ is a quick update on the markets for the month gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

Global Trends

- The top 10 growing cities in the world are in India with Surat, Agra and Bengaluru being in the lead as western city growth takes a back seat.

- India emerges as the most digitally mature nation with Brazil and Thailand as runners up, according to the Dell Technologies Digital Transformation Index. Developed countries fare poorly.

- Closing the skills gap, a partnership between TCS and World Economic Forum aims to train 17.2 million professionals as the fourth industrial revolution unfolds.

- The Asia Pacific region (APAC) emerges as the forerunner in the US$ 5,180 million global digital banking market with India and China assuming the lead in the region.

- A report by Oxford Economics claims that India will remain the world’s fastest growing economy in the next decade with average growth being near 6.5% between 2019 and 2028.

Domestic Trends

- At the two-day event of India Food Forum 2019, India emerges as a major world food market; new avenues for partnership by global partners explored.

- FMCG segment back on track due to sales and margin driven growth in Q3 after facing a few challenging quarters due to increased competition from unlisted companies.

- According to IATA, the domestic Indian aviation market clocked the fastest growth in 2018 at 18.6%.

- Infrastructure growth to remain stable in FY20 according to ratings agency India Ratings & Research. Per day road construction reaches record high of 31.4 km during 2018-19.

- Naukri JobSpeak index for Jan 2019 reaches 2,251 levels as hiring activity sees 15% growth driven by IT software industry.

- Bengaluru witnesses 6.6% office rental growth in 2019, the third highest in the world; New Delhi is the fourth fastest at 6.5% according to the Knight Frank Global Outlook 2019 report.

- India’s boom in e-commerce and organised retail to take packaging industry to US$ 72.6 billion by FY20.

- Morgan Stanley estimates that India’s e-commerce sector will touch US$ 200 billion by 2027. E-commerce is taking market share away from the offline segment due to price attractiveness, aggregation of demand and convenience.

- Payroll data shows that 7.16 lakh jobs were created in December 2018, while 72.32 lakh in the last 16 months. 72.32 lakh new EPFO subscribers were added between Sep17 and Dec18.

- Bengaluru, Hyderabad, Chennai and Kolkata made it to the list of top 10 micro markets which saw maximum year-on-year rental increases in Q4 2018 according to Colliers Research.

- Economic growth to see a boost thanks to 5G introduction, says TRAI. New capabilities such as telesurgery and autonomous vehicles become a reality.

- Real Estate sector gets a boost as GST council reduces tax on under-construction residential properties. GST is now at 1% for affordable housing and 5% for normal category.

- The country’s sole weather forecasting agency Skymet says more than 50% chance that India will witness a normal monsoon in 2019.

- Microfinance industry loan portfolio grows at 43.1% to Rs 1,66,284 crore as of December 2018.

- Boston Consulting Group estimates that India’s consumer market would triple to Rs. 335 trillion by 2028. Growth driven by increasing affluence, demographics, urbanisation and shifting family structures.

- The Nikkei India Manufacturing PMI increased unexpectedly to 54.3 in February 2019 from 53.9 in a month earlier and beating market expectations of 53.5. A reading above 50 indicates an expansion of the manufacturing sector compared to the previous month.

- The Indian Rupee strengthened vis-à-vis the dollar; it was at INR 70.8203 on 28 February 2019 against INR 71.1793 on 31 January 2019.

Market Trends

- RBI set to overhaul equity holding structure for financial conglomerates; the central bank is exploring the holding company model for banks.

- FIIs recorded a net inflow of Rs 12,052.89 crore in February 2019 against a net outflow of Rs. 5,556.22 crore in the previous month.

- The Nifty closed at 10792.50 on 28th February 2019 against 10830.95 on 31st January 2019, having fallen marginally by 38.45 points over the previous month.

- The Nifty 50 P/E ratio was at 26.32 at end-February 2019 against 26.26 at end-January 2019. The average P/E ratio for the past 12 months is 26.39.

Highlights

- The Good: Economic growth momentum to continue, improvement in employment numbers, India - attractive consumption market

- The Bad: Global trade slowdown, election uncertainty

stockaxis’ Outlook for March 2019

Impact of FinTech in the financial sector:

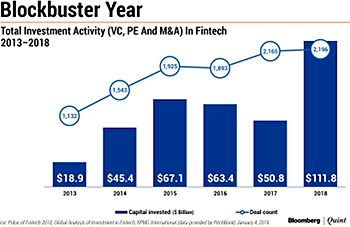

FinTech or Financial Technology is changing the face of the financial services sector as nimble FinTech startups emerge and disrupt existing business models and practices. While in India the FinTech sector is relatively young, the Indian government’s push towards digitalisation and a cashless society mean that this sector has innumerable opportunities. The country is witnessing the impact of FinTech in the Peer-to-Peer lending services segment where alternative credit models and data sources are being used to provide quicker and easier access to credit. Payments is another area where FinTech has had a marked effect with wallet providers rivalling banks and the unique opportunities existent in India due to the regulatory approval of payments banks. India is the largest remittance market in the world at US$ 69 billion according to the World Bank, and startups have the opportunity to fill in the gaps to address remittance needs of Indians - both inbound and outbound. In the arena of personal finance, there is now a possibility of providing tailor-made solutions and information to individuals using data available, thanks to FinTech. Equity funding can be conducted through crowdfunding models including Initial Coin Offerings (ICOs). This said, there are tight restrictions on cryptocurrency in the country; however this may change in the near future as regulators erect the necessary framework for their use or even introduce an official cryptocurrency, which has been discussed in the past. Banks, NBFCs and IT companies from the listed space will be some of the beneficiaries to this fintech revolution.

FinTech or Financial Technology is changing the face of the financial services sector as nimble FinTech startups emerge and disrupt existing business models and practices. While in India the FinTech sector is relatively young, the Indian government’s push towards digitalisation and a cashless society mean that this sector has innumerable opportunities. The country is witnessing the impact of FinTech in the Peer-to-Peer lending services segment where alternative credit models and data sources are being used to provide quicker and easier access to credit. Payments is another area where FinTech has had a marked effect with wallet providers rivalling banks and the unique opportunities existent in India due to the regulatory approval of payments banks. India is the largest remittance market in the world at US$ 69 billion according to the World Bank, and startups have the opportunity to fill in the gaps to address remittance needs of Indians - both inbound and outbound. In the arena of personal finance, there is now a possibility of providing tailor-made solutions and information to individuals using data available, thanks to FinTech. Equity funding can be conducted through crowdfunding models including Initial Coin Offerings (ICOs). This said, there are tight restrictions on cryptocurrency in the country; however this may change in the near future as regulators erect the necessary framework for their use or even introduce an official cryptocurrency, which has been discussed in the past. Banks, NBFCs and IT companies from the listed space will be some of the beneficiaries to this fintech revolution.

India’s changing consumption profile:

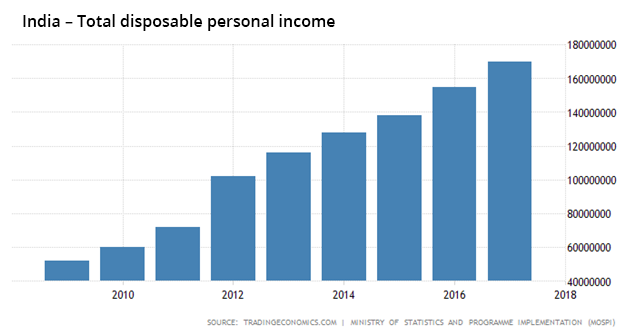

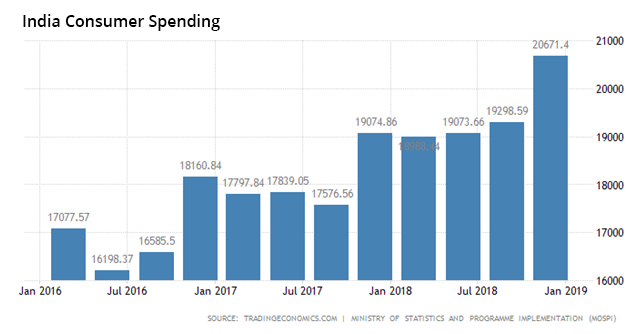

India is all set to become the third largest consumer market by 2030. At the moment, India enjoys a GDP growth rate of 7.5% and is tagged as the world’s fastest growing major economy. With fast growing incomes and an expectation that the growth of the Indian middle class would uplift 25 million households out of poverty, India is riding a consumption wave. Domestic consumption that is the backbone of 60% of the GDP, will translate into US$ 6 trillion opportunity by 2030. According to figures reported by the Bain Price Consumer Survey 2018, It is expected that new categories such as healthy and organic food alone would contribute 32% of the total incremental spending on food consumption by 2030. Formal wear would add 25%, while communication would add an overwhelming 72%. In India, the consumption growth will be driven by middle income consumers who are sensitive to price points and it is expected that nearly US$ 2 trillion of incremental spending will be on products and services described as “more of the same”. We will witness a trend of “many Indias” where the top 40 cities will form a $ 1.5 trillion opportunity, but thousands of Indian small towns will offer the same opportunity in consumption growth as well. The divide between rural-urban India will diminish significantly. In short, the drivers for the change in Indian consumption profile are rising incomes, changing attitudes, technology and demographics.

Media emergence of OTT players:

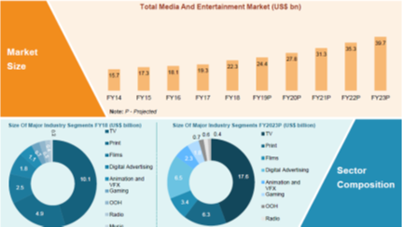

On demand content consumption through ‘over the top’ (OTT) service providers is now an established fact of life. Consumers have a choice in both audio and video content streaming like at no other point in history. The year 2018-19 is a crucial period in India when it comes to media emergence of OTT players. While Netflix has dedicated Rs. 600 crore per year to original content in India and Amazon had committed Rs. 2,230 crore in 2017, to be allocated over the next 2-3 years, new entrants like Spotify have made their presence felt as well. Local companies like Balaji, Zee etc. have also stepped up their game and have entered the OTT segment. According to Deloitte, Video and Audio alone will generate 89% of internet data traffic by 2018 globally and this is being driven by innovation in better mobile networks like 4G and LTE technologies. The growth in India would be substantial as well with OTT market which stood at US$ 0.5 billion in Nov 2018 expected to grow to US$ 5 billion by 2023 as per figures made available in a Boston Consulting Group (BCG) report. With the emergence of these OTT channels, we can expect more original content for India to be generated, convergence of digital advertising and e-commerce, more content regulation from authorities and a highly competitive environment as near-future trends.

On demand content consumption through ‘over the top’ (OTT) service providers is now an established fact of life. Consumers have a choice in both audio and video content streaming like at no other point in history. The year 2018-19 is a crucial period in India when it comes to media emergence of OTT players. While Netflix has dedicated Rs. 600 crore per year to original content in India and Amazon had committed Rs. 2,230 crore in 2017, to be allocated over the next 2-3 years, new entrants like Spotify have made their presence felt as well. Local companies like Balaji, Zee etc. have also stepped up their game and have entered the OTT segment. According to Deloitte, Video and Audio alone will generate 89% of internet data traffic by 2018 globally and this is being driven by innovation in better mobile networks like 4G and LTE technologies. The growth in India would be substantial as well with OTT market which stood at US$ 0.5 billion in Nov 2018 expected to grow to US$ 5 billion by 2023 as per figures made available in a Boston Consulting Group (BCG) report. With the emergence of these OTT channels, we can expect more original content for India to be generated, convergence of digital advertising and e-commerce, more content regulation from authorities and a highly competitive environment as near-future trends.

We, at stockaxis, are constantly on the lookout for great businesses run by honest promoters that are available at the right price with sufficient margin of safety. Our stringent stock selection guidelines and clearly stipulated entry and exit points make equity investing a ‘rich’ experience for our investors!

Continue with Google

Continue with Google