Markets In July 2016: Movers & Shakers Of The Month

August 03, 2016

|

Following the trend that we started last month, we bring to you our second monthly newsletter in 2016 for the month of July. With not many events happening around, be it domestic or global, have a look at the market performance, which was pre-dominantly driven by corporate Q1FY17 results and a positive FII/FPI sentiment:

Good Corporate Earnings:

- As of 31st July 2016, 25 of the 51 companies that form the benchmark Nifty50 index had declared their Q1FY17 results.

- Total combined revenue of those 25 companies stood at Rs. 255189 crores as against Rs. 231471 crores in the same period last year, thereby registering a rise of 10.25%. On the other hand, the combined PAT in Q1FY17stood at Rs. 35161.7 crores as against Rs. 33338.9 in Q1FY16 showing a growth of 5.47% Y-o-Y.

Public Sector Banks' Re-capitalization:

- On the rise since 2012, impaired assets in the banking system have been negatively affecting their credit supply and becoming one of the premier factors dampening India’s growth outlook.

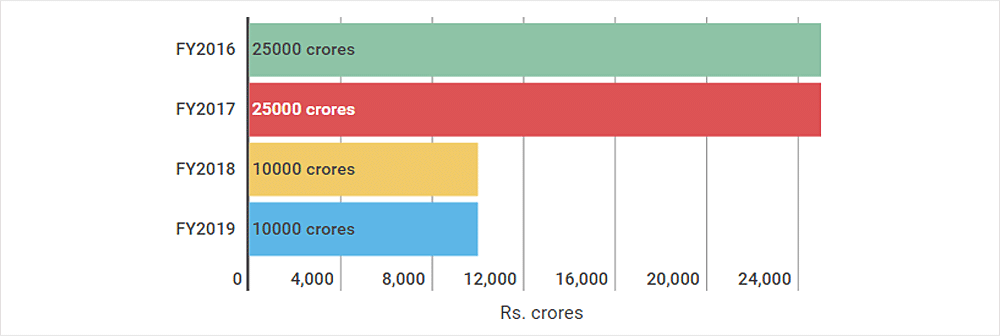

- With the cleaning of the bank’s balance sheets being at the top of the Central Bank’s priorities apart from moving inflation to a more comforting level, the Government last year commenced its infusion plans under the umbrella scheme “Indradhanush”. Under this scheme, the Government is set to infuse Rs. 70000 crores in state-run banks over a period of 4 years. Have a look at its schedule:

- On 19th July 2016, the second tranche of infusion worth Rs. 22915 crores was announced by the Centre to be injected into 13 state-run banks, with SBI receiving the biggest chunk worth Rs. 7575 crores. Following is the list of all the recipients of this year’s infusion:

| Bank Name | FY17 Infusion (Rs. Cr.) | FY16 Infusion (Estimated) (Rs. Cr.) |

|---|---|---|

| State Bank Of India | 7575 | 5393 |

| Indian Overseas Bank | 3101 | 2009 |

| Punjab National Bank | 2816 | 1732 |

| Bank Of India | 1784 | 2455 |

| Central Bank Of India | 1729 | - |

| Syndicate Bank | 1034 | - |

| UCO Bank | 1033 | - |

| Canara Bank | 997 | 947 |

| United Bank Of India | 810 | - |

| Union Bank Of India | 721 | 1080 |

| Corporation Bank | 677 | 857 |

| Dena Bank | 594 | 407 |

| Allahabad Bank | 44 | 283 |

| Total Infusion | Rs. 22915 Cr. | Rs. 15163 Cr. (Rs. 19950 Cr. Overall) |

- It is also said by the Government that it ready to infuse additional capital, over and above the Rs. 25000 crores for FY17 in case of any urgent requirement. The above mentioned allocation will be made against the shares issued by these banks to the Government.

- Just for your information, this capital infusion project “Indradhanush”, is aimed at helping the banks meet the Basel-III capitalization norms, which kick in from 2018. Of the Rs. 180000 crores required for these norms, the Government through this project will help them raise Rs. 70000 crores, with the remaining Rs. 110000 crores to be raised from the markets.

Manufacturing PMI At 4-month High:

- Manufacturing output in India grew at its fastest pace in four months in July 2016 indicating an improvement in the business conditions across the sector.

- The Nikkei/Markit Manufacturing Purchasing Managers' Index (PMI) rose to 51.8 in July from 51.7 in June, with the 50 level separating growth from contraction.

- This high was attributed to increasing demand from both, the domestic as well as external markets. Also, the output and new orders sub-indexes both rose to their highest since March.

- With export orders now increasing and prices remaining muted, the RBI has now room to cut rates further, thereby encouraging further investments.

- One can say that, this encouraging data, which has been generated through a private survey, has come just a week before the RBI's monetary policy review meeting on 9th August 2016, which can be expected to help the policy easing cause.

FII/FPI Inflow In Equity At 4-month High & In Debt At 8-month High:

- Overseas investors have infused a net total of Rs. 19457.26 crores in the Indian Equity and Debt market combined. Here is the bifurcation for the same along with last three month’s data:

| FII/FPI Inflows (Rs. Cr) | July 2016 | June 2016 | May 2016 |

|---|---|---|---|

| Equity | 12611.82 | 3712.88 | 2542.89 |

| Debt | 6845.44 | -6220.24 | -4408.77 |

| Total | 19457.26 | -2507.36 | -1865.88 |

- This positive sentiment can be attributed to the rising hopes of the passage of the much-awaited GST Bill in the Rajya Sabha and expectations of better corporate earnings, with the “above-average” monsoons playing its part.

Increase In FDI In Stock Exchanges:

- As announced by the FinMin in the Budget 2016, the Government has now increased the foreign shareholding limit in Indian Stock Exchanges from 5% to 15%, bring the number at par with those by domestic institutions.

- Also, to bolster private sector participation in defense production, the Government abolished the rules that till date refrained public sector defense companies to form joint ventures with private companies.

Market Performance & Concluding Thoughts:

- July 2016 has been a pleasing one for the investors, with nifty picking up from where it left last month. Not only did the index recover from the outcome of the much hyped Brexit Referendum, but it came back strongly, with domestic cues and good corporate results playing the role of the kingmaker.

- Have a look at the performance of Nifty50, S&P BSE Mid-Cap and S&P BSE Small Cap in July 2016 compared to the previous month:

| Index | July 2016 | June 2016 |

|---|---|---|

| Nifty50 | (+)4.23% | (+)1.56% |

| S&P BSE Mid-Cap | (+)8.05% | (+)5.91% |

| S&P BSE Small Cap | (+)4.31% | (+)3.09% |

- Overall, one can say that the market has been in an uptrend for the last one month. Also, with the investors showing a thumbs-up to the corporate earnings of a majority of the 25 companies which have disclosed their numbers so far, the monsoon picking up, a positive push from the hopes of the GST bill betting passed in this Monsoon session and a crucial July 2016 car sales data (companies posting strong numbers so far), the economy can be said to have all the right ingredients for future growth.

- In case of a downfall, a prudent investor should capitalize on the panic in the market, by not selling in fear, but by BUYING quality businesses at comparatively cheaper valuations.

Continue with Google

Continue with Google