India's steel sector: strong outlook

August 17, 2017

|

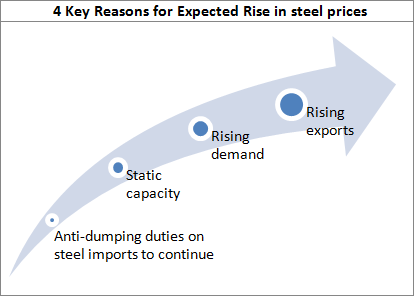

A number of positive developments are taking place in the steel sector, which, in turn, has warranted a re-rating of Indian steel stocks. Levy of anti-dumping duties, lack of new capacities, additional demand as a result of the government’s affordable housing initiative, focus on infrastructure development and growth in the automobiles sector will not only limit a further price fall, but will result in steel prices heading north.

Summary:

The steel sector is on an uptrend due to 4 key reasons:

- Extending of anti-dumping import duty on steel

- Increase in demand due to infrastructure development, affordable housing initiative and growth of the automobile sector

- Lack of new capacities which will result in maximum utilization of existing capacities

- India’s competitive advantage in the global steel market leading to rise in exports

Levy of anti-dumping duties extended by 4 years:

The government has extended the levy of anti-dumping duties on steel imports (hot rolled coil and cold rolled coil steel) by 4 years (till August 2021). This will result in making steel imports expensive thereby benefitting Indian steel manufacturers who will see a pickup in demand and margins. The benefits of this duty levy are already evident in the performance of Indian steel companies, which have recorded an improvement in their finances. Considering the significant outstanding debt of Indian steel makers, the government is expected to continue with the duty levy.

Higher demand; static capacity will result in boosting steel prices:

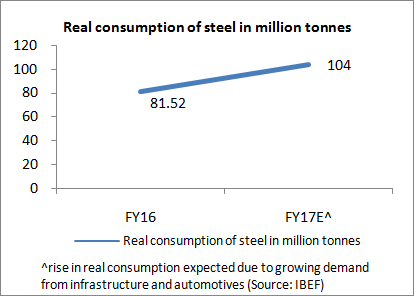

No new capacities have been added in the Indian steel industry over the last 3 years. With an expectation of higher domestic demand along with static supply, existing capacity utilization will become optimal and domestic steel prices will move northward going forward. Any new capacity that may be set up will carry a gestation period of 3-4 years before production and hence, will not have any impact on controlling the rise in steel prices.

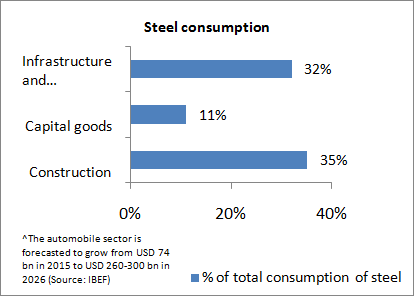

The government’s affordable housing initiative, focus on infrastructure development, economic growth resulting in increase in demand in the automobile sector, higher oil & gas capacities, etc., are expected to result in a significant rise in steel demand, going forward. Additionally, with the government’s ‘Make in India’ initiative, there is an expectation of steel being sourced from domestic producers for public sector infrastructure projects. For instance, GAIL (Gas Authority of India Ltd), a PSU company, has indicated that it will source steel from domestic producers for its forthcoming projects worth Rs. 3,000 crores.

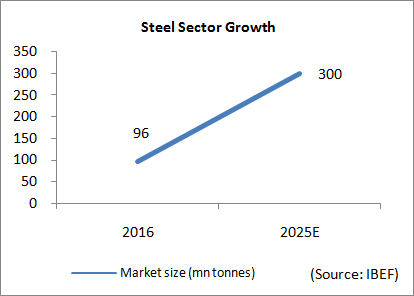

Over the next decade, steel production is expected to increase from the present 124.77 million tonnes (MT) to 300 MT in order to meet rising demand.

India’s competitive advantage in steel:

India is presently the 2nd largest crude steel producer globally. India has the key advantages of low cost manpower and availability of abundant iron ore reserves. India’s steel exports rose 102% in 2016-17 to 8.24 million tonnes (MT) over the previous year (4.08 MT).

The benefit of captive iron ore mines:

Iron ore, an input for the production of steel, will also see an uptick in demand as a result of expected demand rise in steel. A recent auction of iron ore blocks saw some competitive bidding especially from steel companies, which plan to limit their input costs by having iron ore available from their own mines. These companies will have an advantage over steel companies which need to source iron ore from external suppliers.

Going forward:

Going forward:

The combination of levy of anti-dumping duties, rising demand, static capacities and India’s competitive advantage in steel manufacture at the global level, indicates the sector to be on an upcycle.

In the international markets, China, which produced nearly half the world’s steel production, closed down some of its steel plants due to a glut in steel supply globally. However, Chinese demand for steel has been strong during the year due to a step-up in infrastructure spending by the Chinese government.

The result of reduction in Chinese steel output has been a significant price rise in the US and Europe to the extent of about 75% over the past year and a half. Despite this price rise, there is an expectation of higher steel demand in both these regions.

We believe these developments will have a tremendous positive impact on the Indian steel sector including related sectors such as graphite electrodes, limestone, etc. Our recommendations in this sector include fundamentally strong steel and steel-related stocks available at reasonable prices with a high margin of safety and offering an attractive potential upside.

Continue with Google

Continue with Google