Indian Fertilizer Industry: On The Cusp Of A Revival?

August 02, 2016

|

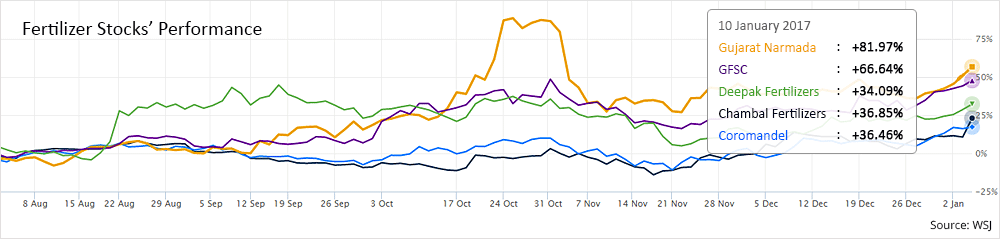

Update (10th Jan, 2017): This report was published by StockAxis on 2nd August, 2016. The conclusion being as follows: “Hence, one can say that the fertilizer industry can achieve its previous highs considering the approach of the government towards agriculture and allied activities…” and that is exactly what is happening right now. Have a look:

As you can see from some of the above given fertilizer companies, investors have enjoyed a pleasing 51.16% returns from the time of publication of this report till date. If you had missed out on the trigger factors earlier, go through the report and make sure you don’t miss them now. You can also get in touch with us at +91-9773076000 or research@stockaxis.com in case of any related queries. Happy Investing!!!

The global economic growth and financial situation impacts various sectors, including agriculture, which is one of the most important sectors in our economy. Keeping in view the growth projected by our country, one should realize the importance of the fertilizer industry, which is the backbone of one of the highest GDP contributors of India. Have a look and enjoy the detailed report:

Summary:

- India is an agrarian economy of which 58% of the population still depends on agriculture and allied activities as their primary source of income. Also, with around 158 Million hectares of agricultural land, India boasts a second spot on that list.

- India is also the largest producer of tea, cashew, jute, spices and pulses and the second highest producer of fruits and vegetables, wheat, rice, cotton, sugarcane and oilseeds. Considering the population growth that is being witnessed over the past 4-5 decades and the area under agriculture, this is justified.

- Also, share of Indian agricultural exports in the World Trade accounts for around 2.7-2.9% according to WTO statistics. These numbers are, and will continue to be backed by the fertilizer usage in our country.

- Recognizing this importance, the Government of India has been interfering and controlling the fertilizer sector for quite some time now.

-

Various types of fertilizers are :

- Nitrogenous: Essential Component Is Nitrogen (N), Ex Urea, Ammonium Nitrate, Ammonium Sulphate

- Potassic: Ex Potassium Nitrate, Chile Saltpetre

- Phosphatic: Ex Super Phosphate, Triple Phosphate

-

These fertilizers provide six macronutrients and eight micronutrients to the plants. They are:

- Primary (Macro) nutrients: Nitrogen (N), Phosphorus (P), and Potassium (K), Calcium (Ca), Magnesium (Mg), Sulphur (S)

- Secondary (Micro) Nutrients: Boron (B), Chlorine (Cl), Copper (Cu), Iron (Fe), Zinc (Zn) etc

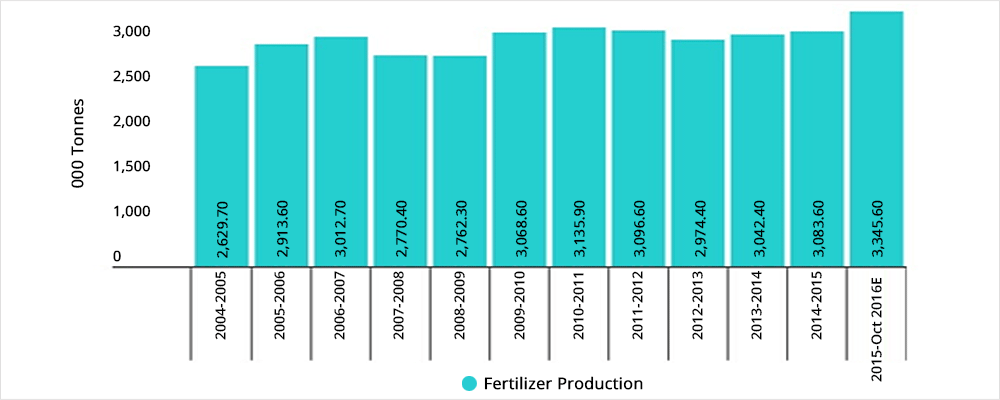

- The following graph gives the production fertilizers in India over the last 12 years:

- Although India is the 2nd largest consumer of fertilizers, just behind China, and the 3rd largest producer too, it faces a supply-demand imbalance. It imports about 20% of its urea fertilizer needs and approximately 50% of its phosphatic fertilizers needs. These imports majorly comprise of the raw ingredients required for the phosphatic and potassium fertilizers. Also, Indian soils are generally deficient in nitrogen, phosphorus and potassium and do not give high yields. Hence, the need for fertilizers is dire.

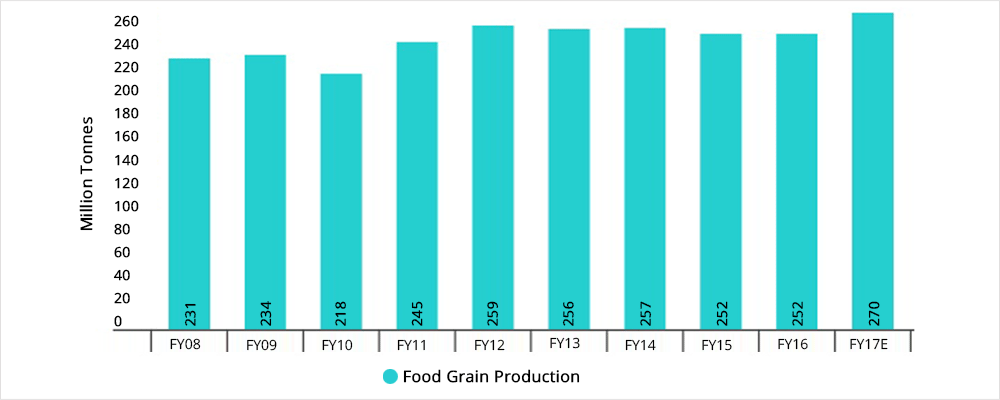

- Total food grains production in India reached an all-time high of around 259 MMT in FY12 and similar levels of 257 MMT in FY14 on account of good monsoons. The production fell in 2015 and 2016 due to two consecutive droughts. This year however, the government is expecting a record high of 270 MMT on account of an “above average” rainfall. Here are the numbers:

Growth Drivers:

-

Increase in sales volumes despite 2 consecutive droughts

- Despite a drought for the second consecutive year in CY2015, it proved to be a moderately satisfying year for the fertilizer industry with volumes increasing by 7% Y-o-Y to 58.2 MMT from 54.1 MMT in FY2015. Again, this was despite two consecutively weak monsoons.

- This was majorly attributed to lower inventory levels from the previous year and a low base effect.

- Urea volumes grew by 4% Y-o-Y to 31.98 MMT in FY2016 and non-urea volumes grew by 19% Y-o-Y to 26.19 MMT in FY2016.

-

Gas price pooling set to be beneficial and level the playing field

- The CCEA, from 1st July 2015 has approved and started the implementation of pooling or averaging of domestic natural gas and imported Liquefied Natural Gas (LNG) to create a uniform rate for the fertilizer plants.

- Indian plants consume around 42.25 MMSCMD (Million Metric Standard Cubic Meter per Day) of gas for manufacturing subsidized urea. Of this requirement, close to 39% i.e. 16 MMSCMD is imported LNG. An important thing to note is that the cost of domestic gas is almost half of that of the imported LNG.

- Thus, the fertilizer plants, based on their geographical locations and differential contract rates, paid non-uniform rates for gas, which were majorly dominated by transportation costs. This will now be nullified as all the plants producing subsidized urea will receive gas at the same average price.

- Also, the prices of pooled gas have decreased from around $7.5/MMBTU (Metric Million British Thermal Unit) in January 2016 to around $6.5-6.6/MMBTU. This is due to a reduction in domestic gas prices from $4.66/MMBTU for the April-September 2015 period to $3.82/ MMBTU for the October 2015-March 2016 period to $3.02/MMBTU for April-September 2016 period.

- According to estimates, every $1/MMBTU fall in the gas prices will reduce the price of urea by Rs. 1800-2000/MT. Currently, the retail price of urea is administered at around Rs. 5360/MT against the average industry production cost of Rs. 20000/MT, which makes close to 75% of the production cost subsidized by the government.

- Therefore, if the prices of pooled gas are managed at around $6.5/MMBTU, it will help the government save around Rs. 3000-3200 crores in subsidy for FY2017. This money can be in turn used to clear the subsidy lags of around Rs. 40000 to whatever extent possible. More on subsidy is covered in the next part of the report.

- Lower initial procurement prices will in turn lead to lower working capital borrowings which will in turn lead to lower interest costs paid by the companies which will in turn boost their profitability.

-

Lucrative contract for Potash import at a 31.62% discount over last year’s prices

- India has the capacity to indigenously meet 50% of its phosphatic fertilizer requirements, but depends on imports for raw materials for the same.

- Usually, the deal signed by China with the potash suppliers sets the benchmark price for deals to be signed by other countries with the suppliers. This year, with China delaying signing the contract due to increased domestic production and high inventory levels, India went ahead and signed a $227/MT agreement (32% discount over 2015 prices) with BPC, the export arm of Belaruskali who is one of the world's largest producers of potash fertilizers.

- This provides room for a cut in the MRP of the non-urea fertilizers (DAP, MoP, and NPK) thereby benefiting the farmers as well. Since the prices of these fertilizers are not controlled by the government, they are extraordinarily expensive than their urea peers (they cost between Rs. 15000-27000), which makes it very difficult for farmers to use them, thereby creating nutrient imbalance in the soil.

- The recent price slash of up to Rs. 5000/MT for non-urea fertilizers has been largely attributed to this deal.

- Just for your information, China, on 14th July 2016, signed its deal with BPC, for import of urea at $219/MT, a 30.48% decrease from its previous year’s number of $315/MT.

Government Subsidy & Initiatives:

- Following table shows the fertilizer subsidy provided by the government over the past 8 years:

| Index |

Subsidy (Rs. Crores)

|

Total Subsidy Disbursed | Liabilities carried over to next year | Carried over liabilities as % of total released | |||

|---|---|---|---|---|---|---|---|

| FY09 | 33900 | 65600 | 99500 | 17100 | 17.19% | ||

| FY10 | 24600 | 39500 | 64100 | 8200 | 12.79% | ||

| FY11 | 24300 | 41500 | 65800 | 7200 | 10.94% | ||

| FY12 | 37800 | 36800 | 74600 | 22200 | 29.76% | ||

| FY13 | 40000 | 30600 | 70600 | 19200 | 27.20% | ||

| FY14 | 41800 | 29400 | 71200 | 22000 | 30.90% | ||

| FY15 | 54400 | 20700 | 75100 | 38000 | 50.60% | ||

| FY16 | 51000 | 19000 | 70000 | - | - | ||

- As you already know, the government pays such high subsidies to make fertilizers available at affordable prices to the relatively poor Indian farmers. In our country, the farmers get access to the controlled fertilizers at an already subsidized rate. It is the urea manufacturers that bear the difference between the cost of production and the selling price/MRP to the farmers, until it is subsidized by the government. For the non-urea fertilizer producers, the subsidy on Phosphatic and Potassic (P&K) fertilizers is announced by the Government of annual basis for each nutrient i.e., Nitrogen (N), Phosphorous (P), Potash (K) and Sulphur (S) depending upon the nutrient content in each grade of the fertilizers. These rates are determined taking into account the international and domestic prices of P&K fertilizers, exchange rate, inventory level in the country etc.

- Hence, until the government clears the subsidies for the companies, the borrowings costs which the companies bear for working capital requirements dampen their bottom-lines to a great extent.

-

Mandatory neem coating of urea

- Urea being relatively cheaper than other non-urea fertilizers, it is being used excessively by the farmers. This has started to disturb the ideal N (nitrogen) P (phosphorus) and K (potash) ratio of 4:2:1, making it 8.2:3.2:1.

- In January last year, the government made it mandatory for urea manufacturers to neem coat a minimum of 75% of the subsidized urea manufactured from its earlier cap of 35%. When a farmer uses conventional urea, about half the applied nitrogen is not assimilated by the plant and leaches into the soil, causing extensive groundwater contamination. Spraying it with neem oil slows the release of nitrogen by about 10-15%, thereby reducing its consumption. Hence, with the nitrogen release partially under check, the above mentioned distorted ratio can be expected to improve.

- It also prevents this subsidized urea from being smuggled for non-agricultural uses, where it is sold at a premium rate otherwise.

- For this, the manufacturers can apply a 5% surcharge which in turn improves their EBITDA margins. This also reduces its usage at the farmer’s end which makes it a win-win for both the parties, apart from saving the government an approximate of Rs. 6500 crores.

-

Implementation of DBT on pilot basis:

- The government in its latest budget announced the implementation of the Direct Benefit Transfer (DBT) scheme on a pilot basis. This scheme will enable the fertilizer subsidy to be directly transferred to the farmer’s bank account, thereby reducing the working capital requirement of the fertilizer industry, apart from plugging leakages.

- This project will be initially implemented for 16 districts starting next rabi season in October 2016. These districts will be selected where penetration of Aadhar, Jan Dhan and banking through ATM is more. Apart from these, areas covered by the Soil Health Cards programme will be ideal candidates.

- The long term roll out of the DBT in urea project largely depends on the success of DBT in LPG. This is due to the lack of the required infrastructure to correctly identify the actual beneficiaries.

-

New Urea Policy

- Consumption of urea in India grew by a CAGR of 4.1% between 2005-14 whereas the production grew by a meager CAGR of just 1.4%. This has been attributed to lack of capacity addition due to subsidy irregularities and lack of raw materials.

- Under the comprehensive New Urea Policy 2015 which will be applicable for the next 4 financial years aims at maximizing indigenous urea production and promoting energy efficiency in urea units to reduce the that part of the subsidy burden on the government.

- This is expected to be achieved via conversion of non-gas based units to gas based units, incentivizing additional urea production and encouraging investments in foreign JVs.

- The policy is expected to result in a direct subsidy saving of around Rs. 2618 crores on account of revised specific energy consumption norms and indirect subsidy saving of Rs. 2211 crores attributed to import substitutions (total savings expected to be Rs.4829 crores) during the next four years. This will in turn result in an additional production of around 2 MMT annually. While annual domestic consumption of urea is over 30 MMT, about a quarter of it is imported. Also, annual demand for DAP is 10 MMT, MoP is MMT and NPK fertilizer 9 MMT.

- This, along with the Gas Pooling Policy, made India import urea 3% less than what it used to in FY2015. It imported 8.47 MMT in FY2016 which was coupled by lower international urea prices that favorably impacted India’s import bill. If average import Cost and Freight (CFR) prices of urea are assumed at around $230/MT for FY2017 with similar import volumes, it could save the government around Rs. 2500-2700 crores.

-

Soil Health Cards

- With imbalanced usage of fertilizers, the soil health has witnessed a major deterioration. Like mentioned above, the actual nutrient ratio is way off the ideal ratio of 4:2:1. In order to improve the soil health, the government has launched a scheme to provide every farmer a Soil Health Card.

- The card will carry crop wise recommendations of nutrients/fertilizers required for particular areas of soil. This is expected to help farmers to review the soil health and increase the adoption of non-urea fertilizers to improve the productivity. Also to encourage the Soil Health Cards initiative, the government increased the budgetary allocation for FY2016 by ~30% to Rs. 200 crores from Rs. 156 crores in FY2015, which is likely to benefit the agriculture sector too.

Other Major Developments:

-

Just recently, state-run fertilizer companies Rashtriya Chemicals and Fertilizers (RCF) and National Fertilizers Ltd (NFL), in participation with private firm Indian Potash Ltd (IPL) have agreed to reduce the price of non-urea fertilizers by up to Rs. 5000/MT. The retail price of

- Di-Ammonium Phosphate (DAP) has been cut by Rs. 2500 to now Rs 22000/MT

- Muriate of Potash (MoP) has been cut by Rs. 5000 to now Rs. 11000/MT

- Complex fertilizers’ rates have been brought down by Rs. 1000/MT

- This rate cut was attributed to drop in global prices of raw materials which witnessed in the deal signed with BPC as mentioned earlier. Also, it is set to save Rs. 4500 for the Indian farmers. This was the first time in 15 years that prices of non-urea fertilizers have been reduced.

- Earlier, the above mentioned price slash was supposed to be implemented only by the state-run companies. But, taking the falling prices of the raw materials required for producing fertilizers into consideration, the government has now asked private firms too, to reduce prices of non-urea fertilizers, failing which, they will suffer a cut in the subsidy provided to them. In March 2016, the government had already reduced the fixed subsidy on phosphatic and potassic (P&K) fertilizers factoring falling global prices. This will affect the margins of companies which have underlying inventory manufactured using costlier raw materials.

-

State-run NTPC Ltd., Coal India Ltd. and Indian Oil Ltd. in participation with Fertilizer Corporation of India Ltd. will together revive three mothballed fertilizer plants at Sindri, Gorakhpur and Barauni, with a cumulative investment of around Rs. 20000 crores.

NTPC Ltd. and Coal India Ltd. have floated a special purpose vehicle for reviving Sindri and Gorakhpur units of Fertilizer Corporation of India Ltd. whereas Indian Oil Ltd. would be investing for the revival of Barauni fertilizer unit of Hindustan Fertilizer Corporation (HFC).

All the three revived fertilizer units are likely to get gas supply from the proposed Jagdishpur-Haldia pipeline worth Rs. 12000 crores that will be laid by the Gas Authority of India Ltd. (GAIL), which will enable them to produce 1.3 MMT of urea each. - A consortium of three companies including China Huanqiu Contracting and Engineering Corporation, Isomeric Holdings, and LEPL Ventures signed a MoU with the Andhra Pradesh government for setting up Rs. 10183 crores gas-based fertilizer plant near Krishnapatnam.

- Again, a consortium of Rashtriya Chemicals and Fertilizers (RCF), Gujrat Narmada Valley Fertilizers & Chemicals (GNFC) and Gujarat Chemicals and Fertilizers (GSFC) are planning to set a urea manufacturing plant at Chahbhar in Iran along with a subsidiary of Iran's Bank Pasargad. he proposed project would have an annual capacity of 1.3 MMT of urea which would be imported by India. The Iranian government has indicated gas price of $2.9/MMBTU for the project, which is cheaper than the price prevailing in the Indian market.

What to expect next:

-

Systemic inventory levels in the fertilizer industry were near about its 5 year high at the start of CY2016. Taking phosphatic and potassic (P&K) fertilizers into consideration, its inventory stood at 1.94 MMT at the end of May 2016, as against 2.98 MMT at the end of January 2016 and 2.69 MMT at the end of October 2015. These inventories are likely to be liquidated by the end of the Indian monsoons provided there is stability in the monsoons and no unnatural spike in imports.

This has dampened the fertilizer sales in FY2017. Talking numbers, the overall fertilizer sales volumes have fallen by 33% Y-o-Y to 4.74 MMT in the 2M-FY2017. But this does not show the fact the consumption at the farmer’s end has been better which is evident from the falling inventory levels of the P&K fertilizers. Considering FY2017, the fertilizer industry is expected to show a dovish 2-5% volume growth with urea volumes likely to increase by 2-4% and non-urea volumes by 3-5%. - Petronet LNG, India’s largest natural gas importer, at the end of CY2016, renegotiated its purchase agreement with Qatar’s RasGas Co. Ltd, thereby obtaining gas at $6-7/MMBTU as against its previous rate of $12-13/MMBTU, will have the government save around Rs. 6000-6200 crores, apart from the Rs. 3000-3200 crores it will save due to lowered domestic gas prices as mentioned earlier. Lower Import Parity Pricing (IPP) further is expected to save the government approximately Rs. 2500 crores apart from the lowered subsidy rates for P&K fertilizers which will save yet another Rs. 4500-5000 crores.

- Hence, on an approximate basis, taking all the factors mentioned above, the government can save roughly Rs. 29800-32000 crores. Here’s how:

| Method | Subsidy Saved (Rs. Cr.) | |

|---|---|---|

| 1 | Gas Pooling Policy | 3000-3200 |

| 2 | Neem Coating Policy | 6500 |

| 3 | New Urea Policy | 4800-4900 |

| 4 | Lowered P&K Subsidy | 4500-5000 |

| 5 | Constant Import CFR Urea Prices | 2500-2700 |

| 6 | Petronet - RasGas Deal | 6000-6200 |

| 7 | Lower Import Pricing Parity | 2500 |

| Total | 29800-32000 |

If the government is successfully able to save the subsidy using the above mentioned policies, it will comfortable be able to pay off atleast 70-75% of the approximately Rs. 40000 subsidy deficit that has been snowballing over the past few years.

- Hence, one can say that the fertilizer industry can achieve its previous highs considering the approach of the government towards agriculture and allied activities. It is focusing to achieve 4% average growth in the agriculture sector, for which it is rolling out favorable policies benefiting all the sections of the pyramid. Also, with rainfall picking up in the country (an “above normal” of 106% of the Long Period Average (LPA) expected this year), one can expect a positive environment for the fertilizer industry.

- Also, implementation of Nutrient Based Subsidy to Urea fertilizers would put them at par with their non-urea peers in terms of competition, as well as usage, which has the potential to re-rate the entire fertilizer industry, enabling companies to not only spend on branding, but also produce more quality fertilizers.

Continue with Google

Continue with Google