Indian Pharmaceuticals Industry: Still A Good Bet?

May 05, 2016

|

Indian Pharma has emerged as one of the most disruptive and profit making industries. It still has the legs to grow exponentially, but will have to watch out for the regulatory interventions that are on a rise since the last 15 odd months. Have a look at some of the key points that will help the industry to up the ante:

Summary:

- The Indian Pharmaceutical market has been on a roll since the last 1-2 decades and has witnessed the kind of growth that no other sector has experienced.

- The sector is currently valued at around $25-27 Billion ~ 3% of the global pharmaceutical industry in terms of value and 10% in terms of volume. It is poised to reach $55 Billion in the next 4 years.

- The Generic Drugs segment dominates the market with a 70% share in terms of revenues making it the largest segment in the Indian pharmaceutical sector. Similarly, Over-The-Counter (OTC) medicines constitute close to 21% and Patented Drugs occupy the remaining 9% of the total market.

- The Generics segment still has a tremendous potential for growth. It is expected to grow by 25% to $26.1 Billion in the next 1.5 years. India ranks 4th in the world among the highest Generic pharmaceuticals producers and accounts for close to 20% of the global exports in Generics which is worth close to $15 Billion currently. This number is expected to balloon to $20 Billion the next 4 years.

- Also, India is en-route to becoming the sixth largest market in the world by 2020 in terms of absolute size. This will be facilitated by increasing household expenditure and improvement in the medical infrastructure.

- Indian pharmaceutical market grew at a handsome CAGR of 17.5% over the past 10 years. It is now expected to grow by 15% annually over the next 5 years as against the global growth estimate of just 5%.

- Currently, India is second after the US for highest number of US Food and Drug Administration (USFDA) approved plants in the world. This is huge in itself as 22% of such plants in the world are Indian. Additionally, India has 1400 plants that have been approved by the World Health Organization Good Manufacturing Practices (WHO GMP) and 253 by the European Directorate of Quality Medicines (EDQM).

Growth Drivers:

- According to reports, for the year which ended on March 2015, India’s leading 25 pharmaceutical companies increased their R&D expenditure to a consolidated $1.48 Billion from $1.19 Billion a year ago. This has enabled Indian companies to gear up for the stiff competition they are facing within and abroad.

- Indian pharmaceutical companies are aggressively bidding for a pie in the Japanese pharmaceutical industry. Japan, whose slightly more than a quarter of the population is aged more than 65, has hence witnessed an increasing demand for high quality and inexpensive generic medicines. Unlike India’s 70% penetration by the Generic medicines, Japan’s Generic segment has a market share of less than 56% which is expected to reach 80% in the next 3-5 years. Just for your information, drug sales in Japan are estimated to be around $120 Billion.

- Indian companies are also trying to grow their share of the US generic drug market which they have successfully increased from 13% in 2010 to 19% currently. US has witnessed acquisitions worth close to $1.5 billion last year. The reason being the expiration of $92 Billion worth of blockbuster drugs patents during the 2014-16 period. Hence, the Indian companies have aggressively increased their ANDA filings and Para-IV certifications which will be beneficial for them as under US laws, the generic company which is the first-to-file a Para IV, gets "exclusive rights" to sell the generic version of a branded drug for 180 days, with only the patent holder as the other player in the market.

- India’s cost of producing medicines is 60% lower than that of the US and almost 50% less than that of Europe. This provides room for better margins for Indian players compared to their American counterparts. This cost efficiency has enabled them to penetrate relatively poor and emerging markets like Africa.

- Rising income, education, insurance, ever increasing population, new diseases, lifestyle changes, etc are the major growth factors will boost the pharmaceutical industry in India. Also, an increasing inclination of patients to self medicate is constantly favoring the OTC market. Government-sponsored schemes are set to provide health benefits to over 380 Million BPL population by 2017 which will in turn ensure increasing sales of medicines.

- The per capita sales of pharmaceuticals in India are likely to touch $33 i.e. a 41% increase from what it was in 2015.

Government Subsidy & Initiatives:

- The growth which is expected in the Generics segment will be facilitated by ‘Biosimilars’ to a great extent. Biosimilars are biological products that are approved based on a demonstration that they are exceedingly similar to an FDA-approved biological product, known as a reference product, and has no clinically meaningful differences in terms of safety and effectiveness from the reference product. Only minor differences in clinically inactive components are allowable in Biosimilar products. This industry is expected to grow at by 30% annually as the government is set to allocate a $70 Million fund for Biosimilars development.

- India pharmaceutical sector is witnessing an ever increasing expenditure by the government

- The Budget 2016 provided a 10% tax deduction on income from worldwide exploitation of patents which were and will be developed and registered in India. This is a positive move by the government for all pharmaceutical companies as the deduction can be claimed not just on new chemical entities, but also on platform technologies.

- Also, the Government in the Budget 2016 had announced a new health protection scheme to provide cover of up to Rs. 1 Lakh/family and an additional Rs. 30000 for senior citizens. This can be viewed as a positive for the sector as it will increase public spending on medicines and health.

- By the end of this year, the Government is likely to spend $53 Billion on the pharmaceutical sector i.e. a 74% increase from the amount it had spent in 2015 and a whopping 122% increase from that in 2014.

Other Major Developments:

- The Indian pharmaceutical sector can possibly witness an immediate loss of Rs. 1000 Crores due to the government ban on 344 Fixed Dose Combination (FDC) drugs. Although a lot of the pharmaceutical companies have managed to obtain a stay on the ban, it is highly likely that it will be reversed again. If that happens, its annual impact on the revenues of involved companies is estimated to be approximately Rs. 3500 Crores i.e. 3.5% of the total pharmaceutical market.

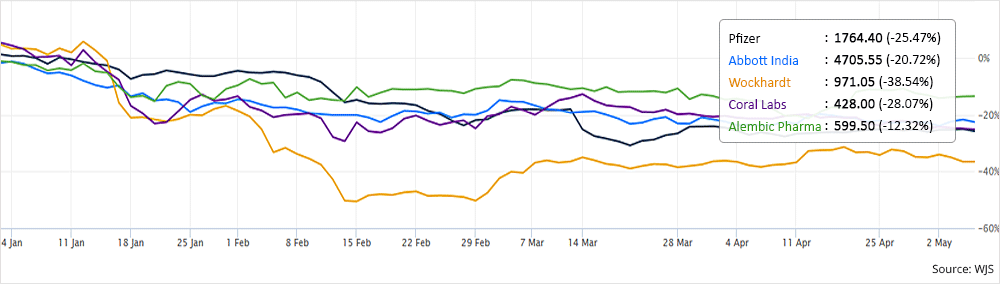

- Some of the major companies affected by this ban are Pfizer, Abbott India, Wockhardt, Coral Laboratories, Alembic Pharmaceuticals, Mankind Pharma, Macleods Pharma among others. Have a look at some of their stock performances in the last 3 months:

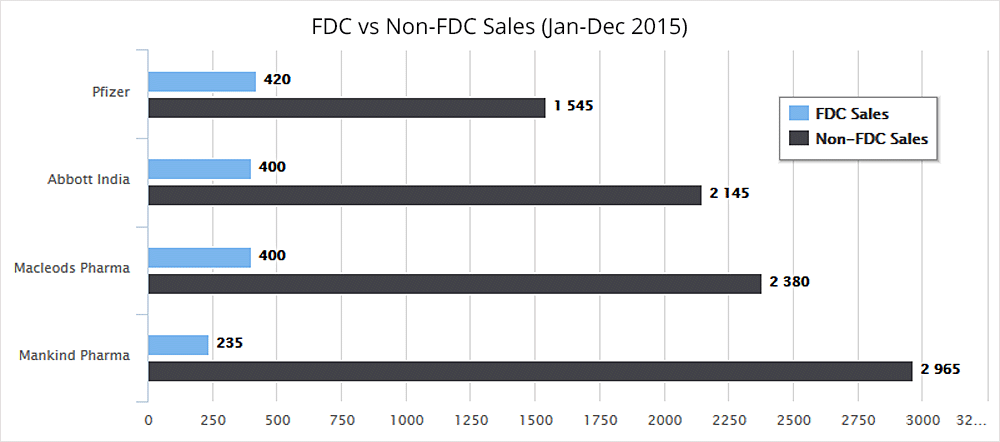

Also, following are the losses in FDC revenues that these pharmaceutical companies will suffer in terms of annual sales:

This ban affects more than 400 pharmaceutical companies in Gujarat, manufacturing and marketing close to 2000 brands of these banned FDCs. This is terrifying as Gujarat accounts for 30-40% of the Indian pharmaceutical market.

-

Some other companies which faced losses are:

- Alkem Laboratories Ltd: 105 Crores

- Sun Pharmaceutical Industries Ltd: Rs. 95 Crores

- IPCA Laboratories Ltd: 85 Crores

- Lupin Ltd: Rs. 46 Crores

- GlaxoSmithKline Pharmaceuticals Ltd: Rs. 58 Crores

- There has been a steady increase in issuance of warning letters and import alerts by the USFDA and European Medicines Agency (EMA) on Indian pharmaceutical manufacturing facilities with the increasing concern over the safety of drugs imported into their countries. The USFDA alone issued 15 warning letters to the Indian pharma companies last year which included big names like Sun Pharmaceuticals, Dr Reddy's Laboratories and Cadila Healthcare. It recently cracked the whip on Lupin issuing it a Form 483 for Mandideep unit which is the second largest contributor to Lupin’s revenue from the US. According to ICRA, Indian pharmaceutical companies in 2015 have witnessed a 143% growth in such warning letters compared to the year before.

What to expect next:

- Companies such as Dabur, Patanjali, Himalaya Herbals, etc are all set to capture the potential market which these former companies might lose. They believe that this ban which has been imposed by the government will make consumers more aware about what are they consuming in the name of medicines and will make them opt for ‘safer’ alternatives which is where these herbal drug making companies will win. However, they are still taking a stock of the situation as a lot of companies have obtained a stay on the ban.

- Out of the 6,220 samples that were taken up for scrutiny, 963 were found irrational after one year of study, and finally the government decided to ban only 344. Hence, further bans are highly possible but might take up more than six months for the government to come up with the fresh list.

- Also, even if these FDCs are banned, the companies might recover their losses by selling newly formed reformulated products under the same brand names.

- Lastly, from an investor point of view, one can consider these warning letters as a temporary setback and the decline in valuations as a blessing in disguise.

Continue with Google

Continue with Google