New Products and New Management - How do they facilitate stock price movements?

December 23, 2015

|

As we have seen in all our previous articles, it takes a lot more than just numbers to enable a stunning price rally. There is no second opinion to the fact that earnings play the most crucial role in mending the sentiments and eventually the stock price, but yes, there’s more to it. A new product or a service launched by the company (may or may not be disruptive) that might sell swiftly and accelerate earnings or a senior level management change that is expected to bring in a new level of enthusiasm, new ideas and clean up the mess created by the previous administrators also affect the stock price heavily.

In our studies of one of the best market winners, we’ve observed that close to 80% of the rallies are attributed to the above given classifications. So does that mean, that whenever a company is about to launch a new product or has just announced to do the same, will in turn shoot up the stock price? Not necessarily. Let us understand both the cases with an example each…

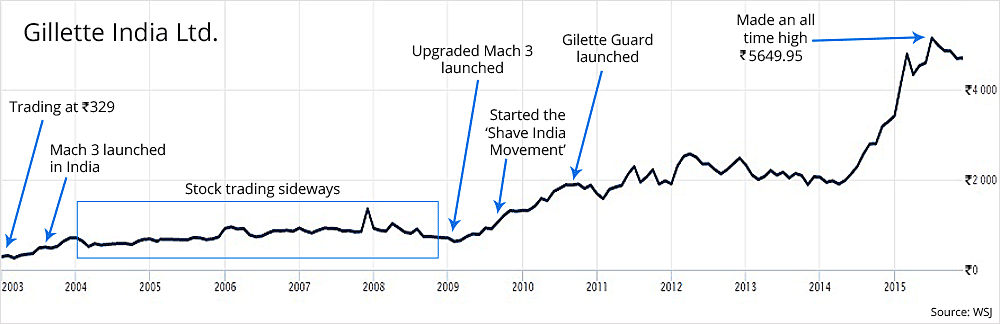

Owned by the multi-national corporation Procter & Gamble (P&G), Gillette India Ltd. is a well known name in the country, especially amongst the men. You can very well see the rally from March 2009 till the mid of 2015 where it gained more than 800%. So what was the reason behind it? Of course, the constant increase in the sales and profits played the kingmaker in the cause, but we will try to understand what caused these earnings to inflate at such a level (after 2009 i.e. 5 years after the launch of Mach3)…

The company had forayed into the Indian market back in 1984 with a ‘One-Size-Fits-All’ strategy and eventually introduced its then latest product, Mach3, in 2004 targeting men with higher spending power. What it failed to realize was that Indian men considered shaving as a not-so-significant activity during the time and a majority of its potential customers could not afford the latest product. Hence, you can see its effect on Gillette’s share price until 2009 when it came up with a new strategy for an upgraded product. Gillette came up with its newest Mach3 in 2009 with a new aim of changing the attitude of Indian men towards shaving. It supported this aim by launching the ‘Shave India Movement 2009’ complemented by the platform 'India votes - to shave or not’ wherein it asked questions like : Does India prefer clean shaven celebrities?, Are clean shaven men more successful? Do women prefer clean shaven men? The purpose of these questions was to create a buzz around shaving this is exactly what happened. The media took it to the next level. Gillette also created a campaign called ‘Women Against Lazy Stubble’ wherein women were motivated to ask their men to shave. They roped in Neha Dhupia and Arjun Rampal too for further promotions. This ultimately resulted in a 30% increase in their revenues and a similar increase in the market share. In October next year, they finally came up with an affordable product ‘Gillette Guard’ which was priced at just Rs. 15 which was then available to the 40 crore men in India. So, there are two things to be learnt:

- Even though Gillette came up with the then latest Mach3, there was no significant movement in the share price of the company. Hence, it is not necessary that the price of the stock will shoot up when the company is about to launch a new product or has already done so…

- It then launched the upgraded version in 2009 coupled with a lot of branding which was a clear dealmaker. Not that it had not invested in product R&D, but the marketing efforts added fuel to fire and the stock rose more than 800%.

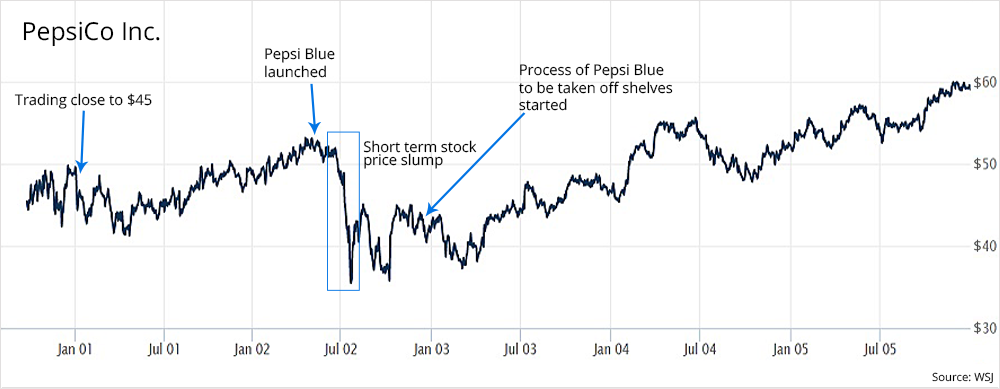

Now let’s take another example, say PepsiCo Inc. which is listed in the New York Stock Exchange (NYSE). Well Pepsi, no one needs an introduction to such a brand; perhaps, one of the most renowned names in the world. It is also one of those companies who constantly tries to fill up the gap in the market it caters by coming up with new products and spending heavily on marketing. We’ll analyze ‘Pepsi Blue’ as a part of our case study here.

Back in 2002, when the company came up with a new strategy that included heavy aggressive marketing and creation of new flavors for its soda brands, it resulted in the creation of Pepsi Blue, Pepsi Twist and Mountain Dew Code Red. Pepsi Blue was teenagers' choice from more than 100 cola fusion concepts that were tested. It was designed to compete with Vanilla Coke, which was produced by The Coca-Cola Company of Atlanta, Georgia. Given below is the stock price movement of PepsiCo Inc. You can clearly see the slump between 2002 and 2003 i.e. when Pepsi Blue was launched. Some of the reasons indicted to Pepsi Blue’s failure are:

- The flavor was described by Pepsi was only "berry", but, the consumers described the taste otherwise and some of them even related it to sugary cotton candy with a berry-like after taste. The downside was that the original product already held a position in the consumer’s mind and thus when people thought of Pepsi Blue, they thought it would taste like Pepsi and not some super-sugary berry drink. Hence the dislike.

- Blue 1, a highly controversial coloring agent banned in numerous countries during the time was used in Pepsi Blue.

- It looked similar to the commercial kerosene sold in India which has a bluish tinge, a boy actually drank kerosene thinking it was Pepsi Blue and later had to be hospitalized.

Hence, one can see the short term impact on the stock price of PepsiCo Inc. in the year 2002. PepsiCo had a similar experience way back in 1994 when it launched Crystal Pepsi. The company even relaunched it in the same year but experienced losses.

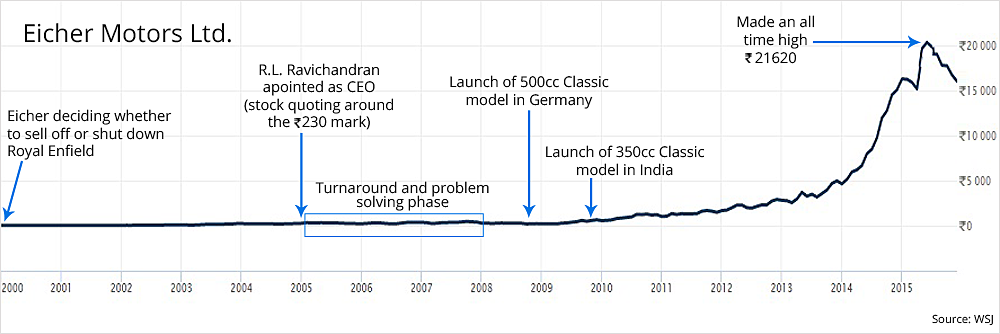

There are many more examples depicting the relationship between a new product launch and the company’s share price including that of Apple Inc. as well. The numbers tell a story of steady anticipation, followed by a steep decline, returning the stock close to or below its original value. The main exceptions to this rule were the original iPhone (announced in January 2007) and the iPad 2 (March 2011). We’ll digress from this topic and shift our focus to the link between a good management change and a resulting stock rally. Consider Eicher Motos Ltd.’s Royal Enfield’s turnaround story when the motivated third generation member of the Delhi based Lal family, Siddhartha Lal roped in R.L. Ravichandran as the CEO of the motorcycle business in 2005.

It all started 5 years before Mr. Ravichandran came in, when Eicher Motors was in a dilemma whether to shut down or sell off its motorcycle division Royal Enfield because of the soaring losses. The sales of its iconic motorcycles decreased to a mere 2000 units/month as against the installed capacity of 6000. Some of the reasons contributing to this decline were an inconveniently positioned gear level, engine seizures, oil leakages, and electrical failures among others. Let’s dig a bit deeper into what they did which changed the fortunes of Royal Enfield completely.

- The old cast iron engine had a separate gear box and its oil sump design which caused engine seizures and oil leakages; all of which could have been eliminated by using aluminum instead of iron. But, replacing the iron engine with an aluminum one would make the bike devoid of vibrations and a characteristic beat it produced earlier. Hence, after a lot of R&D, they came up with hydraulic tappets, a new arrangement of the reduced number engine parts. This new style of the engine gave close to 70% of the amplitude of the original beats and vibrations.

- This new engine had 30% fewer parts and produced 30% more power than the old one, complemented by a better mileage.

- Some other problems that were addressed included the quality of the components used and the sales experience.

Undeviatingly, Royal Enfield made a comeback from the dead. Fewer problems were reported by the dealers and the warranty claims reduced drastically. They also started marquee rides which are scheduled for 1-3 weeks traversing some of the most interesting and challenging terrains in the country and even abroad. All these steps removed the fears about their products' reliability in minds of prospective customers. Given below is the stock price chart of Eicher Motors Ltd. It is a classic example of the positive effect of a management change and product portfolio expansion on a company’s stock price.

One can see the monumental bull run Eicher witnessed from Nov 2008 till the end of July 2015, gaining close to 11000% in its stock price value. Apart from the reasons mentioned above which contributed to this bull run, other significant factors included product launches like:

- Launch of its then newly designed 500cc Classic model in Germany in October 2008 proved to be a huge success.

- Heartened by its success, they launched it in India in November 2009 initially as a 350 cc bike which proved to be a hit too. They then started facing a different set of problems which every company dreams of having, like a tremendously overflowing order pipeline. They overcame that too, expanding capacity.

In fact, they scaled so ferociously, that Eicher’s motorcycle business sold nearly 1,78,000 Royal Enfield bikes in 2013 as against the 1,13,000 units it sold in 2012 and a negligible 24,000 bikes sold just before its revival. Last year, it sold more than a whopping 3 lakh units which helped Eicher double its net profit to Rs.559 crore on a 78.04% increase in revenue to Rs.3031 crore. Well, one hell of a turnaround story; equally contributed by the new products and the new motivated management.

Thus, from an investor point of view, search for companies that are coming up with important and disruptive products or are going to benefit from a management change that is about to happen or has just happened recently. We at StockAxis too consider these events earnestly apart from hundreds of other factors while giving out our multibagger and medium term investment recommendations, as these products and the management will eventually facilitate great earnings growth and even greater, rather disproportionate returns for the long term investors. Happy Investing!

Continue with Google

Continue with Google