stockaxis Market Intelligence (Commentary for March 2019; Outlook for April 2019)

April 01, 2019

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’ is a quick update on the markets for the month gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

Global Trends

- GSM Association’s 8th ‘State of the Industry’ Report shows global mobile money transactions were worth US$ 1.3 billion in 2018 leading to greater financial inclusion.

- Moody’s pegs India’s growth at 7.3% in 2019 and 2020; says the country is less exposed to global manufacturing trade growth compared with other Asian peers.

- World Bank set to provide India with USD 250 million loan for the National Rural Economic Transformation Project (NRETP) aimed at helping women in rural households.

- India is one of the fastest growing major world economies according to International Monetary Fund (IMF). Important reforms implemented, but more needed to sustain growth to tap demographic dividend.

- Zinnov Zones for Digital Services 2019 study points out global enterprise spend at USD 575 billion in 2018 and expected to grow at CAGR (Compound Annual Growth Rate) of 20% to reach USD 1.2 trillion by 2022. 85% of top global enterprises creating intelligent platform-centric business models.

- Pew Research survey indicates 55% of Indians happy with situation of the country and feel they are better off than 20 years ago.

Domestic Trends

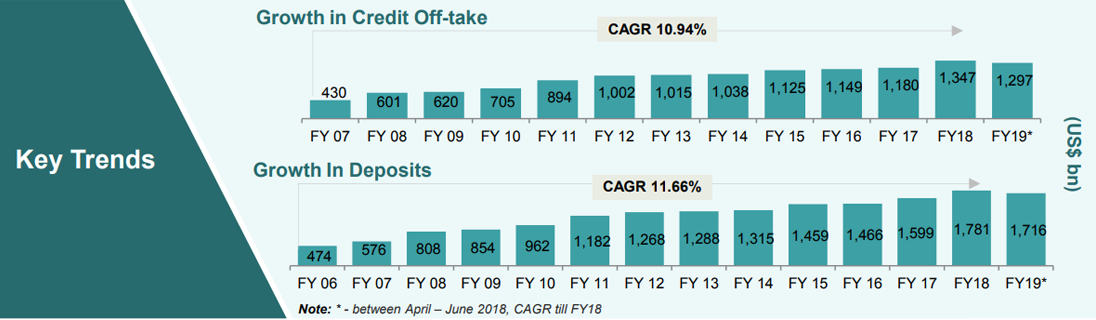

- Bank credit grew by 14.35% to Rs. 94.03 lakh crore and deposits by 10.16% to Rs. 121.21 lakh crore in the fortnight to Feb 15, indicates RBI data.

- E-commerce in India is stated to grow at 27% CAGR while traditional brick and mortar businesses are expected to grow at 16% between 2017-2021; new e-commerce policy to have a marked effect.

- India’s manufacturing activity expands at fastest pace backed by solid demand in more than a year as manufacturing PMI increases to a 14-month high of 54.3 in February 19 from 53.9 in January 19.

- Indian services sector grows in Feb 19 due to increased demand after loss of momentum of the Indian economy in the last quarter of 2018.

- Aon Hewitt report pegs annual average salary increases at 9.7% for 2019 across industries as businesses look forward to a positive economic outlook with expectations of high economic growth.

- Indian internet users reach 627 million in 2019, crossing the half billion mark for the first time ever as internet usage in rural parts of India rises.

- Credit growth among Indian women on the rise as 48% growth registered in loan applications by women. Women over the age of 45 enjoy the highest credit score in the country.

- E-commerce and consumer internet companies raise USD 7 billion in private equity and venture capital funding in 2018, according Ernst and Young (EY) report.

- IBM plans to train more than 1 million female Indian students in 3 years, focus on critical thinking, life skills etc. Program will involve collaboration with seven state governments and focus will be on Science, Technology, Engineering and Math (STEM) subjects.

- Private equity and venture capital investments rise 51% in Feb 19 to USD 2.6 trillion due to higher number of deals.

- Digital to overtake print by 2021 as media and entertainment industry grows 13.4% in 2018 over 2017. FICCI states industry worth Rs. 1.67 lakh crore in 2018 and expected to grow to 2.35 lakh crore by 2021.

- Analytics India magazine and Jigsaw academy study shows financial analytics industry revenue estimated to be USD 1.2 billion. Workforce size of the sector estimated to be 60,000 with 7,000 fresh recruits added in 2018.

- Estimated 21 lakh jobs will be created in India in the coming year with delivery personnel and drivers making up 14 lakh of those jobs, followed by security and facility staff. Blue collar jobs outpace traditional segment.

- General Insurers saw a 23% rise in their premium at Rs. 12,959.44 crore in Feb 19 against Rs. 10,573.70 crore a year ago. Seven standalone private health insurers see a rise of 38% in their premium.

- Industry body Nasscom pegs IT industry growth at 9% in FY20, the same as FY19. Meanwhile ICRA estimates growth of 7-9 % for the sector in FY20.

- India’s foreign exchange reserves have hit USD 405.638 billion mark up by USD 3.602 billion in the week leading up to March 15, according to the RBI. The hike comes on the back of rising foreign currency assets.

- EPFO payroll data indicates 8.96 lakh jobs created in January 2019, while 76.48 lakh jobs were added in the previous 17 months. EPFO enrolment stood at 8.96 lakhs in Jan 19, which is highest since Sept 17.

- MarketsandMarkets report indicates global software defined data centre market size will grow from USD 33.5 billion in 2018 to USD 96.5 billion by 2023. The industry will grow at a CAGR of 23.6%.

- Volume of transactions in Indian hotel industry may cross USD 800 million, highest so far. 2019 expected to be a strong year for deals for hotel industry in India.

- According to Knight Frank’s Global Affordability Monitor, Mumbai witnesses a faster rise in average income compared to real house prices; average household income rose 20.4% while growth in housing prices rose at 8%.

- The average sale price of smartphones can rise 18% by end of 2019 to reach Rs.13,000-Rs. 15,000 as high demand for mid-to-premium segment phones drives prices higher.

- Expect monsoon around June 1; rains predicted to be normal by IMD unless El Niño causes disruption.

- Housing sales to rise in 2019 as realty market revives itself. Real estate stock in the country to reach 3.7 trillion sq. ft by end of 2019. Market driven by tech, demand-supply and improved ease of doing business.

- Mobile Wallet Trends Annual report shows that 2.07 billion consumers will use a mobile wallet to make a purchase in 2019. China leads adoption of technology, while in India, usage is driven by demonetization.

- The Indian Rupee strengthened vis-à-vis the dollar; it was at INR 69.30 on 1 April 2019 against INR 70.8203 on 28 February 2019.

Market Trends

- Public sector banks explore ways to reduce government stake and raise growth capital; move will help meet mandatory 25% public float norms of SEBI.

- Foreign investors are purchasing Indian shares as inflows by investors hit USD 2.42 billion mark in Feb 19. Investors enamoured by chances of Modi winning elections, deeper economic reforms and monetary policy easing.

- Private equity and venture capital investments reach USD 20.5 billion in 2018 across 786 transactions in startups, ecommerce and IT enabled services according to Grant Thornton.

- Investor wealth in Indian markets rose by Rs. 8.83 crore in FY 2018-19 led by rally in the broader markets. Market cap of BSE listed companies rises to Rs. 1,51,08,711.01 crore.

- FIIs recorded a net inflow of Rs 33,980.56 crore in March 2019 against Rs 12,052.89 crore in February 2019.

- The Nifty closed at 11623.90 on 29th March 2019 against 10792.50 on 28th February 2019, having risen by 831.4 points over the previous month.

- The Nifty 50 P/E ratio was at 29.01 at end-March 2019 against 26.32 at end-February 2019. The average P/E ratio for the past 12 months is 26.60.

Highlights

- The Good: Economic growth momentum to continue, FII inflows, strengthening rupee

- The Bad: Global trade slowdown, election uncertainty

stockaxis’ Outlook for April 2019

Packaged food sector

Indian consumers’ spending on food has reached 50% levels of their total spending. There has been a shift in focus from staples such as cereals to packaged foods. India is not different from the rest of the world where changing food preferences are concerned, thanks to digitisation, social media and focus on health. As families grow smaller and more women enter the workforce, packaged foods are becoming more attractive to consumers. Adding to the push towards these foods is lower Goods and Services Tax (GST), higher investments in the sector and less waste in packaging. Consumption of packaged food in the country has seen a boost also due to increased affordability as food inflation has declined since 2014 and the trend has continued. In fact, prices of packaged foods in India have risen at a lower rate than inflation. The government too is keen to support the sector as the overall value addition in the sector is still low at 10-15% but the sector is a major employer in the country. With more efficient food supply chains driven by availability of better refrigeration due to fewer power failures, there is a potential for better distribution and margins for manufacturers.

Although India has a rapidly urbanising population, rural markets are an untapped opportunity for companies operating in this sector. It is expected that rural markets will outperform their urban counterparts in the coming half decade. Preference of consumers for low salt, sugar and saturated foods and a gravitation towards healthy foods also offers manufacturers a chance to sell these premium packaged products. Through a mixture of factors such as demographics, shifting preferences and availability of digital technology, India’s packaged food sector is reaping rich dividends and is likely to do so in the future, growing from US$ 40 bn today to US$ 200 bn over the next 10 years.

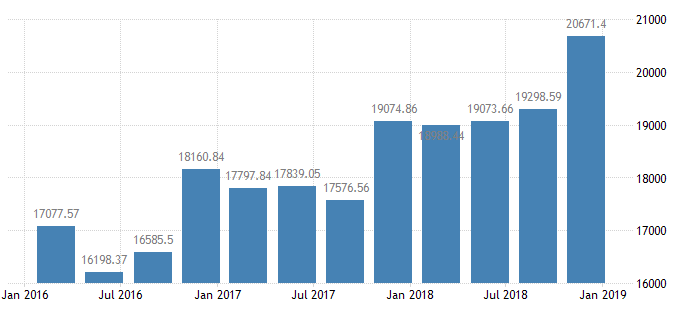

India consumer spending

India – total disposal personal income

Source: www.tradingeconomics.com

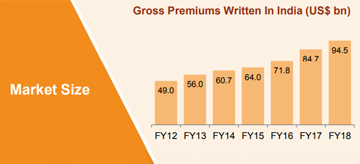

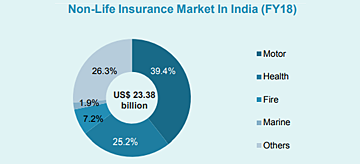

General insurance sector

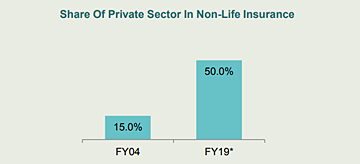

General Insurance (GI) penetration in India is low as industry premiums remain at 0.9% of GDP in 2017 even though it has risen from 0.6% in FY 09. Indian consumers are still not completely protected by the coverage that general insurance companies can provide. However, over a period of time with rising incomes and improved awareness among Indians, the demand for non-life insurance products is rising. Extraneous factors such as strong growth of the automotive industry in India will drive sales of motor insurance, which is compulsory in India. Governmental support is also a big driver of growth of general insurance in India as schemes such as Ayushman Bharat and Pradhan Mantri Suraksha Bima Yojana are incentivised.

This sector has provided stable growth and remains as a hedge against interest rate fluctuation. Additionally, investment income (income of an insurer from its investment activities) and low loss ratio (amounts that the company has paid out in claims) provide the GI industry with protection from vagaries of economic cycles. As the companies have a diversified premium mix, the individual segments that make up the GI industry benefit from uncorrelated growth and profitability drivers. This ensures that there is stability in earnings of these companies.

The sector has grown by CAGR (compound annual growth rate) of 17-18% over the last ten years as it benefitted from de-tariffing. In 2017-18, the number of policies has grown as well due to popularity of crop insurance. Total number of policies sold by the sector as of FY18 is 183 million with a 5-year CAGR of nearly 11%. The GI sector is largely dominated by the motor and health segments, which make up 39% and 25% of the sector respectively.

Potential of growth in GI is high due to low penetration (penetration is well below the world level of 3% of GDP). This sector has the potential to grow at a higher rate as a result of growing smartphone usage and innovative FinTech solutions being deployed.

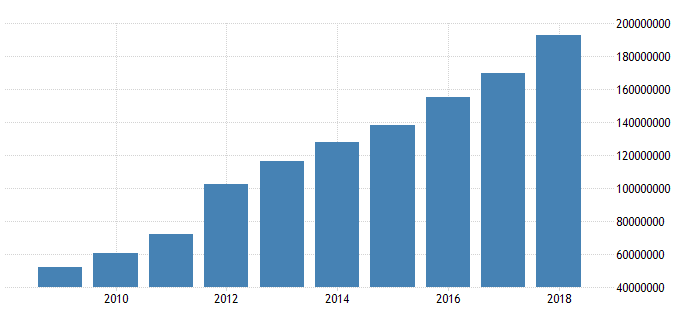

India consumer spending

India consumer spending

India – total disposal personal income

Source: www.tradingeconomics.com

Banking - private sector

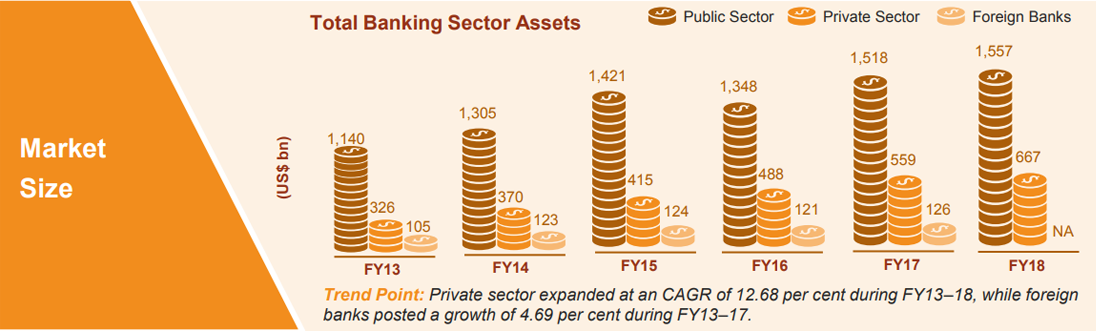

Private banks in India have taken the lead in garnering market share in terms of domestic bank credit, which rose from 18.1% in FY10 to 29.8% in FY18. There are indications that incremental loan growth of private banks may increase to 40% by FY20. Expanding credit growth, increasing number of branches and a healthy capital position are aiding the growth of lending by private banks.

Increasing number of private sector bank branches opening up in the rural hinterland too is adding to growth of these banks; RBI data indicates that private banks expanded their rural branch network by more than 27% and in small towns by nearly 18.4%.

Further, factors such as availability of credit bureau data and deployment of new technologies have also aided the growth of private sector in banking. Retail lending which makes up for 1/5th of overall banking credit is also important to private sector banks which are in a position of comfort due to healthy capital positions and low penetration of such loans in the populace.

In terms of Non-Performing Assets (NPAs), after the RBI instructed banks to shift to a stricter NPA recognition protocol, there are signs of moderation in the numbers. In FY20, NPAs are expected to moderate to 1.9-2.4%. Reforms ushered in by the central bank have ensured that Insolvency and Bankruptcy Code is the main tool in banks’ arsenal to deal with defaulters. Banks are now mandated to resolve default within 180 days failing which the case is moved to bankruptcy courts. These steps will lead to higher recoveries. In terms of growth in current accounts, large private sector banks increased their market share by 5 percentage points between FY16-18. In this period, they held nearly 41% of such deposits.

The pace of growth in current account savings account (CASA) at private banks has risen with nearly 65% of all new CA deposits between FY14-18 being held by private banks. Essentially private sector banks in India are occupying the vacuum in lending and operations that the crisis hit public sector banks have created. Going forward, due to reforms initiated, the sector overall and private sector banks in particular will be reinvigorated.

Source: www.ibef.org

Source: www.ibef.org

Continue with Google

Continue with Google