India’s Two Listed Asset Management Companies - at the threshold of a Bull Run?

February 04, 2020

|

Of 44 asset management companies in India, popularly known as mutual funds or MF, only two are listed on the Indian stock markets - HDFC AMC and Nippon Life AMC (AMC is Asset Management Company). Both these companies had a dream run in 2019 with their stock prices more than doubling during the year, which is representative of the potential of this segment of the financial services sector. Since just two AMCs are presently listed, due to lack of options, investors flocked at these two counters thereby lifting their prices.

HDFC AMC & Nippon life AMC shares are the third- and fourth-best performers among 36 peers with a market value of at least $2 billion. However, unlike developed markets, Indian investors are still not completely well versed with the benefits offered by asset management companies; when this percolates among the masses, the growth of this segment is expected to be phenomenal.

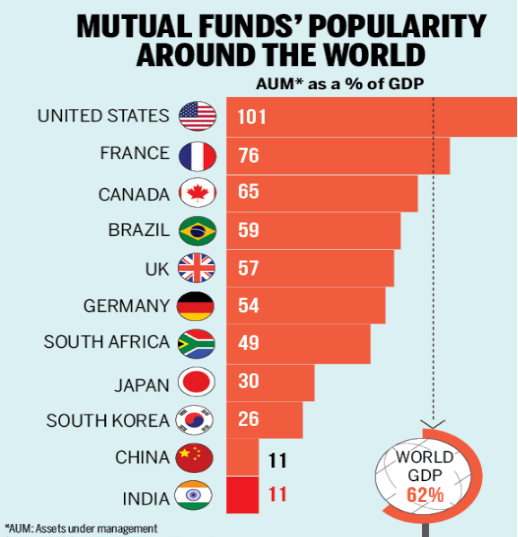

Take a look at the significant exposure investors in developed countries of the world have in mutual funds:

Now let’s understand how the Indian mutual fund industry has fared so far and its scope for future growth.

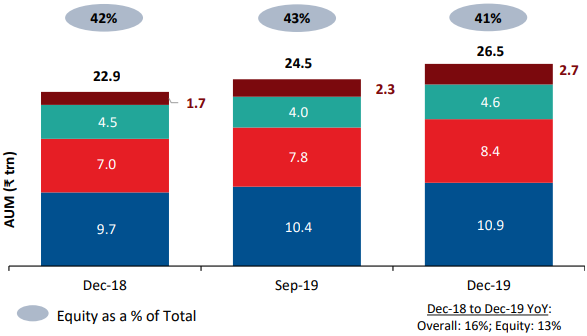

Indian mutual funds’ Assets Under Management (AUM) rose to an all-time high of Rs. 27.26 lakh crores as on 31 December 2019. What led to this phenomenal growth? Is it sustainable? Also, how will the two listed AMCs fare going forward? At stockaxis, we have undertaken extensive research on this segment of the financial services sector and identified the factors that could impact these listed stocks.

Strong AUM growth

With increasing awareness among Indian investors about mutual funds, the AUM of the industry has seen an astonishing growth every year reaching a milestone of Rs 27.26 lakh crores, clocking a CAGR (compounded annualized growth rate) of 13%.

The biggest driver for this growth has been the gradual but steady shift of Indian household savings from physical assets like Gold and Real Estate to financial assets like Mutual Funds, Stocks, Bonds, etc. This trend of shifting wealth between asset classes, which is referred to as “Financialisation of savings”, received a fillip post-demonetization resulting in a sharp rise in inflows into mutual funds. Consequently, the past five years have seen an accelerated growth in AUM at a CAGR of 20% after promising performances by funds over the long term and increased awareness among Indian investors, on the back of a superhit campaign by AMFI: “Mutual Funds Sahi Hai.”

Factors that drove the growth

- Multiple factors have together delivered this growth. Product innovation in the form of systematic investment plans (SIPs) and improved reach and penetration by AMCs have played a key role in bringing smaller investors on to the mutual funds’ platform. Various marketing initiatives and investor awareness campaigns by the industry body AMFI as mentioned earlier, further popularised mutual funds.

- Most importantly, progressive reforms and regulations by market regulator SEBI, such as introduction of direct plans, amendment in upfront commission rules, capping of TER (Total Expense Ratios) charged by MFs to investors, standardization of MF schemes and disclosures have been enablers of the strong growth.

- Increasing share of mutual funds within financial savings is not a one-off effect. The MF investor base has deepened and widened over time. The total number of accounts (or folios) continued to rise for the 67th consecutive month and stood at 8.71 crore as on 31 December 2019. Individual investors now hold a higher share of Mutual Fund assets at around 54% as per the data of AMFI.

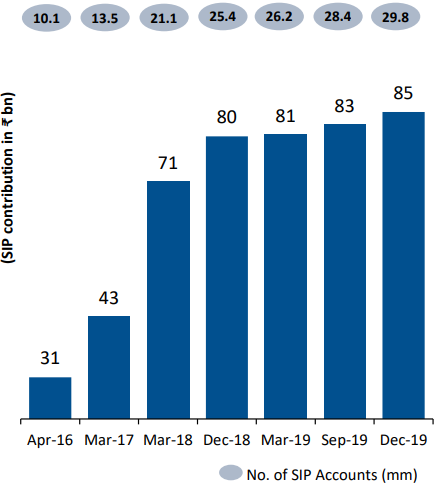

- Apart from the factors highlighted earlier, the prolonged slowdown in real estate post demonetisation and reduced FD rates have also driven MF inflows. The trend of dependency on FIIs/FPIs for cashflows, though inherent to the MF industry, has largely become subdued now. For instance, SIP has emerged as a savings instrument in equity for retail investors drawing in more than Rs 8,200 crore per month. At the current levels, roughly Rs.1 lakh crore of equity inflows is assured for the MF industry only through SIPs, thereby reducing cyclicality in the industry.

Despite increasing popularity, current MF AUM stands at just 17% of financial savings (bank deposits plus mutual funds) indicating the potential for MFs.

| Year | MF AUM (A) | Bank Deposits (B) | Total Savings (A+B) | Share of MF in total savings |

|---|---|---|---|---|

| FY09 | 417,000 | 39,21,980 | 4,338,980 | 10% |

| FY15 | 10,82,757 | 85,33,290 | 9,616,047 | 11% |

| FY19 | 23,80,000 | 12,572,590 | 14,952,590 | 16% |

| Nov-19 | 27,05,000 | 12,958,755 | 15,663,755 | 17% |

Source - Moneycontrol Research. Bank deposits as on 22 Nov 2019.

Overall, the mutual fund industry is witnessing a structural growth story and the robust AUM growth of the past decade will continue going forward. Thanks to growing savings and increasing share of MFs in the pool of savings, profitability of AMCs will continue to be healthy.

Impact of Budget 2020 on your mutual fund investments

Finance Minister, Nirmala Sitharaman chose to retain tax on long-term capital gains (LTCG) on equity mutual funds in her budget for financial year 2020-21. Most market participants were expecting a roll-back of LTCG tax. As per existing rules, returns on investments in equity mutual funds held for over a year are treated as long-term capital gains and taxed at 10% on gains of over Rs 1 lakh in a financial year. The LTCG tax was re-introduced by Arun Jaitley, the then finance minister, in his budget speech in 2016. While re-introducing the LTCG tax, he also provided relief to existing equity investors in the form of grandfathering of returns by a special clause which exempted returns made by investors before January 31, 2018.

Should this impact your mutual fund investment plan?

While making an investment, what is relevant is the intent of that investment – to achieve a financial goal. The tax impact, though important, cannot be the key motive on whether to make an investment or not. Investors must focus on their goals and risk profile while choosing suitable funds; equity funds are good for long-term financial goals and wealth building.

Equity funds not only offer inflation-beating returns, but also help grow your wealth over the long term because of their potential to offer superior returns compared to other asset classes.

In India, equity mutual funds have offered double-digit returns over a long period of 10-15 years. This is the reason why we believe that mutual fund investors should continue with their investments in equity mutual funds to achieve their long-term financial goals. At the same time, investors should always consider inflation and taxes while calculating their target corpus to achieve their long-term goals.

TDS on capital gains

In her union budget speech on Saturday, FM Nirmala Sitharaman announced her intention to abolish Dividend Distribution Tax (DDT) on mutual fund dividends which were paid by the AMC. Earlier, AMCs was deducting DDT on dividend payments and paying directly to the government. According to the new rule, now dividends will be added to the total income of individual investors and will be taxable at individual applicable slab rate. TDS will be levied at the rate of 10% on dividend payments from AMCs for dividends exceeding Rs.5,000 per year.

However, after a lot of queries regarding whether the TDS requirement proposed in the Finance Bill 2020 would also apply to capital gains arising on redemption of mutual fund units, Central Board of Direct Taxes (CBDT) issued a explanatory statement that this proposal will not apply to any capital gains on redemption of mutual fund units. The CBDT statement stated that “It is hereby clarified that under the proposed section, a mutual fund shall be required to deduct TDS at the rate of 10% only on dividend payment and no tax shall be required to be deducted by the Mutual Fund on income which is in the nature of capital gains. Necessary clarification, if required, shall be proposed in the relevant provision of the law."

However, the decision of imposing DDT on dividend income exceeding Rs.5,000 a year is likely to cause a lot of hardship to mutual fund investors and would open up an arbitrage with direct equity and insurance investment products. At present, TDS is deducted for NRI investors in mutual funds but not resident individuals. Resident individuals have to calculate and pay tax on a self-assessment basis.

Mutual fund investors also should remember that dividends from mutual funds would be added to their income and taxed according to their respective tax slab. Currently, mutual funds pay tax on dividends declared at 11.648% on equity mutual funds and at 29.12% on debt mutual funds. Now, investors will have to pay taxes on the dividends as per individual tax slab, rather than AMC deducting the tax at source.

If you are in the 10% or 20% tax slab, you stand to gain on dividends from your debt mutual funds. If you are in the 30% income tax slab, you would pay more tax on dividends because dividends are added to total income and charged as per tax slab. Dividends are not attractive on equity schemes anymore for most people. So, opt for the growth option instead and choose SWP-route to withdraw money regularly. Note: capital gains tax would apply when you are withdrawing money through SWPs.

If you sell your debt mutual funds before three years, short-term capital gains would be added to your income and taxed according to the tax slab applicable to you. If you sell your debt mutual funds after three years, gains are treated as long-term capital gains and taxed at 20% with indexation benefit.

If you sell your equity mutual funds before a year, you need to pay short-term capital gains tax at 15%. If you sell your equity mutual funds after a year, it will be treated as a long-term capital gains (LTCG). Any LTCG in excess of Rs.1,00,000/- per year will be taxed at 10%.

Section 80C and ELSS funds (Post budget 2020)

Under Section 80C of the Income Tax Act, 1961, investors can save tax by investing up to Rs 1.5 lakh in products like ELSS (tax saving mutual funds), ULIPs (unit linked insurance plans) and PPF, among others. As compared to other eligible investments under section 80C, ELSS has the lowest lock-in period of 3 years. Investors have understood this and opted for this investment; this reflects in the growth in AUM (assets under management) of ELSS funds to Rs 99,817 crore in December 2019 as against Rs 88,512 crore in 2018 and Rs 80,891 crore in 2017. In addition to having the lowest lock-in, ELSS also has the advantage of investing in equity, which has the potential to reap attractive returns over the long term.

AUM, Inflows/Outflows in ELSS Funds

| Year (April-March) | Net Inflows/(Outflows) of ELSS (In crs) | AUM as a % of equity |

|---|---|---|

| 2009 | 2,968 | 14.28% |

| 2010 | 1,554 | 13.79% |

| 2011 | 266 | 14.81% |

| 2012 | (142) | 18.18% |

| 2013 | (1,656) | 15% |

| 2014 | (1,641) | 14.29% |

| 2015 | 2,908 | 14.29% |

| 2016 | 6,413 | 14.81% |

| 2017 | 10,097 | 12.90% |

| 2018 | 14,316 | 12.5% |

| 2019 | 12,771 | - |

The new tax laws announced in the finance budget 2020 make investing in tax-saving securities irrelevant. This could have an impact on the amount of investments in ELSS funds. This is especially true in case of investors in the lower tax brackets who would prefer to opt out of tax saving investments in order to have more cash in hand.

At stockaxis, we strongly believe that tax is an incidental element of investing. We advise you to stay focussed on investing in equity mutual funds to meet your financial goals and not let tax become a key component to impact your investment decisions. Simply remind yourself that you are investing in mutual funds because they have the potential to offer superior returns over the long term than other asset classes. Equity funds are essential to earn inflation-beating and high after-tax returns – which are essential to create a large corpus in the long term.

Let’s see how our only two listed asset managers fare on different parameters and what are their long term outlook.

HDFC AMC

HDFC AMC continues to be the face of the mutual fund industry. The AMC operates as a joint venture between Housing Development Finance Corporation (HDFC) and Standard Life Investments (SLI). As on 31st March 2019, HDFC holds 52.77% and SLI holds 29.94% of the AMC.

HDFC is a financial services conglomerate diversified into Housing Finance, Banking, Insurance (Life and General), Asset Management, Real Estate Venture Capital, Education Loans etc. SLI is one of the world’s largest investment companies. The investment business has a substantial global presence with clients across 80 countries and £575.7 billion assets under management. It manages a diverse portfolio covering all major markets world-wide. The brand equity, goodwill, and expertise of the promoters empowers HDFC AMC to grow from strength to strength. While the HDFC brand enjoys deep trust of customers across generations, SLI has contributed towards the industry best practices, particularly in operations and risk management.

HDFC AMC’s AUM Growth

HDFC AMC is at the forefront in terms of growth as well in mutual fund assets, with an AUM of Rs.3.68 lakh crore as on 31 December 2019, the highest in the industry. Its stock price has almost tripled since listing in August 2018 with the support of sound fundamentals and investor confidence in mutual funds as well as HDFC’s strong brand. AUM the AMC has grown by a phenomenal CAGR of 25.86%. The equity component of AUM stood at Rs. 1.69 lakh crores, having grown at 5-year CAGR of 30%.

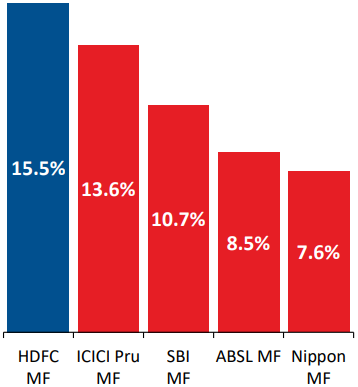

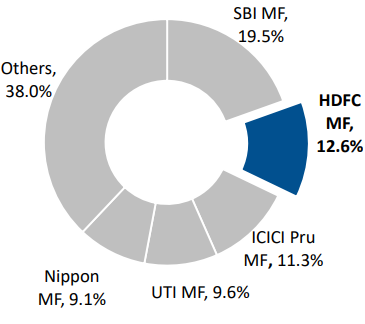

Individual Asset market share based on AUM as on 31 Dec 2019.

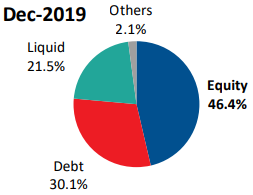

Many of the fund managers are at a view that some of the funds are having large amounts of exposure of AUM into mid and smallcaps which makes them more vulnerable. HDFC AMC has the largest equity AUM among Indian mutual funds. Of its total AUM, equity constituted 46.4%, which was higher than the industry average of 41.1%, as of December 31, 2019. Its market share of total AUM was 13.9% and of actively managed equity oriented AUM was 15.6% among all AMCs in India.

Segment wise breakup of HDFC AUM.

Its market share of 15.5% of the individual monthly average AUM in the industry makes the company the most preferred choice among retail investors.

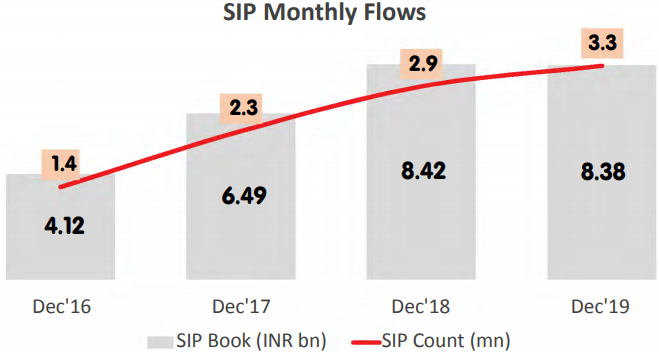

Robust SIP Book is contributing to a continuous flow every month:

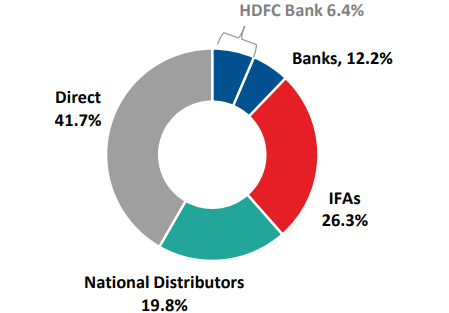

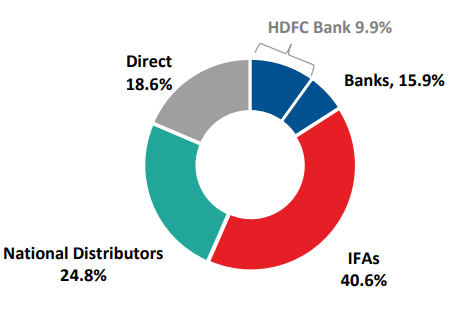

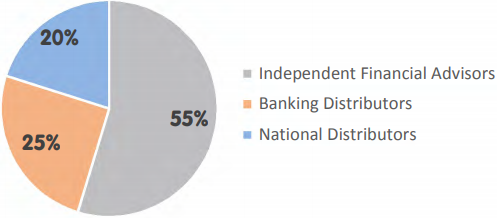

The company has a stable SIP book; it had an inflow of over Rs. 1,220 crore during December 2019, which came from 34.2 lakh customer accounts. As of December 31, 2019, the company served customers through a pan-India network of 220 branches of which 144 are in B-30 (Beyond Top 30) cities, which is supported by a strong and diversified network of over 75,000 empanelled distribution partners across India, consisting of Independent Financial Advisors (IFAs), national distributors and banks. As of December 31, 2019, IFAs, national distributors and banks generated 26.3%, 19.8%, 18.6% of HDFC AMC’s total AUM, respectively, while the remaining 41.7% was invested in direct plans. IFAs, national distributors and banks generated 40.6%, 24.8%, 25.8% of the company’s equity oriented AUM, respectively, while the remaining 18.6% was invested in direct plans, as of December 31, 2019.

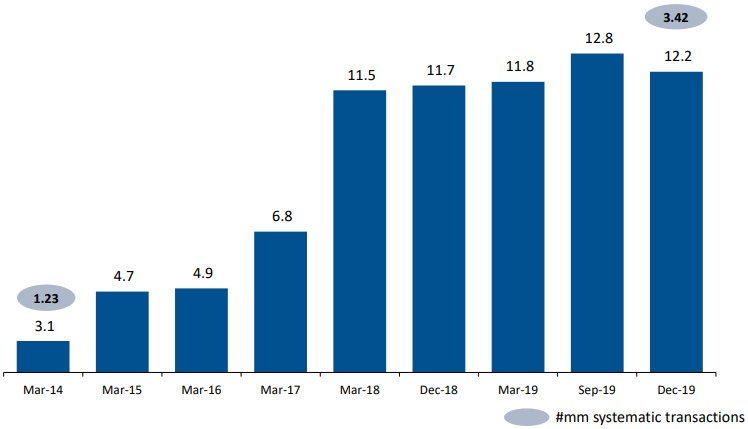

Quality Long-term Inflows to HDFC AMC through Systematic Transactions:

The AMC receives steady flows from systematic transactions of over Rs. 1,220 crore per month as on 31 December 2019. SIP flows, which come from retail investors and HNIs, tend to be largely directed towards equity MFs. Strong SIP book provides a predictable flow and helps to navigate the volatility in the equity market. Moreover, 80.3% of HDFC AMC’s SIP book has a tenure of over 5 years and 68.1% has a tenure of over 10 years.

MF Industry’s monthly inflows through SIP :

Well Diversified Distribution Channel

Total AUM (Dec-19)

Equity-oriented AUM (Dec-19)

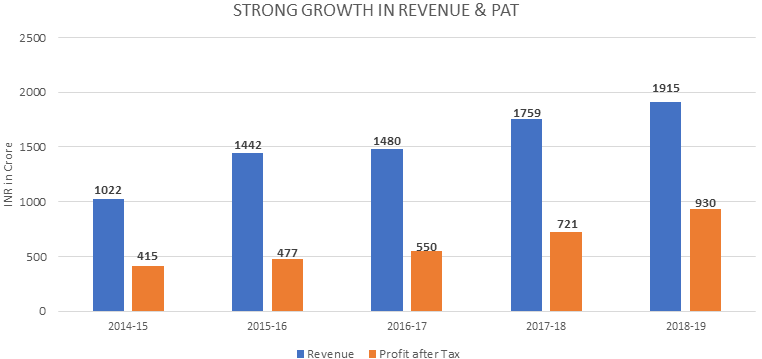

Consistent profitable growth:

HDFC AMC has been the most profitable AMC in India in terms of net profit since FY13. Revenue from operations has been growing at a 5-year CAGR of 17% and its PAT has been growing at a 5-year CAGR of about 20%. The AMC had total AUM of Rs. 3,68,900 crore as of 31st December 2019. Equity oriented AUM was at 46.4% of total AUM, which is higher than the industry average 41.1%. As equity-oriented schemes generally have a higher fee structure compared to non-equity-oriented schemes, higher share of equity oriented AUM helps to achieve higher profits. It has the highest market share in actively managed Equity-oriented AUM at 15.6%.

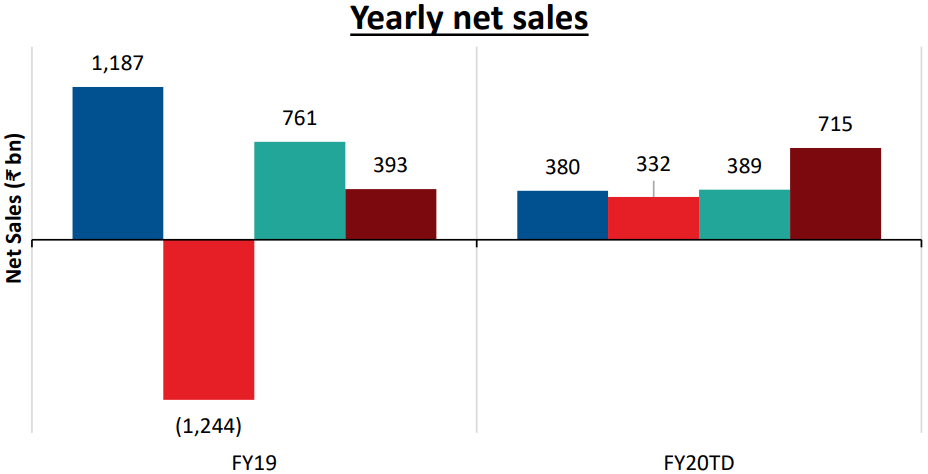

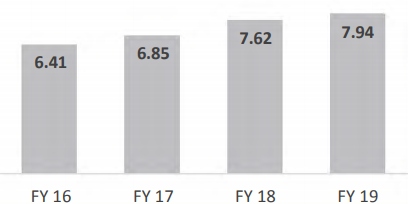

HDFC AMC’s yearly net sales (in thousand crores):

Experienced and stable management:

The senior management team has been with HDFC AMC for an average of 14 years and has a total average work experience of 27 years. The Managing Director, Milind Barve has been with HDFC AMC since inception and with HDFC group for over 35 years. The Chief Investment Officer (CIO), Prashant Jain joined HDFC AMC in 2003 when HDFC AMC acquired Zurich India Asset Management Company where he had been since 1993.

Impact of TER cut and banning of upfront commissions:

TER reduction notified by SEBI came into effect from April 2019. The new TER structure proposed by SEBI has introduced AUM slabs with progressive reduction in the maximum TER allowable. According to HDFC AMC, the gross impact of this on equity schemes is 24bps to 25bps (bps stands for basis points; 1 basis point 1/100th of 1%, or 0.01%). As on date, the AMC has already passed on approximately 21.5 bps to 22 bps to the distributors, so the net impact on the company’s books would be close to 3bps to 3.5bps. It would not be a difficult task for large AMCs with high bargaining power like HDFC AMC to pass on reduction in TER to distributors.

SEBI banned the payment of upfront commissions to distributors with effect from October 2018. It also notified that all commission related expenses are to be borne by the MF scheme and not by the AMC. AMCs generally paid out upfront commissions through the P&L of the AMC, while trail commissions were paid out through the respective schemes. Now with upfront commission ban and all related expenses to be borne by scheme, AMC’s consolidated profits are likely to increase because of decrease in their operating expenditure.

Providing liquidity to FMP investors for long term interest of the company:

HDFC AMC’s Fixed Maturity Plans (FMPs) have exposure to Non-Convertible Debentures (NCDs) of Essel group companies, which has declared its inability to repay its lenders. HDFC AMC and other MFs had entered into an agreement with Essel promoters, and extended their timeline till September 2019 for repaying their debt. According to us, this development will have a very positive impact on the company in the long run, as the AMC is focused on its unit-holders’ financial wellbeing, which is a long-term positive as it builds loyalty and faith in the minds of MF investors for HDFC AMC.

Structural growth opportunity in Indian Asset Management:

MF Industry in India is poised for strong growth. The equity investment culture through mutual funds has been deepening and we believe the MF industry is in a sweet spot to exploit the same. The strengthening of SIP flows looks sustainable.

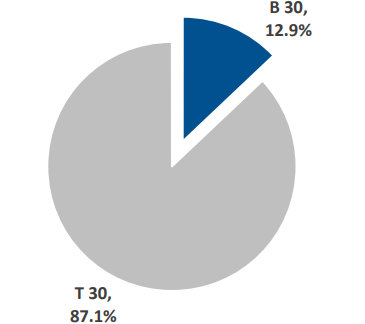

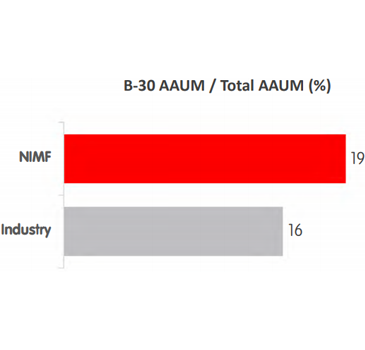

The Indian mutual fund AUM trend suggests a likely growth rate of 20-22% CAGR between FY20-FY23E. This can take the MF AUMs beyond Rs. 50 lakh crore over the next three to four years. We expect increased retail participation in the form SIPs and tax saving ELSS (which offers tax deduction under section 80C of the Income tax Act). Penetration of MF products beyond the top 30 cities (B30) remains a key focus in the asset management space. A large part of MF AUM currently originates from the top 5 cities. Very low penetration levels in small towns is an attractive growth opportunity for AMCs. The B-30 locations are showing strong promise with the AUM from B-30 cities growing faster than T-30 (Top 30 cities) locations since FY14. Retail investors form a major portion of investments from B-30 locations.

We believe that inflows to MFs from small towns will continue to build in a robust manner and should largely come from retail investors with small ticket sizes. Currently, only 14.9% of total Monthly Average AUM comes from B-30 cities and HDFC AMC continues to be the second largest player in terms of market share in B-30 markets. Among HDFC AMC’s network of 220 branches, 144 are in B-30 cities. The AMC has 70k+empaneled distribution partners.

Total AUM by T30 and B30 cities

#2 Player in B-30 Markets

The operating performance of HDFC AMC continues to be robust despite macro headwinds such as slowing economy, diminishing inflows and uncertain equity outlook due to domestic slowdown as well as geo-political tensions like US-China Trade War. It is precisely its ability to outperform even under such difficult conditions that makes HDFC AMC’s stock very expensive. Despite the rich valuations, many mutual fund managers and institutional investors are continuously bullish on the stock seeing its potential in the long term.

Composition of the MF’s assets and customer profiling are the vital determinants of profits in the asset management business and HDFC AMC enjoys a favourable mix in both these variables. Additionally, superior performance, customer trust and distribution network are equally important in attracting investors. HDFC AMC scores a bullseye on all these parameters too given the strong brand name of the HDFC group, a skilled and experienced investment team and multi-channel distribution mix.

Beneficiary of fundamental transformation in the Indian savings environment :

India has historically been and is expected to remain a savings economy. The gross domestic savings rate (as a percentage of GDP) is higher than those of major economies such as the US, the UK, France, Japan and Germany. Indians traditionally have been great ‘savers’ but not good investors. Most of the savings went into gold, real estate and fixed deposits. However, what is happening now is nothing short of a revolution with people preferring more of financial assets as compared to physical assets and within the realm of financial assets, the allocation towards smarter investment products like mutual funds is increasing compared to fixed deposits.

Nippon Life Asset Management Company

Beginning of a new journey with huge opportunity lying ahead

Nippon Life Insurance Company (“NLI”) is Japan’s leading private life insurer and offers a wide range of financial products including individual and group life and annuity policies through various distribution channels, mainly using face-to-face sales channels for its traditional insurance products. It primarily operates in Japan, North America, Europe, Oceania and Asia, and is headquartered in Osaka, Japan. NLI conducts asset management operations in Asia through its subsidiary Nissay Asset Management Corporation (“Nissay”), which manages assets globally.

About Nippon Life Insurance

- Fortune 500 company (Rank 125 in 2019).

- Japan’s largest private life insurer and one of the largest in the world.

- Total assets over US$ 700 billion.

- 50 Asset Management related operations and 21 Insurance related operations globally.

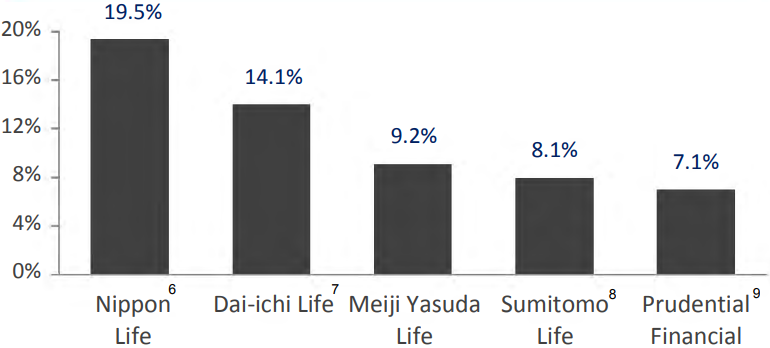

Market Share in Japan (Premium Income)5

Exposure to ADAG group stands clear:

The erstwhile Reliance AMC was one of the largest asset managers in India, with 24 years of track record. Reliance AMC’s stock jumped around 128% in the previous year. The sharp rally in the stock price was on the back of Nippon Life of Japan buying out Reliance Capital’s stake and consequently becoming a 75% holder in the AMC. Also, the exit of Reliance ADAG group from the AMC helped to relieve investors’ concerns and led to re-rating of the stock which resulted in a vertical rally in the stock price of the asset manager. Nippon AMC is the fifth largest AMC with MF assets of approximately Rs.3.10 lakh crore as on December 2019.

Anil Dhirubhai Ambani Group (ADAG) group has repaid Inter Corporate Deposits (ICDs) worth Rs 4200 crores to Nippon AMC. Accordingly, to this extent, the exposure of ADAG to the AMC stands cleared. Scheme level exposures to ADAG have also been on a decline.

Gaining lost market share:

With the change of brand name to ‘Nippon India Mutual Fund’ from earlier ‘Reliance Mutual Fund’ and a global sponsor with a good track record, the fund house hopes to regain its market share, which it has steadily lost over the years and attract a section of institutional and high net worth customers who had exited because of concerns about the financial health of ADAG - the erstwhile co-sponsor of the fund house.

Emerging growth opportunities in ETFs, AIF and offshore funds:

Nippon AMC is the second largest ETF player with a market share of approximately 18% in the segment. AIF (alternate investment funds) is emerging as the next engine of growth. Nippon AMC has launched industry-first commodity and offshore real estate fund. The AMC will work closely with Nippon Life Insurance to leverage its global tie-ups for attracting higher flows from international investors.

Strengthened risk management with international best practices:

Based on Nippon’s global positioning and relationships, Nippon AMC is expected to adopt best governance and risk management practices.

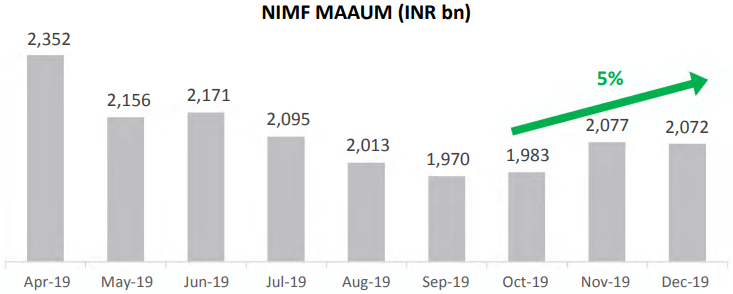

Increasing AUM:

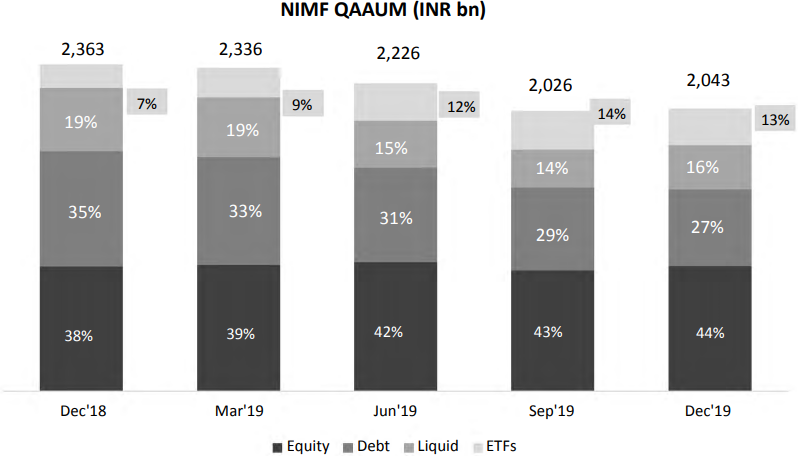

Equity now contributes 44% of the Total AUM:

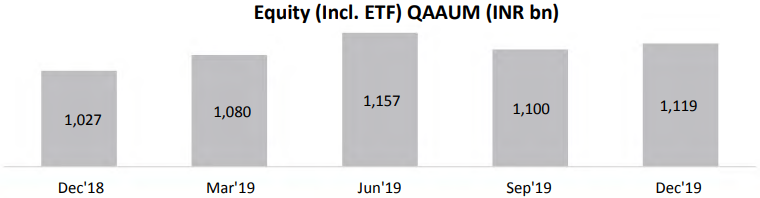

Nippon AMC Equity Assets (incl. ETF) grew by 9% YoY:

QAAUM - Quarterly Average AUM

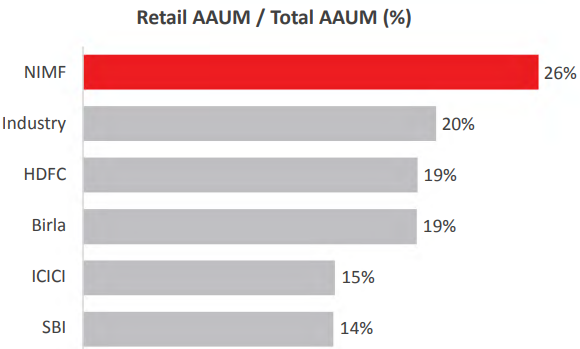

Nippon AMC has higher composition of retail assets in AUM at 26% v/s Industry 20% which shows their focus on smaller investors who constitute a large part of country's population.

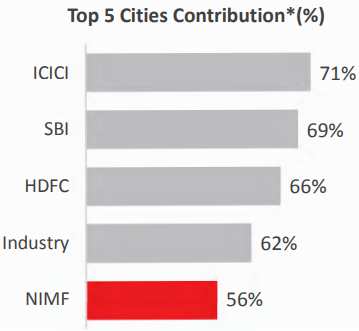

Geographical De-risking by lower concentration of assets from Top 5 (31 Dec 2019) :

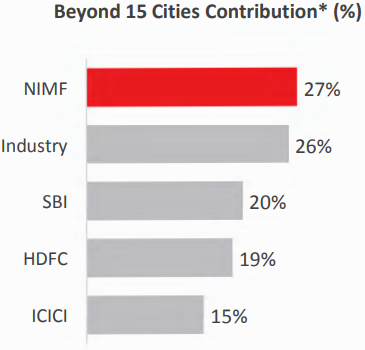

Nippon is the first AMC which has made a business model that has deleveraged them from the dependency of cashflows from top 5 cities. They concentrate more on increasing their AUM from less touched B15 (Beyond top 15 cities) which shows their increasing on-ground presence.

Higher Penetration in Smaller cities and towns.

B-30 has a higher proportion of Equity Assets and growing B-30 AUM by.

Nippon SIP’s Long & Stable Cashflows:

With an annualized SIP book of over INR 10,000 crores, 80% of Nippon’s Incremental SIPs have a tenure of 5+ years.

Distribution Mix:

Nippon AMC has empanelled ~ 600 New Distributors in Q3 FY20 to make a total base count at ~ 76,000.

De-risked Distribution Model

No single distributor contributes more than 5.3% of AUM

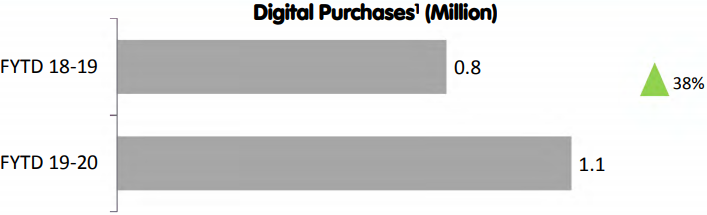

Nippon AMC’s Lumpsum and New SIP Registrations through digital platform:

- Digital contribution to total Nippon AMC business transactions > 40%. Some of

- Digital Lumpsum Purchase Transactions grew 32% YoY.

- New Digital SIP registrations grew 27% YoY.

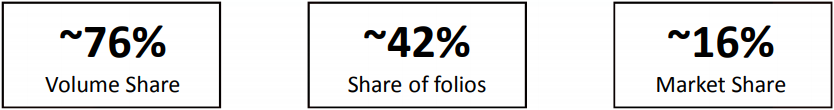

ETF - Future Ready:

Large ETFs product suite Nippon AMC’s (as on 31 Dec 2019)

- Only AMC in India with more than 18 years track record in managing ETFs.

- Highest investor folios in Industry -- About 42% Market Share of ETF folios as on December 2019.

- About 76% Market Share in ETF Volumes on the NSE & BSE (Jan’19 to Dec’19).

- On AUM basis, Nippon AMC ETFs holding is INR 26,350 crores.

- Largest bouquet of 18 ETFs in the industry across Equities, Debts & Commodity (Gold).

- Successfully launched six tranches of CPSE (Central Public Sector Enterprises). ETF as a part of government’s divestment strategy.

- Launched Nifty 50 ETF in Australia in June 2019.

Leveraging Nippon Life’s Insurance Network

Other International Tie Ups

Revenue from operations during 9 months ended on 31st December 2019 saw a dip of 18% YoY; however, net profits rose by 22.84% to Rs. 411.5 crores.

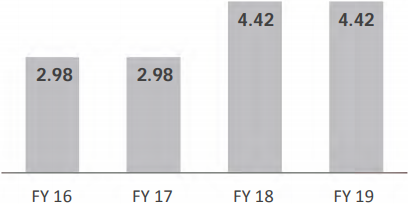

Continuously increasing Earnings Per Share

Dividend Payout (In hundred crores)

- AMC has a Return on Equity of 19% in FY19.

- Total Dividend paid Rs. 6 per share in FY19.

- 91% of FY19 Earnings shared with shareholders.

- Paid cumulative dividend of Rs. 2000+ crores in last 6 financial years.

We are positive on Nippon Life as the sole promoter of Nippon AMC given its credibility world over. We are bullish that the company will reclaim its lost market share along with a meaningful pick up in asset growth over the next few years.

Risks of investing in AMC:

Prolonged bear market in equities

AMCs’ business is closely linked to performance of debt and equity markets. Any prolonged underperformance of these capital markets may result in reduction in AUM and thereby weakness in operational performance for the AMC.

Credit Risk

Credit risk or default risk is the inability of an issuer to meet its principal and interest payments as per its obligations. The investments in fixed income schemes carry varying degrees of credit risk. Any deterioration in the credit profile of fixed income investments or a credit event can have an adverse impact on the performance of the AMC’s schemes and, in turn, on the AUM and its revenues.

Competitive scenario

As of FY19, the MF industry comprised 44 players. ICICI Prudential MF and HDFC MF together managed over a fourth of the industry’s AUM. The top five players, based on annual average AUM (AAAUM) each year, have shown a steady increase in share of AUMs. Equity as a percentage of total AUM has increased from 25% in 2014 to 43% in 2019. The ETF segment also saw robust growth due to the recent move by the Employees’ Provident Fund Organization (EPFO) to invest a portion (currently 15%) of the corpus in equities.

Mutual funds have emerged as a strong counterweight to FIIs. Historically, Indian financial markets, especially equities, used to mirror the movement of fund flows from FIIs/FPIs. However, the FII/FPI flows have also been a major source of volatility in the market. This trend has started to change of late. The strong inflows into equity mutual funds from retail investors during the recent years have emerged as a stabilizing factor.

Asset Management is undoubtedly a great business to invest in for the long term except for AMCs’ current astronomical valuations. Hence, any dips should be seen as a buying opportunity for long term wealth creation.

Mutual Fund industry is seen as “The Next Big Thing” in India as investors are getting more and more educated and concerned about their investment portfolio across asset classes. Also, more information and news-flows are available to them on their fingertips anytime, anywhere, thanks to technology. With increasing inflation, there are fewer investment options available that offer inflation-beating returns that could help investors achieve their financial goals. Mutual funds offer this potential and hence, they are forming greater portions of investors’ portfolios.

Additionally, in a reducing interest rate scenario, all major global brokerage houses and market veterans are turning to listed Indian mutual funds and the Indian mutual fund industry as a whole in order to earn better returns.

We welcome your feedback and comments on this analysis. Please send in your feedback to research@stockaxis.com or call on +91 22 6639 3000. For more useful articles, and our views on Mutual Funds, Stocks, and Markets, visit us at stockaxis.com.

Continue with Google

Continue with Google