Indian Hotel Industry : Now Gaining Momentum

February 14, 2017

|

The Indian travel and tourism sector has emerged as one of the key sectors, contributing handsomely to our GDP. It has been one of those sectors that has been driving the growth of the services sector of India. However, its success or failure has always been linked to the prospects of growth in the hospitality industry on the outer level and the maturation of the hotel industry on the inner level. The hotel industry, being one of the most ignored industries in the lot, is still expected to generate more than 2.3 million jobs in India. Have a look at our outlook for the sector:

Summary

- The Indian hotel industry is highly fragmented, with a large number of small and unorganized players dominating the market. In recent years, there has been a shift towards the mid-market and budget segments in the industry, and towards the development of hotel aggregators in the budget space, who have consolidated the massive and unorganized hotel market.

- The services sector recorded 9.2% growth over the previous year, with the subsectors comprising of trade, hotels, transport, communication and broadcasting. Hotels and restaurants segment is estimated to have grown at 21.5% during the same time period. This growth potential is illustrated by the increase in online bookings alone which will see an estimated 8.4 million Indians likely to book hotels online by FY2017, up from 3.5 million in FY2015.

- India ranked 3rd among 184 countries in terms of travel and tourism’s total contribution to GDP in 2016. Also it has moved up 13 positions to 52nd rank from 65th in Tourism & Travel competitive index. A significant drop in rankings of Switzerland, Austria, Sweden, etc and a significant rise in rankings of Japan, India, Portugal, etc shows a growing trend of tourism towards emerging and Asian markets.

- India is host to 35 world heritage sites, 10 bio-geographical zones and 26 biotic provinces.

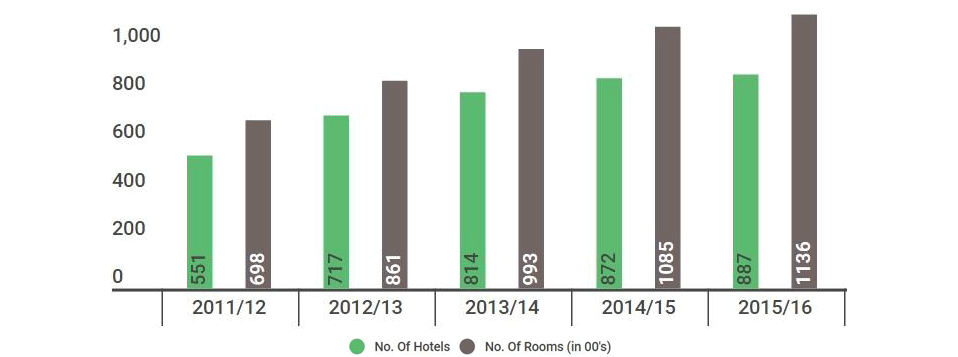

- Have a look at the growth in the number of branded hotels and number of rooms for the past 5 years:

As you can see, on a CAGR basis, the number of hotels in increased by a pleasing 9.99% where as the number of rooms increased by 10.23%, from 69800 rooms to 113600 rooms in a span of 5 years.

- Also, close to 57000 branded rooms are set to join the existing supply of around 113650 branded rooms with an active supply development ratio of 66% by 2020-21. Thus, a sub-10% increase in supply is no reason to not to expect an even more growth in demand, mostly in double digits, over the next 5 years. This will ensure a definite increase in occupancy rates, and thereby boost margins of hotels.

- Overall, the occupancy rate for India is 63.4%, with demand at 16.4% outpacing the supply at 9.9% last year. Average Daily Rate (ADR), which is nothing but Revenue in a unit time divided by the total number of occupied rooms stood at Rs. 5541, on an average basis. But sometimes, we consider RevPAR viz. Revenue Per Available Room, which is defined as ADR multiplied by occupancy rate. The current RevPAR is Rs. 3521. Have a look at their growth for the past 5 years:

| Occupancy | ADR | Rev PAR |

|---|---|---|

| 59.3% | Rs. 6032 | Rs. 3575 |

| 57.8% (-2.53%) | Rs. 5779 (-4.19%) | Rs. 3343 (-6.49%) |

| 58.4% (+1.04%) | Rs. 5611 (-2.91%) | Rs. 3275 (-2.03%) |

| 59.8% (+2.40%) | Rs. 5532 (-1.41%) | Rs. 3310 (+1.07%) |

| 63.4% (+6.02%) | Rs. 5541 (+0.16%) | Rs. 3512 (+6.10%) |

As you can see, with the occupancy increasing from the past 3 years and the ADR remaining almost constant, RevPAR has witnessed a healthy growth of 7.24% in the past 3 years. Although many reasons can be attributed to this increase, demand triumphing over supply has been the kingmaker.

Growth Drivers

- According to the World Travel & Tourism Council's (WTTC's) Economic Impact 2016 - India report, the total contribution of Travel and Tourism to the GDP was $122.11 Billion (6.3% of the GDP) in 2015. This is projected to grow by 7.3% to $130.99 Billion in 2016 and eventually reach $269.83 Billion (7.2% of the GDP) by 2026.

- Foreign Tourist Arrivals (FTAs) during the month of December 2016 rose by 13.6% on a Y-o-Y basis, from 0.885 Million last year in December to 1.037 Million this time. Overall in CY2016, FTAs increased by 4.5% from 8.027 Million in 2015 to 8.890 Million 2016 of which nearly 3.2 Million were medical tourists. This facilitated to Foreign Exchange Earnings (FEEs) worth $2.47 Billion in December 2016, registering a growth of 18.7% on a Y-o-Y basis. This growth shows the growing potential for the hotel industry to capture.

- The Government of India has made the facility of e-Visa available to the citizens of 161 countries (as against the earlier coverage of 113 countries), arriving at 16 International Airports in India. The effect, a total of over 0.162 Million foreign tourists arrived in India in December 2016 on e-Tourist Visa as compared to 0.103 Million during the same month last year. Thus, a whopping 56.6% growth showed that FTA beat demonetization comfortably.

- With smartphone prices crashing and penetration increasing rapidly, the Indian consumers are rapidly using mobile devices as their primary means to book travel and hotels. An estimated 8.4 Million Indians are likely to book hotels online by the end of FY2017, up from 3.5 Million in FY2015. This figure is just 16% of the current bookings, where it is 35-50% in USA and 70% in Europe.

- India will witness more than 2x growth in average household incomes from around $8000 currently to $18500 by 2020. Also, it is estimated that by 2030, India will have around 91 Million ‘middle-class’ families from its current number of around 21 Million. Also, India is set to become the youngest country on this planet by 2020, with close to 69% of its population in the working age group with a median individual age of around 29. This will provide our economy an unprecedented edge over China, Japan and the West whose population ageing and boost our GDP growth rate by 2%. This also compliments the Indian hotel industry, as the share of leisure spending due to changing tastes and digitization nothing but boosts demand and hence the ADR.

- Although, the majority of demand for hotels originates from commercial activity, there is a large portion of Indians travelling for leisure, both within the country and overseas. Notably, leisure spending generated 83.2% of the direct Travel and Tourism GDP, as against 16.8% from business travel spending. Also, of the top 25 ADR leaders, 23 operate in leisure markets, clocking a RevPAR of Rs. 12600, which is 3.6x the national average. The fact that just 2.5% of India’s existing supply clocked ADRs of more than Rs. 13000 last year is in itself a positive sign for future growth potential.

- Also, business hotels, which operate via a RPF (Request For Proposal) model, have seen a constant deterioration in their ADRs due to the constant negotiations by organizations floating the RPFs with the hotel sales professionals. Leisure hotels do not face such a situation as their businesses are facilitated by FITs (Fully Independent Travelers), who rather than focusing much on pricing, instead seek experience. This helps them maintain and also control the pricing, unlike their business peers.

Government Subsidy & Initiatives

- The first Incredible India Tourism Investors' Summit witnessed signing of 86 pacts worth around Rs. 15000 crores for the development of tourism and hospitality projects. This is set to boost the hotel industry further.

- The average Indian customer takes four to five holidays a year. This consumer is the young and experience hungry, increasing the share of leisure bookings from 40% to 60%.

- 100% FDI allowed in tourism construction projects, including the development of hotels, resorts and recreational facilities. This enables the hotel industry to be amongst those privileged sectors which have been equipped to receive complete foreign funding.

- India has been recognized as a premier destination for spiritual tourism. Hence, to boost this religious tourism, projects worth $230 Million have been cleared by the Government.

- Based on specific themes, under the Swadesh Darshan scheme, the Government has identified five circuits which include Krishna Circuit, Buddhist Circuit, Himalayan Circuit, North East Circuit and Coastal Circuit. Funding worth close to $100 Million has been allocated for the same.

- The Government has also formulated a National Tourism Policy, that encourages the citizens of India to explore their own country as well as position the country as a ‘Must See’ destination for global travelers. Under ‘Project Mausam’ the Government of India has proposed to establish cross cultural linkages and to revive historic maritime cultural and economic ties with 39 Indian Ocean countries.

- Collectively, Government’s collective spending on tourism and hospitality sector, in 2016, stood at around $2.2 Billion.

- Further, as an initiative to enhance regional connectivity and to make air travel more affordable for the growing middle class, the government capped the fare for one-hour flights at Rs. 2500.

Other Major Developments

- Royal Orchids Hotels acquired 24.9% shares in Amartara Hospitality Private Limited through its subsidiary. Amartara now becomes 100% subsidiary of Royal Orchids.

- Mahindra Holidays & Resorts, through its step down subsidiary Covington S.a.r. I, Luxembourg (Covington), has increased its stake in Holiday Club Resorts Oy, Finland (HCR) by 6.33% to 91.94%. Also, with Royal Orchids and Mahindra Holidays being a listed entities in the Indian market, they are definitely worth looking into!

- Louvre Hotels Group, part of the Shanghai based Jin Jiang International Holdings and the second largest hotel group in Europe, announced its acquisition of a majority stake in Sarovar Hotels on Thursday. The deal catapults Louvre as one of the largest hotel groups in India as Sarovar has grown from 4500 to nearly 6000 rooms in over 50 cities in just 5 years. It also has a pipeline of over 20 hotels set to join the supply shortly.

- With the services sector set to be taxed at 18% in the four-tier tax structure of the GST (5,12,18,28), it remains important to see the rate assigned to hoteliers. It is estimated that the 5% slab will more than double both foreign travel coming to India to 20 Million tourists and domestic travel within India to 2.5 Billion.

What to expect next

- In the Budget 2017, the announcement for creation of five Special Tourism Zones, and launching the 'Incredible India-II' campaign across the world is set to promote India as a major tourism destination. This will directly benefit the hotel industry in terms of FTAs. Although the expectations of a lower tax rate for hospitality business and lower rate of interest for real-estate development were not fulfilled in the Budget, a strong focus on strengthing rail-road infrastructure and building airports in tier-II cities will nothing but complement the hotel business.

- In India, hotels are taxed anywhere between 20% and 25%depending on the state that they are operating in, when other Asian countries are levying 8-10%. In addition to this, different tax structures in different states are difficult for tourists to comprehend. The result, India's tourism competitors in South East Asia (excluding Japan and China) earn among themselves over $150 Billion in foreign exchange and attract almost 100 Million tourists annually, whereas India earns slightly over $23 Billion.

- The Government will need to reassure foreign investment. It is one thing having a market that possesses so much potential. It is another to make sure that investors lose their traditional concerns. There is no doubt that the Indian hotel industry is highly fragmented with a large number of small, independent operators, but there is no brand that covers all of India.

- The growth potential in India is phenomenal. India currently has less than 1.2 lakh hotel rooms. This figure is significantly lower than the total room inventory in any US city, say, New York or Orlando. The US has over 36 lakh hotel rooms. Thus, India can be one of the growth powerhouses in the hotel industry in the next 5 years, given the Government continues on its path of opening up India to the world.

- Fragmentation and consolidation will be key drivers of change in the industry, creating both risks and opportunities. In recent years, there has been a shift towards the mid-market and budget hotels, and the development of hotel aggregators like OYO, FabHotels, TreeBo, etc in the budget space have consolidated the massive and unorganized hotel market. With venture funding slowing down in India, it is important to see the sustainability of these startups providing rooms for as low as Rs. 999 with margins of less than Rs. 200.

- Even though the hospitality industry has been granted an infrastructure status, Hotels are still treated like regular corporate borrowers with a maximum tenure of around 10 years. Thus with long gestation periods, the tenure can be broken down as 3-3.5 years (construction period) + 1 year (moratorium on interest payment) + 5.5-6 years (operations period). Therefore, the project has only 5.5-6 years to pay for the debt service, which is extremely difficult. Also, unlike in other countries, interest rates here are on the higher side at 12-14%, whereas it is 5-7% in Dubai and New York, and 9-10% in cities like Beijing. Thus, an actual implementation of the infrastructure status and lowering the threshold for hotel projects to Rs. 25 crores would benefit the cause.

- The hospitality industry in India is struggling with issues like high tax rates and complicated clearance norms as mentioned earlier. As per the Federation of Hotels and Restaurant Association of India (FHRAI), a customer at an Indian five-star hotel ends up paying as much as 40% tax, compared to the a meager 7% in Singapore or Malaysia. Thus, India ends up losing a share in the inbound tourist numbers of Asia.

- Also, with demonetization taking a toll on the consumption pattern of all sectors including hotels, it is necessary for the government to come up with measures that will help boost cashless transactions, which it is and that is in turn facilitating seamless and easy online travel bookings for the masses.

- Thus, with a modest increase in the Occupancy Rate and the RevPAR alongside a constant ADR for the past three years, with demand steadily outpacing supply, one can say that the Indian Hotel Industry is on the cusp of an up-cycle. Some impetus from the Government in terms of tax relief and some smart decision making by the stakeholders will surely prove to be a booster for the industry.

Continue with Google

Continue with Google