Markets In January 2017 : Movers & Shakers Of The Month

February 08, 2017

|

Every month we collect and publish the top news of the past 30 days, to help our readers be in touch with the overall market conditions and thereby make smarter and informed investment decisions. Continuing our trend of our exclusive monthly newsletter, we again bring to you, all the news and events that affected the Indian Stock Market for the first month of 2017. Hope you find the newsletter insightful and have a good time reading it. Sit back, and enjoy:

Automobile Sales

While vehicle sales witnessed quite an impact due to demonetization in December 2016 (baring Toyota India, Royal Enfield and Escorts), January 2016 was a relatively happier month for the auto makers. India’s leading car-maker Maruti Suzuki declared a handsome 27.10% growth in number of units sold, which was backed by a 44.8% increase in its exports. Royal Enfield and Toyota India were Maruti Suzuki’s only companions in the 20%+ growth range. Have a look at the numbers:

| Company Name | Jan 2017 Sales | Jan 2016 Sales | Growth |

|---|---|---|---|

| Maruti Suzuki | 144,396 | 113,606 | 27.10% |

| Royal Enfield | 59,676 | 47,710 | 25.08% |

| Toyota India | 11,252 | 9,256 | 21.56% |

| Hyundai | 51,834 | 44,230 | 17.19% |

| Escorts | 3,652 | 3,140 | 16.31% |

| Ashok Leyland | 14,872 | 13,886 | 7.10% |

| TVS Motor | 207,059 | 208,485 | -0.68% |

| Tata Motors | 46,349 | 47,035 | -1.46% |

| M&M | 36,363 | 37,915 | -4.09% |

| Force Motors | 2,353 | 2,549 | -7.69% |

| Hero MotoCorp | 487,088 | 563,348 | -13.54% |

| Bajaj Auto | 241,917 | 293,939 | -17.70% |

FII/FPI Outflow For 4th Straight Month, DIIs Still Buyers

After making a 11-month high of total FII/FPI inflows in September 2016, the equity and debt markets have witnessed outflows for four straight months now. But on the contrary, DIIs have been heavy net buyers for all the four months. Have a look at the last three months’ data:

| FII/FPI Inflows (Rs. Cr) | January-17 | December-16 | November-16 | October-16 |

|---|---|---|---|---|

| Equity | -1177 | -8176 | -18244 | -4306 |

| Debt | -2319 | -18935 | -21152 | -6000 |

| Total | -3496 | -27111 | -39396 | -10306 |

| DII Inflows (Rs. Cr) | January-17 | December-16 | November-16 | October-16 |

|---|---|---|---|---|

| Equity | 6185.4 | 8032.8 | 13610.4 | 9118.4 |

| Debt | 35770.7 | 23995.5 | 11498.1 | 24637.3 |

| Total | 41956.1 | 32028.3 | 25108.5 | 33755.7 |

RBI Removes Cash Withdrawal Limits for Current Accounts

Reserve Bank of India (RBI) removed the limits on withdrawals from current accounts, but kept the overall limit at Rs. 24,000 a week for savings bank accounts. The limit on weekly withdrawals from current account was raised to Rs. 1 lakh earlier in January from Rs. 50,000 set just after the Demonetization announcement.

Good Corporate Earnings

As of 31st January 2017, 25 Nifty companies that form the benchmark Nifty50 index had declared their Q3FY17 results.

Total combined revenue of those 25 companies stood at Rs. 398205.09 crores as against Rs. 361197.32 crores in the same period last year, thereby registering a pleasing rise of 10.25%. On the other hand, the combined PAT during Q3FY17 was Rs. 50403.78 crores as against Rs. 46251.20 crores in Q3FY16 showing growth of 8.98% Y-o-Y.

Nifty P/E, P/B and Dividend Yield

The ratio which measures the average PE ratio of the Nifty 50 companies, showed convincing signs of reversal at the end of the first month of 2017, indicating growth in companies. Basically, Nifty50 P/E ratio is broadly used to identify how cheap or expensive the index is. (Formula: sum of all market capitalizations/sum of consolidated earnings)

Applying the same analogy as above, P/B ratio of an index is the weighted average P/B ratio of all the stocks covered by the index, Nifty50 in our case. (Formula: closing level of the Nifty50/latest quarters’ book value per share (average of all companies))

Like the above two ratios, it is basically the weighted average dividend yield of all the Nifty50 companies. Have a look at the numbers for the last 4 months:

| End of Month | P/E | P/B | Div. Yield |

|---|---|---|---|

| October 2016 | 23.31 | 3.27 | 1.28 |

| November 2016 | 21.61 | 3.12 | 1.34 |

| December 2016 | 21.93 | 3.10 | 1.35 |

| January 2017 | 22.86 | 3.25 | 1.29 |

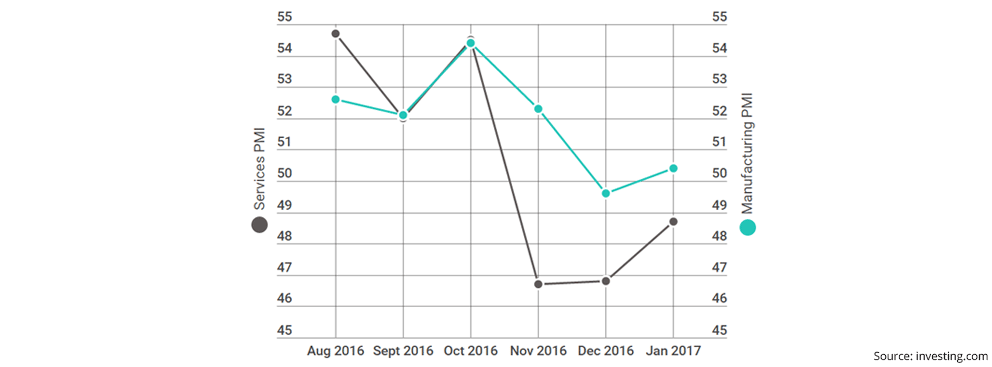

>> Indian Services Activity End In Contraction For 3rd Straight Month, Manufacturing Activity Grows

The India Nikkei Services Purchasing Managers’ Index (PMI), showed contraction levels of 48.7 in January 2017, as against similar levels of 46.7 in the preceding month. This was the third straight time that the reading fell below the 50 mark (that separates growth from contraction) since June 2015. On the other hand, the India Nikkei Markit Manufacturing Purchasing Managers Index (PMI) with levels of 50.4, again forayed into the growth range. Have a look at the historical data:

Also, a new business sub-index, an indicator of domestic and foreign demand, rose to 48.6 from its 39-month low of 46.0 in December 2016. Overall, all indicators suggested that Asia's third-largest economy is limping back to health after the demonetization episode.

Market Performance & Concluding Thoughts

Nifty50, after giving negative monthly returns for the previous three out of four months, has given a robust 4.59% monthly gain for the first month of CY2017. This was based on the expectations of an investor and consumer friendly Budget 2017, especially after three difficult months of the Demonetization episode. This was against a (-)0.47% returns for the month of December 2017. Have a look at the performances of Nifty50, S&P BSE Mid-Cap and S&P BSE Small Cap for the month of January 2017:

| Inde | Performance in January 2017 |

|---|---|

| Nifty50 | (+)4.59% |

| S&P BSE Mid-Cap | (+)6.87% |

| S&P BSE Small Cap | (+)7.38% |

The market has bounced back strongly in the past 31 odd days, after a disappointing couple of months, and has now gained momentum. Also, with a lot of companies announcing better than expected Q3FY17 results and a positive Budget 2017, one can satisfactorily say that the economy has now got all the right ingredients for future growth. Interestingly, there are a lot of companies with great business models still trading at attractive valuations, make sure you don’t miss out on them. Happy Investing!

Continue with Google

Continue with Google