stockaxis Market Intelligence (Commentary for July 2019; Outlook for August 2019)

August 03, 2019

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’ is a quick update on the markets for the month gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

Global Trends

- Worldwide Database Management System (DBMS) revenue grows 18.4% in 2018 to USD 46 billion. Gartner estimates 75% of all databases will be cloud deployed by 2022.

- India attracts USD 64.4 billion in FY 18-19 despite global headwinds, aims for a USD 5 trillion economy tag.

- 271 million people in India rise out of poverty in the decade spanning 2006-16 according to the United Nations Development Programme (UNDP). Strong improvements in assets such as cooking fuel, sanitation and nutrition.

- On last count, 250 game development companies operational in India. Immense potential to become outsourcing hub for international gaming companies.

- India sees immense growth in digital transactions as they rise 382% over last year. UPI alone grows 71% according to Razorpay report.

- India rises as the most innovative economy in Central and South Asian regions, jumps 5 places to rank 52nd in Global Innovation Index 2019.

- India receives the highest ever FDI inflow at USD 63.37 billion during FY19 according to the government.

Domestic Trends

- Startups raise USD 1.17 billion in first six month of 2019 according to Venture intelligence as investors doubled down on Series B and C rounds considered as growth stages.

- JSW Group and PwC report identifies Odisha as having potential for a USD 1 trillion economy. Agriculture, food processing, mineral based industries etc. identified as drivers.

- CFA institute report states India holds potential to be the world’s future investment hub with financial services industry in the country to see the highest job growth in the world.

- RBI data indicates India’s forex reserves touch all time high of USD 429.91 billion at week ended July 5, 2019. Gold reserves rise by USD 3.65 billion over the year.

- NASSCOM estimates demand for digitally skilled talent to grow at 35% CAGR till 2023 of current talent base of 4 million. The industry body mulling tie ups to reskill existing base.

- Fundraising to become easier through various financial instruments as Companies Act gets a fine tune by the Union Government.

- Cheaper operating costs and better savings lead to electric three-wheelers selling more than conventional counterparts for the first time in India.

- Unsold luxury home inventory falls 12% with Bengaluru recording 49% reduction and Kolkata 37% fall and NCR and MMR stocks falling 7% each according to ANAROCK survey.

- In 2018, Digital Media in India grew by 42% and was valued at USD 2.4 billion. Poised to reach USD 5.1 billion by 2021 according to FICCI-EY Report.

- Median salary increments to be 10.95% for corporate India according to Jobs and Salaries Primer 2019 report. Banking, financial services, insurance, BPO and IT enabled services along with several other sectors to be top paymasters.

- Calendar Year 2019 will see a 10% revenue growth for readymade garment makers according to CRISIL ratings, thanks to healthy domestic demand and 10% growth in exports.

Market Trends

- FIIs recorded a net outflow of Rs. 16,870.13 crore in July 2019 against a net outflow of Rs. 688.50 crore in June 2019.

- The Nifty closed at 11085.40 on 30th July 2019 against 11788.85 on 28th June 2019, having fallen by 703.45 points over the previous month.

- The Nifty 50 P/E ratio was at 27.34 at end-July 2019 against 28.98 at end-June 2019. The average P/E ratio for the past 12 months is 27.35.

Highlights

- The Good: Monsoon pick-up, India is the only major Asian nation recording growth in exports, focus on removing hurdles from ‘Housing for all by 2022’ mission

- The Bad: Economic slowdown, lack of growth triggers in Budget 2019, higher tax on super-rich

stockaxis’ Outlook for August 2019

Green shoots in the pharma sector

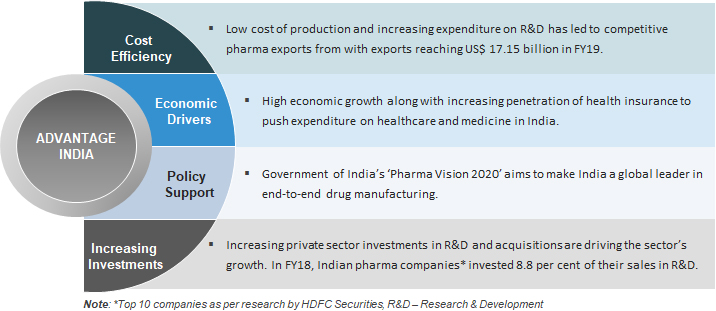

The Indian pharmaceutical (pharma) industry is in the process of consolidating and preparing for growth going forward. From a situation of receiving enquiries, observations and warning letters from the US Food and Drug Administration (USFDA), players in this sector have used these challenges to improve operations, invest in automation, better collaboration with regulators and staff training.

Source: www.ibef.org

Several factors precipitated the decline of the Indian pharma sector in the recent past; these include regulatory issues, consolidation of channels in the US (big pharma buyers in the US came together to negotiate hard with pharma companies, which led to lower margins for Indian pharma companies), increased competition, etc. These led to a fall in revenue of US focused Indian pharma companies by 30% over FY18. In FY19, a gradual revival in the fortunes of large cap pharma companies is expected. The key reasons for the expected growth are expected launches of several new lucrative products like inhalers, trans-dermals, biosimilars and other niche injectables, stabilization of prices of generics, resolution of regulatory issues, setting up of new capacities, entry into new geographies, etc. Indian pharma companies have realized the need to increase R&D in order to innovate to stay competitive. R&D spends in most pharma companies have peaked as a result.

The scale of the Indian pharma sector can be gauged from the fact that it was worth USD 33 billion as of 2017 and is growing at a CAGR of 22.4% over 2015-20 and expected to reach USD 55 billion figure. Indian pharma exports reached US$ 19.14 billion in FY19 and these constitute bulk drugs, drug formulations, biologicals, intermediaries and Indian traditional medicine (Ayurveda) products. Companies from India have received 304 Abbreviated New Drug Application (ANDA) approvals from the USFDA as of 2017. Indian generics make up 30% by volume and 10% by value in the United States. USFDA approvals have remained strong in the fourth quarter of 2019 with the US regulator approving 254 ANDAs in this period alone.

Going forward, the export story of the Indian pharma industry won’t be the only focus. Indian pharma industry has realized the need to move up the value chain to remain relevant. The government has already announced a ‘Pharma Vision 2020’ which is aimed at making the country an end-to-end leader in drug manufacturing in the world. Domestically, the National Health Protection Scheme, which is the world’s largest government funded healthcare programme has been announced. The Drug Controller General of India (DCGI) has already announced their plans to start a single-window facility for providing approvals, consents and other information and this is expected to give a push to the ‘Make in India’ initiative. Medicine spending in the country is slated to grow at 9-12% over the coming five years. Thus, in the next couple of years, the Indian pharma industry is gearing itself for a revival on both domestic and international fronts. The Indian pharma industry can also benefit from the emerging niche specialists, companies that only focus on certain therapies and diseases and provide complete care solutions focused on certain modalities. On the micro level, the companies that will be successful thus would be ones that adapt to changing environment rather than just upscaling or tinkering with their existing business models. However, for the industry overall, this is the beginning of a new turnaround.

We, at stockaxis, are constantly on the lookout for great businesses run by honest promoters that are available at the right price with sufficient margin of safety. Our stringent stock selection guidelines and clearly stipulated entry and exit points make equity investing a ‘rich’ experience for our investors!

Continue with Google

Continue with Google