Markets In December 2016 : Movers & Shakers Of The Month

January 04, 2017

|

Every month we collect and publish the top news of the past 30 days, to help our readers be in touch with the overall market conditions and thereby make smarter and informed investment decisions. Continuing our trend of our exclusive monthly newsletter, we again bring to you, all the news and events that affected the Indian Stock Market for the last month of 2016. Hope you find the newsletter insightful and have a good time reading it. Sit back, and enjoy:

Automobile Sales

With demonetization process into its final phase in December 2016, most automakers managed to report growth not so pleasing, but expected de-growth in sales. Baring Toyota India, Royal Enfield and Escorts, none managed to show a double digit growth. Also, note that the sales figures of Royal Enfield do not show its true growth in numbers as the sales last year was subdued due to the Chennai floods in December. Have a look at the numbers:

| Company Name | Dec 2016 Sales | Dec 2015 Sales | Growth |

|---|---|---|---|

| Royal Enfield | 57,098 | 40,453 | 41.15% |

| Toyota India | 14,093 | 10,883 | 29.50% |

| Escorts | 3,187 | 2,751 | 15.85% |

| Renault India | 11,244 | 10,292 | 9.25% |

| M&M | 14,047 | 12,868 | 9.16% |

| Tata Motors | 40,944 | 39,973 | 2.43% |

| Maruti Suzuki | 117,908 | 119,149 | -1.04% |

| Hyundai | 40,057 | 41,861 | -4.31% |

| TVS Motor | 184,901 | 202,021 | -8.47% |

| Ashok Leyland | 10,731 | 12,154 | -11.71% |

| Bajaj Auto | 225,529 | 289,003 | -21.96% |

FII/FPI Outflow For 3rd Straight Month

After making a 11-month high of total FII/FPI inflows in September 2016, the equity and debt markets have witnessed outflows for three straight months now. In November, after recording its steepest fall since after June 2013, the outflow relatively reduced, but was still the 2nd highest after the June 2013 outflow. Have a look at the last three months’ data:

| FII/FPI Inflows (Rs. Cr) | December-16 | November-16 | October-16 |

|---|---|---|---|

| Equity | -8176 | -18244 | -4306 |

| Debt | -18935 | -21152 | -6000 |

| Total | -27111 | -39396 | -10306 |

RBI Doesn’t Cut Repo Rates

The Reserve Bank of India (RBI), in its fifth bi-monthly policy statement for the year, against all expectations decided to go against the rate cut, supposedly to wait for the impact of demonetization to be more visible. Another reason attributed to this withholding of the rate is to suck out the excess liquidity in the system. This was because post demonetization till the RBI policy date, the banks had been flooded with deposits of nearly Rs. 5.12 lakh crores, while the withdrawals have been only a fifth of the deposits, at Rs 1.3 lakh crores. With an accommodative monetary stance, the RBI expects retail inflation to at 5% in Q4FY2017.

US Fed Raises Rates for First Time in 2016, by 25 bps

The Federal Reserve increased its key interest rate by 0.25 bps to a range of 0.50% and 0.75% signifying its confidence in the improving U.S. economy. It was just the second time in a decade that the Fed has raised interest rates; the first being in December 2015. It also signaled that interest rates would rise at a faster pace than previously projected. The Federal Open Market Committee (FOMC) pointed to a strengthening labor market with unemployment rate at 4.6% (lowest since 2007) and inflation moving more rapidly toward targeted levels of 2%.

Nifty P/E, P/B and Dividend Yield

The ratio which measures the average PE ratio of the Nifty 50 companies, showed slight signs of reversal at the end of the last month of 2016, indicating stabilization. Basically, Nifty50 P/E ratio is broadly used to identify how cheap or expensive the index is. (Formula: sum of all market capitalizations/sum of consolidated earnings)

Applying the same analogy as above, P/B ratio of an index is the weighted average P/B ratio of all the stocks covered by the index, Nifty50 in our case. (Formula: closing level of the Nifty50/latest quarters’ book value per share (average of all companies)

Like the above two ratios, it is basically the weighted average dividend yield of all the Nifty50 companies. Have a look at the numbers for the last 4 months:

| End of Month | P/E | P/B | Div. Yield |

|---|---|---|---|

| September 2016 | 23.40 | 3.27 | 1.29 |

| October 2016 | 23.31 | 3.27 | 1.28 |

| November 2016 | 21.61 | 3.12 | 1.34 |

| December 2016 | 21.93 | 3.10 | 1.35 |

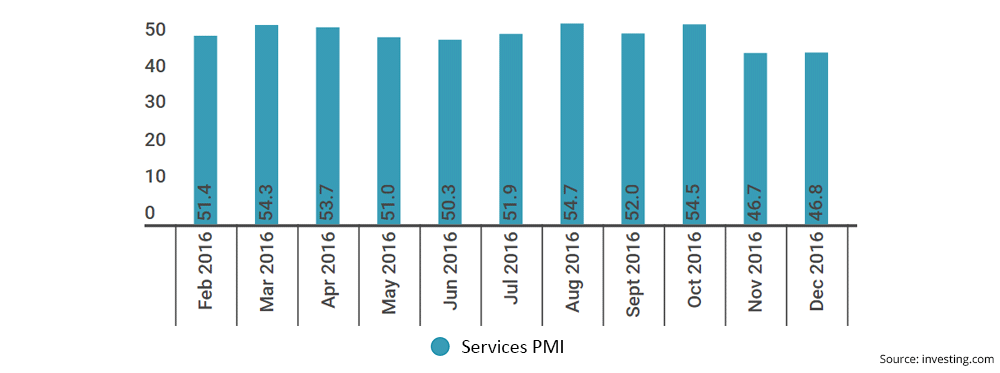

Indian Services Activity End In Contraction For 2nd Straight Month

The Nikkei/Markit Services Purchasing Managers' Index, showed contraction levels of 46.8 in December 2016, as against similar levels of 46.7 in the preceding month. This was the second time that the reading fell below the 50 mark (that separates growth from contraction) since June 2015. Have a look at the historical data:

Also, a new business sub-index, an indicator of domestic and foreign demand, fell to a 39-month low of 46.0 in December 2016 from 46.7 in November, even though firms cut prices of their goods despite input costs rising at a faster pace.

Highlights of PM’s New Year’s Eve Speech

- Banks told to raise cash credit limit to small businesses from 20% to 25%.

- The government will give NABARD Rs. 20000 crores for giving loans to cooperatives at low interest rates.

- Home loans in villages up to Rs 2 lakh to get 3% interest exemption, available for building a new house or expanding an old one; while the urban poor will get 4% and 3% interest subvention on loans up to Rs. 9 lakh and up to Rs. 12 lakh respectively.

- Providing 8% interest on deposits of up to Rs 7.5 lakh for senior citizens for 10 years.

- Providing pregnant women Rs. 6,000 which is to be transferred into their bank accounts directly.

Market Performance & Concluding Thoughts

Nifty50, for the third time in 4 months, has given negative monthly returns (in September, November and December). Although by a meager margin, but it closed (-)0.47% in the month of December, as against (-)4.65% in November. Have a look at the performances of Nifty50, S&P BSE Mid-Cap and S&P BSE Small Cap for the month of December 2016, as well as for 2016 as a whole:

| Index | Performance in December | Yearly Performance |

|---|---|---|

| Nifty50 | (-)0.47% | (+)2.98% |

| S&P BSE Mid-Cap | (-)3.74% | (+)7.97% |

| S&P BSE Small Cap | (-)2.30% | (+)1.77% |

Currently, despite all the ‘bothering’ events like US Polls, Demonetization, No RBI Rate Cut, Fed Rate Hike, Possibilities of muted Q3 earnings, etc having taken place, the weakness has already been factored in. So make sure you make the most of this market opportunity, for you may never know when the market will reverse its trend and get over this anxious episode. Happy Investing!

Continue with Google

Continue with Google