Multibaggers Do Make Money… But Wait, Did You Chose The Right Ones?

October 07, 2015

|

Multibagger… One of the most loved words in the stock market and rightly so. They make you rich, in fact filthy rich if you have made you investment in the right one at the right time and in the right quantity. Who doesn’t want to fetch handsome returns on their investments? Well everyone does, but not everyone has an appetite for it.

So what exactly is this appetite? Say you are not a risk taker or a moderate one or say you need your cash back with the profits within 3-9 months of the investment or say you don’t like uncertainty and prefer a steady cash flow; even if you fit in one of the above mentioned criterion, well then investing in a multibagger is not your cup of tea. Now, the question is WHY? Let us understand that with an example:

Mirza International moved sideways around the30-35 mark for the period from January 2014 till the end of June in the same year (See the first box). Post June, till the year end, it slowly reached the 45 mark (See the second box) and post January 2015, bulls broke the shackles and took the stock to an altogether new level making a high of 141.5 on 19th August (See the third box). It is currently trading around the 95 mark. Hence, it can be learnt that, if you are in the line for making quick money and if you lack patience, a multibagger like Mirza International is not made for you. If you had invested Rs. 1000 in this stock on 1st January 2014, you would have made a profit of Rs 3725 on the amount. This is a classic case where the stock showed no or hardly any movement for a continuous 12 month period and then took off! Usually people get anxious and exit the scrip only to end up seeing make new highs. Now let us understand what exactly a multibagger is and how to find one.

In the simplest terms, multibagger is a stock that has a potential of meteoric growth and can multiply your investment value over a period of time. A Two-bagger is a stock that has doubled in price while a Ten-Bagger is the one which has multiplied its value ten times and hence the name multibagger.

Say you had bought Ajanta Pharma Limited in January 2013 when it was trading at Rs. 107 (split adjusted), you could have multiplied your investment amount 14.7 times by exiting in July this year. Great…Right? Suppose you had invested in Relaxo Footwears Limited back in October 2010 and exited in July this year, you would have fetched returns worth more than a whopping 41.5 times your investment. Even Greater…!!! So the question rises again, why doesn’t everyone invest in multibaggers? The answer is quite obvious. Finding a multibagger is like finding a needle in a haystack, but do keep in mind that the needle(s) do exist. It depends on how thoroughly you go about your research.

To start your research, try to look at companies with small market caps as they are more likely to grow exponentially compared to the ones with large market caps. Do your diligence on the background of the promoters and their holdings. Make sure that the company has a lower equity base as it is directly proportional to its valuations and earnings per share (EPS). Also, make sure that the company has a strong balance sheet and belongs to a booming industry. Apart from these, there are lots and lots of factors to be considered before you conclude that the company is a potential multibagger.

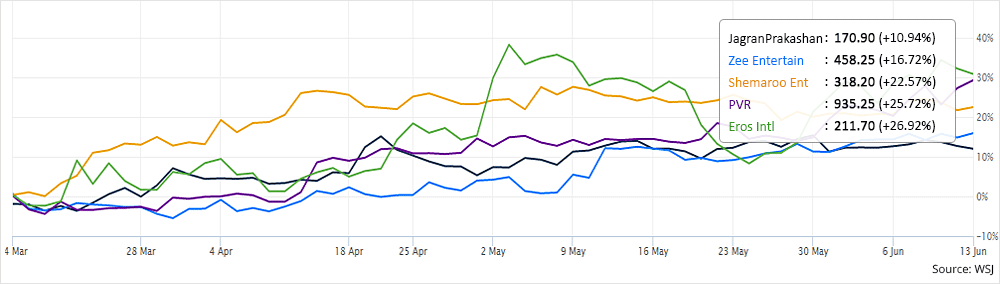

Keep in mind that all multibaggers go through a tough ride during a crash or some economic slowdown. Sometimes potential multibaggers including Pantaloons Fashion & Retail, Infosys, Zee entertainment etc have seen a crash up to 50% from their peak. You must have the patience of a saint in order to generate returns from a these stocks.

StockAxis has compiled a list of multibaggers that it has recommended in the past three years, all of which have given substantial returns. Let’s take a look at them, they are great:

| Scrip Name | Reco. Price | Reco. Date | Peak Price | Peak Price Date | Nifty on Reco. Date | Nifty on Peak Price day | % Change in Nifty | % Profit | Duration (months) |

| Atul Auto Ltd | 84.00 | 3-Sep-13 | 721.80 | 19-Jan-15 | 5,341 | 8,551 | 60% | 758% | 16 |

| Cera Sanitaryware Ltd | 603.00 | 21-Oct-13 | 2,952.00 | 15-Apr-15 | 6,204 | 8,750 | 41% | 390% | 17 |

| Kitex Garments Ltd | 118.00 | 30-Apr-14 | 1,070.00 | 3-Jul-15 | 6,696 | 8,484 | 27% | 807% | 14 |

| Capital First Ltd | 250.00 | 18-Jul-14 | 464.80 | 15-Apr-15 | 7,664 | 8,750 | 14% | 86% | 9 |

| Astec LifeSciences Ltd | 61.70 | 30-Jul-14 | 304.00 | 21-Jul-15 | 8,422 | 8,529 | 1% | 393% | 11 |

As you can see, almost all the recommendations provided by StockAxis have outperformed Nifty by a huge margin. For example, consider Astec LifeSciences Limited; the scrip was trading at Rs. 61.70 on 30th July 2014 when it was recommended as a ‘BUY’ by StockAxis and the Nifty level during the time was 8422. Post 11 months, Astec grew monumentally and peaked at Rs. 304 i.e. a 393% growth from the reco price whereas Nifty grew by a mere 1% to the 8529 level.

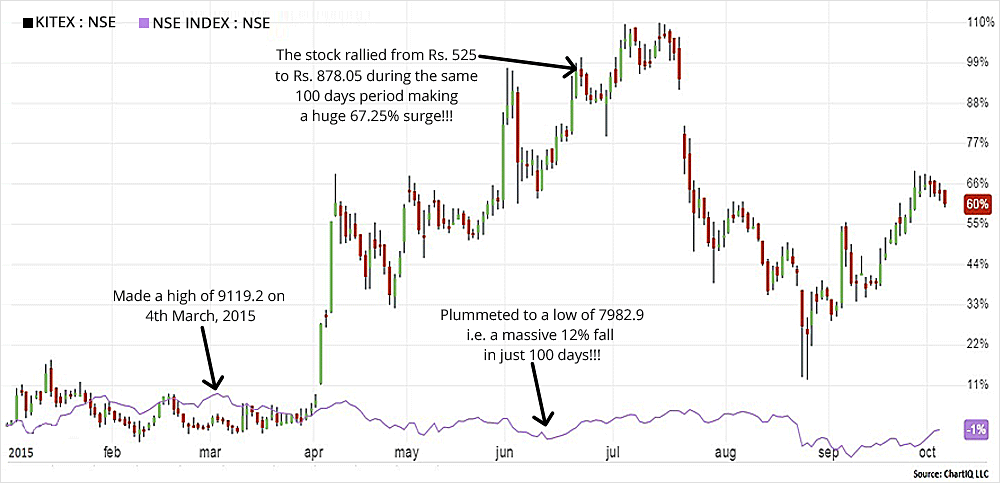

Let’s take another example; say Kitex Garments Limited; the scrip was trading at Rs. 118 on 30th April 2014 when it was recommended as a ‘BUY’ by StockAxis and the Nifty level during the time was 6696. Post 14 months, Kitex too rose at an exponential level and almost touched the Rs. 1100 mark i.e. a 807% growth from the reco price. Nifty on the other hand also grew by 27% but one can easily make out the growth difference between the two. The point made is, multibaggers also follow the market sentiments like all other stocks, but these examples prove that they bounce back extensively and make you a lot of money if you had entered and exited them at the right time.

Also, they have the potential to negate the downward market trend and go the opposite. Let’s again consider Kitex Garments Limited for this scenario. Nifty touched a high of 9119.2 in March this year, 4th March to be specific and plummeted to a low of 7982.9 on 12th June 2015 i.e. it lost slightly more 12% in just 100 days post its high. On the other hand, during the same period, Kitex rose from Rs. 525 to Rs. 878.05 thereby making a massive 67% gain in its value as against Nifty’s 12% fall. This makes multibaggers so appealing.

Remember, there are no shortcuts to finding them. If you are conducting the research by yourself, you will have to go through a comprehensive and a repetitive process which includes both, technical and fundamental methodologies. The stock price and the company’s fundamentals will have to be followed dedicatedly for months or even years to identify if the stock is a multibagger. Also, stock charts will have to be compared with all their peer companies keeping the industry trend into consideration constantly. This is where advisory services like us come into the picture. StockAxis is the only company that analyses the trends of over 2000 stocks every day.

Every investor in the world of stock market thinks that she/he will make it big. But what they fail to understand is it takes a lot of patience and a heavy risk appetite to invest in a multibagger. Many have picked out top multibaggers in the past but did not have the patience to hold them and reap the fruits of their hardwork. Remember, finding those moneyminters is just half the battle won; riding them till the end will actually make a difference to your wealth!

Continue with Google

Continue with Google