stockaxis Market Intelligence (Commentary for November 2019; Outlook for December 2019)

December 03, 2019

|

We are pleased to present to you our monthly market commentary and outlook for the forthcoming month. The ‘stockaxis’ Market Intelligence’ is a quick update on the markets for the mo,nth gone by and our view for the next month. Use our sharp and crisp synopsis to continue building your wealth!

Global Trends

- Research firm Gartner stated that IT spending in India will cross USD 94 billion in 2020, up 6.6% from $88.5 billion in 2019.

- According to research firm IDC, India’s PC market grew 15.8% year-on-year reaching 3.1 million units in the September 2019 quarter.

- As per a report by the Federation of Indian Chambers of Commerce and Industry (FICCI) and Ernst & Young, India's medical tourism market is expected to touch $9 billion by 2020.

- The UK India Business Council's fifth annual Doing Business in India report revealed that UK companies are positive about doing business in India, with 56% stating that it is getting easier to do business in India.

- According to billionaire philanthropist and Microsoft co-founder Bill Gates, India has the potential for "very rapid" economic growth over the next decade which will alleviate poverty with the government investing in health and education.

- The International Organisation for Migration said in its 'Global Migration Report 2020' that India continues to be the country with the highest international migrants of 17.5 million across the world. India received the highest remittance of USD 78.6 billion from Indians living abroad.

Domestic Trends

- An Export-Import Bank of India report stated that Bihar has export potential of nearly USD 900 million, which, if realised, could result in shipments exceeding USD 2 billion.

- As per government data, India’s urban unemployment rate fell to 9.3% January-March 2019 from 9.8% in April-June 2018.

- According to the 'India Corruption Survey 2019' carried out in 20 states, incidents of bribery have reduced by 10% since last year.

- According to the Confederation of Indian Industry (CII) Tamil Nadu State Council Vice Chairman Hari Thiagarajan, the Indian textile industry can become a $300 billion industry by 2030 and create an additional 35 million jobs.

Market Trends

- FIIs recorded a net inflow of Rs. 12,924.93 crore in November 2019 against net inflow of Rs. 8,595.66 crore in October 2019.

- The Nifty closed at 12056.05 on 29th November 2019 against 11877.45 on 31st October 2019, having risen by 178.6 points over the previous month.

- The Nifty 50 P/E ratio was at 28.1 at end-November 2019 against 27.38 at end-October 2019. The average P/E ratio for the past 12 months is 27.52.

Highlights

- The Good: Expected US-China trade resolution, positive Q2 corporate results, lower trade deficit

- The Bad: Slowing GDP growth, Brexit, high probability of recession in US and Europe

Aquaculture – a promising sector

India is the second largest aquaculture producer in the world after China. China and India along with Indonesia, Vietnam and Thailand form nearly 80% of the world’s total aquaculture production. The country’s aquaculture production exceeds USD 10 billion of which about 80% is exported. India’s aquaculture industry is one of the major forex earners for the country. Shrimps form about 70% of India’s aquaculture market. Cuttlefish, frozen squids and dried fish form the other products in India’s basket of aquaculture production. India’s shrimp exports have increased by about 20% since FY 2010.

The US is the largest market for India’s shrimp exports accounting for about 40% of the country’s shrimp exports. South-east Asia and the EU are the other large markets for Indian shrimps.

India has numerous advantages in production of shrimps such as its large coastline with salty water that is favourable for shrimp production and conducive weather.

stockaxis’ Outlook for December 2019

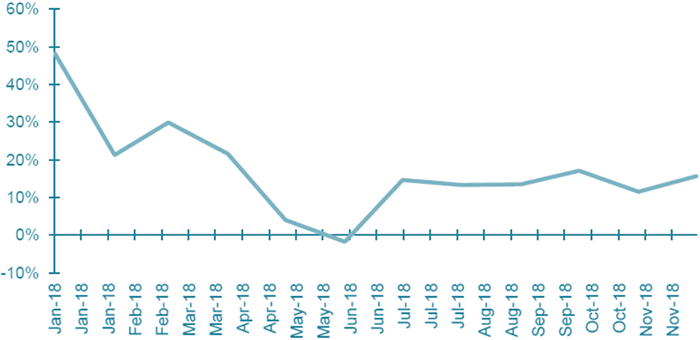

Shrimp prices fell during mid-2018 as a result of overstocking in the US, the largest market for shrimps. As a result, Indian shrimp farmers shifted from shrimp production to other crops. Since early-2019s, US imports of shrimps have been on the rise. With a combination of lower production in India and increase in demand, shrimp prices have been on the rise.

India currently faces an advantage with disease-free production and low labour costs as against other exporters facing diseases in their shrimp production and high labour costs. By 2022, India is expected to achieve production of about 1 million tonnes growing at a CAGR of more than 10%. Shrimp consumption has been on the rise globally. India is one of the top exporting countries and has also increased its share in the global markets from about 16% in 2010 to more than 20% currently.

India’s shrimp exports

Shrimp feed industry

Shrimp feed is one of the largest inputs in the aquaculture industry forming more than 60% of input costs. The fortunes of this industry are linked to the overall aquaculture industry. This segment is expected to grow in sync with the overall aquaculture industry.

Shrimp value added products

India is on the growth path to increasing its market share of shrimp value-added products, which command a higher margin. This segment requires specialized skills and different ingredients. Exports of value-added products are expected to grow at about 40% CAGR, going forward.

We, at stockaxis, are constantly on the lookout for great businesses run by honest promoters that are available at the right price with sufficient margin of safety. Our stringent stock selection guidelines and clearly stipulated entry and exit points make equity investing a ‘rich’ experience for our investors!

Continue with Google

Continue with Google