Is It The Right Time To Invest In Quality Mid-Caps Now?

15875 Views | December 07, 2019

If you are currently unsure, and contemplating whether to invest now or wait for a more opportune entry point due to current market conditions, we’ve put together some insights drawn from data-driven facts and our experience to hopefully lead you to a wise investment decision, one that you gives you investing comfort and confidence.

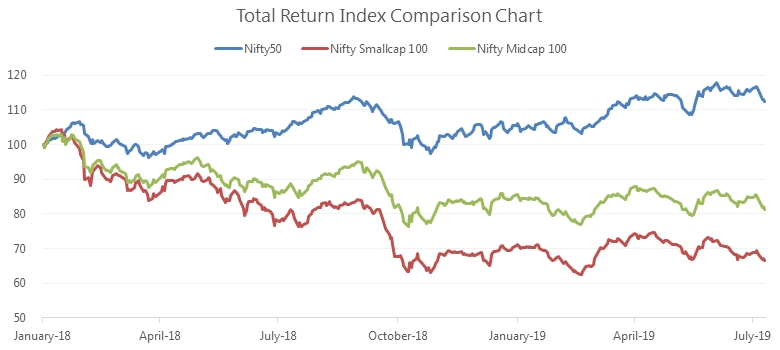

1. Nifty50 near to its Lifetime High but Midcaps continue to fall since January 2018

| Index Name | Total Return (%) |

|---|---|

| Nifty 50 | 12.51% |

| Nifty MidCap 100 | -18.68% |

| Nifty SmallCap 100 | -33.34% |

| Nifty MidSmallCap 400 | -20.88% |

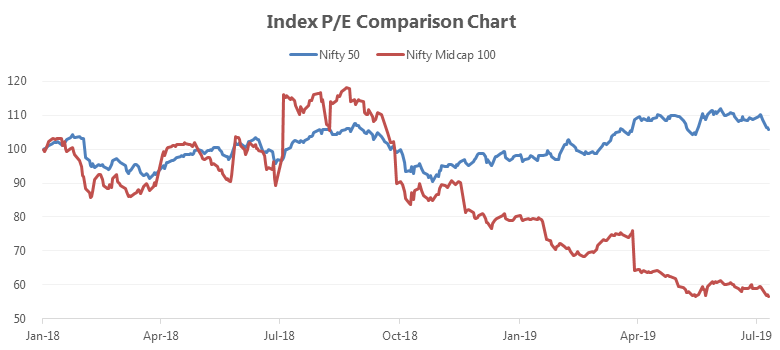

2. Nifty Mid Caps Relative Valuations Vs. Nifty 50 has corrected a lot

Nifty PE Ratio

| Indices | 1-Jan-18 | 10-Jul-19 | % Change | Remarks |

|---|---|---|---|---|

| Nifty 50 | 26.68 | 28.20 | 6% | Over Valued |

| Nifty MidCap 100 | 52.55 | 29.72 | -43% | Under Valued |

Nifty Price Book Ratio

| Indices | 1-Jan-18 | 10-Jul-19 | % Change | Remarks |

|---|---|---|---|---|

| Nifty 50 | 3.51 | 3.62 | 3% | Neutral |

| Nifty MidCap 100 | 2.97 | 2.35 | -21% | +ve |

Nifty Dividend Yield

| Indices | 1-Jan-18 | 10-Jul-19 | % Change | Remarks |

|---|---|---|---|---|

| Nifty 50 | 1.09 | 1.27 | 17% | Neutral |

| Nifty MidCap 100 | 0.84 | 1.31 | 56% | Very +ve |

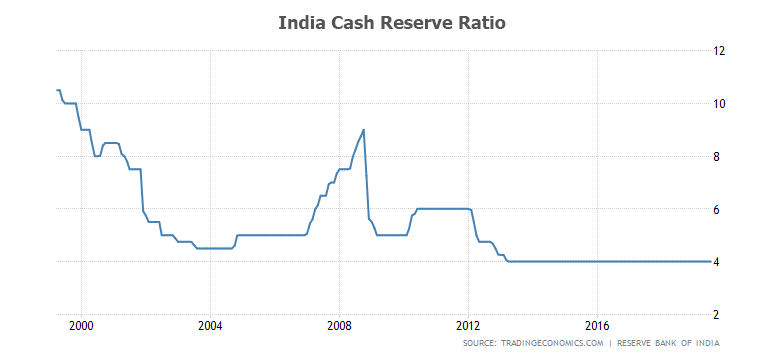

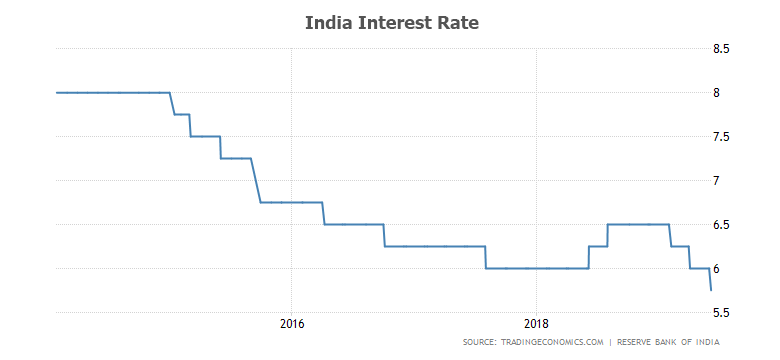

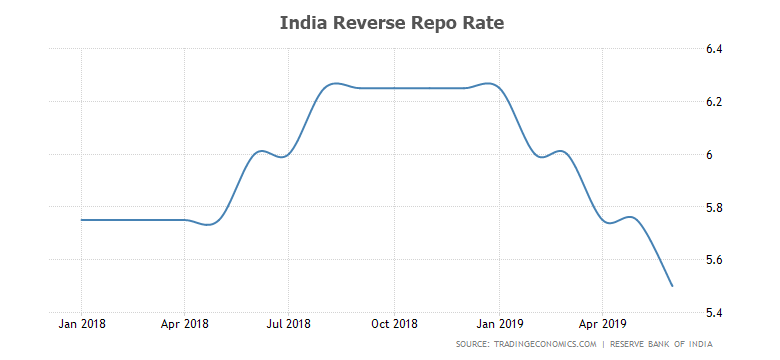

3. Improving Liquidity & Reducing Interest Rates will Help Companies to grow

Latest RBI Bank Rates in Indian Banking – 2019

| SLR Rate | CRR | Bank Rate | Repo Rate | Reverse Repo Rate |

|---|---|---|---|---|

| 18.75% | 4% | 6% | 5.75% | 5.50% |

| India Money | Last | Previous | Highest | Lowest | Unit |

|---|---|---|---|---|---|

| Interest Rate | 5.75 | 6.00 | 14.50 | 4.25 | percent |

| Cash Reserve Ratio | 4.00 | 4.00 | 10.50 | 4.00 | percent |

| Reverse Repo Rate | 5.50 | 5.75 | 13.50 | 3.25 | percent |

History reminds us that the worst days in the market are often followed immediately by some of the best days in the market. Many investors can find themselves whipsawed, first selling and taking a severe loss after a significant correction, then investing again in the markets when it’s too late and miss the larger than normal “gains” generated from the “off-the-bottom” cycle of recovery.

While the Nifty50 may currently be near a high, but Midcap indexes are nowhere near its all-time high. We’ve NEVER seen the market hit a point that it never surpasses. The key is to think long term.

We firmly believe that when investing in stocks, time and stock selection is the greatest ally.

That’s why investing now is so essential.

However, more often than not, we believe that investors are best served when they position for the long term and invest into the equity markets as soon as they have the opportunity and never attempt to time or outsmart the markets.

If there’s one thing that’s likely never to change about long-term investing in the equity markets, it’s that market volatility will always be a part of the experience.

In our view, an unemotional, well thought out, investments in well researched companies is the way to generate exponential, compounded growth provided by the equity markets.

At the end of the day, you should invest in the way that makes you feel most comfortable—that is the number 1 rule of investing.

We'd love to hear from you on this.

Continue with Google

Continue with Google