Nifty50 At 9150!!! But Do These 'Levels' Actually Matter?

March 16, 2017

|

If you’re wondering whether the emphatic victory BJP witnessed in the all important state of Uttar Pradhesh, alongside Uttarakhand too, and also readying to form governments in Manipur and Goa is reason enough to drive markets crazy (a 150 point ↑ crazy), the answer is yes. I mean why not??? This phenomenal victory sets the foundation for its emulation in the 2019 general elections. It also gives a clear message that Mr. Narendra Modi and his reforms are here to stay. All the reforms that have sprouted in the past 30 months including the banking sector cleanup, check on tax evasion and black money recovery, focus on ease of doing business in India, the Make in India program, Demonetization, etc are all set to mushroom their impacts in the future and help our economy accelerate on the path of growth.

And yes, these reforms and this victory have had a resounding effect on our stock market too. It’s just been 2.5 months into 2017 and the Nifty50 has soared by a solid 11.45%. But one thing has not changed at all – The outlook of investors, especially the retails. The same people who were dead worried to invest during the recent Demonetization episode are now wary of a so-called imminent bubble burst. A lot of investors now feel that our market is overvalued and it would be wiser for them to wait for some correction in the market before buying stocks again!

But wait! What market are they exactly talking about? Nifty50? S&P BSE Midcap?? S&P BSE Smallcap???

Just for the sake of discussion, let us consider our very own Nifty50, which at the time of me writing this article is pushing towards 9150. Just imagine… Nifty50 At 9150?? That’s insane right? No one has ever seen Nifty50 even close above 9000, let aside inching towards 9150. So now everyone feels that playing the waiting game and investing at lower levels is the right game ploy. Yes, and it does sounds reasonable. But it does not sound like it is coming from a well informed investor. It actually sounds like a gambler talking about equity investments. Think over it! Why exactly do you (if you do) think or feel that there is a correction on the cards?

- Are companies reporting poor earnings?

NO - Are institutional investors pulling out money?

NO - Are there signs of geo-political tensions in our country?

NO - Is the government unstable?

NO - Is the global macro-economic environment sluggish?

NO

Then why does everyone feel that the market is overvalued? For starters, feeling or thinking in the stock market is no different than feeling or thinking while gambling in a casino. With regards to stocks, there is only analysis and research, and no feeling or thinking. Guts might earn you some money here, but you need to be lucky in that case, and that is something that most of us are not, especially in the market. Yes, traders always tend to book profits in the slightest of the rallies, but that is what makes them good traders and not good investors. If a good trader does not speculate the next Nifty50 levels, well, that makes him/her a bad trader. And, we all know the consequences of trying to time the market, which, as we’ve seen over the years, is impossible and absolutely unnecessary.

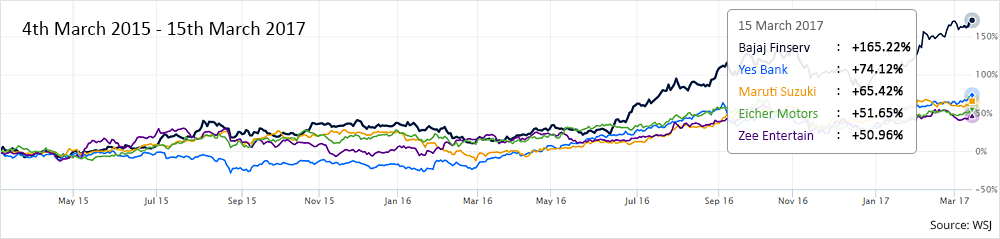

Let us understand this with the help of some very well known blue-chip examples. If you think that the current 9100 levels of the Nifty50 are too steep for fresh investments, you would have thought in a similar way when Nifty50 crossed the 9100 mark back in March 2015. For information sake, Nifty50 made its then all-time-high of 9119.20 on 4th March 2015, riding on the Modi-wave like it is doing right now. But what if you had invested in the right stocks at those then-insane levels and waited? Have a look:

You would have enjoyed an enviable 81% average gain from these five marquee stocks, even though they being large-caps, that too in just 2 years time. I am sure that this would have taken you by surprise. Investment in these 5 stocks, exactly on the day that the index that they are part of made its then all-time-high giving such stellar returns is something that cannot be ignored. Sure, if you would have ‘waited’ for the market to correct and then invest in these, it wouldn’t have altered the gains much, but the point to prove here is, there is no such thing as market-highs and market-lows unless and until you invest in the right companies.

Well, these were all examples of large-cap companies, so you can co-relate the performance to the mid-caps and small-caps that usually outperform their large-cap peers. Consider the example of one of our most recent and noteworthy stock recommendation, Zuari Agro Chemicals Ltd., which was recommended to our paid Multibagger subscribers, when the Nifty50 was trading at 8670 levels. Considering till 18th October 2016, 8670 levels are almost at par with the then 52-week highs of the Nifty50, but still, solely based on exhaustive fundamental research, Zuari seemed to be an attractive BUY, irrespective of the then market conditions. And yes, the market did take a freefall due to the demonetization episode, which only made us recommend our clients to add more of the company in their portfolios. For numbers sake, post our BUY call, the stock rose by a good 18-20%, which again was seen at our recommended price. Hence, even though the index was trading near its highs, we recommended the stock which has given more 88% returns to our clients in around to 4-5 months. Sure, we witnessed Demonetization, a Fed Rate hike, Trump policies, etc post that, which pulled the overall market down, but since the focus was on company fundamentals and not these noisy elements, the stock price thrived. There are many more examples to corroborate this theory, but I suppose you get the message that is being conveyed.

Lastly, at the start of every financial year, we get all kinds of estimations of how will the markets perform in the coming 12 months. Even if we consider a very modest, say a constant 7% growth every year (which is around 0.5-1% less than our expected annual GDP growth every year), we are still looking at an approximate 12650-12700 levels of the Nifty50. Just imagine the Nifty50 trading at such insane levels, and imagine yourself investing then. If 9100 bothers you, at 12700, I’m sure that you will shift to, say fixed deposit schemes, only to see the index at 18000 levels (provided it grows at the same rate with no ups and downs, which, even though is not possible, but considerable for the argument here) and killing yourself with guilt of opting out of equities.

This is what our Indian Warren Buffett, Rakesh Jhunjhunwala, had to say during one of his interviews in the Outlook magazine on 3rd April 2015, when the Nifty50 was near its then highs of around 9000 levels:

“There are two to three reasons why one should invest in the markets. The one advice I offer to young couples is that they must invest all their savings in a house. After a house, devote 80% of your savings to the market. Here’s why: India is in a growth phase - the index (Sensex) has gone up from 100 to 28000 over the past 30 years. I don’t see why this situation will not repeat itself over the next decade. This being a stock market, valuations have to grow. If India grows, earnings have to grow. India saves over $650 Billion a year. In four to five years, this figure will go up to a trillion dollars. Even if 10% of that money flows into the equity markets, that adds up to about a $100 Billion. Why will this money not come to the equity markets? In 1991, 18% of savings flowed into equities and by 2007, this figure stood at 13%. So, there is going to be an upsurge in earnings and money flowing into the market.

If India achieves a GDP growth of 12-14%, corporate profit growth will be 18-20%. At some stage, valuations will expand. Which other nation can provide this kind of growth? The most important question is if debt can give me a return of 7% post-tax or if equity can give me a return of 18% post-tax, which other asset class can give me that kind of return? Guys like me are 101% invested in equity.”

Hence, this over-thinking of whether the market is too high or too low to invest or exit the stocks can really make you lose your mind. So, the golden question: Is the market too high right now? NO!!! !!! It’s always a good time to invest, always; but only if you are investing and not trading, and that too in well research company only and nothing else. Even if we do witness some correction, you can simply add more of those quality businesses and reap the comeback rally too. Why to fear an upcoming bear market during a bull one and vice versa, when you can use that time, energy and mind to find that next big multibagger stock which no one is aware of. Also, if we do witness the above mentioned growth, why not exploit it right from today itself? It’s simple: If you can overcome fear and greed while making investment decisions and thereby back your research, there is nothing but money waiting for you to be made each and every day of the market.

Every now and then, we see some market guru giving his/her forecasts on the market levels, which more often than not, go haywire, and investors following them are then stranded in disbelief. It’s actually quite a simple theory here – why not try and analyze what the companies (which form the market) are set to grow into in the coming quarters rather than trying to guess how the entire lot as a whole will perform in the future. I mean, how is it even possible to analyze, or rather guess, what the market as a whole is set to do unless and until you analyze all the companies in it?

The bottom line is, only two things should matter to you as an investor and nothing else - Is the company having a good business model? & Is the growth sustainable? Sort these two out, and you are game for some serious profits in the future. Think over it and please let us know if you think otherwise, we would love to discuss more.

Happy Investing!

Continue with Google

Continue with Google