Media & Entertainment (M&E) Industry: The Sunrise Sector Of India

June 08, 2016

|

The year 2015 is considered to be an inflection point for the Indian Media & Entertainment (M&E) industry. It has now positioned itself on the cusp of a strong phase of growth backed by digitization and increased consumer demand. Following are the key triggers that we think will make M&E the sunrise sector of our economic growth:

Summary:

- The Indian M&E industry which is valued at close to $20 Billion is expected to reach $29-30 Billion by 2019 and more than $62-63 Billion by 2025. This year, it registered a growth of close to 13.5% over its value in 2015.

- The industry is divided into 9 segments. Their growth since the past 6 years and the future prospects are as follows:

| $ Billion | FY11 | FY12 | FY13 | FY14 | FY15 | FY16 | FY17E | FY18E | FY19E | FY20E | CAGR |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Television | 4.96 | 5.58 | 6.29 | 7.17 | 8.18 | 9.31 | 10.71 | 12.42 | 14.44 | 16.56 | 12.81% |

| 3.15 | 3.38 | 3.67 | 3.97 | 4.28 | 4.60 | 4.97 | 5.37 | 5.79 | 6.22 | 7.04% | |

| Films | 1.40 | 1.70 | 1.89 | 1.91 | 2.09 | 2.39 | 2.63 | 2.87 | 3.14 | 3.43 | 9.37% |

| Radio | 0.17 | 0.19 | 0.22 | 0.26 | 0.30 | 0.35 | 0.43 | 0.49 | 0.57 | 0.65 | 14.35% |

| Digital Advertising | 0.23 | 0.33 | 0.45 | 0.66 | 0.91 | 1.22 | 1.71 | 2.31 | 3.01 | 3.85 | 32.55% |

| Music | 0.14 | 0.16 | 0.14 | 0.15 | 0.16 | 0.18 | 0.21 | 0.24 | 0.28 | 0.31 | 8.27% |

| Out-Of-Home Advertising | 0.27 | 0.27 | 0.29 | 0.33 | 0.37 | 0.43 | 0.48 | 0.53 | 0.60 | 0.68 | 9.68% |

| Animation | 0.47 | 0.53 | 0.60 | 0.68 | 0.77 | 0.88 | 1.01 | 1.18 | 1.38 | 1.63 | 13.24% |

| Gaming | 0.20 | 0.23 | 0.29 | 0.35 | 0.40 | 0.46 | 0.52 | 0.59 | 0.68 | 0.76 | 14.28% |

| Total | 10.99 | 12.38 | 13.85 | 15.47 | 17.45 | 19.84 | 22.67 | 26.01 | 29.88 | 34.10 | 11.99% |

- Television continues to dominate the M&E industry, with almost 50% of the total market share; the reason being increase in the number of TV Households over the years. The number increased from 168 Million in 2014 to 175 Million in 2015, i.e. close to 70% of the total households in India. India is the second largest television market in the world, after China. Have a look at the television industry growth, which is divided into two sectors:

| $ Billion | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017E | 2018E | 2019E | 2020E |

|---|---|---|---|---|---|---|---|---|---|---|

| Subscription Revenue | 3.21 | 3.70 | 4.24 | 4.83 | 5.45 | 6.14 | 7.06 | 8.27 | 9.61 | 11.06 |

| Advertising Revenue | 1.75 | 1.89 | 2.05 | 2.34 | 2.73 | 3.17 | 3.65 | 4.16 | 4.83 | 5.51 |

| Total | 4.96 | 5.58 | 6.29 | 7.17 | 8.18 | 9.31 | 10.71 | 12.43 | 14.44 | 16.57 |

- Out of the total households mentioned above, 145 Million are Cable & Satellite subscribers (C&S) which implies a penetration of 83% and is expected to grow to 87% by 2020.

- The total number of transactions in the industry decreased from 61 deals worth $ 2.38 Billion in 2014 to 57 deals worth $1.20 Billion in 2015. The reason for this huge difference in the total deal value is the acquisition of Network 18 Media & Investments Ltd. and TV 18 Broadcast Ltd. by Reliance Industries Ltd in 2014 for around $1.42 Billion.

Growth Drivers:

- India has around 500 Million unique mobile users which is likely to become 1.3 Billion by 2020. Currently, around 200 Million have access to internet and this number is set to increase with the introduction of 3G and 4G services.

- In a market like India, which is not yet blessed with high data speeds, as of now, 2G users are important too. However, with increasing choices in smartphone selection and the pace at which the smartphone penetration is growing, it is expected that by 2020, all handsets sold will be atleast 4G ready. Also, the rise in app downloads in the recent times have increased the revenue from paid apps from around $145 Million in 2014 to $250 Million in 2015.

- India will witness more than 2x growth in the average household incomes from around $8000 currently to $18500 by 2020. This will help the industry to a great extent as a significant portion of the mobile users are in the lower half of the socio-economic pyramid who provide an Average Revenue Per User (ARPU) of just Rs. 120 per month. Hence, an increase in the spending power will definitely increase the ARPU in India and enable its users to explore other applications like email and browsers more, apart from Facebook and Whatsapp.

- The Information & Broadcasting (I&B) ministry completed the rollout of digital cable set top boxes in phases I and II.

-

- The phase I digitization covered the four metropolitan cities of Delhi, Mumbai, Kolkata and Chennai.

- Phase II covered 38 cities across India which seeded 12 Million set top boxes in all.

- Phase III, whose deadline was extended from 30th Sept 2014 to 31st Dec 2015 covered all the remaining urban areas in India.

- Phase IV, whose deadline too was extended to 31st Dec 2016 will cover all the remaining households in India

Government Subsidy & Initiatives:

- Television

-

- DTH Satellite: FDI raised to 100% from 74%

- Cable Network: FDI raised to 100% from 49%

- News Channels: FDI raised to 49% from 26%

- Cable Network: FDI raised to 100% from 49%

- No restriction on FDI in uplinking and downlinking of TV Channels apart from news channels

- The government has allotted around $50 Million in the current Five-Year-Plan for various development projects in the film industry. The funds will be utilized to set up a centre for excellence in animation, gaming and visual effects among others.

- The Indian and Canadian governments have signed an audio-visual co-production deal that would help producers from both countries to explore their technical, creative, artistic, financial and marketing resources for co-productions, and subsequently, lead to exchange of culture and art amongst them. A similar agreement is under negotiation with the Republic of Korea.

- The Government has also given licenses to 45 new news and entertainment channels in India. Star, Sony, Viacom and Zee are amongst those who have received these licenses.

-

- Newspapers & Periodicals: FDI stands at 26%

- Foreign Magazines (Indian Edition): FDI stands at26%

- Scientific & Technical Journals: FDI stands at 100%

- The Union Budget 2016-17 has proposed basic custom duty exemption on news printing. The customs duty on the wood in chips or particles for manufacture of paper, paperboard and newsprint has been reduced to 0% from 5%.

- Films

-

- 100% FDI through automatic route

- Given the industry status to the films segment

- With GST expected to pass in the monsoon session, entertainment tax will be subsumed in GST thereby creating a uniform tax rate regime and reduce the burden and complexity.

- Radio

-

- FDI raised to 49% from 26%

- This will bring in global expertise, innovation and better programming. Also, private players are now allowed to own multiple channels in a city provided they don’t exceed 40% of the total channels.

- The third round of Phase III radio channel auction, which was delayed for 2 years, finally got the green signal and will enable as many as 839 new FM radio channels to go on air in nearly 300 cities by the end of the year. This is expected to earn close to $390 Million for the government too.

Other Major Developments:

- Last week, Reliance Entertainment today sold majority stake in film and television studio IM Global to Los Angeles-based Tang Media Partners (TMP) for $200 Million.

- Eros Now, the digital over-the-top distribution service of Eros International Ltd., has expanded the availability of its service to the Apple TV platform, which will allow the former to showcase its repository of media across Apple TV’s presence in 80 key countries.

- PVR Ltd. recently acquired operations of 32 screens of DLF’s cinema exhibition business, DT Cinemas for around $64.5 Million.

What to expect next:

- With the FDI limit raised in many of the segments in the M&E industry, global giants like Comcast, 21st Century Fox, Time Warner Cable, Liberty Media Corporation, etc are set to invest in their Indian peers or even set up headquarters in India. From April 2000-June 2015, the FDI inflows in the information and broadcasting (I&B) sector (including print media) stood at more than $4.3 Billion.

- Also, India is set to have the youngest population in the world in the next 4-5 years. Internet will then become the new television and online music the new radio. The revenue from advertising is expected to grow at a CAGR of 13% and will exceed $ 12.29 Billion. Hence, there is no doubt that the Indian M&E sector, particularly the Digital Advertising segment (expected to grow at a CAGR of 32.55% 2011-2020E) will be a happy place to be invested in and can be rightfully called the sunrise sector of India.

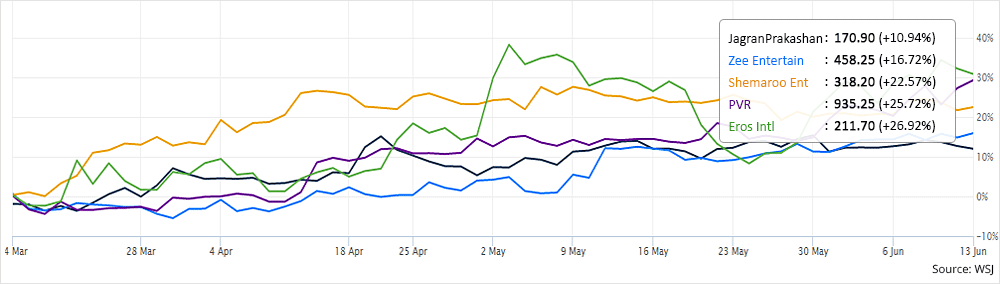

- Have a look at the performances of some of stocks in the M&E industry in the last three months:

We are pleased to say that out of the above mentioned stocks, we have already recommended Shemaroo Entertainment Ltd. and PVR Ltd. to our subscribers apart from two other open calls in the M&E industry.

- Lastly, one can, without any doubt say that the Indian M&E industry has witnessed tremendous growth in the last few years and this momentum is expected to continue in the future as shown in the table. Although it faces some tax and regulatory issues, with our government’s positive stance and approach on making business easy in India, it can be safely assumed that M&E has many more miles to go!

Continue with Google

Continue with Google