Indian Cement Sector: Back In The Black?

September 06, 2016

|

Cement is one of the core industries of India that plays a vital role in the growth and development of our country. We are the second largest producer of cement worldwide, with the industry expanding on back of increasing infrastructure activities and demand from housing sector over the past many years. However, in the recent times, muted demand, excess capacity and declining prices lead to a short term downfall. Here are some of the most important triggers that we think will help take the industry to levels like never before:

Summary:

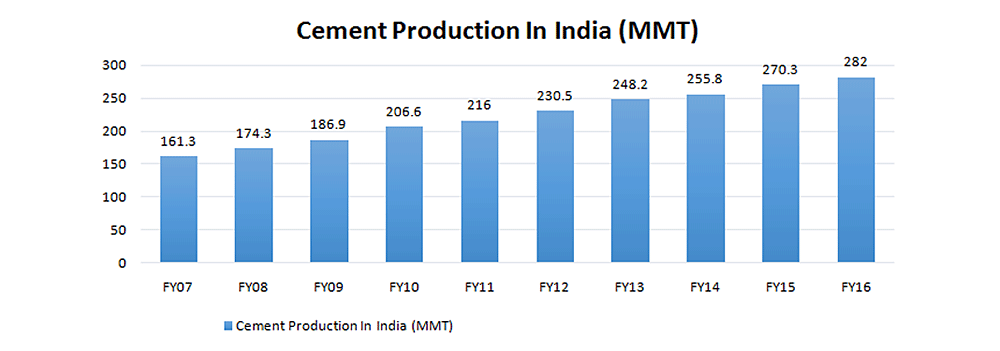

- India is the second largest cement producer in the world, with close to 400 MMT of capacity currently and an average capacity utilization rate of 70% in FY2016. Thus, with a 282 MMT output (70% of 400 MMT), Indian cement production accounts for around 6.7% of the total world production.

- Only China is ahead of India in terms of production and consumption, with their total capacity being ~2500 MMT. US stands 3rd in the list, with a capacity of ~82 MMT.

- Indian cement production grew at a CAGR of 6.40% to 282 MMT over FY07-16. But, as per the 12th Five Year Plan, production is expected to reach 407 MMT in FY17. Another interesting thing to note, is that, as of now, the top 20 companies account for around 70% of the total production.

- Out of the current total capacity, Public Sector Companies account for just 20% of the share, whereas the remaining 80% belongs to the Private Sector.

- The industry can be said to be heavily dominated by a few players. The top 20 cement companies account for almost 70% of the total cement production of the country.

- India has around 575-580 cement plants (~210 large + ~370 small). Surprisingly, close to 30% of these large plants are concentrated in the states of Andhra Pradesh, Rajasthan and Tamil Nadu.

- Lastly, in terms of cross-border trade, India exports ~$215 Million worth of cement against China’s $777 Million. It stands on the 15th position in that list, just ahead of Pakistan ($198 Million) and behind Portugal ($223 Million).

Growth Drivers:

-

Improvement in All-India prices:

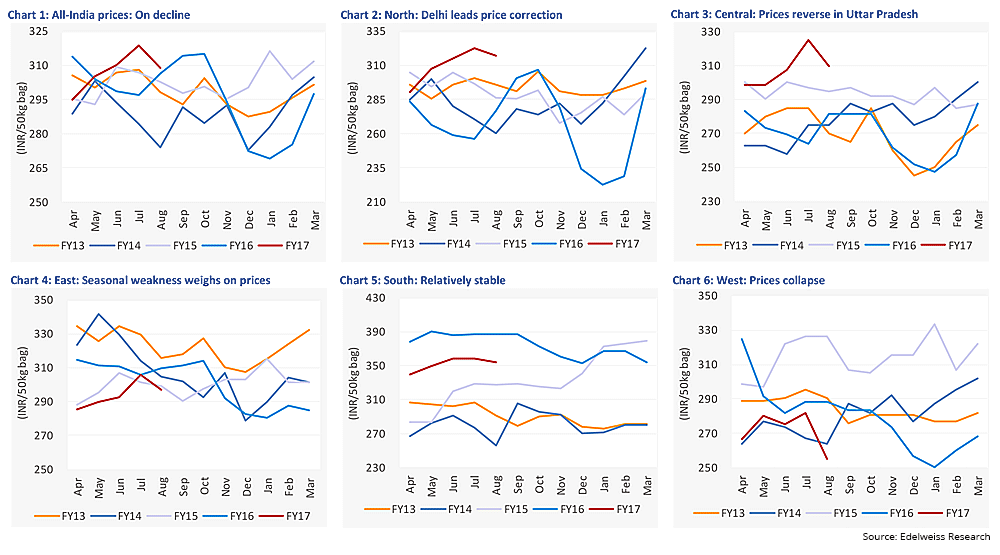

- After increasing constantly from Rs. 295 to Rs. 320 (per 50kg bag), during April to July 2016, prices have witnessed a moderate correction in August 2016 to Rs. 310 (per 50kg bag) which can be attributed to the seasonality factor coming into play.

- The important thing to be noticed here is the current rebound in prices which were otherwise in the range of Rs. 265 to Rs. 270 in January 2016 is due to the pick up from the infrastructure segment, primarily road projects.

- Following are the regional cement price trends in India, with south being the most stable market:

-

Per Capita Consumption

- India's per capita consumption of cement is at 207 kg, which is well below the world average of 540 kg. Thus, one can see that India has a very wide scope of growth in the cement sector as the players are all set to fulfill this significant business opportunity of catering to the unmet and rising demand.

- To meet this demand, the capacity addition during FY2016 stood at an approximate 24 MMPTA, a marginal decline when compared to the 26 MMTPA addition in FY2015. This was due to a drop in demand, mainly during 9MFY2016, with utilization rates too declining marginally from 71% in FY2015 to 70% in FY2016. Given the capacity overhang, the utilization rates are likely to remain moderate at 71% in FY2017 but are expected to improve to 75% in FY2018, driven by both, the pick-up in demand as well as the slowdown in new capacity addition.

- These utilization rates, which are expected to improve marginally in FY2017 and handsomely in FY2018, will be fundamentally due to the incremental supply just meeting the demand because of low expected capacity addition of just 16 MMPTA in FY2017 and an even lower expected addition of just 8 MMPTA in FY2018, thereby maintaining the demand-supply balance firmly.

- Due to the sluggish demand during 9MFY2016, the sector witnessed an overall decline in demand growth from 6% in FY2015 to 5% in FY2016. Even though there was a rebound in demand in Q4FY2016, the lag in the previous 9 months subdued the effect. The demand outlook for FY2017 can be expected to be relatively more favorable, given the Government’s focus on revival of infrastructure spending, and the likelihood of a recovery in the rural demand from H2FY2017 given the onset a better monsoon. Thus, demand is expected to increase up to 6% during FY2017 and 7% during FY2018.

- Further, in the southern markets, the demand is likely to recover further during FY2017, supported by the construction of a new capital for Andhra Pradesh and with the focus on irrigation and water grid schemes by the Telangana Government.

-

Demand by 2025

- India's cement demand is expected to reach 550-600 MMTPA by 2025. The housing sector is, and will be the biggest demand driver of cement, accounting for about 67% of the total consumption currently. The other major consumers include infrastructure at 13%, commercial construction at 11% and industrial construction at 9%.

- Notably, the housing sector in the United States and China account for just 22% and 25% of the total cement demand respectively, whereas, the number shoots up to 56% in Brazil.

- With the lion’s share of cement demand coming from the housing market in India, one can expect a growth in the housing demand, with expectations of interest rate cuts by the RBI in FY2017 and the implementation of the 7th Pay Commission recommendations.

Government Subsidy & Initiatives:

- The Government of India has decided to adopt cement instead of bitumen for the construction of all new road projects on the grounds that cement is more durable and cheaper to maintain than bitumen in the long run. This can be a big boost to the sector, which otherwise depends majorly on the housing segment.

- Investment in infrastructure, according to the 12th Five Year Plan (2012–17) has increased to over $1 Trillion, as against $514 Billion under the 11th Five Year Plan (2007–12). This is towards the Urban Rejuvenation Mission (AMRUT) and Mission for Development of 100 Smart Cities.

- Allocation under Pradhan Mantri Gram Sadak Yojana (PMGSY) has increased from Rs. 14921 crores for FY2016to Rs. 19000 crores for FY2017.

- The Government of India has also decided to adopt cement instead of bitumen for the construction of all new road projects on the grounds that cement is more durable and cheaper to maintain than bitumen in the long run.

- The Mines and Minerals (Development and Regulation) Act, 2015 (MMDR), which regulates mining activities in the country, earlier allowed transfer of mining lease for auctioned mines only. But now, under the revised Act of 2016, the Government has given a green signal to transfer of mining lease for captive mines, easing up passage for merger and acquisition (M&A) activities in the cement sector. Additionally, the step will help in checking the stressed and non-performing assets of banks, in cases where the companies have mortgaged these licenses, as it will now allow the banks to transfer them to the potential buyer of the stressed companies, eventually helping all creditors recover dues to some extent.

- The Government has applied a 100% tax deduction for profits (MAT tax still applicable) to an undertaking from a housing project for flats (approved during June 2016 to March 2019 and completed in 3 years) up to 30 sq. mt. in four metro cities and 60 q. mt. in other cities will benefit developers in the low-cost housing space. This is a positive sign for the real estate developer building such a project, as it can bring in a 15-20% upside in their profits, which will encourage them to take up more such projects, and thereby boosting the cement sector as well.

- The Andhra Pradesh State Investment Promotion Board (SIPB) has approved proposals worth Rs. 9200 crores including three cement plants, which will a total capacity of around 12 MMPTA, thereby employing close to 4000 people directly.

Other Major Developments:

- Just recently, the Indian Railways hiked the cost of freight by 7-14% for distances between 200 km and 700 km and imposed a Rs. 55/Ton extra charge on both loading and unloading for distances beyond 100 km. At the same time, it reduced the freight for long-lead traffic by 4-13%. The tariff hike will increase the fuel costs of cement units closer to the mines, while units far away from coal mines could see their fuel/input costs decline. Most likely, the extra fuel/input costs will be passed on to the end-consumers by cement firms while those who see their freight costs coming down as a result of the railways’ latest decision might improve their margins.

- Due to declining pet-coke prices during most times in the last 12-15 months, most manufacturers have, and will continue to benefit from the lower cost of inventory fuel which has seen an increased usage of pet-coke in the fuel mix. But this benefit is expected to recede in the coming quarters, given the recent increase in pet-coke prices by around from its lows of January 2016. Still, the commodity is considered to be favorable as it is cheaper by 10-15% on a Kcal basis compared to coal.

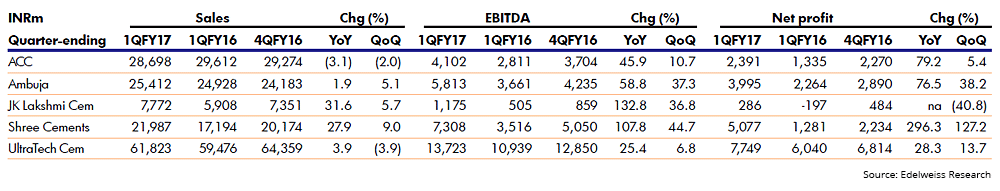

- Here are the earning performances of the top 5 players of the industry:

What to expect next:

- Cement sector is one of those sectors that is sure to gain from the clearance of the GST bill. Currently, the tax on cement ranges from 27% to 32%. The GST rate is expected to be much lower than the current indirect tax rate. Apart from the savings in the form of lower tax rates, the logistics and transportation cost is expected to come down considerably for the cement companies, which in turn will lead to further savings. Currently the transportation costs for the cement companies range between 20-25% of the total revenue. There is an estimate that the logistics cost may come down by almost 30% once the GST bill gets implemented.

- It can be said that heavy rains have dragged demand temporarily, but once this factor diffuses, it will lead to a better demand environment in H2FY2017, as two back-to-back droughts had led to slump in rural demand and fall in construction activity.

- Unlike other regions, volumes will be relatively stable in southern markets, with newer opportunities likely to open up in the eastern part. With some help from the Government in terms of friendlier laws, lower taxation, and increased infrastructure spending, one can say that the Indian cement sector could grow well and take economy forward along with it.

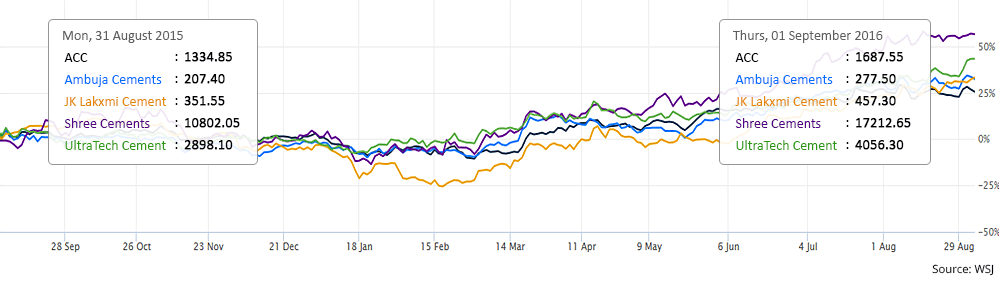

- Here are the stock performances of the top 5 players in the industry:

- Even though ~70% utilization rates of cement capacities not being that great, the industry is still said to be healthy because it has a low breakeven point.

- Cement demand is closely linked to the overall economic growth, particularly the housing and infrastructure sector. The Modi government's thrust on housing and infrastructure development should augur well for cement demand. The crash in the global crude oil prices and other commodities should help cement companies to reign over cost pressures and improve profitability of the sector.

Continue with Google

Continue with Google